TurboTax Support

Get Expert Help and Guidance with Turbotax Support

TurboTax Helpdesk - Get In Touch

Welcome to TurboTax Customer Service! We are available to help you at every stage. Whether you need assistance with managing your account, using TurboTax software, or filing taxes, our expert staff is committed to offering you timely and supportive help. Together, let’s make tax season stress-free!

If you need any kind of assistance financially, our certified TurboTax professionals are always ready to help you:

Customer Care Helpline

Phone: +1-855-875-1223

Hours: Monday-Friday, 9:00 AM – 5:00 PM (Your Time Zone)

Live Chat Helpdesk

Our live chat helpdesk is available during business hours for real-time assistance. Click the "Live Chat" button to connect with our TurboTax Experts.

Email Assistance

Email: [email protected]

We will get back to you within 24-48 hours of asking your query

The Turbotax Assistance Services We Provide

Turbotax Setup and Configuration

We provide complete assistance for setting up and configuring the TurboTax software, making sure you have the tools, settings, and integrations needed for effective tax management.

Training & Guidance

Customized workshops, training sessions, and materials to help you and your team, raise financial literacy levels, and increase productivity are provided by our experts.

Data Import and Management

We provide you with professional assistance or the management of your financial data to guarantee accuracy, consistency, and adherence to rules and accounting standards.

Tax Planning & Strategy Consultation

To maximize your tax position, reduce your tax liabilities, and help you reach your financial goals, we assess and find tax planning opportunities and offer you strategic recommendations.

Ongoing Assistance

Our committed staff is ready to help with any questions about TurboTax, offer advice on tricky tax situations, and even provide instant solutions for the tax filing process.

Review & Assurance

Your tax return will be thoroughly examined by our team of experts, who will make sure that all applicable laws and regulations are followed, and will spot any possible problems.

Full Service for Personal Taxes

We provide you with a tax professional to handle your taxes from beginning to end. We also guarantee you precision and 100% accurate tax filing specifically to your needs.

Do your Own Taxes

You can file your own taxes with confidence using TurboTax and we will help you with that. It guarantees 100% accurate calculations and maximizes refunds.

Do Personal Taxes with Expert Help

We will prepare your taxes with assurance and receive professional help at every stage. We guarantee 100% correct filings with the help of a professional final review to guarantee accuracy.

Get Instant Help With Various TurboTax Products

TurboTax Basic Edition

For individuals with basic tax situations, this provides tax filing solutions and guarantees accurate filings with no additional costs by supporting and providing step-by-step guidance. If you need any help with tax filings, you can contact our experts.

TurboTax Deluxe

For businesses with complicated tax situations, it provides extra advice and resources to help maximize credits and deductions and it is perfect for investors and homeowners. Our committed staff is available to help you at every stage.

TurboTax Premier

In this, the investors and owners of rental properties provide professional advice on how to maximize deductions and confidently handle complicated tax scenarios. For any help required, you can reach out to our experts for better assistance.

TurboTax Home & Business

This offers step-by-step assistance and guidance for accurately and efficiently preparing business taxes and is specially made for partnerships, LLCs, corporations, and trusts. Our committed experts are available to help you at every stage.

TurboTax Full Service

With accuracy, TurboTax Full Service provides comprehensive tax preparation by a certified tax professional who handles the entire process from beginning to end. For any help required, you can reach out to our experts for better assistance.

TurboTax Assisted

It offers professional guidance throughout tax preparation, with a final review by experts to guarantee accuracy and maximize refunds. For any help required, you can reach out to our experts for better assistance.

How Is Our TurboTax Customer

Service Different from Others?

Expertise

Our professional unmatched expertise, provides specialized knowledge, customized solutions, and assistance for better user support, making our TurboTax customer service stand out.

Committed Assistance

Our team is committed to providing our clients with individualized guidance, prompt responses, and devoted assistance. This approach builds lasting relationships and increases customer satisfaction.

Customized Solution

We help you with solutions that provide detailed assistance to meet the requirements of every customer, guaranteeing detailed and successful resolution of every issue.

Strategic Partnership

To achieve mutual success, we strategically partner with businesses by enhancing relationships with them, providing advice, and coordinating help with long-term business goals.

Value-Driven Approach

We ensure customer satisfaction and business success, and our value-driven approach gives high priority to providing measurable benefits, solutions, and improvements.

Proactive Issue Resolution

To ensure easy operations and minimal disruptions, our team helps you actively identify and address potential problems before they have an impact on your business’s tax filing process.

Process We Follow for Consulting Your Queries

Initial Assessment

Before beginning the process, the initial assessment involves reviewing the submitted queries to understand their scope, urgency, and complexity.

Strategy Development

Developing strategies includes creating structured plans to respond to inquiries easily and making use of resources to guarantee that you receive the best answers for your problems.

Implementation

To properly answer your questions, we carry out planned solutions and make the required adjustments or configurations within TurboTax.

Monitoring and Assistance

We provide continuous assistance and direction to guarantee query resolution and user satisfaction, monitoring involves supervising solutions that need to be implemented.

Common Errors Of TurboTax

Error Code 0019:

Occurs during installation of software

Error Code 190:

Indicates a problem with file installation

Error Code 1921:

Occur due to corrupted files

Error Code 65535:

Indicates installation or software update failure

Error Code 36:

Indicates a problem with accessing or saving files

Error Code 42015:

Internet connectivity issues.

Error Code 1922:

Permission issues or restrictions on the user's system

Error Code 70001:

Occurs during the e-filing process

Error Code 603:

Indicates a problem with the taxpayer's information

Explore TurboTax’s Features and Functionalities

Personalized Tax Advice

TurboTax provides tax guidance by customizing suggestions to your financial needs. It guarantees accurate filings and maximizes refunds and you can receive guidance on deductions, and credits.

Import and Integration Capabilities

TurboTax makes the tax preparation process easy by directly importing financial data from various sources. The accuracy of filing taxes is guaranteed by its integration capabilities.

Real-Time Refund Tracking

With this feature, you can keep an eye on the status of your tax refunds as they move through the IRS system. This also guarantees transparency in the tax filing process.

Comprehensive Error Checking

It is a tool that TurboTax uses to examine tax returns and spot any potential errors. This feature gives you confidence in tax filings by guaranteeing accuracy and assisting them in avoiding costly errors.

Audit Support and Guidance

If the IRS audits a user's tax return, TurboTax provides audit support and guidance, throughout the audit process. This also provides expert assistance and peace of mind.

Deduction and Credit Maximization

You can improve your deductions and credits while receiving personalized tax-saving advice based on your financial circumstances, which could lead to savings and refunds.

Mobile Access and Convenience

With mobile access to TurboTax, you can prepare and submit your taxes from any location. Tax preparation can be done quickly while on the go, giving people flexibility and ease of use.

Accurate Calculations

This feature makes you feel secure as the tax calculations are accurate with TurboTax's accurate calculations. Its dedication to accuracy and dependability will give you confidence in tax returns.

Deduction Finder

You can maximize your potential tax savings by finding frequently missed deductions. You can take advantage of all available tax benefits for your particular financial situation by identifying eligible deductions.

FAQs

Go to the “Support” or “Help” section of TurboTax’s website to get in touch with customer service. You can then use a variety of support channels, including email, phone support, and live

chat. It even provides a community forum where you can post queries and look for answers from other users and professionals.

Yes, one of TurboTax’s services is audit assistance. If the IRS audits a user’s tax return, they can get advice and help. Access to professionals who can guide you through the audit process, address your concerns, and help you with any paperwork or responses you might need is part of this service.

Instead of using TurboTax online via a web browser, TurboTax desktop refers to the software version of the program that is installed and operated directly on a user’s computer. It functions offline and provides comparable features and functionality to the online version. You can easily use a TurboTax desktop on a Mac or Windows computer.

No, customer service for TurboTax is not open around the clock. The hours of customer service differ based on the season and region. Service is typically offered during regular business hours, with extended hours offered during the busiest tax season.

Yes, complicated tax situations can benefit from TurboTax Assistance. It offers professional advice and assistance suited to different tax situations, such as income from self-employment, investments, rental properties, and more. You can obtain specialized assistance from tax professionals who are adept at complex tax laws and regulations.

TurboTax can offer tailored assistance to customers with intricate tax situations or distinct needs. To address a variety of tax scenarios, including those involving investments, rental properties, self-employment income, and more, TurboTax provides several products, including TurboTax Premier and TurboTax Self-Employed.

The user-friendly interface, extensive feature set, and availability of live tax experts make TurboTax assistance unique. TurboTax provides a variety of products that are suited to various tax scenarios, guaranteeing that each person receives individualized advice. With the help of a company, you can maximize deductions and credits while finding complex tax scenarios.

With its step-by-step instructions, TurboTax helps you prepare your taxes by guaranteeing that your income, credits, and deductions are reported accurately. People can input their financial information and get real-time help through its user-friendly interface. You can also get in contact with live tax professionals who can offer advice and check tax returns for accuracy and legal compliance.

Helpful Guides & Tutorials

What is TurboTax and How Does It Work?

What is TurboTax? TurboTax is a tax preparation software that allows individuals to file their taxes electronically. It is designed to simplify the tax filing

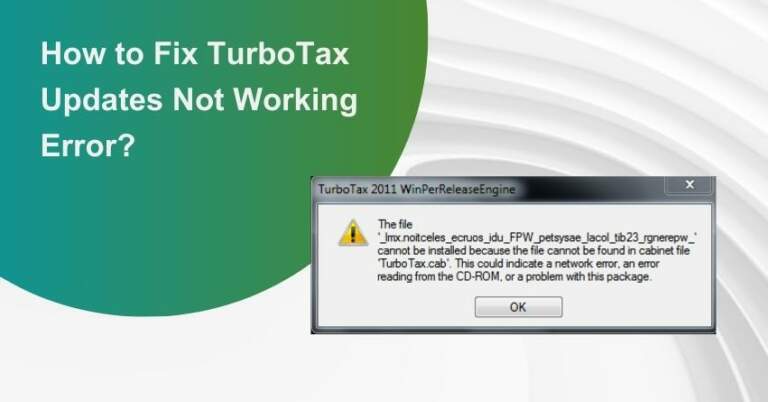

How to Fix TurboTax Updates Not Working Error?

Experiencing challenges with TurboTax updates not working error can be a frustrating roadblock for users seeking a seamless tax preparation experience. In this article, we’ll

How to Upgrade and Downgrade TurboTax?

You must know that the TurboTax Deluxe version is not free, and you have to pay a fixed amount to avail of all the features