As your business continues to grow, your financial setup is bound to shift. Whether you’re closing an old bank account, switching credit card providers, or choosing to upload transactions manually, it’s important to adjust your accounting tools accordingly. One crucial step in keeping your books clean and organized is to disconnect a bank or credit card account from QuickBooks Online when it’s no longer in use.

Disconnecting an account doesn’t delete any of your existing data. It simply stops QuickBooks from importing new transactions from that account. This helps you avoid unnecessary clutter, eliminate duplicate entries, and streamline your bookkeeping processes. It’s also a helpful move when you’re fixing bank connection issues, reorganizing your chart of accounts, or managing accounts used only for a specific season or one-time purpose.

Most importantly, the process is safe, easy, and reversible. In this blog, we’ll walk you through how to disconnect a bank account from QuickBooks Online the right way, plus offer key tips on what to check before and after you do it.

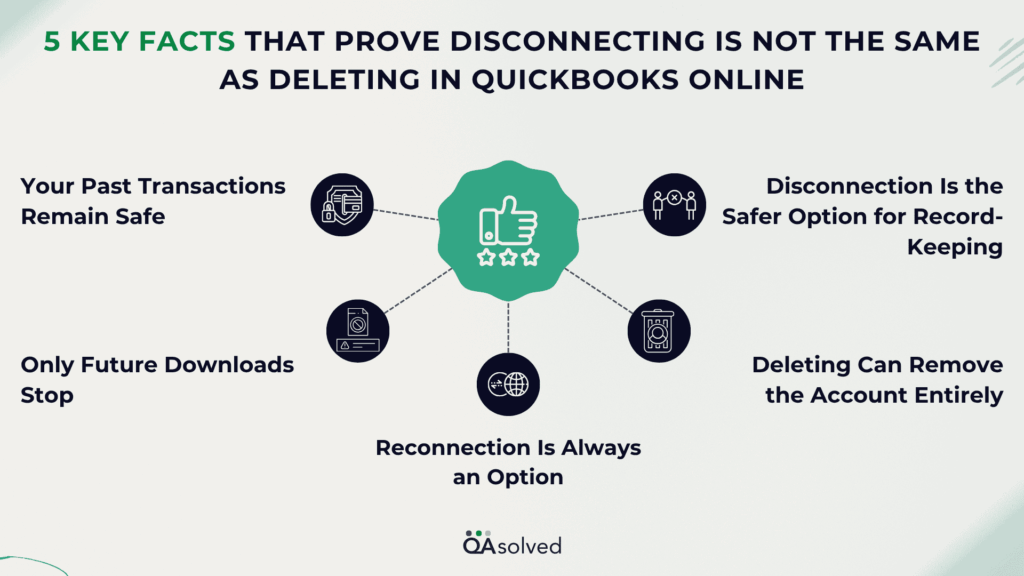

5 Key Facts That Prove Disconnecting Is Not the Same as Deleting in QuickBooks Online

When managing your financial accounts in QuickBooks Online, it’s easy to confuse “disconnecting” with “deleting.” But the two actions have very different effects on your data and how you manage it. Here are 5 key facts that clearly show disconnecting a bank account from QuickBooks Online is not the same as deleting it from your chart of accounts:

1. Your Past Transactions Remain Safe

When you disconnect a bank or credit card account, QuickBooks retains all previously imported transactions. You won’t lose any history, and your reports and records remain intact.

2. Only Future Downloads Stop

Disconnecting simply stops QuickBooks from downloading new transactions. It doesn’t affect what’s already been imported or reconciled.

3. Reconnection Is Always an Option

You can reconnect a disconnected account anytime. Once linked again, QuickBooks will start syncing new transactions moving forward.

4. Deleting Can Remove the Account Entirely

Deleting a bank account removes it from your Chart of Accounts. If there are past transactions tied to it, you risk causing discrepancies, missing data, or errors in your financial reports.

5. Disconnection Is the Safer Option for Record-Keeping

If you no longer use a bank or credit card but still need access to historical data for taxes, audits, or reporting, disconnecting is the recommended approach—not deleting.

Bottom line? If you’re looking to stop syncing without losing valuable data, disconnecting the bank account in QuickBooks Online is the safer, smarter move.

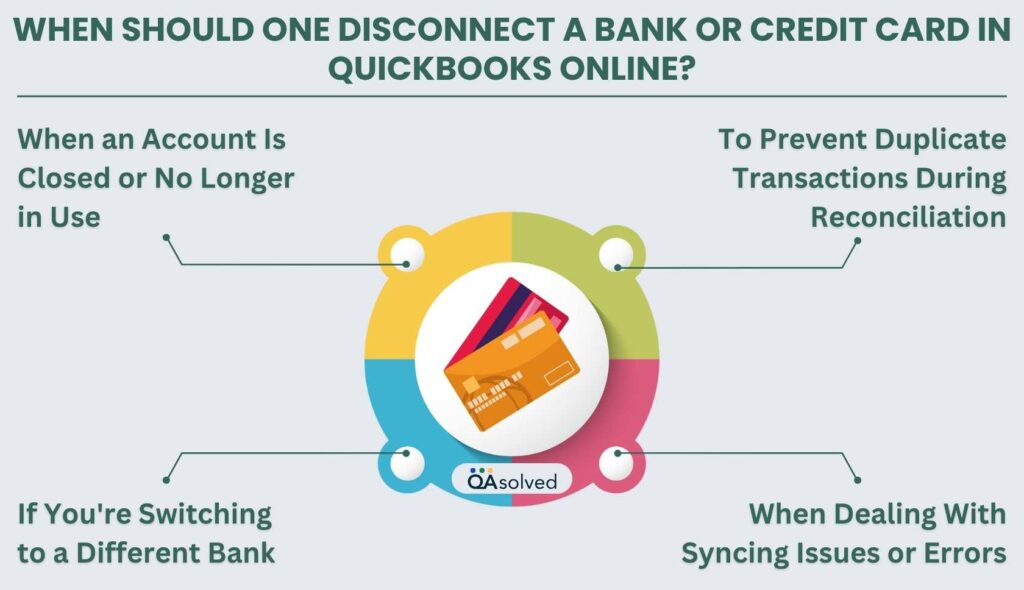

When Should One Disconnect a Bank or Credit Card in QuickBooks Online?

Disconnecting bank and credit card accounts from QuickBooks Online can help you maintain accurate financial records and prevent unnecessary confusion. Disconnecting does not mean deleting, it’s just a way to stop automatic downloads without losing any past data. Disconnecting makes sense in the following scenarios:

1. When an Account Is Closed or No Longer in Use

If you’ve closed a business bank account or credit card, or simply no longer use it for business transactions, disconnect it.The purpose of this is to keep your records organized and to prevent QuickBooks from pulling transactions from inactive accounts.

2. To Prevent Duplicate Transactions During Reconciliation

Reconnecting a bank account can result in duplicate transactions being pulled into QuickBooks. Keeping things clean and accurate can be easier if you disconnect the account before changing connection types or fixing reconciliation errors.

3. If You’re Switching to a Different Bank

You should disconnect the old account once all final transactions have been reconciled if you’re moving your business banking from one financial institution to another. It helps you avoid confusion and ensures that your bank feeds only reflect current, active accounts.

4. When Dealing With Syncing Issues or Errors

There are times when a bank feed might not sync properly due to login changes or server issues. You can resolve errors and restore syncing by disconnecting the bank feed QuickBooks Online temporarily and reconnecting it.

By disconnecting an account at the right time, you ensure that your QuickBooks remains organized and up-to-date, without losing any critical financial data. As your business banking needs evolve, it’s an important step in keeping your books clean.

Steps to Disconnect an Account from QuickBooks Online

When you disconnect a bank or credit card account in QuickBooks Online, any uncategorized transactions in the For Review (Pending) tab will no longer be visible. Also, keep in mind that if the disconnected account has transactions older than 90 days, QuickBooks won’t be able to re-download them when you reconnect. If needed, you can still upload those older transactions manually to keep your records complete.

Important: If your account shows a bank connection error, don’t disconnect it right away. The first step is to resolve the error. Disconnecting an account while errors are present may result in duplicate transactions when the account is reconnected.

It’s best to have your customer sign in directly using the secure link provided in the next step to maintain the security of their account. Assist them with Intuit account recovery if they cannot sign in. You can also copy and share the direct login link with your customer, if needed. Now, let’s take a look at the steps to disconnect an account connected to QuickBooks Online banking.

- Login to your QuickBooks Online account.

- Navigate to Transactions > Bank Transactions.

- Choose the bank account title.

- Click the pencil icon, then select Edit account details.

- Check the Disconnect this account on the save box.

Note: You won’t see the option if QuickBooks is updating your transactions. Give it a few minutes to finish, and then check back. - Choose Save and Close.

How to Disconnect an Account in QuickBooks Solopreneur?

Here are the steps you can take to successfully disconnect an account in QuickBooks Solopreneur:

- Select Transactions, then Bank Transactions.

- Choose New transactions, then Manage connections.

- Choose the Unlink option for the bank account you wish to disconnect.

- Hit Unlink now to confirm.

To stop importing new transactions while maintaining your previous records, you can unlink a bank account from QuickBooks Online if you are switching banks or no longer use it.

Best Practices for Managing Disconnected Accounts

If you disconnect a bank or credit card account from QuickBooks Online, you need to manage it properly to maintain clarity. Keeping organized and preventing confusion can be achieved by following a few best practices:

1. Rename Disconnected Accounts for Clarity

Consider renaming the disconnected account to avoid confusion with active accounts. You can add “(Disconnected)” or the closure date to the account name. In this way, you and your team can instantly recognize that the account is no longer linked to online banking.

2. Add Notes for Your Accounting Team

Leaving a note explaining why an account was disconnected is helpful if you are working with an accountant or finance team. As a result, others can better understand changes and avoid reconciliation and reporting errors.

3. Archive or Inactivate Accounts You No Longer Need

Consider inactivating the account if it’s permanently closed and you won’t be using it to track historical data. Your Chart of Accounts will be cleaned up without deleting any historical transactions, making your bookkeeping more efficient.

4. Reconcile the Account Before Disconnecting

Always reconcile the account before you disconnect it. This ensures that all transactions are accounted for and that your financial reports remain accurate. Unreconciled transactions may cause issues later if left unresolved.

5. Export a Transaction Report for Backup

Before disconnecting, export a detailed transaction report for the account. This gives you a backup reference in case you need to review or cross-check past entries, especially during audits or tax season.

You can reduce the risk of accounting errors and improve overall efficiency by following these best practices to ensure your disconnected accounts remain tidy, traceable, and easy to manage.

Conclusion

Connecting and disconnecting a bank account or credit card is a smart move if you are wrapping up an account, switching banks, or resolving connection issues. It protects your existing financial data and prevents new transactions from being downloaded. Unlike deleting, which deletes the account entirely and may result in data loss, disconnecting simply pauses the bank feed.

Whether you’re managing a closed account or troubleshooting syncing issues, disconnecting properly ensures accuracy in your books. Remember, if you need to reconnect later, QuickBooks makes it easy – though if your transactions are older than 90 days, you may have to manually upload them. Let us know if you need assistance or if you are unsure at any point so that we can keep your financial data organized and error-free.

Frequently Asked Questions

QuickBooks Online does not provide a direct way to unmerge bank accounts after they’ve been combined. Restoring from a backup (if available) or manually recreating the accounts and reassigning transactions is the only solution. Keep a backup of your Chart of Accounts before making major changes, and avoid merging unless absolutely necessary.

Follow these steps to remove a bank account from QuickBooks:

1. Go to the QuickBooks Dashboard.

2. Navigate to Transactions > Bank Transactions.

3. Select the bank account you want to remove.

4. Click the pencil icon in the upper right corner.

5. Choose Edit Account Info.

6. Check the box labeled “Disconnect this account on save.”

7. Click Save and Close to confirm.

1. Click the Gear icon and choose the Chart of Accounts.

2. Select the account you wish to edit from the dropdown menu in the Action column.

3. Hit Edit.

4. Change the account name, type, detail type, or description if needed.

5. To apply the changes, click Save and Close.

If you’ve matched a transaction by mistake in QuickBooks, you can easily undo it by following these steps:

1. Launch QuickBooks on your system.

2. Go to the bank or credit card account where the transaction was downloaded.

3. Click on the Categorized tab to view processed transactions.

4. Locate the specific transaction you’d like to unmatch.

5. Click the blue link under the “Added or Matched” column to open the matched transaction.

6. Choose Undo in the Action column to unmatch it.

This will return the transaction to the “For Review” tab so you can re-categorize or match it correctly.

No, once a bank account is deleted in QuickBooks, the action is permanent. This removal erases all associated transactions and data linked to that account. Unfortunately, there is no option to undo the deletion.

Yes, QuickBooks allows you to connect multiple bank accounts. Follow these steps to add them:

1. Go to your QuickBooks Dashboard.

2. Click on Transactions and then select the Chart of Accounts.

3. Now, click the New button to add a new account.

4. Enter the account name.

5. Choose the appropriate Account Type and Detail Type from the dropdown menus.

6. Click Save and Close.

Repeat these steps for each bank account you want to connect.