Table of Contents

ToggleFor decades, payday has been a highly anticipated day for all working professionals across the globe. However, for companies with no structured payroll process, paying employees on time can become a worst nightmare. In a nutshell, managing and processing the entire payroll system without compelling tools can be challenging for businesses out there. That is exactly when Inuit’s QuickBooks Payroll software comes to the scene. By streamlining the entire process, QuickBooks payroll benefits businesses by resolving a lot of complex tasks, providing them with a more implicit path to keep their employees satisfied with timely compensation.

In the past couple of decades, QuickBooks has become the ultimate platform for businesses of all sizes and verticals to manage their accounting needs. Intuit’s QuickBooks comes with a range of products and solutions that enable companies to focus on other business verticals. So, if you are looking forward to simplifying your financial aspects of the business, then QuickBooks can streamline your accounting processes, making it easier to manage your finances efficiently.

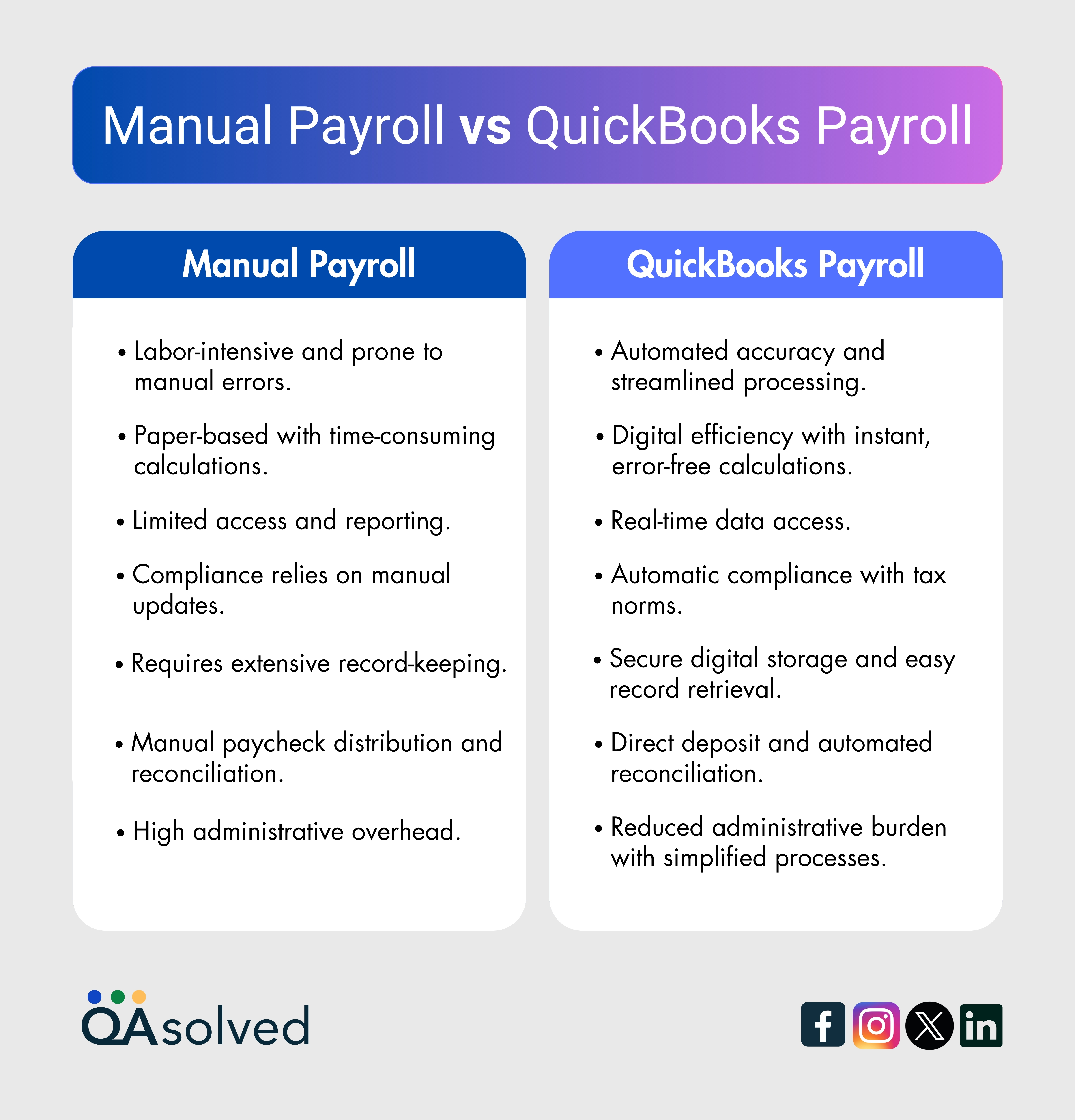

Coming back to the focal point, we will highlight the features of QuickBooks Payroll software along with its benefits for small and mid-sized businesses. But before that, let us quickly compare the manual payroll processes with QuickBooks payroll.

The image above clearly demonstrates how payroll with QuickBooks is different and beneficial from the conventional methods. Now, moving towards the focal points of the blog, let us first highlight the main features of QuickBooks payroll software.

7 Features of QuickBooks Payroll Software

QuickBooks payroll is a comprehensive software solution designed to simplify and automate payroll management for businesses of all sizes. It ensures handling complexities and empowers entrepreneurs to focus on growth and success. It possesses different features that are more desirable for all sizes of businesses. These features are mentioned below:

1. Streamlined Payroll Processing

QuickBooks streamline your payroll seamlessly by efficiently handling and calculating deductions, wages, and taxes.

2. Smooth Deposits

QuickBooks payroll offers the convenience of direct transfer of payment to your employees. It ensures paychecks are securely transferred to their bank accounts.

3. Automated Tax Calculations

QuickBooks payroll automates complex tax calculations, ensuring compliance with state and federal regulations. Easily generate essential tax forms and file W-2s and 1099s.

4. Employee Benefits

It allows you to manage employee compensation and benefits like health insurance, retirement plans, and other benefits.

5. Time Tracking

It enables you to efficiently manage working hours and keep a track record of each employee to monitor their performance and productivity.

6. Tailored Payroll Configuration

It provides a wide range of customized tools for configuring payroll parameters to align with organizational needs.

7. Authenticate Users

It grants access to authorized users and manages payroll processes in an organization by maintaining its integrity.

The above-mentioned points discussed the key features of using QuickBooks for efficient payroll management in any organization.

7 Advantages of Using QuickBooks Payroll Software for Small Businesses

Considering the wide range of features that QuickBooks Payroll offers, it becomes an indispensable tool for managing employee compensation, taxes, and compliance with ease. Now, let’s talk about the benefits of the automated payroll system with QuickBooks.

1. Time Optimization

It eliminates the crunch of manual tasks by implementing the fastest online tax calculations along with the safest digital monitoring of all your to-do tasks.

2. Streamlined Payroll Compliance

It keeps you updated with the latest tax updates and compliance integrated with single touch payroll (STP).

3. Enhanced Accuracy

It enhances accuracy through precise calculations and effective recording of payroll, minimizing the chances of errors.

4. Payroll Automation

The generation of automated payslips and secure reports is also one of the benefits of an automated payroll system with QuickBooks.

5. Systematic Bookkeeping

QuickBooks Payroll Software keeps a systematic record of all your financial information and is accessible whenever required.

6. Prevent Penalties

It saves you from hefty penalties by keeping you compliant and updated with all the latest tax norms along with filing taxes on time.

7. All-Time Accessibility

QuickBooks Payroll allows you to access any type of data from anywhere through several devices at any time.

So, these are the main features and benefits of using QuickBooks for payroll. With streamlined payroll processing, direct deposits, custom payroll reports, and year-end processing, businesses can not only prevent hefty penalties but can also keep the workforce satisfied.

Conclusion

With the fast-growing business world and cut-throat competition, one needs to keep their business pillars fortified. Integrating QuickBooks with your business streamlines financial processes and generates valuable insights to track your business performance. With its wide range of features and benefits, QuickBooks Payroll not only simplifies the complexities of payroll but also ensures accuracy and timeliness.

So, seize the future with the benefits of QuickBooks Payroll for the overall financial management of your business. If you’re also looking forward to switching from conventional to advanced accounting methods, then we are here to help you with that at every step. Contact us today and reap the benefits of exceptional QuickBooks Payroll support service. Feel free to reach out to our dedicated experts through customer support at +1-855-875-1223.

Frequently Asked Questions

QuickBooks payroll Software offers several key benefits:

1. Saves time through automation of payments and taxes.

2. Ensures accuracy by reducing errors in payroll Processing.

3. Adherence to tax laws and regulations.

4. Streamline payroll tasks and integrate them with other business functions.

5. Provide employee satisfaction through self-service options.

It simplifies tax compliance by:

1. Automatically calculating taxes.

2. Filing Taxes digitally.

3. Provides Updates on Tax Laws.

QuickBooks payroll is suitable for both small and medium-sized businesses by offering unique and flexible features.

Yes, it offers cloud-based access allowing you to manage payroll from any device having Internet connectivity.

QuickBooks payroll helps you prevent penalties by:

1. Provides alerts and reminders for important deadlines.

2. Ensuring timely tax filings.

3. Updated with the latest tax laws.