Setup Job Costing In QuickBooks Online and Desktop

Job costing is an accounting method used to track the specific expenses that are directly associated with a particular project or job. This unique approach

QuickBooks for Restaurants

Say goodbye to conventional bookkeeping! Manage Inventory, track expenses & sales, streamline payroll.

Start at $49.50 / mo.

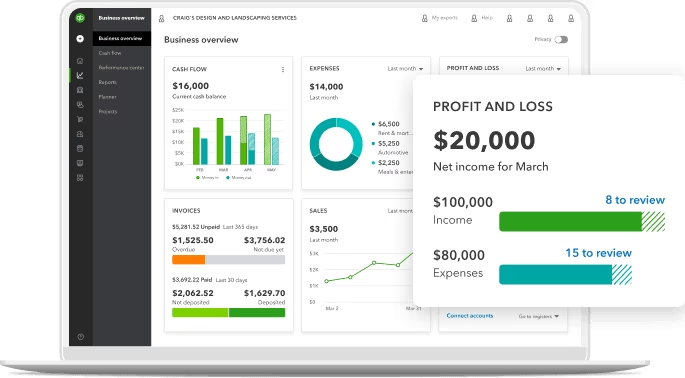

Running a restaurant is no easy feat—managing inventory, tracking daily sales, monitoring expenses, and ensuring seamless payroll can get overwhelming. This is exactly why you need an ideal ingredient for your restaurant, QuickBooks. With features like automated accounting, expense tracking, and real-time reporting, QuickBooks helps you keep your business running smoothly. The capability to transform and elevate financial operations makes QuickBooks the best accounting system for restaurants, helping you deliver exceptional dining experience.

We assist you in setting up QuickBooks and ensure everything works seamlessly from integrating your POS system to connecting your bank accounts and payment platforms.

The QuickBooks team will customize financial reports to suit your needs. Your inventory, profits, and losses are all tracked in real-time, so you're always in the know.

You can track food costs accurately, manage inventory effectively, and minimize waste with us. With QuickBooks, you'll be able to manage your spending and make the best purchase decisions.

We provide hands-on training and support for QuickBooks to ensure your success. Whether it's payroll, taxes, or creating reports, we're always here to help.

Tax tracking in QuickBooks ensures everything is compliant, especially when it comes to sales tax and restaurant taxes. It's easy to report and file taxes with us.

We begin with a deep dive into your restaurant’s operations, financial challenges, and goals. This helps us identify areas where QuickBooks can streamline your processes and improve efficiency.

Before we dive in, we take the time to understand your unique business operations, challenges, and goals. We customize our approach to meet your requirements.

Based on our assessment, we create a customized strategy for implementing QuickBooks. This includes integrating essential tools like POS systems, payroll, inventory management, and tax tracking.

As your restaurant grows, your needs may evolve. We offer regular check-ins to monitor QuickBooks’ performance, make necessary adjustments, and gather feedback to ensure it continues to meet your requirements.

Once QuickBooks is ready, we will provide hands-on training to you and your team. We guide you through the platform, ensuring you’re comfortable using its features to manage your finances effectively.

Each restaurant is unique, and we understand that. Whether it's tracking inventory, managing payroll, or preparing taxes, we customize our services to meet your needs.

With years of experience in financial management, our team can handle your restaurant's finances effectively. Our team stays on top of the latest tools and industry trends so that we can offer the best services.

We provide timely assistance, ensuring that your QuickBooks for Restaurants operates seamlessly, helping you manage finances, track inventory, and streamline operations without unnecessary delays.

Customer satisfaction is our top priority, so we go above and beyond to meet your expectations. Our top priority is the success of your restaurant.

Follow these steps to record restaurant sales in QuickBooks:

The flexibility and ease of use of QuickBooks make it one of the best accounting software options for restaurants. It allows you to track sales, manage payroll, and create custom reports. In addition to QuickBooks, Xero and Restaurant365 also offer robust integrations with point-of-sale systems.

There are several categories in a QuickBooks restaurant chart of accounts, including:

For better financial tracking, you can customize your chart of accounts to meet your restaurant’s specific needs.

QuickBooks offers customizable reports for restaurants, such as Profit & Loss, Sales by Item, and Cash Flow Reports. In addition to tracking food and beverage sales, labor costs, and inventory, you can also customize general reports to suit your business.

Yes, QuickBooks can track data from multiple locations, including food trucks. To track performance across your business units, you can create separate company files for each location or use classes and locations in QuickBooks Online. Each location’s financials can be managed individually, but the data can be consolidated for overall reporting.

Yes, QuickBooks allows you to itemize your expenses easily. You can create expense categories such as food costs, labor costs, and utility costs. You can easily keep track of your business expenses by categorizing them and generating reports.

QuickBooks integrates payroll features to help manage labor costs. It is possible to track hours worked, calculate wages, and generate payroll reports. QuickBooks also lets you view labor costs by department and location, giving you a better understanding of how labor affects profitability.

Job costing is an accounting method used to track the specific expenses that are directly associated with a particular project or job. This unique approach

In the manufacturing industry, scrap is an inevitable part of the production process. It refers to the material that remains after a product is made

In today’s fast-paced world, manufacturing and wholesale businesses face unique challenges that basic accounting software simply can’t handle. From inventory management to complex pricing structures,