Buy QuickBooks Solopreneur

QuickBooks Solopreneur, QuickBooks Simple Start

Simplify Your Solo Finances and Business Tasks with QuickBooks Solopreneur.

Start at $10.00 / Mon.

QuickBooks Solopreneur, QuickBooks Simple Start

Simplify Your Solo Finances and Business Tasks with QuickBooks Solopreneur.

Start at $10.00 / Mon.

Purchase QuickBooks Solopreneur, a new and improved financial management tool designed specifically to help self-employed individuals overcome everyday financial challenges. Built for freelancers, creators, and independent professionals, it simplifies how you organize, track, and grow your business. With an intuitive setup, smoother navigation, and smarter transaction management, QuickBooks Solopreneur makes it easier to stay in control of your finances. So, make Intuit QuickBooks Solopreneur your companion to manage, track, and grow your solo business with complete financial confidence.

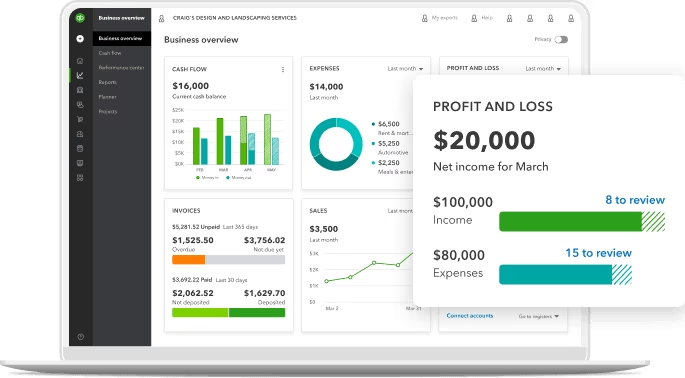

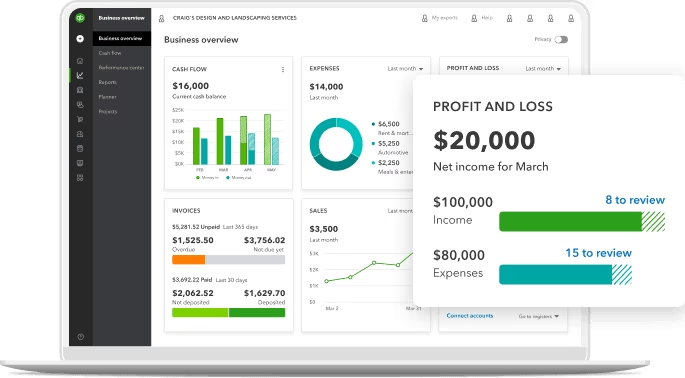

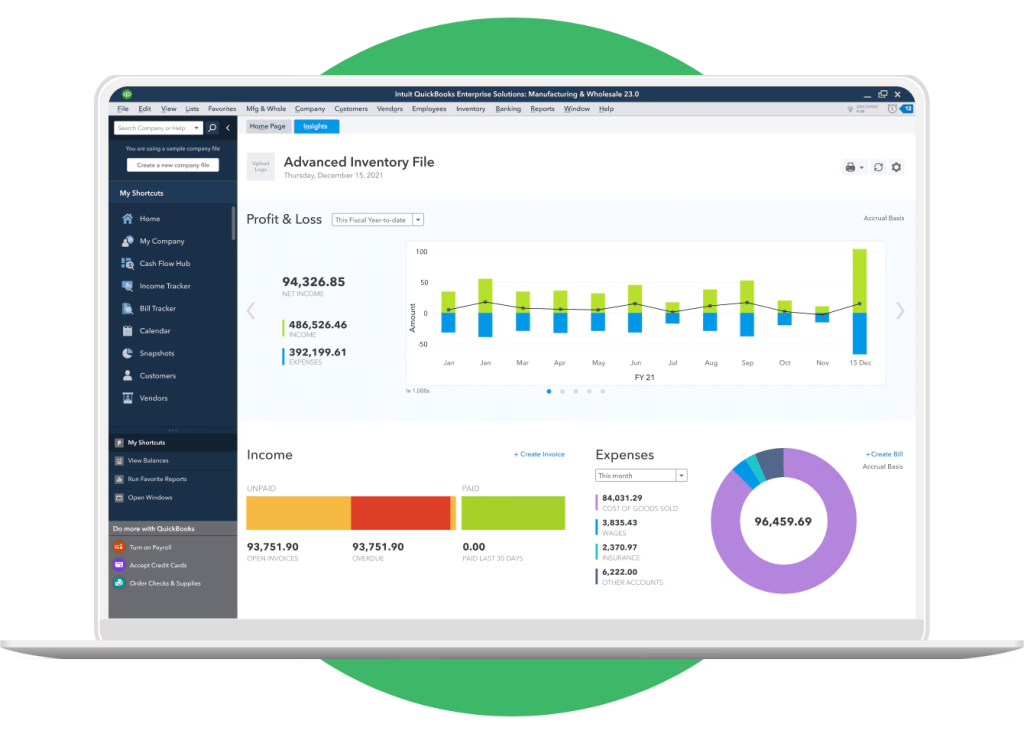

Easily manage income, track expenses, and monitor business performance without feeling overwhelmed with one of the ideal self-employed accounting software for Solopreneurs. Stay organized and focus on building and growing your brand.

Unlike traditional accounting tools, QuickBooks Solopreneur keeps things simple yet powerful. You see exactly what matters, clear insights, simple dashboards, and smooth workflows that save time and energy for what truly drives your business forward.

Backed by Intuit’s trusted legacy, QuickBooks Solopreneur delivers proven reliability and innovation. It’s the choice of millions worldwide, combining expert design, credibility, and consistent accuracy to support solopreneurs at every stage of growth.

QuickBooks Solopreneur turns numbers into stories that drive action. Instead of complex reports, you get real, understandable insights that help you make smart business decisions and stay ahead with clarity and confidence every day.

QuickBooks Solopreneur evolves as your business grows. It scales effortlessly, adapting to your goals while maintaining simplicity, so you never outgrow your system or lose control as your ambitions expand naturally.

Join a global network of solopreneurs and professionals who trust QuickBooks. Gain confidence, credibility, and continuous support through a community that shares knowledge, offers guidance, and helps your business thrive consistently.

Windows 10 or later, or the latest version of macOS.

Minimum 2.0 GHz (recommended 2.4 GHz or higher).

At least 4 GB (8 GB or more for optimal performance)

1 GB free disk space for installation, plus extra for data files.

Minimum 1280 x 1024 screen resolution.

Works best on Google Chrome, Microsoft Edge, or Safari (latest versions).

Our clients are our top priority. We work closely with you to comprehend your business goals and provide solutions that align with your objectives.

We customize our services to meet the unique needs of your business. Whether you're a startup or a large enterprise, we provide solutions that fit your business requirements.

We have extensive expertise and experience in QuickBooks. We stay updated with the latest industry trends and regulations to provide accurate and compliant services.

Our dedicated support team is here to address your queries and concerns promptly. We provide ongoing support to ensure smooth business operations.

QuickBooks Solopreneur is offered on a subscription basis, making it easy to budget and scale your financial management as your business grows. It typically includes a free trial period, so you can explore the full experience before committing. After the trial phase, you move to a standard monthly (or sometimes annual) plan.

Yes, QuickBooks Solopreneur includes essential reports designed specifically for individual business owners. You can easily view income summaries, expense breakdowns, cash flow statements, and tax estimates, all presented in clear, easy-to-read formats.

You can migrate your subscription and much of your data automatically using the instructions provided by Intuit. There is also the option to move manually or start fresh in Solopreneur. Before switching, you should download/back up your data from Self-Employed.

Solopreneur vs Self Employed has been one of the most trending topics amongst people who use Quickbooks. QuickBooks Solopreneur serves as the updated replacement for QuickBooks Self-Employed. It’s designed for independent professionals who want a more modern, streamlined experience with enhanced tools for tracking income, expenses, and taxes, all within a single, easy-to-use platform.