How to View, Export, or Print a Reconciliation Report in QuickBooks?

At the end of every month, the routine is the same for many business owners and accountants. You open your bank statement, log in to

Streamline and optimize routine tasks, workflows to save tons of time and fallible manual labour. Get the most out of your QuickBooks.

Tired of getting data to and from the third-party softwares; we help you integrate your QuickBooks seemlessly with other systems so your data stay in sync across all your systems.

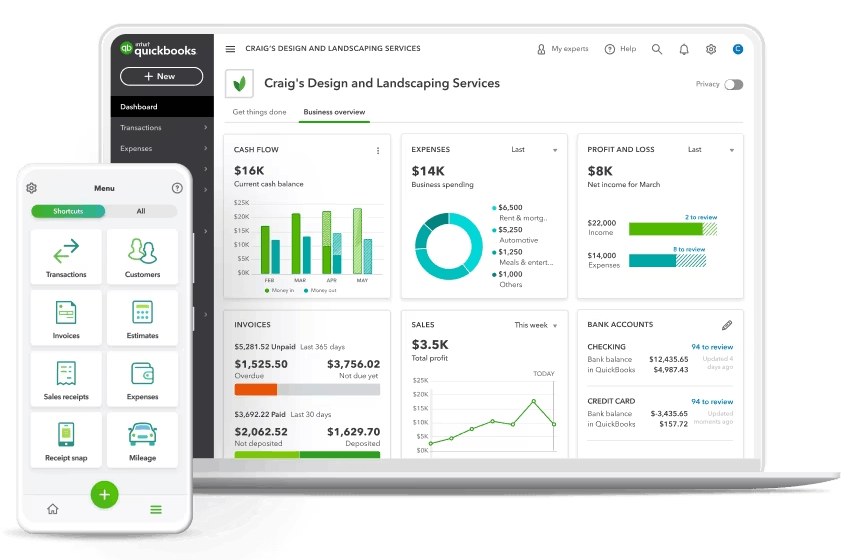

Visualize your financial data at a glance and gather real-time insights on the performance of your organisation to set data-driven goals and achieve them with confidence.

Our experience spans a wide spectrum of industries, from healthcare and technology to manufacturing and finance. We thrive on the diversity of challenges presented by each sector, allowing us to bring fresh perspectives to every client engagement.

Our team of experts is well-equipped to tackle even the most complex challenges. We understand that each client is unique, and our dedication to delivering the best solutions sets us apart and we’re committed to providing solutions that perfectly align with your goals.

EXCELLENTTrustindex verifies that the original source of the review is Google. Our QuickBooks client machine was unable to locate the data file on the server. The QASolved team resolved the server issue and remapped the drive. We're glad to have everything running smoothly again.Posted onTrustindex verifies that the original source of the review is Google. We were previously unable to send emails from our QuickBooks Desktop. After their intervention, email functionality has been fully restored and is now working well.Posted onTrustindex verifies that the original source of the review is Google. They assisted us with hosting our QuickBooks Desktop on the cloud, and the migration process was seamless.Posted onTrustindex verifies that the original source of the review is Google. Faced issues with generating invoices on QB, but their support team quickly stepped in and resolved the problem. Very satisfied with their prompt and efficient customer service!

At the end of every month, the routine is the same for many business owners and accountants. You open your bank statement, log in to

In a groundbreaking move set to reshape financial technology, Intuit has announced a strategic partnership with Anthropic to introduce customized, industry-specific AI agents designed to

If you pay independent contractors, filing 1099s is not optional. It is a responsibility that directly impacts your tax compliance and business credibility. When a