Table of Contents

Toggle- Features of Xero

- Types of Xero Products

- Industries where Xero can be Used

- How to Get Started with Xero?

- 1. Establish Your Organization's Details

- 2. Configure Your Financial Settings

- 3. Incorporate Your Company's Branding

- 4. Establish Your Chart of Accounts

- 5. Set up your Bank Account Feed

- 6. Reconfirm your Bank Feed Consent

- 7. Reconcile

- 8. Establish Payroll

- 9. Add Payment Services

- 10. Establish Payment Reminders

- 11. Add Users

- 12. Get to Know Basic Reports

- 13. Connect with Apps

- Benefits of using Xero

- Pricing

- Final Thought

- Frequently Asked Questions

Xero is a cloud-based accounting software designed to make managing finances easier for businesses of all sizes. Instead of using traditional desktop software, It operates entirely online, allowing users to access their financial information anytime, anywhere with an internet connection.

The platform offers a user-friendly interface that simplifies accounting tasks such as invoicing, expense tracking, and bank reconciliation. One of the key features of Xero is its real-time collaboration, enabling multiple users to work on financial data simultaneously. This makes it an excellent tool for accountants, business owners, and other team members who must collaborate on financial matters.

Xero also integrates with various third-party applications and offers a range of add-ons, allowing users to customize their accounting system based on their specific needs. The automation features in Xero help manage repetitive tasks, saving time and reducing the likelihood of errors.

In this article, we will discover everything about Xero to stay on top of your accounting.

Features of Xero

Xero is a robust cloud-based accounting software that offers a range of features tailored to meet the accounting needs of small and medium-sized businesses. Here are some key features that make Xero stand out:

| Pay Bills | Easily handle your expenses by tracking and paying bills on time. Xero gives you a clear view of accounts payable and cash flow. |

| Claim Expenses | Manage spending effortlessly with Xero’s expense tools. Submit or get reimbursed for expense claims efficiently |

| Bank Connections | Connect with over 21,000 global financial institutions. Save time using bank feeds and automated reconciliation, helping you manage finances more efficiently. |

| Accept Payments | Boost your chances of getting paid on time by accepting online payments via credit card, debit card, or direct debit directly from your Xero invoice. |

| Track Projects | Utilize Xero’s job-tracking tools for project planning, budgeting, quoting, and invoicing. Keep tabs on time and costs with project accounting. |

| Payroll with Gusto | Simplify payroll with Xero. Use Gusto payroll software to calculate pay and deductions, ensuring a smarter approach to employee payments. |

| Bank Reconciliation | Keep your accounts up to date with easy bank reconciliation. Confirm that your bank transactions match your financial records seamlessly. |

| Manage Xero Contacts | Streamline contact management. Access customer or supplier sales, invoices, and payments in one centralized location. |

| Capture Data | Automate data capture by seamlessly storing documents and key data into Xero with Hubdoc. |

| Files | Safely manage and share documents, contracts, bills, and receipts online with Xero’s file storage feature. |

| Reporting | Track your finances with accurate accounting reports and collaborate with your online advisor in real-time. |

| Inventory | Monitor stock levels and populate invoices and orders effortlessly with Xero’s inventory software |

| Online Invoicing | Send invoices, automate reminders, and manage invoicing tasks easily with Xero’s intuitive online invoicing software. |

| Multi-Currency Accounting | Pay and get paid in over 160 currencies, simplifying international business accounting with up-to-date exchange rates. |

| Purchase Orders | Create and send digital purchase orders, keeping track of orders and deliveries seamlessly. |

| Quotes | Generate professional online estimates and quotes instantly with Xero’s software. |

| Sales Tax | Automatically calculate sales tax on invoices with Avalara integration, saving time and ensuring compliance. |

| Analytics | Forecast cash flow, check financial health, and track metrics with Analytics Plus. |

| Accounting Dashboard | Keep an eye on your finances day by day with Xero’s accounting dashboard, tracking bank balances, invoices, bills, and more. |

| Manage Fixed Assets | Easily track fixed assets and collaborate with your accountant to manage them effectively. |

| Integrate Apps | Enhance business operations by choosing apps and integrations that connect seamlessly with Xero. |

| Xero Accounting App | Run your small business from anywhere with the Xero bookkeeping and accounting app, ensuring productivity on the go. |

Types of Xero Products

1. Xero HQ

Xero HQ makes managing your accounting or bookkeeping practice easier. Quickly access and assign client information, securely collect documents, and efficiently handle client queries—all in one place. Streamline your workflow by working from a centralized list of all your clients in Xero HQ.

2. Xero Cashbook, Xero Ledger

Xero Cashbook is tailored for clients who require Xero’s automated bank feeds but don’t require invoicing features. With this service, clients receive daily bank feeds of their transactions along with all the functionalities available in Xero Ledger. Notably, clients have the flexibility to independently code their transactions and access their data and reports for a more hands-on financial management experience.

Xero Ledger is designed for clients needing annual accounts preparation. It offers features like bank reconciliation, budgeting, fixed asset management, and financial statements. Clients can access data and reports but can’t directly code transactions, ensuring accuracy and control.

3. Xero Practice Manager

Xero Practice Manager is a flexible accounting practice management software that improves efficiency by adapting to your workflow. You can easily customize tasks, job statuses, and templates to match your practice’s needs. It also allows you to create personalized documents like quotes and invoices with your branding for effective communication.

4. Xero Workpapers

Workpapers, integrated with Xero, simplifies the creation of workpapers for faster and automated financial audits. It’s a collaborative tool that helps manage digital compliance workflows, providing customized work programs and efficient handling of client queries.

The three distinct types of workpapers cater to specific needs:

Reconciliation: This involves comparing client records with the corresponding data in Xero.

Calculation: It enables the direct calculation of values from client records.

Work program: This feature allows you to record notes and queries as part of your workflow.

Also Read:- Xero vs QuickBooks

Industries where Xero can be Used

| Business by industry | Business by type |

| Construction | Football clubs |

| Trade | Landlords |

| Manufacturing | Nonprofits |

| Real Estate | Self-Employed Businesses |

| Retail | Startups |

| E-commerce | |

| Hospitality | |

| Farming | |

| Health & Social care |

How to Get Started with Xero?

Read the following steps to start your journey:-

1. Establish Your Organization’s Details

For a limited company, make sure you have a registration number and registered office address, as these details must be visible on your invoices.

Access Settings > Organisation Settings to enter or modify your business’s contact information, covering:

- Display name

- Legal/trading name

- Registration number

- Organization description

- Physical address

- Registered address

- Organization type

- Phone and fax numbers

- Logo

- Website

2. Configure Your Financial Settings

Visit Settings > Advanced Settings > Financial Settings to input your company details:

Financial Year End: Set the appropriate year-end to ensure accurate reporting.

Sales Tax / VAT Details: Specify your VAT scheme (flat, cash, or accrual rate), along with your VAT number and VAT period.

3. Incorporate Your Company’s Branding

Enhance your professional image by configuring your invoices with payment terms, contracts, and logo. Visit Settings > Invoice Settings to establish multiple branding schemes.

Customizing your terms of payment is key to optimizing your cash flow. Implementing shorter payment terms can contribute to receiving payments more promptly.

4. Establish Your Chart of Accounts

Whether you’re transitioning from another accounting software or starting fresh, you have the flexibility to import your existing chart of accounts into Xero or tailor the default chart to suit your needs.

If you have an accountant, consider seeking their guidance in making this decision. If you handle your bookkeeping, using Xero’s default chart of accounts is advisable. You can easily add, customize, or remove accounts to align with your business requirements.

To manage your accounts, visit Accounting > Chart of Accounts.

5. Set up your Bank Account Feed

- Go to the “Bank accounts” section in the Accounting menu.

- Click on “Add Bank Account.”

- Choose your bank from the popular bank’s list, or type your bank’s name, and select it from the options.

- If your bank isn’t listed, proceed by clicking “Add without bank feed” to manually import statements.

- Click “Agree and log in to the bank.”

- Log in to your bank account, provide online banking credentials, and complete any required multi-factor authentication.

- Select the specific accounts you want to share with Xero and follow the sharing steps until redirected back to Xero.

- Verify that the correct bank accounts are selected; if needed, choose a different account or add a new one. Each selected account should display a green tick before clicking “Continue.”

- Confirm the start date for importing transactions, allowing up to 12 months’ worth.

- For bank accounts already in Xero, the date will default to the last imported transactions; no change is necessary.

- Click “Finish.”

6. Reconfirm your Bank Feed Consent

Some feeds require periodic renewal; check your dashboard for notifications and renew the connection as needed.

To renew the connection

- Select “Bank accounts” in the Accounting menu.

- Click “Manage Account and Renew Bank Connection” for the relevant bank account.

- Follow the prompts to complete the renewal process.

7. Reconcile

Reconciling with Xero is super easy. Just spend a few minutes each week approving transactions, and Xero takes care of the rest by automatically pulling in your bank data. It even remembers your previous categories, so categorizing transactions is a quick ‘OK’ click.

For accurate accounts and a clear cash flow view, aim to reconcile weekly or even daily. Up-to-date invoices help you make smart business decisions and stay on top of payments.

8. Establish Payroll

Setting up payroll with Xero is simple and helps you keep track of your staff costs efficiently. With Xero Payroll, you can consolidate payroll information in one place, eliminating the need to import data from a separate system.

Whether you’re starting fresh or transferring payroll from another system in the middle of the financial year, It has you covered. Just remember to input opening balances if you’re making a mid-year switch. To access this feature, simply go to Payroll > Payroll Overview.

9. Add Payment Services

To broaden your payment options and make it convenient for customers to pay, it’s essential to link active payment services to your Xero account. This can include popular services like PayPal, Stripe, or GoCardless.

To set this up, follow these steps:

- Go to Settings

- Select Invoice Settings

- Click on Payment Services

10. Establish Payment Reminders

Facilitating payment is vital for any business, and one effective way to achieve this is by establishing payment reminders to manage your credit control systems. To set up payment reminders in Xero, follow these steps:

- Head to Settings.

- Choose Invoice Settings.

- Click on Invoice Reminders.

| Note: It’s crucial to note that you should only activate payment reminders once you’ve started daily reconciliation. Pursuing payments from customers who have already settled their dues can harm your reputation. |

11. Add Users

To add users in Xero, follow these steps:

- Go to Settings.

- Select Users.

- Add your accountant, bookkeeper, and other essential stakeholders.

- For more detailed actions related to users, you can:

12. Get to Know Basic Reports

Understanding basic Xero reports is essential for gaining insights into your financial data. After inputting some data, take a look at key reports such as the Balance Sheet, Profit and Loss, Aged Receivables, and Aged Payables. To access these reports, follow these steps:

- Access Accounting.

- Select Reports to explore the available options.

This provides a snapshot of your financial health, detailing your assets, liabilities, income, and expenses. Regularly reviewing these reports helps you stay informed about your business’s performance.

13. Connect with Apps

You can save time and manage your work with Xero’s apps and add-ons. From cash flow forecasting to document management, Xero offers a variety of functionalities. Explore your options easily on the Xero app marketplace to find tools that fit your business needs.

Now that you’ve understood these points you’ve a basic understanding of Xero and you are good to start your journey in Xero!

Benefits of using Xero

Real-time Financial Reports: Xero provides the advantage of real-time financial reporting, allowing businesses to access up-to-date statistics on their finances instantly. Unlike traditional accounting systems that may provide weekly or daily reports, Xero processes money transfers immediately, offering a more accurate and timely overview of the financial situation.

Access Anywhere, Anytime: The cloud-based nature of Xero ensures that financial data is accessible from anywhere with an internet connection. This flexibility enables users to perform accounting tasks, check financial information, and make informed decisions.

Facilitating Collaboration: Xero’s cloud functionality allows multiple users to access the platform simultaneously. This collaborative feature facilitates teamwork, enabling various team members to make changes and adjustments in real-time, promoting efficient collaboration within the organization.

Data Backup: Xero incorporates a straightforward backup system, ensuring the protection of financial data from tampering and potential hardware failures. Regular backups contribute to data security and provide a safety net for businesses in the event of unforeseen challenges.

Workflow and Scalability: Xero offers an easy-to-use platform that supports efficient workflow processes. Its scalability allows businesses to handle an increasing number of orders and clients without facing early limitations. This adaptability makes Xero suitable for both small and growing businesses.

Expandability with Add-on Support: Third-party developers can extend Xero’s functionality through add-ons, ensuring that the platform can continuously evolve based on community requests. This expandability allows businesses to tailor their accounting solution to meet specific needs and take advantage of new features as they become available.

Integration: While Xero is a standalone accounting solution, it boasts easy integration capabilities with other software. This means businesses can integrate Xero with complementary tools such as payroll software or payment processing solutions, creating an interconnected software ecosystem.

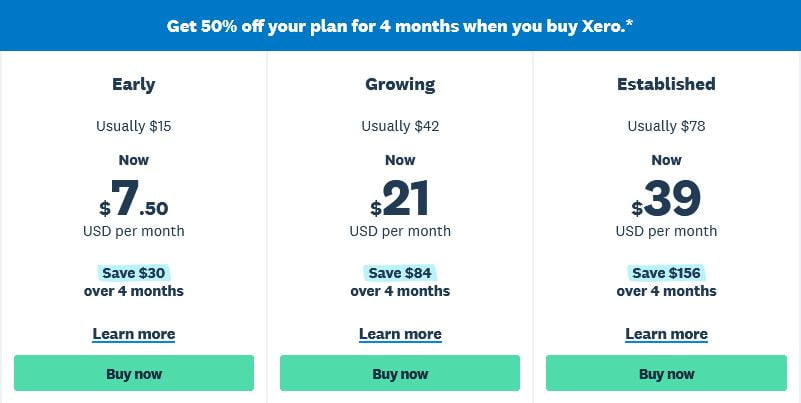

Pricing

| Early | Growing | Established | |

| Send invoices and quotes | Send quotes and 20 invoices | ||

| Enter bills | Enter 5 bills | ||

| Reconcile bank transactions | |||

| Capture bills and receipts with Hubdoc | |||

| Short-term cash flow and business snapshot | |||

| Bulk reconcile transactions | |||

| Use Multiple currencies | |||

| Track projects | |||

| Claim expenses | |||

| Analytics Plus | |||

| Payroll with Gusto | Optional | Optional | Optional |

Final Thought

Xero is user-friendly accounting software designed to help businesses manage their finances efficiently. It works by allowing users to easily track income and expenses, create and send invoices, reconcile bank transactions, and generate insightful financial reports. With its cloud-based platform, It provides real-time collaboration and accessibility, making financial management accessible from anywhere. Overall, Xero simplifies the accounting process, saving time and enabling businesses to make informed financial decisions.

We’re here to ensure that you have all the knowledge for smooth functioning. For personalized assistance and expert guidance, contact our Xero Customer Care team at our Toll-Free Number at +1-855-875-1223.

Frequently Asked Questions

This app simplifies accounting tasks, automating processes like invoicing and payroll. It offers features such as Xero Verify, Xero Accounting, Xero Projects, Xero Me, Xero Go and Hubdoc for a real-time overview of company finances, enhancing efficiency and accuracy.

Xero offers a 30-day free trial allowing users to explore its features. However, after the trial period, subscription plans with varying costs are available, depending on the user’s business needs and requirements.

Xero streamlines numerous laborious accounting tasks, including invoicing, bank reconciliation, and payroll, through automation. This not only saves valuable time but also minimizes the likelihood of errors. Furthermore, Xero provides a real-time perspective on your company’s financial status throughout the year, offering a dynamic and up-to-date overview of your business’s financial health.

Yes, you can learn independently. The platform provides various learning resources, including tutorials, webinars, and documentation. Additionally, Xero’s user-friendly interface makes self-learning feasible for individuals looking to understand and utilize its features.