Table of Contents

ToggleManaging finances in a small business can sometimes blur the lines between personal and business expenses, especially when it comes to using company accounts for personal bills or withdrawing money for owner compensation. In this article, we’ll explore the steps to properly record personal expenses and owner draws in QuickBooks Online. We’ll cover what to do when a business owner pays for personal expenses using the company’s account and how to handle owner draws. Additionally, we’ll discuss the impact of these transactions on the company’s financial statements.

What is an Owner’s Draw?

An owner’s draw is when a business owner takes money out of their business for personal use. It’s like taking a portion of the profits for themselves. This money isn’t considered a business expense because it’s for the owner’s personal needs, not for running the business. In QuickBooks Online, you can create a specific account called “Owner’s Draw” or use a category called “personal expense” to record these transactions. When an owner takes a draw, it reduces the equity of the business because it’s like taking out their share of the company’s profits. Keeping track of these draws is important for keeping accurate financial records and following accounting rules.

How to Record a Personal Expense?

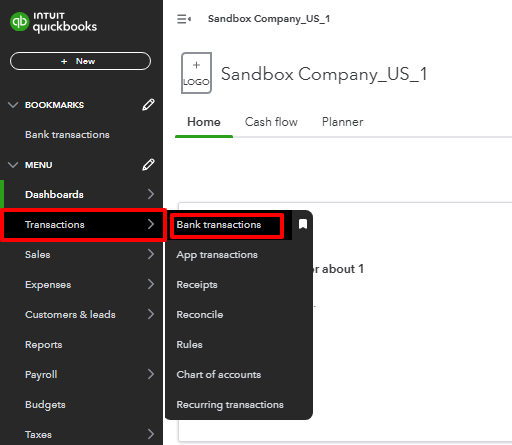

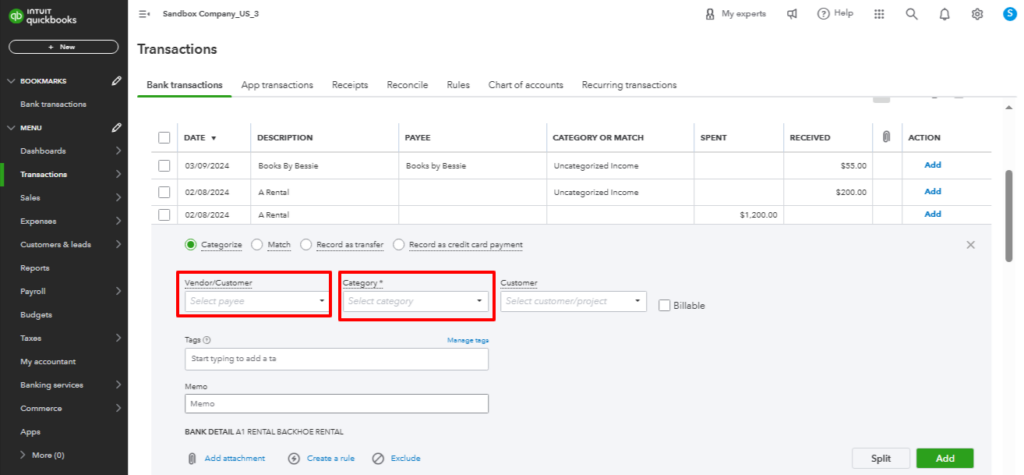

- To review your downloaded transactions, select Transactions and then Bank Transactions.

- First, enter the payee in the Vendor/Customer section.

- If you made a transaction with someone not listed as a vendor, you can categorize it under a general category.

- Next, go to the Category section, and select an equity account.

- An equity account is usually named owner’s draw or owner’s pay in personal expenses.

- If you don’t already have a suitable account, click on “See and add more categories.”

- Then, create a new equity-type account for it.

- Finally, confirm the transaction.

| Note: It is advisable to reconcile accounts from time to time. If you skip personal expenses in your downloaded transactions because they’re not business-related, you’ll have trouble reconciling your accounts later. |

to resolve your query in no-time.

How to Record the Owner’s Draw?

When the owner draws the money from QuickBooks:

- If the owner’s name isn’t listed, add them as a vendor.

- If funds were sent from the business’s bank account to the owner’s personal bank account.

- In the category section select the owner’s draw equity account.

- If you prefer to write a check to the owner:

- Click on “+ New” and then select “Check.”

- Enter the owner’s name as the payee.

- In the category field, select “Owner’s Draw” and enter the desired amount.

- If it’s a handwritten check, input the check number. Otherwise, if you want QuickBooks to print the check, select “Print Later.”

- Finally, save and close the check.

The Impact of Owner’s Draws and Personal Expenses on your Financial Statements

- Access reports and select Balance Sheets.

- These transactions reduce the balance in your bank account.

This action is reasonable because the owner used funds from the business account for purchases and compensation.

Additionally, it reduced equity, which represents the business’s value to the owner. When the owner takes a draw or spends company funds personally, the business becomes less valuable to them.

This approach is sensible as it avoids using an expense account. Moreover, these transactions don’t impact the profit and loss statement, preserving the business’s profit.

Conclusion

It’s important to handle personal expenses and owner draws correctly in QuickBooks Online to keep your business finances in order. Following these steps ensures transactions are recorded accurately, reducing errors. Understanding their impact on financial statements helps you make informed decisions about your business’s finances. Stay organized and consistent with recording the personal expenses to manage your business finances effectively.

Frequently Asked Questions

1. Fill out paperwork to set up your business officially.

2. Open a separate bank account for your business and another one for personal use.

3. Set up distinct profiles to receive payments for your business activities.

4. Make sure all financial transactions related to your business go through its dedicated accounts.

5. As your business expands, consider setting up additional accounts under its name.

6. Keep careful records of all money coming in and going out for your business.

To label a transaction that doesn’t belong to your business as Personal:

1. Go to the Transactions menu and locate the transaction.

2. Under the Type column, select “Personal.”

3. Review or choose a suitable category in the Category column. You can pick a general type and then a more specific category.

4. Once you’re finished, click on Save to confirm the changes.

When the owner pays themselves:

1. If the owner isn’t listed, add them.

2. If money goes from the business to the owner’s personal account, use the owner’s draw account.

To write a check:

1. Click “+ New” and pick “Check.”

2. Add the owner’s name.

3. Choose “Owner’s Draw” for the category and enter the amount.

4. Input the check number or select “Print Later.”

5. Save and close.

1. Visit https://quickbooks.intuit.com/

2. Go to “Banking”

3. Choose the transaction you need to categorize.

4. Select the payee.

5. Pick “Owner’s Draw” under Category.

6. Add a description in the memo field.

7. Click “Add” to finish.

An owner’s draw refers to the practice where the proprietor of a sole proprietorship, a partner in a partnership, or a member of a limited liability company (LLC) withdraws funds from their business for personal use. Instead of receiving a conventional salary, these funds are utilized for personal expenses.

To add a new user in QuickBooks Online, follow these steps:

1. Go to the Expenses menu.

2. Select the Vendors option.

3. Choose the New Vendor option.

4. Input all the required information for the new user.

5. Save your changes by clicking on the Save Button.