TurboTax Customer Service

Welcome to TurboTax Support Hub! Get fast & reliable TurboTax help to ensure compliance and accuracy.

- TurboTax Basic

- TurboTax Deluxe

- TurboTax Premier

- TurboTax Home & Business

- TurboTax Full Service

- TurboTax Assisted

Request A Free Consultation

Dedicated TurboTax Helpdesk Awaits You - Get In Touch

TurboTax has established itself as one of the most trusted and widely used tax preparation software solutions, valued for its intuitive design, step-by-step guidance, and reliable accuracy. Yet, like any advanced platform, it can sometimes present technical issues that disrupt the filing process. That is where our TurboTax customer service makes a difference by offering expert guidance, fast resolutions, and personalized support to help you overcome challenges and file your taxes with complete confidence. Contact our TurboTax customer service team for immediate assistance.

If you need any kind of assistance financially, our certified TurboTax professionals are always ready to help you:

Customer Care Helpline Number

Hours: Monday-Friday, 9:00 AM – 5:00 PM (Your Time Zone)

Live Chat Helpdesk

Our live chat helpdesk is available during business hours for real-time assistance.

Email Assistance

Please allow 24-48 hours for a response. Our experts will get back to you.

The Turbotax Assistance Services We Provide

Setup and Configuration

Get started with expert TurboTax customer service for seamless setup and configuration, ensuring the right tools, settings, and integrations for fast, accurate tax management.

Version Upgrade

Let our experts handle your TurboTax upgrade. From version transitions and secure data transfer to customized settings configuration, we make sure your software remains efficient and aligned.

Data Import and Record Management

Our experts assist in securely importing and organizing your financial data within TurboTax. We ensure every entry is accurate, consistent, and fully aligned with accounting standards and regulatory requirements.

Tax Planning & Strategy Consultation

To maximize your tax position, reduce your tax liabilities, and help you reach your financial goals, we assess and find tax planning opportunities and offer you strategic recommendations.

Errors Resolution

Eliminate delays caused by TurboTax errors with our professional assistance. Our TurboTax error resolution service offers prompt, expert-led support to address technical glitches and prevent workflow disruptions.

Data Recovery & Backup

Protect your tax data with expert-guided recovery and backup services. We restore lost TurboTax files and implement secure backup protocols to ensure uninterrupted operations and safeguard sensitive data.

E-Filing & Troubleshooting

Simplify your e-filing process with guided troubleshooting, real-time return tracking, and IRS submission verification, ensuring your organization meets all compliance requirements without disruptions to your tax workflow.

State Return Filling

Avoid filing complications and regional tax missteps. Get expert assistance with state return filing across multiple jurisdictions to help your business meet regional tax obligations without delays, errors, or penalties.

Multi-User Setup & Permissions

Optimize your team’s productivity by configuring TurboTax for multiple users. Define user roles, set permissions, and maintain full control over data for smooth coordination across your operations team.

Get Instant Help With Various TurboTax Products

TurboTax Basic

TurboTax Basic is built for straightforward tax returns, making it simple for individuals with minimal deductions or credits. Still, users may face issues like software setup, e-filing errors, or form confusion. Our TurboTax Basic assistance team helps resolve these challenges quickly, ensuring smooth and accurate filing.

TurboTax Deluxe

TurboTax Deluxe helps taxpayers maximize deductions such as mortgage interest, charitable donations, and medical expenses. While it offers more features than Basic, some users encounter difficulties with navigation, credit claims, or filing errors. Our TurboTax Deluxe support ensures you receive help for a hassle-free filing experience.

TurboTax Premier

TurboTax Premier is ideal for users with investments or rental property income. It manages stock sales, dividends, capital gains, and rental expenses, but these advanced features may sometimes create confusion or errors. With TurboTax Premier support, you get expert assistance to handle complexities and file with confidence.

TurboTax Home & Business

TurboTax Home & Business is tailored for freelancers, contractors, and small business owners. It supports Schedule C filing, 1099 reporting, and self-employment tax management. If you face issues with expense tracking or industry-specific deductions, our TurboTax Home & Business support ensures accurate solutions for both personal and business filings.

TurboTax Full Service

TurboTax Full Service allows a tax professional to prepare and file your return for you. While convenient, users may face issues with account setup, document uploads, or communication with tax experts. Our TurboTax Full Service support ensures a smooth process, providing timely guidance and reliable technical assistance.

TurboTax Assisted

TurboTax Assisted combines do-it-yourself filing with expert guidance, giving you live help when needed. Challenges may occur in scheduling consultations, sharing documents, or resolving software glitches. With TurboTax Assisted support, you receive dependable solutions to make your tax preparation experience efficient & stress-free from start to finish.

QAsolved - Where TurboTax Support Goes Beyond The Basics

Expertise

Our professional unmatched expertise, provides specialized knowledge, customized solutions, and assistance for better user support, making TurboTax customer service stand out.

Committed Assistance

Our team is committed to providing our clients with individualized guidance, prompt responses, and devoted assistance. This approach builds lasting relationships and increases customer satisfaction.

Customized Solution

We help you with solutions that provide detailed assistance to meet the requirements of every customer, guaranteeing detailed and successful resolution of every issue.

Strategic Partnership

To achieve mutual success, we strategically partner with businesses by enhancing relationships with them, providing advice, and coordinating help with long-term business goals.

Value-Driven Approach

We ensure customer satisfaction and business success, and our value-driven approach gives high priority to providing measurable benefits, solutions, and improvements.

Proactive Issue Resolution

To ensure easy operations and minimal disruptions, our team helps you actively identify and address potential problems before they have an impact on business’s tax filing process.

Our Success-Driven Path to Smarter, Faster TurboTax Resolutions

Learn Before We Solve

We analyze your query for urgency, complexity, and scope and before any action is taken, our team reviews your submitted request in detail. This helps us onboard the right expert to respond faster and smarter.

Plan with Precision

Post analysis, we create a custom plan based on your needs. Be it a TurboTax error, setup issue, or filing challenge, our experts map out a clear plan so that every move is made in the right direction and with the right intent.

Execute with Expertise

Once the plan is in place, we move fast. From configuration changes to error fixes, our team executes each step with precision, ensuring your TurboTax version works smoothly and efficiently, without disruption.

Assistance Beyond the Fix

After execution, we stay connected. Our team continues to monitor progress, answer follow-up queries, and provide ongoing guidance to ensure that your software remains stable, agile, and optimized.

Common Errors Of TurboTax Software

Error Code 0019

Occurs during installation of software

Error Code 190

Indicates a problem with file installation

Error Code 1921

Occur due to corrupted files

Error Code 65535

Indicates installation or software update failure

Error Code 36

Indicates a problem with accessing or saving files

Error Code 42015

Internet connectivity issues.

Error Code 1922

Permission issues or restrictions on the user's system

Error Code 70001

Occurs during the e-filing process

Explore the Powerful Features of TurboTax

Personalized Tax Guidance

TurboTax is designed with an easy-to-follow, question-and-answer style interface that walks you through the filing process. Instead of dealing with confusing tax jargon, you simply respond to prompts tailored to your situation. This approach makes tax preparation simpler and far less intimidating for individuals and businesses alike.

Automatic W-2 and 1099 Import

Manually entering income documents can be time-consuming and prone to mistakes. TurboTax lets you import W-2s, 1099s, and other income forms directly from employers, banks, and investment companies. This feature ensures accuracy, saves time, and minimizes the chances of errors in your return.

Deduction and Credit Maximizer

TurboTax actively searches for deductions and credits you qualify for, from mortgage interest and medical expenses to education and charitable contributions. By analyzing your financial data, it ensures that nothing important is overlooked. This feature helps you maximize your refund and reduce your tax liability.

Support for Investments and Rentals

Filing taxes involving investments or rental properties can be complex. TurboTax Premier and higher versions simplify the process by handling stock transactions, dividends, capital gains, and rental income with precision. It ensures that your investment reporting is accurate and compliant with IRS requirements.

Self-Employment and Business Tools

Freelancers, contractors, and small business owners often face unique tax challenges. TurboTax Home & Business provides dedicated tools for Schedule C filing, expense categorization, mileage tracking, and 1099 reporting. These features make it easier to manage both personal and professional taxes in one place.

Accuracy and Error Check

Submitting a tax return with mistakes can lead to delays, penalties, or IRS rejections. TurboTax includes a built-in error checking system that reviews your entire return before filing. It highlights missing details, inconsistencies, and potential issues so you can correct them in advance.

Audit Support Tools

While audits are uncommon, they can be stressful when they occur. TurboTax provides audit guidance tools and resources that help you understand the process and prepare the necessary documentation. Having access to this support gives you added peace of mind during tax season.

Live Expert Assistance

Not everyone feels confident filing taxes on their own. TurboTax Assisted allows you to connect with a tax professional in real time, while Full Service gives you the option to have an expert prepare and file your return for you. This ensures professional accuracy combined with personal convenience.

Mobile and Multi-Device Access

TurboTax adapts to your lifestyle by working seamlessly across desktop, tablet, and mobile devices. You can start preparing your taxes on one device and finish on another without losing progress. This flexibility makes it easy to work on your return anytime, anywhere.

Refund Tracking

Wondering where your refund is after filing? TurboTax includes built-in tools that allow you to track the progress of both federal and state refunds. This feature keeps you informed and reassured while you wait for your money to arrive.

Data Transfer from Previous Years

Re-entering old tax data can be tedious and error prone. TurboTax automatically imports information from prior years, making the filing process faster and more accurate. This continuity helps you stay consistent while ensuring important details aren’t missed.

Bank-Level Security

Protecting sensitive financial information is a top priority during tax season. TurboTax uses advanced encryption, secure logins, and cloud-based storage to keep your data safe. With multiple layers of protection, you can file your return with confidence knowing your information is secure.

Frequently Asked Questions

What exactly is TurboTax?

TurboTax is a leading tax preparation software that helps individuals and businesses file their taxes quickly and accurately. It guides you step by step through the filing process, identifies eligible deductions and credits, and even offers expert assistance when needed.

How can I get TurboTax support if I need help?

You can connect with TurboTax support through multiple channels, including phone, live chat, and online help within the software itself. Depending on the version you’re using, you may also have access to live tax experts who can answer your questions directly.

What is a TurboTax desktop?

Instead of using TurboTax online via a web browser, TurboTax desktop refers to the software version of the program that is installed and operated directly on a user’s computer. It functions offline and provides comparable features and functionality to the online version. You can easily use a TurboTax desktop on a Mac or Windows computer.

What information should I have on hand before speaking with a support agent?

To receive the fastest and most accurate assistance, it’s best to have your TurboTax account details, a copy of your tax return, and any related forms, such as W-2s, 1099s, or receipts, ready. This helps the agent understand your situation and resolve your issue more efficiently.

How long does a typical support session take?

The time varies depending on the complexity of your question. Simple issues may be resolved in just a few minutes, while more detailed problems might take longer. Rest assured, the support team stays with you until your concern is addressed.

Can I share my screen with a TurboTax agent for quicker help?

Yes, TurboTax offers a secure screen-sharing option in certain support cases. This allows the agent to see exactly what you’re seeing, making it easier for them to guide you step by step without confusion.

Will your support agent answer tax-related questions or only software issues?

TurboTax agents can help with both software-related questions and many tax-related concerns. However, if you’re using TurboTax Assisted or Full Service, you’ll also have access to licensed tax experts who can provide personalized tax advice and filing guidance.

Can your team help me with documents I need to submit to the IRS?

Yes, TurboTax support can guide you on how to prepare and submit the required documents electronically. They’ll help ensure that forms are filled out correctly and sent through the proper channels, so your filing is accepted without delays.

Helpful Guides & Tutorials

What is TurboTax and How Does It Work?

What is TurboTax? TurboTax is a tax preparation software that allows individuals to file their taxes electronically. It is designed to simplify the tax filing

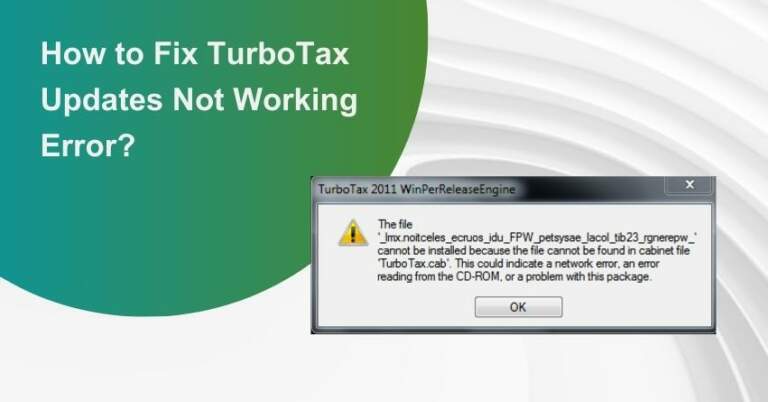

How to Fix TurboTax Updates Not Working Error?

Experiencing challenges with TurboTax updates not working error can be a frustrating roadblock for users seeking a seamless tax preparation experience. In this article, we’ll

How to Upgrade and Downgrade TurboTax?

You must know that the TurboTax Deluxe version is not free, and you have to pay a fixed amount to avail of all the features