Cash flow management is the key to a successful business. It determines your ability to pay bills, invest in the future, and cope with unexpected financial challenges. It’s easy to run into cash shortages, missed opportunities, or even financial crises without clear visibility into your cash flow. This is when QuickBooks arrives at the scene. QuickBooks offers a comprehensive suite of features to help you manage your cash flow, such as managing income and expenses, generating detailed reports, tracking invoices, and more. QuickBooks gives you the financial stability you need to make smarter decisions.

With QuickBooks cash flow management, you can not only monitor, forecast, and optimize your business’s financial health by tracking income and expenses but can also identify cash flow trends, and make informed decisions to ensure stability and growth. In this article, we’ll unveil the importance of cash flow management and discuss various strategies to manage your cash flow effectively through QuickBooks. So, let’s get started!

What is a Cash Flow Statement and How to Calculate It?

Financial reports such as the cash flow statement, balance sheet, and income statement are essential to evaluating your business’s health. Over time, you can track the flow of cash in and out of your business from operating, investing, and financing activities. “Cash” refers to both actual cash and cash equivalents-assets that are easily converted into cash. It provides important insights into your business’s liquidity, earnings quality, and overall solvency.

In today’s ever-evolving financial landscape, It has become crucial for businesses and aspirational CPAs to understand the three main components of the cash flow statement i.e. Operating, Investing, and Financing activities. The final total amount should align with the ending cash balance of your balance sheet, which helps you forecast cash flow precisely. The equation to find the actual cash flow is given below:

Formula: Net Cash Flow = Operating Cash Flow + Investing Cash Flow + Financing Cash Flow

This formula provides key insights:

- Cash Inflows: Income from sales, loans, investments, etc. It’s important to keep track of these sources.

- Cash Outflows: Payments for bills, payroll, taxes, and loans. Knowing where your money goes is crucial.

- Net Cash Flow: Positive cash flow occurs when inflows exceed outflows. Cash flow is negative if outflows exceed inflows.

What Financial Information Does a Cash Flow Statement Provide?

A cash flow statement provides insights into the changes in cash position in a business. It includes cash in bank accounts and short-term investments that can easily be converted into cash. It reflects the flow of money in and out of an organization from various activities. Let’s unveil them below in detail:

- Operating Activities: Cash receipts from operating activities include sales revenue, interest and dividends received by the business, and other cash receipts. Operating activities include payroll costs, such as wages, benefits, and employment sales tax, payments to suppliers and overhead costs.

- Investing Activities: Inflows from investing activities include proceeds from selling business assets (excluding inventory), payments from loans, and other non-business income. Outflows include equipment purchases and loan repayments.

- Financing Activities: The inflow of cash reflects borrowed money and proceeds from the sale of company securities. The outflow includes debt service and dividend payments.

- Net Cash Flow: Net cash flow is another aspect that a business can calculate with the help of this statement. It is the overall change in cash position during a specific period, showing if the company’s cash reserves are growing or shrinking.

Also Read: Why is QuickBooks the Ideal Solution for Construction Businesses?

10 Effective Tips For Managing Cash Flow in QuickBooks

Properly managing cash flow has become a crucial aspect for sustained growth and survival. It ensures you have enough working capital and helps with future financial decisions. Using QuickBooks for cash flow management is an efficient way to track your finances and boost productivity.

Below are the top ten strategies or tips to enhance your cash flow tailored for all types of businesses:

- Encourage Faster Customer Payments: Incentivize customers to pay early by offering attractive discounts. Let’s say, offering a 2% discount for payments for 10 days can improve your liquidity position.

- Reduce Expenses: Another way to ease the cash flow pressure is to minimize or cut irrelevant expenses. For example, consider using each stock before reordering. Deducting personal expenses can also lead to a significant impact on business finances and can make a difference.

- Finance Purchase Orders: If you receive large purchase orders but lack the liquidity to avail of them, consider purchase order financing. This allows you to have the necessary materials without impacting your cash flow and avoid the situation of stock-out.

- Increase Margins: Boosting margins by raising prices or cutting costs can generate more cash flow. But you also need to ensure that the price increases are strategically aligned to avoid losing potential customers.

- Sell Invoices: Selling invoices which is also known as “Invoice Factoring” allows businesses to unlock cash tied up in unpaid invoices. Invoices are the assets for a business and selling them to a factoring company ensures immediate cash flow, especially, when payment terms are extended.

- Request a Deposit or Milestone Payment: Companies that require significant time or money before delivering a product or service are ideal candidates for milestone payments. It includes graphic design, web development, marketing, PR, and construction.

- Negotiate Better Payment Terms with Suppliers: Many suppliers value long-term relationships and may be willing to extend payment terms. Extra time, such as moving from 15 to 30 or 30 to 45 days, can improve cash flow.

- Sell or Lease Idle Equipment: Selling or leasing idle equipment can be an option when cash is tight. Even if the equipment is in use, renting similar equipment may be cheaper than selling yours while freeing up funds. It is especially useful for durable, movable equipment.

- Sell Future Revenue: Retailers and restaurants can take advantage of merchant cash advances by deducting repayments from their credit card or debit card sales automatically. Businesses with high transaction volumes may use this method, but it is important to make sure the business can afford the cost of financing.

- Turn Down or Postpone Work: Timing is key to managing cash flow. Consider postponing or declining certain jobs to maintain consistency. Although seasonal businesses like retailers and tax accountants can’t change their busy periods, others can plan for more steady workloads.

Using these 10 strategies, businesses can increase their profitability and overall efficiency. Now let us understand why MSMEs and even CPAs are using QuickBooks for cash flow as well as other accounting needs.

Also Read: How to Reconcile Bank Account in QuickBooks Online?

Why Are Cash Flow Statements Essential for Businesses?

Imagine your business’s cash flow as a busy highway – revenue is the steady stream of cars moving forward, while expenses are the exits and tolls that slow or divert traffic. As cash flows constantly change, influenced by various factors, capturing an accurate picture of cash flow can be challenging. Keeping an eye on your cash flow is crucial to identifying patterns, managing funds efficiently, and keeping your business on track financially.

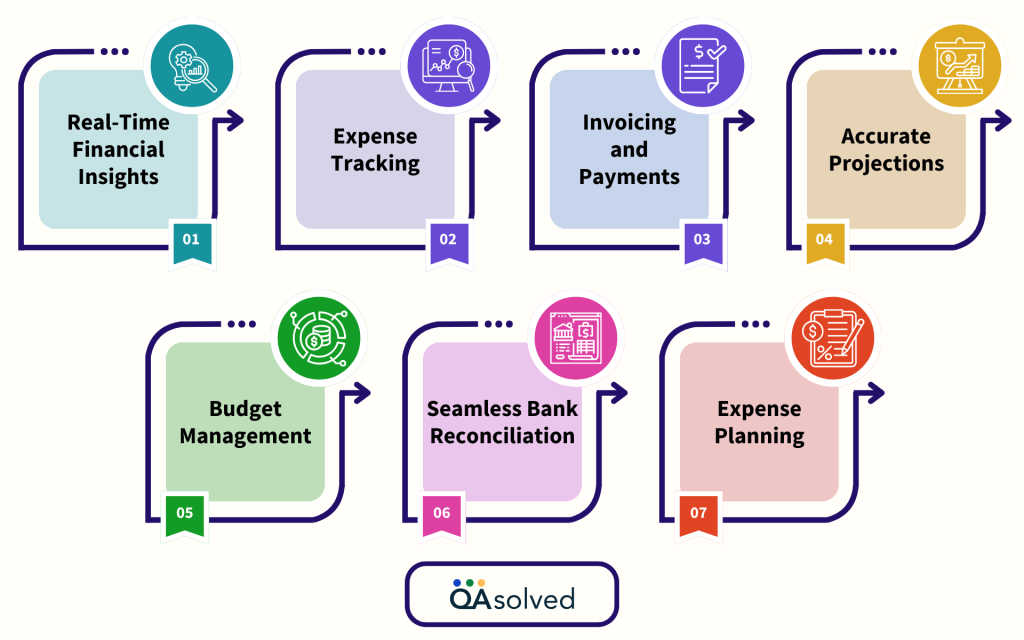

Cash flow management is essential for maintaining stability and fortifying the financial pillar of a business. With QuickBooks cash flow management businesses can enjoy a wide range of features and tools that are specifically designed to enhance their accounting experience. Here’s how QB cash flow management can benefit business:

- Real-Time Financial Insights: To efficiently manage cash flow in QuickBooks Online and other products, one needs to leverage its real-time tracking feature. This allows businesses to accurately monitor cash inflows and outflows to provide a sense of clarity on their financial circumstances.

- Expense Tracking: Cash flow management in QB also allows businesses to categorize and track expenses by allowing them to minimize costs and manage finances in an appropriate way. Additionally, it also ensures that your expenditures are aligned with your budget.

- Invoicing and Payments: Another cash flow feature that attracts businesses of all sizes towards QuickBooks is that it streamlines billing and payment processes by ensuring timely invoicing and initiating payments.

- Accurate Projections: The next on our list is “Accurate Projections.” QuickBooks accesses past data and helps one generate reliable cash flow projections. This feature is essential to cater to your own future financial needs.

- Budget Management: QuickBooks allows you to develop and manage budgets efficiently. By setting up financial goals and monitoring adherence to the budget, it improves your ability to accurately manage cash flow and maintain a healthy financial situation.

- Seamless Bank Reconciliation: QuickBooks ensures an innovative bank reconciliation feature to match your financial records with actual bank balances. It is a viral process for preventing discrepancies and maintaining consistent cash flow, which supports accurate cash flow forecasting in QuickBooks.

- Expense Planning: By tracking and planning expenses, QuickBooks allows you to prepare for cash outflows in bulk. This proactive approach is crucial for preventing unexpected financial challenges and maintaining positive cash flow in the business operations for long-term sustainability.

So, these are the possible reasons and advantages that captivate small and medium-sized businesses to purchase QuickBooks for their cash flow management and other accounting needs as well. By taking advantage of its powerful features, you can get better control over your finances, avoid cash shortages, and set your business up for long-term success.

Steps to Run a Statement of Cash Flows

An Analysis of Cash Flows illustrates how your business is doing by detailing the cash inflows and outflows over time.

To run a Statement of Cash Flows:

Note: Only accrual reports are available.

- Go to Reports.

- Next, search for Statement of Cash Flows.

- Open the Statement of Cash Flows report.

- To change the date range displayed in the report, click Customize.

- Click on Run Report.

- You will find the requested information in the Statement of Cash Flows.

Steps to Forecast Cash Flow in QuickBooks

QuickBooks offers a powerful tool called Cash Flow Projector, which can help you forecast cash flow. It allows you to perform scenario analysis and view estimates without modifying your QuickBooks ledger data.

Important: Only QuickBooks Desktop supports the Cash Flow Projector.

- Go to QuickBooks’ Company menu and select Planning and Budgeting.

- Choose Cash Flow Projector from the menu.

- Decide the bank accounts you want to use for forecasting.

- Various methods can be used to forecast cash receipts for the next six weeks, including:

- Receipts are manually entered.

- Using the last six weeks’ data or a weighted average.

- Comparing the same 6-week period from last year.

- Decide when to pay salaries, for example, and how often.

- Check the due dates for open accounts payable.

- Print or export the report as a PDF.

Using these strategies, you can effectively manage cash flow in QuickBooks. As a small business owner juggling multiple tasks, QuickBooks is an essential tool to guide your growth and ensure you’re making the right financial decisions.

Use Cash flow Planner in QuickBooks

Cash Flow Planner helps forecast income and expenses by showing the amount of money coming in and going out. The tool allows you to add or adjust items to avoid losses. As soon as the planner is set up, here’s what you need to do:

Set Up Your Account:

Keep track of your cash inflows, outflows, and due dates with QuickBooks by connecting your bank and credit card accounts.

Add a New Item:

- Access Cash Flow and then the Planner.

- Select Add Item from the menu.

- Choose Money In or Money Out depending on whether it’s income or an expense.

- Enter the item’s name and the amount.

- Enter Save.

Edit or Delete an Item:

- Select Planner from Cash Flow.

- To edit an item, select it.

- Make changes to the name, amount, type (in/out money), or date.

- To save, enter Update.

Delete an Item:

- Go to Cash Flow and choose Planner.

- Pick the item you wish to delete.

- To delete a series or a single item, hit Remove.

- The changes will be saved when you click Update.

Using the Cash Flow Planner, you can gain better control over your business’ finances, ensuring an accurate forecast of income and expenses. It helps you avoid losses and make informed decisions by allowing you to add, edit, or delete items as needed. Your bank and credit card transactions are automatically tracked by QuickBooks, making managing your cash flow easier than ever.

6 Alternative Tools for Managing Cash Flow

While QuickBooks is widely used for managing cash flow, several other tools offer unique features for improving cash flow. Here are six alternatives to help you track, forecast, and optimize your cash flow:

- PlanGuru: An advanced budgeting and forecasting tool for creating long-term financial plans.

- Float: An accounting software integration that forecasts cash flows in real-time.

- Scoro: A platform for tracking cash flow, managing projects, and reporting financial data.

- Pulse: Tracks inflows, outflows, and projections of cash flow for small businesses.

- CashAnalytics: Manage liquidity and cash positions with cash flow forecasting and reporting.

- Google Docs: A free spreadsheet and template program that helps you track cash flow manually.

Conclusion

In conclusion, cash is one of the most important aspects to run a business. A clear understanding of where your money is coming from and where its going, will not only help you avoid cash shortages but also meet your financial obligations. By using QuickBooks cash flow statement template, you can gain valuable insight into your company’s cash position, enabling you to make informed decisions and maintain financial stability. The right tools can help you manage cash flow confidently and set your business up for long-term success.

If you have any queries related to QuickBooks cash flow management or need any assistance for the same, feel free to connect with our Certified QuickBooks ProAdvisors anytime.

Frequently Asked Questions

QuickBooks automates tracking income and expenses, generates real-time insights, and provides detailed reports. It offers tools like invoicing, payment tracking, expense management, and budget allocation.

QuickBooks offers real-time tracking of cash inflows and outflows, gives valuable financial information, and allows you to facilitate effective financial planning.

Yes, QuickBooks gathers past data to generate reliable future cash flow projections allowing businesses to fulfill their financial needs and avoid situations of cash shortage.

Yes, you can by setting up a desirable limit which helps you in managing your cash balances proactively.

Sure, alarms for low cash levels can be set up. With QuickBooks, you can set up alerts to tell you when your cash balance approaches a given limit, which can help you manage your money more proactively.