Receiving payment is great, but getting paid on time is even better! Providing compensation timely to the employees has always been one of the greatest aspects for businesses of all sizes and verticals. Swift remuneration process is something that many companies are facing problems with and that is exactly when QuickBooks and its direct deposit feature comes to the picture. QuickBooks direct deposit lets you skip the paper checks and bank trips to ensure your team’s wages are directly deposited into their accounts every payday without any no fuss or waiting time. In addition to ensuring your employees get paid on time, QuickBooks Payroll direct deposit restricts payroll errors, eliminates lost checks, and simplifies your financial records.

In this blog, we will walk you through the steps to set up direct deposits in QuickBooks. But before that, let us understand the benefits of activating QuickBooks Direct Deposits along with some of its features. So, let’s begin with it.

Advantages of Activating QuickBooks Payroll Direct Deposit

Apart from ensuring timely payroll processing and employee compensation, there are a wide range of benefits that QuickBooks Online Direct Deposit covers. For employees, Direct Deposit provides the convenience of instant access to their funds on payday, eliminating trips to the bank and offering a sense of security. Here are the seven benefits of setting up Direct Deposits in QuickBooks Online.

- Timely Payments: Employees receive their paychecks immediately, without having to wait for checks to clear.

- Convenience: Paper checks no longer need to be printed, signed, and distributed. Payroll can be processed in just a few clicks with QuickBooks Direct Deposit.

- Cost-Effective: Direct deposit reduces payroll expenses by eliminating paper checks, envelopes, and postage.

- Reduced Errors: Direct deposit reduces mistakes caused by manual data entry by automating the transfer.

- Eco-Friendly: Less paper means less environmental impact. Direct deposit helps you run your business more efficiently while contributing to sustainability.

- Secure Payments: Employers use direct deposit to ensure payments are securely transferred directly to employees’ accounts, reducing the risk of fraud.

- Simplified Record-Keeping: Digital records simplify payroll tracking and reconciliation. In addition to keeping your financial records organized, QuickBooks keeps a clear audit trail.

So, these are seven benefits that attract more and more businesses toward QuickBooks Direct Deposit. Paying employees on time is one way to appreciate their hard-work and dedication they show throughout the month. So, set up Direct Deposit in QuickBooks to simplify your payroll process, increase productivity, and provide your employees and yourself with peace of mind. Let us now talk about the exciting features of the same.

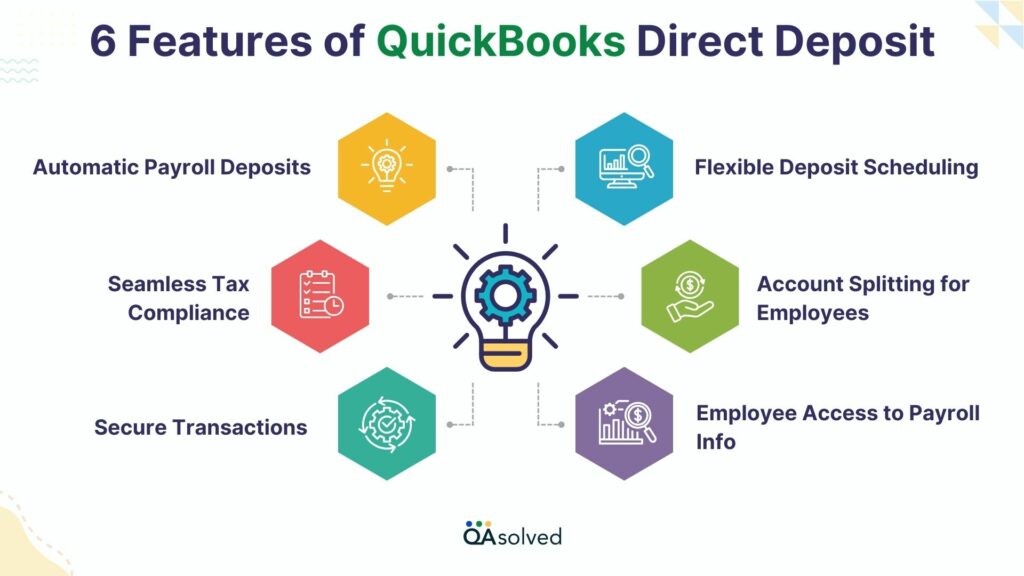

6 Exciting Features of QuickBooks Online Direct Deposit

Just like the advantages, we have also made a list of seven exciting features of QuickBooks Online Direct Deposit. These features attract small and medium-sized businesses to further switch from other QB versions to QB Online. Here’s a list of 6 main features that enhance Payroll management effortlessly.

- Automatic Payroll Deposits: Deposit wages directly into employee bank accounts without paper checks.

- Flexible Deposit Scheduling: Choose from same-day, next-day, or scheduled payroll deposits.

- Seamless Tax Compliance: Automates tax calculations and filings to ensure compliance.

- Account Splitting for Employees: Allows employees to split paychecks across multiple accounts.

- Secure Transactions: Uses encryption to keep payroll deposits secure and private.

- Employee Access to Payroll Info: Employees can access pay stubs and deposits through an online portal.

These are the six features of Direct Deposit in QuickBooks. Now that we’ve discussed the benefits and features, let’s move ahead and highlight the three easy yet complex steps to activate Direct Deposit in QBO.

3 Steps to Activate QuickBooks Direct Deposit

With QuickBooks Online Direct Deposit, paying your employees has become more convenient, quick, easy, and secure- ensuring they get their payments directly into their bank accounts without any delays or manual intervention.

Here are the steps to activate QuickBooks Direct Deposit:

Step 1: Verify Your Bank Account

When you sign up, Intuit makes two small withdrawals (under $1 each) from your linked Direct Deposit account to ensure your security. Check your bank account for these amounts band confirm them within QuickBooks. Following your confirmation, your account is ready for payroll transactions and any associated fees.

Here’s how to verify your bank account:

- Your bank account will receive two small withdrawals (usually within 2-3 days of signup). There will be a reference to “QuickBooks” in the transaction description.

- Go to Employees > My Payroll Service > Activate Direct Deposit.

- Click “Next” when you have entered both withdrawal amounts.

Note: You will receive a refund of these two withdrawals several banking days after completing the verification and activation process.

Step 2: Add Your Employees’ Bank Account Information to QuickBooks

Employees who wish to receive their pay via direct deposit should provide their bank account information. Paychecks must be deposited directly into the employee’s bank account following written consent. A direct deposit authorization form can be used for this purpose.

- Select the Employee Center from the Employees menu.

- Click “Set Up Direct Deposit” under Employee Information for the employee you wish to set up.

- Select whether you want your paycheck deposited into one or two accounts when the box for “Use Direct Deposit” appears.

- Finally, hit OK to save the employee’s bank details.

Step 3: Use Direct Deposit to Pay Employees

- In QuickBooks, create paychecks.

- Check the Direct Deposit checkbox for each employee you want to pay via direct deposit in the Review & Create Paychecks window.

- Select the Send Payroll to Intuit button and enter your Direct Deposit PIN.

- You will receive a confirmation once the payroll has been submitted.

- QuickBooks pay stubs can be printed for employees to see details about their paychecks, which are automatically deposited into their bank accounts.

So, these are the three easy steps to set up and activate QuickBooks Direct Deposit. If you’re facing any trouble with the same, then our QuickBooks Payroll Support team is here to assist you with that with round-the-clock availability.

Conclusion

Activating and using QuickBooks Direct Deposit simplifies payroll management. Setting up and verifying your bank account information ensures that your payments are processed securely and efficiently. By setting up direct deposit, you can easily create paychecks, authorize direct deposits, and send payroll directly to your employees’ bank accounts without the hassle of manual checks. The same-day direct deposit in QuickBooks ensures that your employees get their paychecks quickly and efficiently. Furthermore, by printing pay stubs for your employees, you can provide full transparency and documentation of their earnings.

Despite following the above-mentioned, if you’re still facing issue, then connect with experts via toll-free number: 1-888-245-6075.

Frequently Asked Questions

Yes. There are two limits. A company total limit, and a per-employee limit. This is to protect you against fraud. If you use QuickBooks Online Payroll, you can see your direct deposit limit in your Payroll Settings, Direct deposit. You can request a direct deposit limit increase if your payroll is higher than your limits, or if you need to pay out bonuses.

QuickBooks employs robust encryption and security measures to protect direct deposit data. However, always ensure your system is updated and use secure networks when accessing sensitive information.

If a direct deposit fails, QuickBooks typically notifies the user or administrator. Common reasons include incorrect bank details, insufficient funds, or account closures. You’ll need to rectify the issue and reinitiate the deposit.

Yes, QuickBooks offers flexibility in setting up different direct deposit schedules for various employees, catering to individual preferences or requirements.