Setup Job Costing In QuickBooks Online and Desktop

Job costing is an accounting method used to track the specific expenses that are directly associated with a particular project or job. This unique approach

QuickBooks for Accountants

Start at $13.30 / mo.

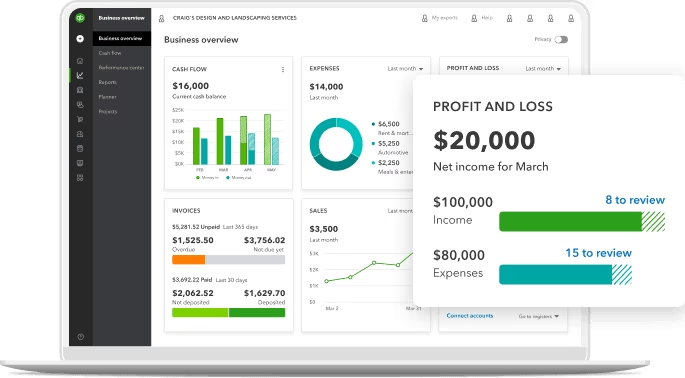

Managing multiple clients and ensuring accurate financial records can be challenging—tracking expenses, handling invoices, managing payroll, and maintaining cash flow requires efficiency. That’s why you need a reliable accounting solution: QuickBooks. With powerful features like automated invoicing, expense tracking, client bookkeeping, and real-time financial reporting, QuickBooks streamlines your workflow and enhances accuracy. Its robust tools make QuickBooks the ultimate accounting software for accountants, helping you manage finances effortlessly and drive success with confidence.

We’ll help you set up your client accounts so that you can easily automate tax preparation alongside bank reconciliation, advanced reporting, and more. Focus on your clients, not on data entries.

We simplify the setup process for accountants and CPAs, ensuring seamless integration with tax software, payroll systems, and financial management tools. This smooth integration ensures real-time data synchronization, allowing you to focus on delivering accurate financial services to your clients.

Our team of ProAdvisors helps accountants generate customized financial reports tailored to client needs. From cash flow statements and tax reports to profit and loss analyses, QuickBooks provides deep financial insights that enhance decision-making and business advisory services.

If you experience software slowdowns or technical issues, we provide expert troubleshooting, system maintenance, and performance optimization. Our goal is to ensure that your QuickBooks runs efficiently, minimizing downtime and maximizing productivity.

As your client base grows, we ensure that QuickBooks stays up to date and fully optimized. From setting up automated workflows to improving reporting capabilities, we help accountants adapt to evolving financial needs with ease.

We configure QuickBooks to help CPAs and Accountants maintain compliance with tax regulations, financial reporting standards, and industry specific requirements. Our setup ensures smooth integration with tax preparation tools, simplifying audits and documentation.

We help users to configure multi-user access in QuickBooks, allowing accounting firms to collaborate securely with team members, clients, and other stakeholders. By assigning specific roles and permissions, we ensure that each user has controlled access.

We start with a detailed evaluation of your accounting firm or practice, analyzing your current financial workflows, client management processes, and operational challenges. This allows us to identify areas where QuickBooks can enhance efficiency and improve overall financial accuracy.

Following our assessment, we develop a customized QuickBooks implementation plan tailored to the specific needs of accountants and CPAs. This includes automating tasks like client bookkeeping, tax preparation, payroll management, and financial reporting to align with your firm’s objectives.

As your client base grows, so do your financial management needs. We provide continuous monitoring and optimization of your QuickBooks system to ensure seamless performance. Regular check-ins allow us to fine-tune workflows and incorporate feedback to ensure your firm’s peak efficiency.

Once your QuickBooks system is fully configured, we offer in-depth training for your team. From managing client accounts and reconciling transactions to generating financial reports and ensuring tax compliance, we equip your firm with the skills needed to maximize QuickBooks’ performance.

Your success is at the heart of what we do. We take the time to understand the unique challenges of accounting firms, providing clear communication and tailored QuickBooks solutions that simplify workflows, improve efficiency, and enhance financial management.

With deep expertise in QuickBooks and financial management, our certified ProAdvisors stay ahead of evolving accounting trends, tools, and compliance standards—empowering CPAs and accountants to maintain precision, efficiency, and compliance in financial reporting.

We provide round-the-clock support to ensure your QuickBooks system operates smoothly. Whether you need help with bookkeeping, tax preparation, client management, or troubleshooting, our experts are always available to assist.

At QASolved, we are dedicated to providing seamless QuickBooks solutions, from installation and setup to optimization and ongoing support. Our goal is to help accountants and CPAs maximize productivity and focus on delivering top-tier financial services.

Accountants and CPAs typically use QuickBooks Online Accountant (QBOA) and QuickBooks Desktop Accountant to manage their clients’ books efficiently.

Yes, even if you have an accountant, using QuickBooks can streamline your financial management and improve collaboration. Here are some of the reasons why:

Hence, using QuickBooks alongside your accountant ensures greater financial transparency, better decision-making, and a smoother accounting process.

Your clients can grant you access to their QuickBooks data easily, ensuring seamless collaboration and efficient bookkeeping. n QuickBooks Online, they can invite you as an accountant through the Manage Users section, giving you direct access to their books. For QuickBooks Desktop, they can share an Accountant’s Copy or use cloud hosting for real-time collaboration.

CPA accounting software is a specialized financial tool designed to help Certified Public Accountants (CPAs) manage bookkeeping, tax preparation, financial reporting, and client accounts efficiently. Software like QuickBooks enhance workflows, automate calculations, and ensure compliance with accounting standards and tax regulations.

QuickBooks offers Online Payroll Core, Premium, and Elite to help accountants manage payroll efficiently. For those handling multiple clients, QuickBooks Online Accountant (QBOA) includes Payroll for Accountants, allowing seamless payroll processing, tax compliance, and automation—all from one dashboard.

Job costing is an accounting method used to track the specific expenses that are directly associated with a particular project or job. This unique approach

In the manufacturing industry, scrap is an inevitable part of the production process. It refers to the material that remains after a product is made

In today’s fast-paced world, manufacturing and wholesale businesses face unique challenges that basic accounting software simply can’t handle. From inventory management to complex pricing structures,