Table of Contents

ToggleIf you are a business owner then at some point of time you must have come across a term ‘bank reconciliation’. And if you are not someone with an in depth knowledge of financial terms then it is also obvious for you to wonder ‘What is a Bank Reconciliation’? There is no need to worry as here we are going to discuss this topic in great detail. And you will get a clear understanding of bank reconciliation, its purpose and the steps of the process.

What is a Bank Reconciliation?

It is a process in which a business ensures that all of its data is in place. And for this, they take a detailed overview of all records like check register, general ledger account, balance sheet etc. In this process they make sure that the amounts mentioned in the records are the same as the amounts in the bank statement. They also need to figure out if there are any differences then what is the reason for that.

Bank reconciliation helps to identify if there are any accounting changes required or not. And if a company performs regular reconciliation then it can ensure that all the cash records are correct.

What is the Primary Purpose of Bank Reconciliation?

With bank reconciliation a company makes sure that all the transactions that are mentioned in the accounts match with the bank statement. This process helps them to find out if there are any discrepancies in the entries recorded on the register. This also helps the business to make any changes to the accounting records and avoid any fraudulent transactions or cash manipulations.

Along with this, it also plays a significant role in detecting any errors such as double payments, missed payments, calculation errors etc. The business owners can easily track and add bank fees and penalties in the records. Bank reconciliation makes the process of keeping track of accounts payable and receivables effortless.

A Detailed Overview of the Process:

If you are performing the reconciliation for your business, you have to compare the bank statement with the general ledger of your company. Every business keeps a cash book in which it records all the bank transactions and cash transactions also. And the bank statement also provides a detailed list of all the transactions. You receive your bank statement every month or at regular intervals.

There can be instances when the transactions in your cashbook do not match with transactions mentioned on the bank statement. To keep your records clean you have to identify the reasons for any such discrepancies.

Every time you perform bank reconciliation, the chances are high that you will find some differences in the ending cash balances. The most common of these difference are:

- Deposits in transit

- Outstanding checks

- Bank service fees

- Interest income

- Not sufficient funds (NSF) checks

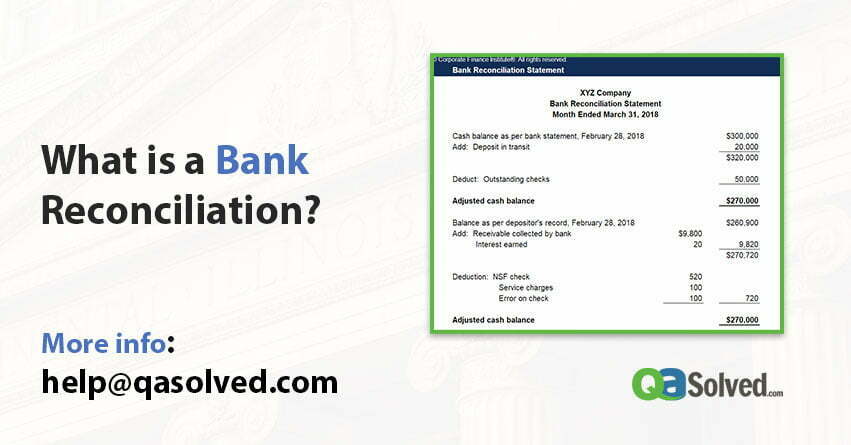

When you find discrepancies, this is the point at which reconciling is a must. This way you can also make sure that every item is accounted for and the ending balances are the same on your records and bank statements. A statement is prepared to do this and it is called the bank reconciliation statement.

Also Read: What is IRS Form 8965 and How to Fill it?

Here are the Steps of the Process of Bank Reconciliation:

Comparison of Deposits:

In the very first step, you have to compare the deposits mentioned in your accounting records with the ones in the bank statement. And then mark the items also that appear in both the records.

Adjustments in Bank Statements:

Now you have to adjust the balance of the bank statement according to the corrected balance. Add all the deposits in transit and then deduct the outstanding checks. After that add or deduct bank errors if required.

The deposits in transit are the ones that you received and recorded. But these amounts are not yet recorded on your bank statement. This is why you need to add them yourself. And outstanding checks are the ones you have mentioned in your cash account but they will get cleared in the future by your bank. Your bank balance also has not been deducted for these amounts. Generally, this happens when you write a check in the last days of the month.

Sometimes, there can be a few mistakes in your bank statements. These errors can be like an incorrect amount has been entered in the statement. By comparing the cash account’s general ledger to the bank statement you can easily spot these bank errors.

to resolve your query in no-time.

Adjustments in Cash Accounts:

The next step is adjustments in cash accounts. You have to adjust the cash balances in your accounting record. And for doing so, you have to either add interest or deduct monthly charges and overdraft fees.

Balance Comparison:

To keep your accounting records clean, it is a must that you reconcile the bank account whenever you receive your bank statement. How often you should do it, depends on the number of transactions in your business. So you can do it monthly, weekly or daily if you have a large number of transactions.

Before the bank reconciliation you have to make sure that you have all the transactions in place. And if you are using online banking for your business then you have an added benefit. You can easily download the bank statements and perform the reconciliation regularly. This way you will save yourself from making all these entries manually.

Final Thoughts!

At this point you must have understood how important bank reconciliation is. If you are running a business and want to manage the finances smoothly then it is a must-do for you. Regardless of the type of business you are running, coming across an accounting error is the last thing you would want. This can cause so many unnecessary problems for you. The best way to avoid such things is performing regular bank reconciliations. This way you will be able to spot any fraudulent transactions and you can also minimize the risk of penalties and late fees.

If you want to know more about What is a bank reconciliation then contact QASolved.

FAQ

A: In this process, you have to compare the transactions of your financial records with the ones on your bank statement.

A: This helps to detect fraud transactions in your business.

A: There are five main types of reconciliation:

1. bank reconciliation

2. customer reconciliation

3. vendor reconciliation

4. inter-company reconciliation

5. business-specific reconciliation

A: In this process, you have to subtract the total debits from the total credits.

A: Yes, there are a few tools available for this purpose.

A: There are total of four steps in the process:

1. Comparison of Deposits

2. Adjustments in Bank Statements

3. Adjustments in Cash Accounts

4. Balance Comparison

A: The formula is (Cash account balance per your records) plus or minus (reconciling items) = (Bank statement balance).

A: Your cash account balance is the book balance.

A: If any discrepancy is not a bank error then there are chances that it is a fraudulent activity.

A: A bank reconciliation accountant is someone who ensures that cash amounts in an organization’s accounting ledgers reconcile with the actual bank balance.