How to Import Journal Entries into QuickBooks Online and Desktop?

Journal entries are the quiet workhorses of every accounting system. They record your business’s financial activity through the double-entry method, where every transaction affects at

QuickBooks Online Plus, QuickBooks Online Advanced

Ditch the paperwork and embrace efficiency! Track project costs, manage invoices & monitor cash flow with the best construction accounting software.

Start at $49.50 / mo.

Managing a construction business comes with its challenges—tracking project costs, handling invoices, managing payroll, and keeping an eye on cash flow can be overwhelming. That’s why you need the right foundation for financial management: QuickBooks. With features like job costing, automated invoicing, expense tracking, and real-time reporting, QuickBooks ensures your projects stay on budget and your business runs smoothly. Its ability to organize financial operations makes QuickBooks the ultimate accounting solution for construction businesses, helping you build success with confidence.

Whether you’re just getting started or need help migrating, QuickBooks offers tools designed to make accounting easier for contractors—so you can focus on building projects, not balancing books.

We help you set up QuickBooks for construction with ease, integrating it seamlessly with your existing project management tools, bank accounts, and payment platforms. This ensures that your financial data flows smoothly from day one, so you can focus on managing your projects.

Our team customizes QuickBooks to generate financial reports that fit the specific needs of your construction business. From tracking job costs to monitoring cash flow and project profitability, you'll have real-time insights to make data-driven decisions.

QuickBooks allows you to track project costs accurately, manage budgets, and control expenses. Whether it's labor, materials, or subcontractor payments, you’ll have full visibility over every cost, helping you keep projects on budget and maximize profitability.

We provide comprehensive training and ongoing support for QuickBooks, ensuring you're equipped to handle payroll, tax reporting, job costing, and more. Our expert team is always available to help you optimize your financial processes.

QuickBooks ensures that your construction business stays compliant with tax regulations. Whether it’s sales tax, payroll taxes, or contractor payments, QuickBooks helps track and report everything accurately, making tax filing stress-free.

As your construction business grows, we keep your QuickBooks system up to date. We continuously optimize your setup to ensure maximum efficiency, helping you streamline accounting and financial management as your operations expand.

We thoroughly analyze your construction business’s financial processes and project workflows to identify how QuickBooks can streamline operations, reduce costs, and enhance profitability.

Based on the assessment, we develop a customized plan for your construction businesses. This includes integrating project management tools, job costing, and payroll systems.

As your construction business grows, so do your accounting needs. We provide ongoing QuickBooks monitoring, regular check-ins, and adjustments to keep your financial management effective and aligned.

Once QB is fully set up, we will provide comprehensive training for your team. Whether it's managing job costs, running reports, or tracking expenses, we ensure your team is equipped with everything.

Every construction business is unique, and we recognize that. Whether it's job costing, managing subcontractor payments, or tracking expenses, we customize our QuickBooks solutions to fit your specific needs and project requirements.

With years of experience in construction financial management, our team has the knowledge and skills to handle your business’s finances effectively. We stay updated on the latest tools, trends, and industry best practices.

We provide timely and reliable support, ensuring your QuickBooks for Construction is running smoothly. Whether it's tracking costs, managing payroll, or generating reports, our Certified QuickBooks ProAdvisors are available to assist you 24/7.

At QAsolved, we are committed to delivering exceptional service and exceeding your expectations. Whether you're working on a single project or managing multiple sites, we are always here to ensure your financial processes are flawless.

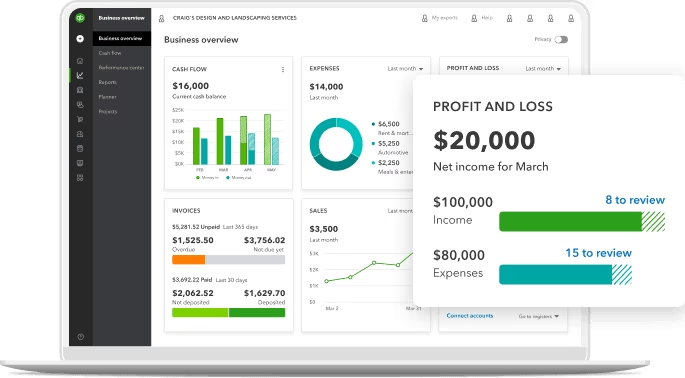

QuickBooks Online is the best construction accounting software that offers specialized features tailored to the construction industry, including job costing, project tracking, and job profitability reports. For Construction businesses, QuickBooks Online Plus and Advanced are the best choices in terms of plans.

Categorizing construction expenses in QuickBooks is crucial for accurate job costing and financial tracking. Here’s how you can do it:

QuickBooks for construction integrates easily with a variety of specialized software designed to streamline various aspects of construction management. Here are some different types of software that can integrate with QuickBooks for construction businesses:

Setting up payroll for a construction company in QuickBooks involves a few key steps to ensure compliance, accuracy, and efficiency. Click the link for a detailed solution.

QuickBooks helps with job costing by allowing you to track and assign expenses such as labor, materials, and subcontractor costs to specific jobs or projects. It provides a clear overview of costs associated with each project and enables you to monitor profitability in real time. The software integrates payroll and time tracking tools to allocate labor costs, tracks material usage and expenses, and organizes subcontractor costs by job.

Journal entries are the quiet workhorses of every accounting system. They record your business’s financial activity through the double-entry method, where every transaction affects at

Every small business owner has lived that moment: you open your QuickBooks dashboard with a cup of coffee, expecting a smooth start to the day,

Accurately tracking labor costs is one of the biggest challenges businesses faces when managing projects in QuickBooks Online. Whether you’re overseeing a construction job, a