The construction industry has witnessed impressive transformations in the past couple of decades. Be it raw material, machinery, or accounting techniques, the construction industry is only booming at a significant pace. One aspect that has helped them make informed decisions and strengthen the financial pillar is accounting software like QuickBooks. At present, small to mid-sized construction businesses are using QuickBooks to streamline their daily bookkeeping tasks effortlessly. But why do contractors trust QuickBooks? The answer is simple; QuickBooks is one of the most prominent and popular accounting and bookkeeping software for businesses of all sizes and verticals. Its advanced features help construction businesses gain better financial insights and grow organically. One such aspect is QuickBooks construction job costing!

QuickBooks construction job costing enables contractors to accurately track project expenses, monitor budgets, and ensure profitability. This powerful feature is one of the key reasons why QuickBooks has become the preferred choice for contractors worldwide. In this blog, we will help you to set up construction job costing in QuickBooks Online and Desktop. But before that, we will cover several other aspects of QuickBooks Construction, including:

- How QuickBooks Construction Job Costing works?

- Advantages of QuickBooks Job Costing for Contractors.

- 7 Tips to Effectively Build a Construction Job Costing Structure.

- How to Setup Construction Job Costing in QuickBooks Online and Desktop?

So, let’s get started!

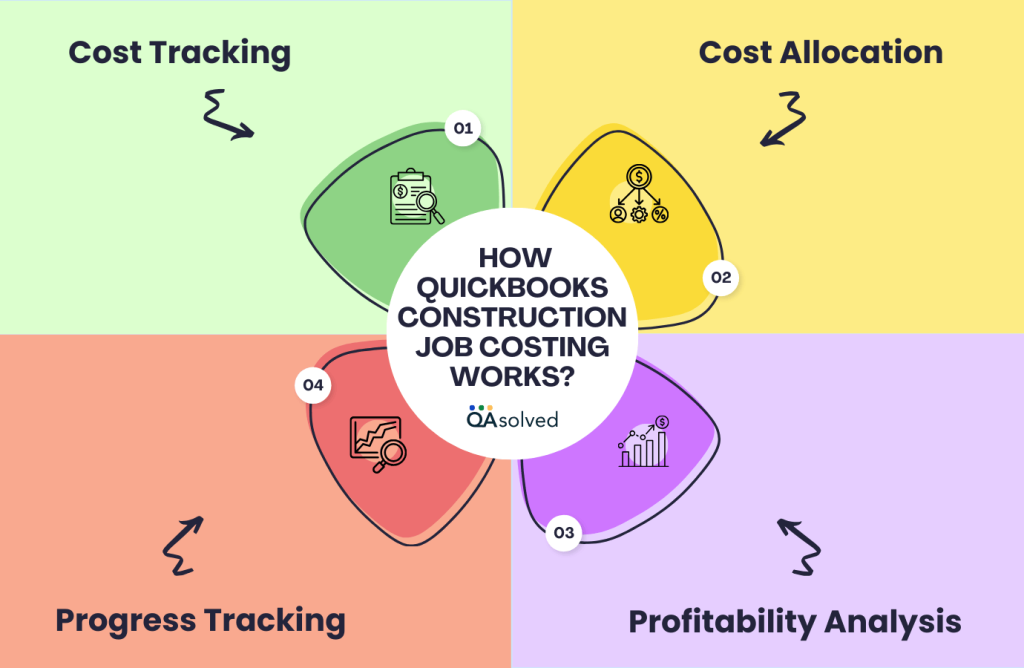

How QuickBooks Construction Job Costing Works?

QuickBooks serves a wide range of industries, and construction is one of them. In QuickBooks, job costing for construction begins with setting up the project. This project consists of several activities that are related to all direct and indirect costs. As a contractor, you need to create a job cost sheet before starting the project.

This sheet involves several details like:

- Cost Tracking: In cost tracking, one needs to mention all the incurred costs during the course of that very project. It is vital to record all these costs correctly with proper categorization. Cost tracking includes costs of material, equipment, labor, subcontractors, and overhead.

- Cost Allocation: Here, you need to allocate all direct and indirect costs. Direct costs involve all the resources that are directly used in the project, like labor and material costs. On the other hand, indirect costs like overhead expenses are distributed by using a predetermined allocation technique.

- Progress Tracking: The next thing to keep in mind is to update the job cost sheet on a regular basis. This will not only help you monitor the project’s progress but also allow you to compare actual costs against the estimates. Progress tracking helps contractors identify cost overruns or underruns in prior.

- Profitability Analysis: With the help of Cost-plus Pricing, contractors can easily analyze a project’s profitability with QuickBooks for construction businesses. This information is crucial to evaluate the overall performance of different projects, helping you make informed business decisions.

So, this is how you can make the best use of QuickBooks Construction job costing.

Also Read: Why is QuickBooks the Ideal Solution for Construction Businesses?

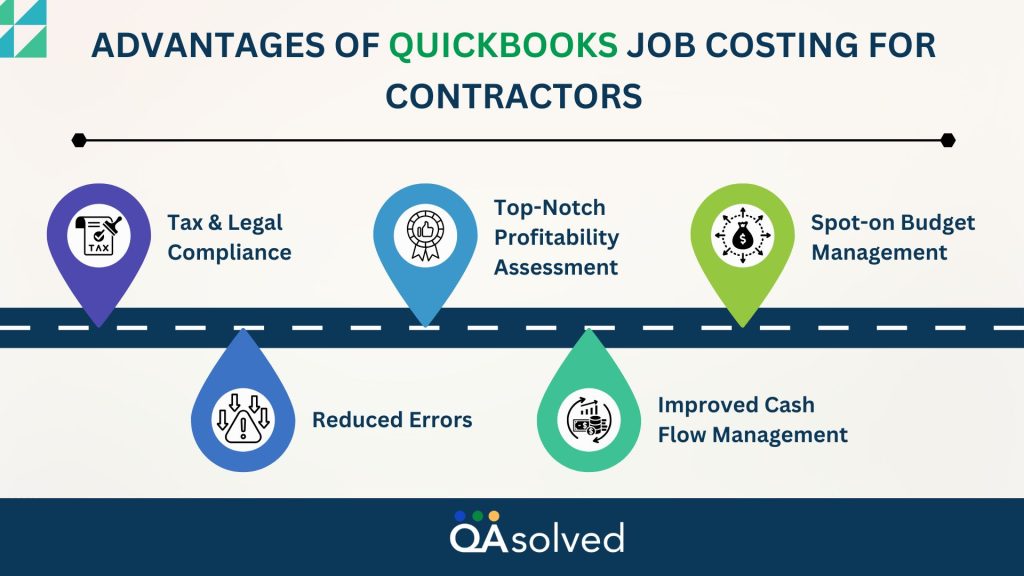

Advantages of QuickBooks Job Costing for Contractors

Job costing is a part of several industries. For the construction industry, job costing offers numerous advantages that can help improve efficiency and profitability. Here are some benefits of job costing:

1. Tax & Legal Compliance

Job costing also helps you to stay compliant with a variety of regulatory requirements. These regulatory requirements include several activities like tax reporting and even contract compliance. This level of organization also simplifies tax filing, as you can easily generate reports that reflect all relevant expenses and income for each project, ensuring smooth and timely submissions.

2. Reduced Errors

With the help of job costing in QuickBooks, users can significantly minimize the scope of manual errors and transaction missing. This ensures greater accuracy in financial reporting, allowing contractors to make more informed decisions and maintain better control over their project budgets.

3. Top-Notch Profitability Assessment

One of the biggest advantages for contractors of using tools like QuickBooks is that they can easily assess the profits. With job costing, users get a clear image of every project and its profitability by comparing revenue to actual costs—not operating costs. Hence, profitability assessment can optimize strategies, enhance profitability, and make adjustments to future projects to ensure better financial outcomes.

4. Improved Cash Flow Management

Another benefit of QuickBooks job costing for contractors is “Improved Cash Flow Management.” Job costing enables users to closely monitor cash flow and predict potential financial threats. This allows users to better manage cash flow and eliminate the scope of liquidity threats.

5. Spot-on Budget Management

With detailed job costing reports, construction businesses and independent contractors can easily compare actual costs to the estimated budget, enabling them to identify any budget discrepancies early on, address issues promptly, and make necessary adjustments as needed to stay within financial goals.

Apart from these five, QuickBooks construction job costing helps users to identify cost trends, facilitates risk management, and even continuously supports improvements.

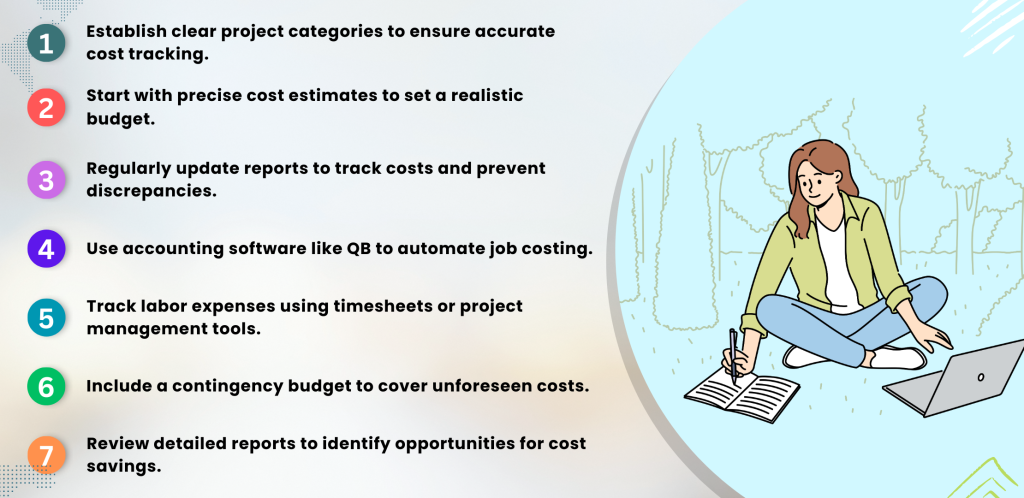

7 Effective Tips to Build a Construction Job Costing Structure

Building an effective construction job costing structure is essential for managing project expenses, staying within budget, and ensuring profitability. The following seven tips provide practical strategies to help contractors set up a reliable and efficient job costing system. Here we go!

Now that we covered everything, let us talk about how to set up construction job costing in QuickBooks Online and Desktop.

How to Setup Construction Job Costing in QuickBooks Online and Desktop?

Setting up construction job costing in QuickBooks Online and Desktop allows contractors to accurately track and manage project expenses, ensuring better financial control and decision-making. Let’s first talk about job costing in QuickBooks Online.

Setup Construction Job Costing in QuickBooks Online

There are five major steps to setup job costing in QuickBooks Online for contractors and construction businesses:

Step 1: Add a New Project

To add a new construction job costing project in QuickBooks Online, follow these steps:

- Go to Projects section from the Business Overview or the left-side menu.

- Click “Create New Project” button located at the top-right corner.

Step 2: Fill Out the Project Details

Here, you need to follow the below mentioned sub-steps.

- Enter the project name.

- Select or add the customer associated with the project.

- Fill in any additional project details.

- Click “Save” to finalize the project setup.

Step 3: Assign Labor Costs to the Project

QuickBooks Online ensures efficient cost management and budget control by directly allocating labor costs to a project, allowing for precise expense tracking.

When Using QuickBooks Payroll

You can allocate project time to employees using their weekly timesheets or QuickBooks Time. For one-time tasks, you can log them without needing timesheets. These expenses will be reflected in the project once payroll is processed.

In Case You’re Not Using QuickBooks Payroll

- Manually input employee information and their time for each project.

- Choose the hourly rate and select or add the employee.

- Use the integrated calculator to calculate the employee’s hourly labor burden by entering their cost rate.

Step 4: Assign All Other Costs to the Project

Now, you need to assign all the other expenses to the project with the help of given steps:

- Locate the relevant expenses on the Transaction screen.

- Select your project from the customer/project field.

- Click the “Confirm” button to save any billable expenses.

- When recording a bill, check, or manual expense, choose the correct project from the Customer/Project field.

Step 5: Assign Income to the Project

- Choose the project from the customer field when creating an invoice.

- Add any billable expenses to the project using the right-hand menu.

- Ensure all changes are saved.

So, these are the steps to setup construction job costing in QuickBooks Online. Let’s move ahead with QB Desktop now.

Also Read: How to Create an Estimate and Covert it to Invoice in QuickBooks Online?

Setup Construction Job Costing in QuickBooks Desktop

Here are the five easy steps to setup job costing in QuickBooks Desktop:

Step 1: Create a Job for Each Customer

To set up a job for each customer in QuickBooks Desktop, follow these steps:

- Go to the Customers menu and select Customer Center.

- Select the customer for whom you want to set up a job, right-click, and choose Add Job.

- Enter job details such as job name, type, status, and start and end dates.

- The job will automatically be linked to the selected customer.

- Click OK or Save & Close to save the job for the customer.

Step 2: Assign All Your Expenses to Jobs

In order to have a proper view of all the job costs, ensure that every expense is assigned to a specific job. When recording a bill, check, or timesheet, choose the appropriate job from the Customer column.

- For Billable Time: Track job hours using a weekly timesheet or single activity entry and allocate them to customers or jobs. Billable entries are automatically marked.

Note: Timesheets are non-posting entries, so you need to import time into a bill or invoice for it to appear in Job Profitability or Company Financial Reports.

- For Job-Related Purchases: For job-related purchases or subcontracted services, record the transaction using a bill, check, or credit card charge. Enter each purchased item or service in the Items tab and assign it to the appropriate customer or job in the Customer: Job column.

- For Overhead Expenses: You should know how to calculate and track overhead costs if you’re choosing to allocate all the overhead expenses to specific jobs.

- For Mileage: Enter mileage in the Enter Vehicle Mileage window. To adjust the expense amount and charge the customer more than the standard rate, modify it on the invoice.

- For Other Expenses: Record expenses like freight charges or postage using a bill, check, or credit card charge. Enter each expense in the Expenses tab and assign it to the correct customer or job in the Customer: Job column.

Step 3: Enter Your Estimates in QuickBooks Desktop

With QuickBooks Desktop, you can create estimates internally and externally as well. If using spreadsheets or other tools, enter summary estimates into QuickBooks. If invoicing in QuickBooks, input estimate details in the Create Estimates window to convert them into invoices. Here are the steps to enter your estimates in QuickBooks Desktop:

- Go to the Customers menu and select Create Estimates.

- Choose the Customer:Job from the dropdown menu. If the customer or job is not listed, add it.

- Fill in the estimate details, including the date, items, quantity, rate, and amount.

- Adjust the markup, tax, or discounts if necessary.

- Review the estimate and ensure all details are accurate.

- Click Save & Close to finalize or Save & New to create another estimate.

Step 4: Create Appropriate Invoices

Here are the two steps to create appropriate invoices:

- Select the correct Customer:Job when generating invoices.

- If invoicing outside QuickBooks Desktop, enter a summary of each invoice to ensure revenue is reflected in Job Profitability reports.

Step 5: Run Construction Job Costing in QuickBooks Desktop

Now, you can use Job Reports to assess job profitability, improve estimates, track financial progress, and spot potential issues before they become unmanageable.

To access different job reports:

- Go to the Reports menu.

- Select Jobs, Time, & Mileage.

QuickBooks Premier Contractor Edition and Accountant Edition provide a broader selection of job costing reports. To access them:

- Go to the Reports menu.

- Select Industry Specific, then choose Contractor Reports.

So, these are the steps to setup construction job costing in QuickBooks Online and QuickBooks Desktop. In case you’re unable to setup job costing via given steps, then it is ideal to connect with our certified ProAdvisors for expert QuickBooks assistance.

Conclusion

In conclusion, QuickBooks construction job costing is an essential tool for contractors to efficiently manage their project expenses, track profitability, and maintain financial control. By providing detailed insights into labor, materials, overhead, and other costs, QuickBooks helps contractors make informed decisions and avoid budget overruns. With the right setup, whether in QuickBooks Online or Desktop, contractors can streamline their processes, reduce errors, and ensure that each job remains profitable.

Frequently Asked Questions

Yes, you can use QuickBooks Online and Desktop for construction job costing activities. Apart from job costing, QuickBooks allows users to automate invoicing, manage payroll, track inventory, and integrate with construction applications.

A common construction job costing structure involves two prominent components:

1. Direct Costs: Materials, labor, and equipment costs.

2. Indirect Costs: Project management or administrative costs.

Yes, QuickBooks can handle project costing. It allows contractors and businesses to track and manage costs associated with specific projects. Using job costing features, QuickBooks helps you assign and monitor expenses like labor, materials, overhead, and subcontracted services for each project.

There are five steps involved in the construction job costing process:

1. Setting up a project.

2. Tracking costs

3. Allocating costs

4. Tracking your progress

5. Analyzing your profitability