Buy QuickBooks Payroll

Payroll Core, Payroll Premium, Payroll Elite, Payroll Core + Simple Start, Payroll Core + Essentials, Payroll Premium + Plus

Simplify Payroll, Track Hours, and Ensure Compliance with QuickBooks Payroll

Payroll Core, Payroll Premium, Payroll Elite, Payroll Core + Simple Start, Payroll Core + Essentials, Payroll Premium + Plus

Simplify Payroll, Track Hours, and Ensure Compliance with QuickBooks Payroll

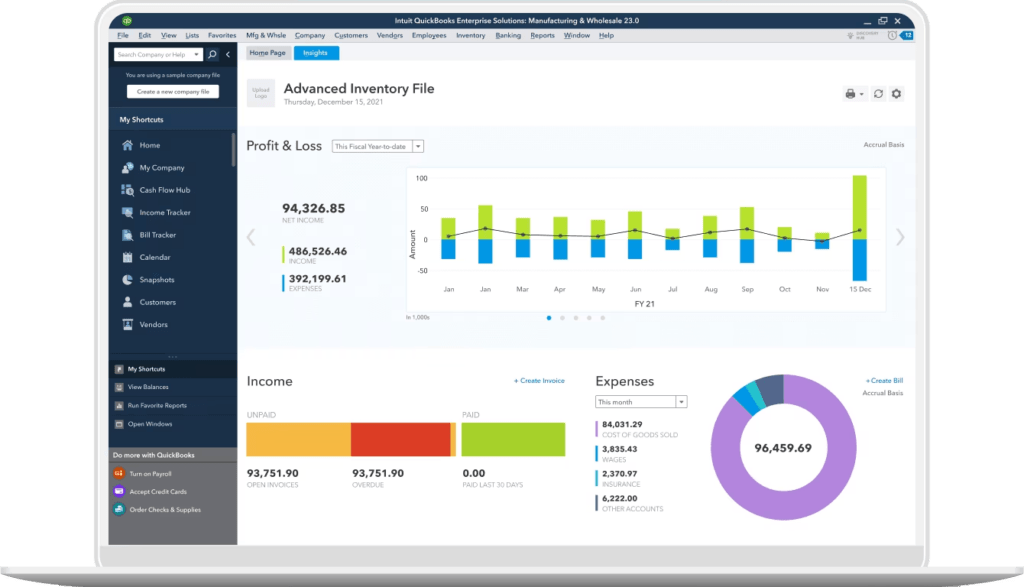

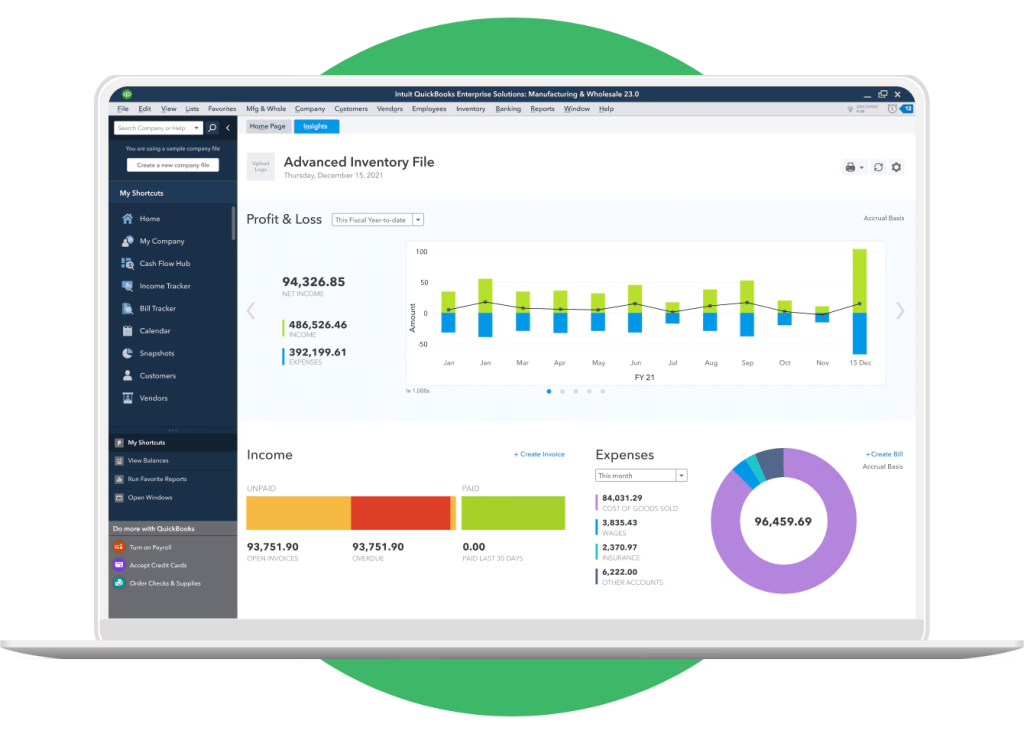

Simplify payroll like never before and handle employee payments, deductions, and tax filings with ease. From automated payroll to real-time reports, QuickBooks Desktop Payroll streamlines every step of payroll processing. Designed for business owners and finance teams, Payroll through QuickBooks saves time, reduces errors, and ensures your employees are paid correctly and promptly. With easy-to-use tools and real-time reporting, you can focus on growing your business while staying fully compliant with tax regulations. So, experience a smoother, faster, and smarter way to manage your workforce with Payroll through QuickBooks.

Give employees access to their pay details, W-2s, and work hours anytime through the QuickBooks Workforce app. It simplifies communication and keeps your team connected and informed.

Experience the convenience of same-day direct deposit and keep cash flow in check. QuickBooks Payroll lets you pay employees on your schedule, faster, smoother, and always on time.

Forget the hassle of filing and paying taxes manually. QuickBooks Payroll automatically calculates, files, and pays your payroll taxes with complete accuracy backed by an accuracy guarantee.

Save time and reduce errors by automating your payroll process. With Auto Payroll, QuickBooks handles everything for your salaried employees so you can focus on growing your business.

Boost payroll accuracy and efficiency with QuickBooks Payroll’s built-in time tracking. Easily review and approve employee timesheets while saving over two hours every time you run payroll.

Enhance employee satisfaction and retention by providing access to health, retirement, and other valuable benefits. QB Payroll helps you attract top talent and support long-term employee growth.

QuickBooks Payroll works best on Windows 10, 11, or supported Windows Server versions. Keeping OS updated ensures full compatibility and smooth performance.

A minimum 2.4 GHz processor is required, but a 3 GHz or higher CPU is recommended to handle complex payroll calculations efficiently and quickly.

At least 4 GB of RAM is necessary to run QuickBooks Payroll, while 8 GB or more is ideal for larger businesses with multiple employees.

QuickBooks Payroll requires a minimum of 2.5 GB free disk space for installation, plus additional space for storing payroll data, reports, and backups.

A screen resolution of 1280 x 1024 or higher ensures that dashboards, menus, and payroll reports display clearly, providing an efficient user experience.

Our clients are our top priority. We work closely with you to comprehend your business goals and provide solutions that align with your objectives.

We customize our services to meet the unique needs of your business. Whether you're a startup or a large enterprise, we provide solutions that fit your business requirements.

We have extensive expertise and experience in QuickBooks. We stay updated with the latest industry trends and regulations to provide accurate and compliant services.

Our dedicated support team is here to address your queries and concerns promptly. We provide ongoing support to ensure smooth business operations.

The cost of QuickBooks Payroll depends on the plan you select and the number of employees in your business. Pricing varies based on the features included in each plan, and there may also be promotional offers or discounts available. For a plan that best suits your business needs, it’s recommended to review the available options and consult with QuickBooks or a certified provider.

While ADP focuses primarily on payroll and HR services, QuickBooks Payroll provides a more comprehensive solution by integrating payroll, accounting, and tax management on one platform. This seamless connection helps businesses save time, minimize errors, and maintain accurate financial records, all within the trusted QuickBooks ecosystem. It’s an ideal choice for businesses seeking efficiency and simplicity in their payroll and accounting processes.

QuickBooks Payroll stands out as one of the most reliable payroll solutions for businesses of all sizes. It simplifies payroll management, automates tax filing, and integrates seamlessly with QuickBooks accounting. With features like same-day direct deposit, error-free calculations, and expert support, it ensures accuracy, compliance, and complete peace of mind for business owners.

Some of the most widely used payroll software include QuickBooks Payroll, ADP, and Gusto. Among them, QuickBooks Payroll is especially popular for its seamless integration with QuickBooks accounting, automated tax filing, and user-friendly interface. It’s trusted by small to mid-sized businesses for efficiently managing payroll, taxes, and employee payments all in one place.

Yes, you can purchase QuickBooks Payroll as a standalone service without subscribing to QuickBooks accounting software. This allows you to manage payroll, taxes, and employee payments independently while still having the flexibility to export data or integrate it with other accounting platforms whenever needed.