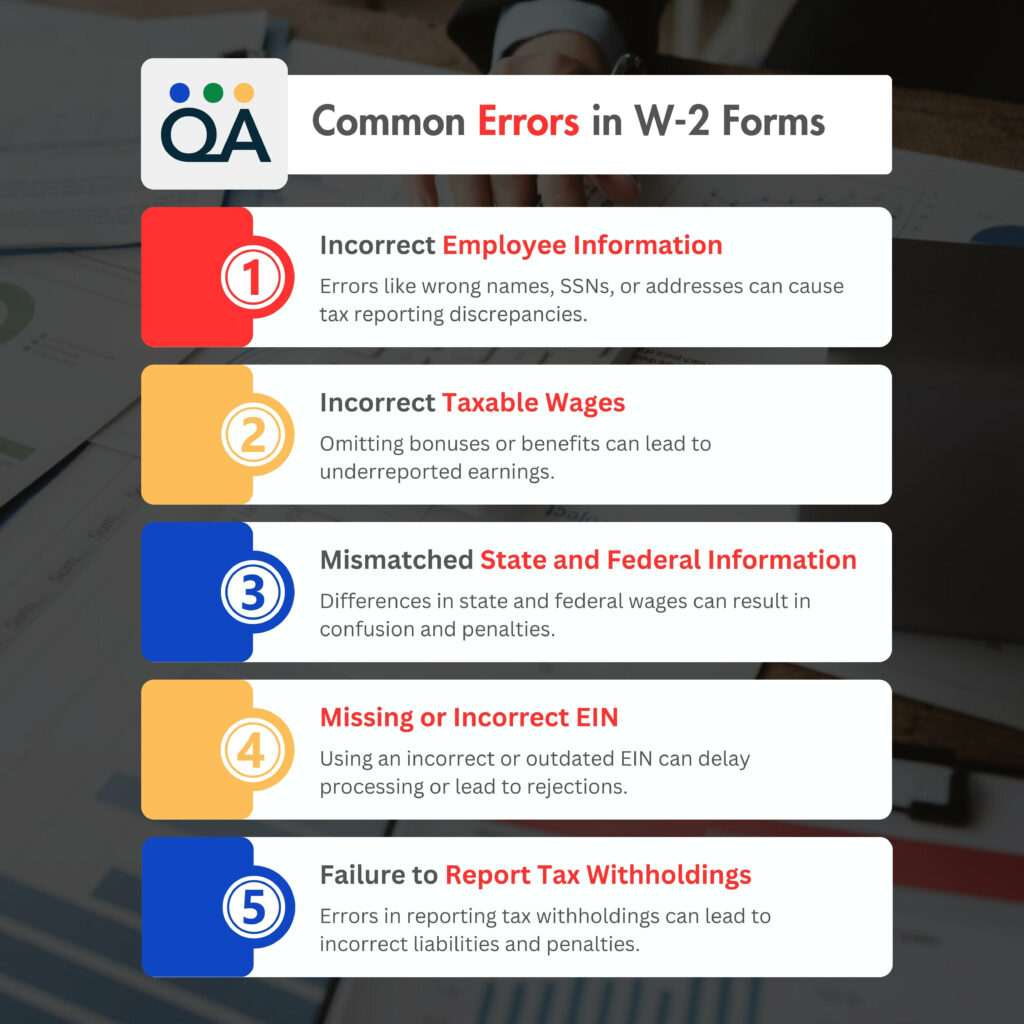

For entrepreneurs, stress is an unavoidable companion. Whether it’s about generating revenue, overseeing operations, developing unique strategies, or ensuring tax compliance, small and mid-sized business leaders are constantly juggling multiple responsibilities. In the context of tax compliance, managing and filing W-2 forms can be particularly challenging. The W-2 form holds severe importance as it reports the annual wages of the employees and the amount of taxes withheld from their paychecks. Accurate and timely filing and submission of W-2 forms is not just a legal requirement but also critical to maintaining employee trust and avoiding hefty penalties from the IRS.

To manage all these tasks, entrepreneurs either look to hire an internal CFO or seek other advanced solutions that meet all their finance-related needs. This is exactly where QuickBooks comes into the picture. QuickBooks Online offers a range of advanced accounting and bookkeeping solutions that also involve efficient tax and compliance solutions. However, the process of filing and printing W-2 in QuickBooks Desktop and QuickBooks Online is not that easy. Moving ahead, we will help you with the steps that can help you print W-2 in this revolutionary accounting software.

How to Print W-2 in QuickBooks Desktop?

While printing W-2 forms, certain considerations have to be followed to ensure efficiency and avoid the chances of error.

Prerequisites for Printing W-2 Forms in QuickBooks Desktop

The following requisites have to be taken care of while printing W-2 forms:

- Keep the backup while printing W-2 forms for your future reference.

- Use the upgraded desktop version for the latest payroll/tax forms compliances.

- Make sure you have enrolled for an active enhanced or standard QuickBooks payroll subscription.

- Check the latest payroll tax table is installed for accurate and compliant tax calculations.

- Use correct and proper alignment of pages, and execute a print test on blank paper.

- Check the latest upgraded version of Adobe Reader installed on your desktop.

By considering these prerequisites, you can ensure a quick and efficient printing of W-2 forms in QuickBooks Desktop.

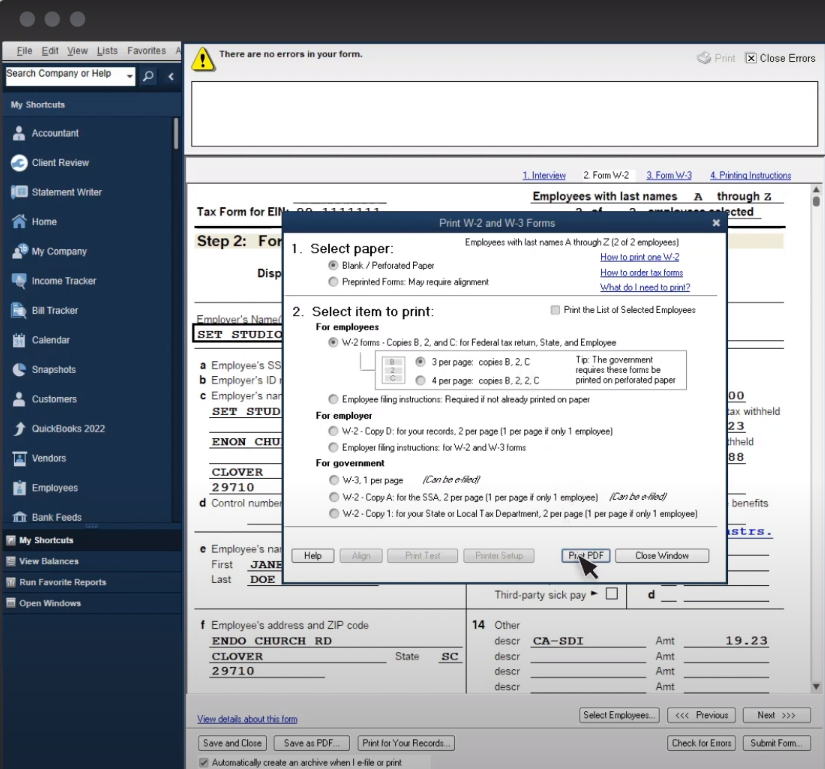

7 Steps to Print W-2 in QuickBooks Desktop

Let us understand how to print W-2 in QuickBooks Desktop in the detailed steps mentioned below:

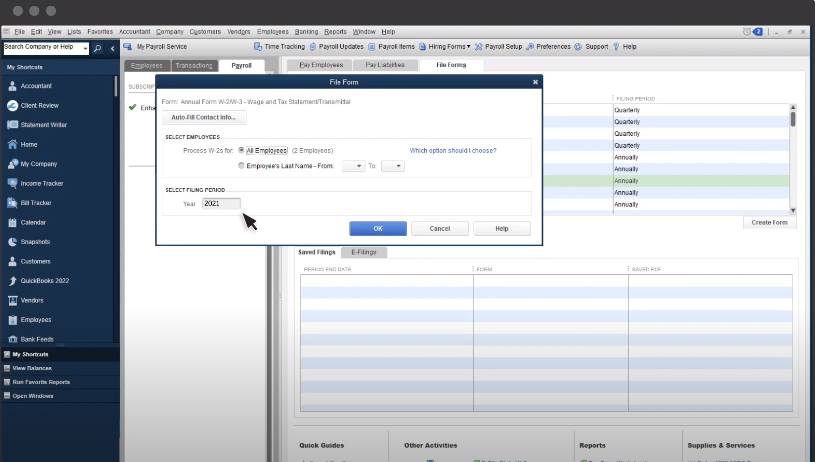

1. Click on ‘Employees’ and choose ‘Payroll Center’ in QuickBooks Desktop.

2. From the ‘Payroll Center’, select the ‘File Forms’ tab to get access to W-2 forms.

3. Choose View/Print Forms & W-2S to begin with your Payroll Pin and click on Ok.

4. Now select all or individual employees for which you want to generate forms and choose the financial year under the W-2s tab.

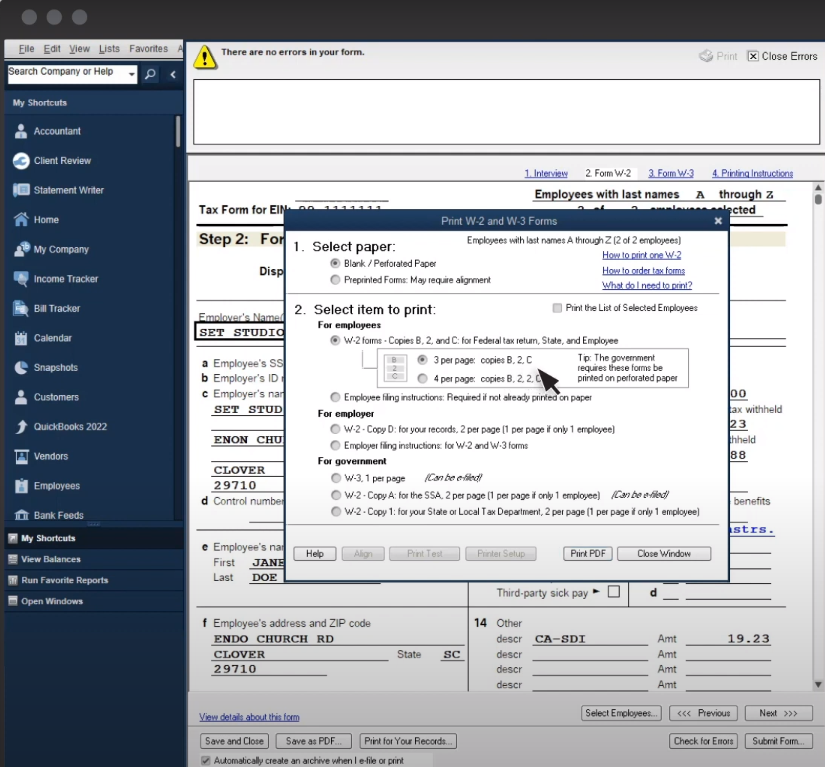

5. Select the type of W-2 form from the given list of Copies B, C & D.

6. See a Print Preview before printing to confirm the accuracy of the form.

7. After reviewing all the details mentioned in the form, give the command for Print by clicking on ‘Print’.

So, these are seven simple steps that can help you print W-2 forms in QuickBooks Desktop successfully.

Benefits of Printing W-2 Forms in QuickBooks Desktop

There are several pros of printing W-2 forms via QuickBooks Desktop. Some of these benefits are as follows:

- Streamline Payroll: QuickBooks Desktop is directly integrated with payroll systems and streamlines the process of retrieving data required to fill W-2 forms.

- Foster Editing: It allows you to edit or customize details as per your need to meet tax compliance and company policies or standards.

- Past Records: It allows access to the previous records of employees related to their payroll, and previous W-2 forms, which is helpful in Audits, Employee Verification, and Compliance Check.

- Regular Updates: It offers you continuous software updates that enable your system to be upgraded with the latest tax compliances and regulations which are required to be met as per the IRS standards.

- Compatibility: It also offers you various tools to simplify your tax process and is compatible with the latest versions of in-built software to manage Payroll.

How to Print W-2 in QuickBooks Online?

Just like QuickBooks Desktop, QuickBooks Online also supports the printing process of the W-2 forms.

Here also, you need to consider some of the prerequisites before printing W-2 forms in QuickBooks Online.

Prerequisites for Printing W-2 Forms in QuickBooks Online

The following prerequisites have to be taken care of before proceeding further:

- Configure the correct printer setup to support QuickBooks Online.

- Make sure to use Black Ink.

- Avail active subscription of Payroll.

- Use blank perforated paper for printing which is in horizontal shape.

- Confirm that QuickBooks Online is compatible with the latest Tax compliance.

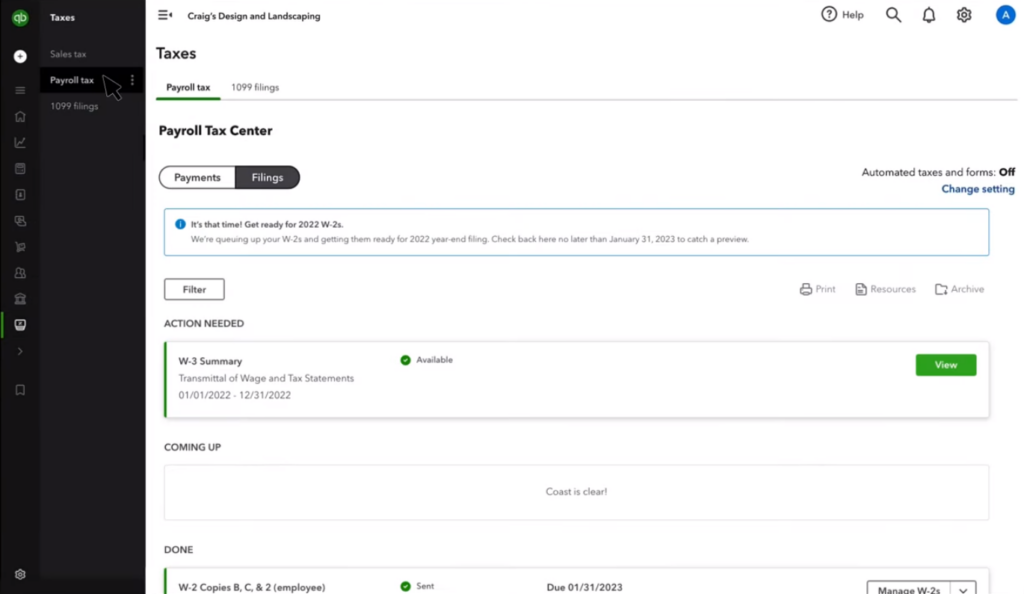

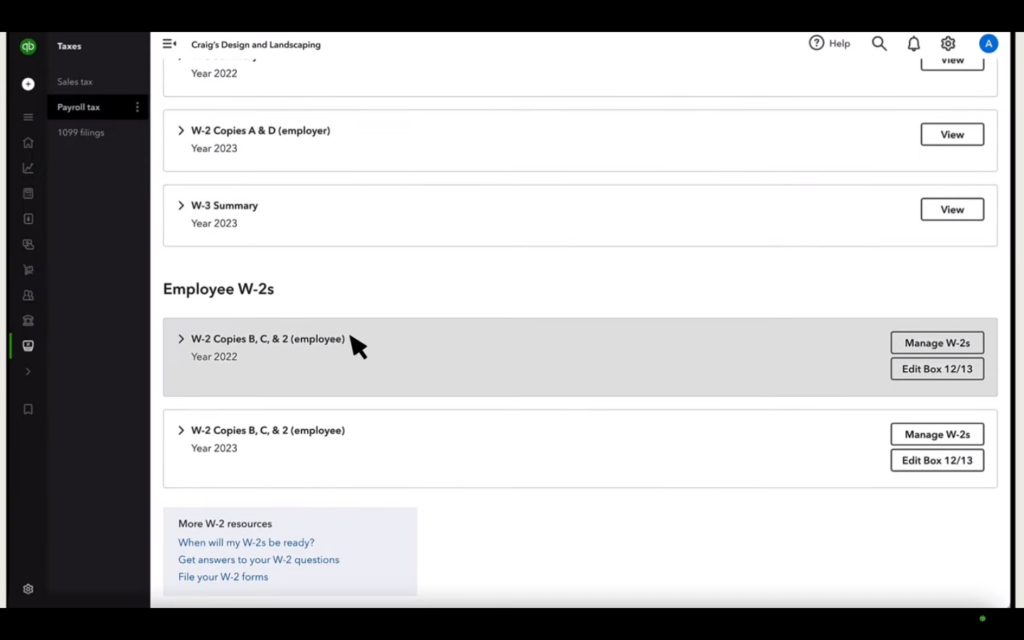

6 Steps to Print W-2 in QuickBooks Online

After ensuring all the requirements, let us understand how to print W-2 in QuickBooks Online with the help of the following steps:

- Navigate to the Taxes tab and click on the Payroll Tax section.

- Choose Annual Forms under the Forms tab.

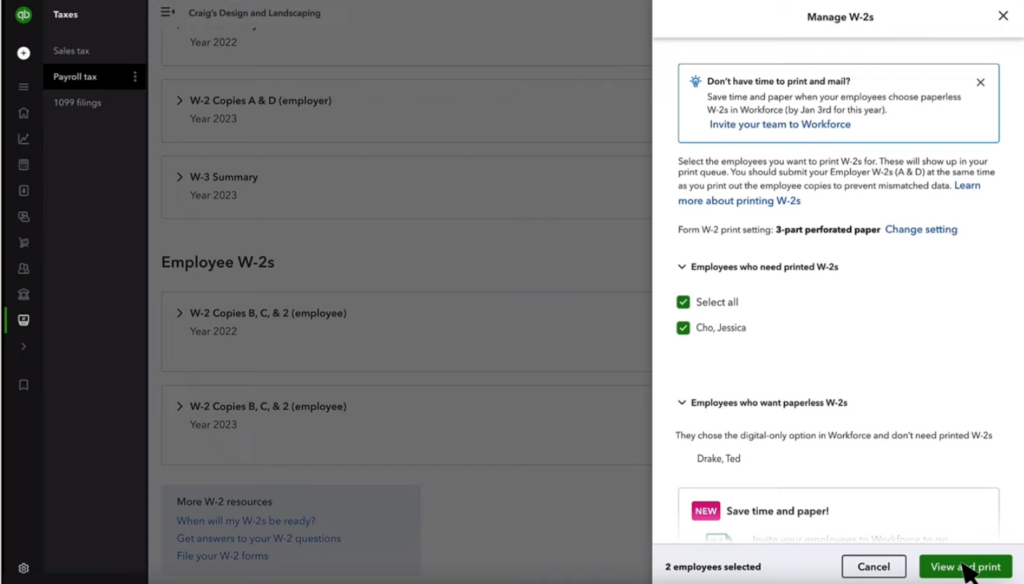

- Select from the drop-down either All Employees or Specific Name of the Employee.

- Choose the Employee Printable Copies from W-2, Copies B, C & 2 list.

- Now you have to choose the desirable financial period for which you require a W-2 form.

- At last, click on the view tab and then the print icon to print the form successfully.

Done! With these simple steps, you can easily print W-2 forms using QuickBooks Online and make your tax filing more convenient and quick.

Benefits of Printing W-2 Forms in QuickBooks Online

- Automation: QuickBooks Online automates the task of generating W-2 forms that not only simplify complex calculations but also avoid the probability of human error.

- Time-Saving: Generating forms through online mode saves a lot of time as it eliminates the manual entry process.

- Data Security: It ensures confidentiality through its advanced encrypted data measures to protect employees’ information and maintain their servers to be secure.

- Real-Time Updates: It enables you to receive the latest information from Intuit to adhere to the latest tax compliances.

- Easy Accessibility: It allows you to access and print W-2 forms from anywhere and can be beneficial for remote-work culture or multi-businesses purposes.

Conclusion

QuickBooks Desktop and QuickBooks Online are two great platforms that can simplify your tax filing process, especially when it comes to printing W-2 in QuickBooks. It offers you a unique feature to reprint W-2 in QuickBooks in case you lose them. It also automatically saves previous forms once you have printed them, ensuring easy access.

QuickBooks provides an innovative feature to its user with its AI Interface, tailored for small and medium businesses, making it an attractive option for their businesses. QuickBooks streamlines your business processes, automates tasks like Payroll, and provides financial insights, allowing business owners to focus on growth strategies.

So, let’s take your business to the next level with QuickBooks Online and QuickBooks Desktop.

If you need any further assistance on how to print W-2 in QuickBooks or any other query related to QuickBooks, feel free to reach out to our QuickBooks Support Phone Number.

Frequently Asked Questions

Yes, Also you have the option to print W-2 forms on pre-printed forms or blank or perforated paper. These documents are supported by QB Online Payroll.

To modify the alignment,

1. Click the “Align” button in the W-2 and W-3 forms window.

2. Then select the “Pre-printed forms alignment page.”

3. To see how your alignment turned out, click Print Test.

4. Click OK to confirm that the alignment is already precise and perfect.

To Generate W-2 forms;

1. Verify Employee Information in the Employee Center.

2. Check Payroll Configurations.

3. Run Year-End Payroll Reports.

4. Navigate to Employees > Prepare W-2s.

5. Choose the applicable year & fill in the details.

6. Review the form & then generate the forms

W-2 forms can be printed on blank or perforated paper or preprinted forms. They are for Employees (Copies B, C & 2), Employers (Copy D), and the Government (W-3, Copy A, & Copy 1).

Yes, It is possible. Follow the instructions below:

1. Navigate to the Payroll Center.

2. Click on the File Forms tab.

3. Choose the W-2 forms for the relevant financial year.

4. Print the form for the selected employee.

Yes, It does automatically save previously printed W-2 forms. This feature allows you to easily access and reprint forms, if needed in the future.

QuickBooks Online enables:

1. Automation saves time, ensures accuracy, and reduces human errors.

2. It also enables data handling and real-time updates on tax compliance.

3. Accessibility from anywhere, ideal for remote work scenarios.

Whereas QuickBooks Desktop requires:

1. Individual installation and maintenance.

2. It provides local data storage instead of cloud storage,

3. Records have to be set up manually.

4. Suitable for people who prefer to maintain paper or manual records.