When it comes to managing your business finances in QuickBooks, having a clear understanding of the concept of Members’ Equity is absolutely essential. This is particularly true for businesses structured as limited liability companies (LLCs), partnerships, or sole proprietorships. It accounts for several financial elements, including the initial capital contributions made by each member, additional investments, allocated profits to the members, and withdrawals that have been taken from the business. In simple terms, it provides a detailed snapshot of what each member has invested in the business and what they have earned from it over time.

In QuickBooks, accurately tracking members’ equity is vital for maintaining well-organized and reliable financial records. It not only simplifies the tax filing process but also promotes transparency among all members or partners involved in the business. Whether you are in the process of setting up new equity accounts, recording owner contributions, or documenting member withdrawals, QuickBooks offers user-friendly tools that make the entire process efficient and easy to manage.

In this blog, we are going to walk you through how to manage the members’ equity account in QuickBooks, including its meaning, types, benefits, and step-by-step setup. So, let’s get started!

What is Meant By Members’ Equity in QuickBooks?

Members’ equity plays a vital role in showing the true financial position of a business owner or partner. Whether you run an LLC, partnership, or sole proprietorship, knowing how equity is structured helps you track ownership, investments, and withdrawals accurately. Let’s discuss them in detail:

1. Members’ Equity in LLCs

In an LLC, members’ equity reflects each member’s ownership stake based on their capital contributions, share of profits, and any withdrawals. It’s essential for tracking how much value each member holds in the business over time.

2. Members’ Equity in Partnerships

For partnerships, members’ equity represents each partner’s share in the business. It includes their initial investment, share of income or losses, and any draws taken. Equity accounts help ensure clear financial separation between all partners.

3. Members’ Equity in Sole Proprietorships

In a sole proprietorship, members’ equity is typically referred to as Owner’s Equity. It tracks the owner’s capital investment, business profits, and withdrawals. This account shows the net worth of the business from the owner’s perspective.

Understanding how members’ equity functions across different business structures is key to maintaining organized and transparent financial records.

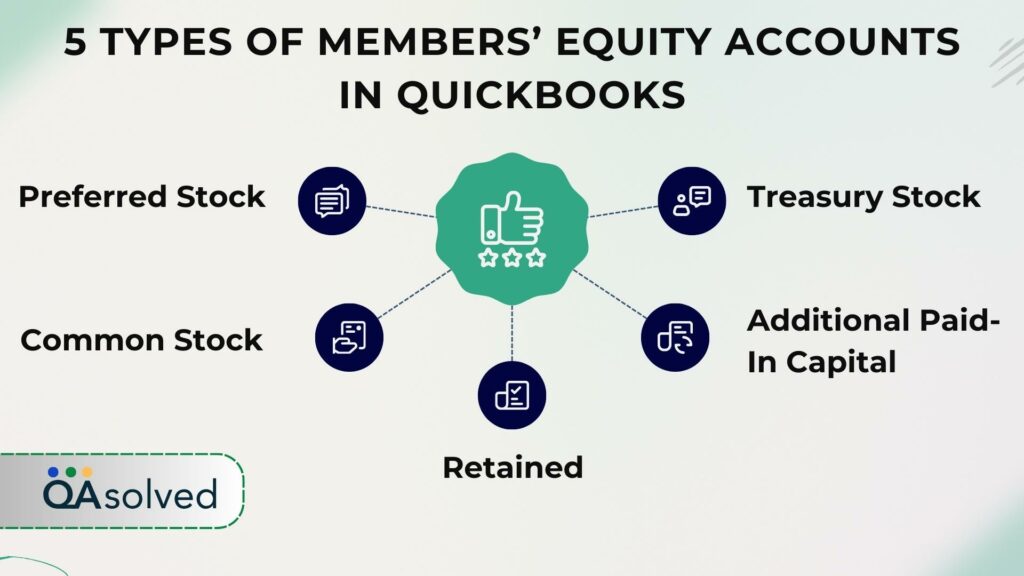

5 Types of Members’ Equity Accounts in QuickBooks

QuickBooks allows you to set up different types of equity accounts to accurately reflect each owner’s or member’s financial involvement in the business. Understanding these types helps you organize contributions, distributions, and retained earnings clearly. Here are the common types of members’ equity in QuickBooks.

1. Preferred Stock

Preferred stock represents a class of company shares that come with special privileges not available to common shareholders. These may include priority in dividend payments and claims on assets during liquidation.

2. Common Stock

Common stock refers to standard ownership shares in a company, often associated with voting rights. Shareholders holding common stock typically have the power to elect the Board of Directors and influence major company decisions.

3. Retained

Retained earnings are the accumulated profits that a business chooses to reinvest rather than distribute to its members or shareholders. These earnings appear on both the balance sheet and cash flow statement and reflect a company’s financial growth.

4. Additional Paid-In Capital

This refers to the amount investors contribute that exceeds the stock’s par value. It represents extra funds received by the company during equity financing, beyond the nominal share price.

5. Treasury Stock

Treasury stock consists of a company’s own shares that have been repurchased and held in its treasury. These shares reduce total equity and may appear as a negative balance on the books.

Also Read: Which Account Is Not Included in the Balance Sheet?

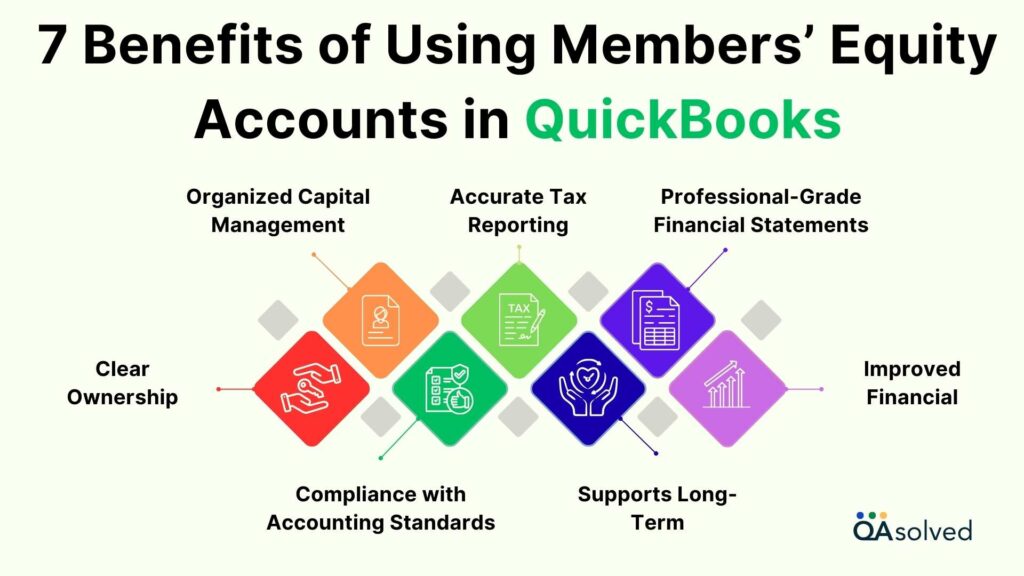

7 Benefits of Using Members’ Equity Accounts in QuickBooks

Using members’ equity accounts in QuickBooks offers several benefits to business owners, accountants, and partners by helping them maintain clear and structured financial records.

1. Clear Ownership

QuickBooks makes it easy to track each member’s financial involvement, from initial contributions to ongoing investments and profit shares. You’ll always have a clear record of who owns what.

2. Organized Capital Management

No more scattered spreadsheets or manual notes. QuickBooks helps you keep all capital activity, like contributions, draws, and retained earnings, neatly recorded in one centralized place, making equity management stress-free.

3. Improved Financial

When equity records are clearly maintained, it builds trust. Members and partners can see exactly where they stand, encouraging open communication and financial clarity across your organization.

4. Accurate Tax Reporting

Come tax season, your books will already be in order. QuickBooks equity tracking makes it easy to report member distributions, capital changes, and other financial details required for filing.

5. Professional-Grade Financial Statements

QuickBooks generates detailed balance sheets and equity reports that look polished and professional. These reports give a true picture of your business’s financial health and satisfy partners or investors with ease.

6. Compliance with Accounting Standards

Using equity accounts properly helps you stay aligned with accepted accounting principles. It reduces the chances of errors and ensures your financial records are always audit-ready and legally compliant.

7. Supports Long-Term

Having a clear view of member equity trends over time gives you the insight needed to plan for future growth, funding, or restructuring. It’s the foundation for making smart, strategic decisions.

How to Set Up and Manage Members’ Equity Account in QuickBooks?

Managing members’ equity in QuickBooks requires a clear understanding of how ownership contributions, distributions, and retained earnings are recorded. In QuickBooks, you can create various equity accounts under the Chart of Accounts, such as common stock, paid-in capital, retained earnings, and dividends. The accounts you use depend on your business’s financial structure.

Steps to Set Up and Manage Equity Accounts in QuickBooks Desktop

Setting up and managing equity accounts in QuickBooks Desktop is essential for tracking owner contributions, draws, and ownership stakes accurately. Follow the steps given below:

- Open QuickBooks Desktop.

- Go to the Lists menu and select Chart of Accounts.

- At the bottom left of the Chart of Accounts window, click Account, then choose New.

- Select Equity as the account type and click Continue.

- Enter a name for the account and add any additional details if needed.

- Click Save & Close to complete the setup.

Also, to record an equity transaction, navigate to the Company menu and select Make General Journal Entries. Enter the required details such as the equity account, the corresponding account, and the transaction amount to complete the entry.

Steps to Set Up and Manage Equity Accounts in QuickBooks Online

To manage ownership records effectively, setting up equity accounts in QuickBooks Online is essential for tracking contributions, withdrawals, and even retained earnings. Here are the steps for the same:

- Open QuickBooks Online.

- Click on Accounting from the left-hand menu, then choose the Chart of Accounts.

- Select the New button to add a new account.

- In the Account Type dropdown, choose Equity.

- From the Detail Type menu, pick the specific type of equity account you need

- Enter a suitable name for the account.

- Click Save and Close to finish creating the account.

So, these are the steps that can help you set up and manage members’ equity accounts in QuickBooks Desktop and Online.

Conclusion

In short, managing members’ equity in QuickBooks is a critical part of maintaining accurate and transparent financial records, especially for businesses like LLCs, partnerships, and sole proprietorships. Understanding how equity works, through contributions, withdrawals, retained earnings, and ownership shares, enables you to track the financial involvement of each member or partner with precision. Whether you are using QuickBooks Desktop or QuickBooks Online, setting up and managing equity accounts is straightforward once you follow the correct steps.

QuickBooks offers intuitive tools through its Chart of Accounts, allowing you to create and categorize various types of equity accounts such as common stock, retained earnings, and paid-in capital. These accounts serve as the foundation for recording owner investments and distributions, ensuring that every transaction reflects the true financial state of your business. By leveraging these accounts, you benefit from streamlined capital management, improved tax reporting, and compliance with accounting standards.

Whether you’re just getting started or optimizing existing equity tracking, QuickBooks empowers you with the flexibility and accuracy needed to manage member equity effectively.

Frequently Asked Questions

Members’ equity is classified as an equity account on the balance sheet. It represents the ownership interest that remains in a business after all liabilities have been subtracted from its assets. In simple terms, it reflects what the owners or members truly own. In the case of cooperatives or credit unions, it indicates each member’s financial stake in the organization.

To calculate equity in QuickBooks, start by running a Balance Sheet report for the desired time period. On the report, find the Total Assets and Total Liabilities figures. Then, subtract the total liabilities from the total assets. The resulting amount represents the Total Equity of your business for that period.

Members Equity is calculated using the formula:

Members Equity = Total Assets – Total Liabilities

This formula shows the net value or ownership interest that remains after all debts and obligations are subtracted from the company’s assets. It reflects the true financial stake of members or owners in the business.

Owner’s equity represents the owner’s share in the business, calculated by subtracting total liabilities from total assets. It is shown on the company’s balance sheet and often referred to as the book value of the business. While it reflects the net worth from an accounting perspective, it may differ from the actual market value of the company.

If you’re wondering how to set up or enter owner equity in QuickBooks, it starts with setting up the right account. To set up an Owner’s Equity account in QuickBooks, follow these steps:

1. Go to the Chart of Accounts: From the dashboard, click on the gear icon and select Chart of Accounts.

2. Create a New Account: Click the New button.

3. Choose Account Type: Select Equity as the account type.

4. Select a Detail Type: Choose a suitable detail type like Owner’s Equity or Partner’s Equity, depending on your business structure.

5. Name the Account: Use a clear name like Owner’s Equity or [Owner’s Name] Capital Account for easy tracking.

6. Add a Description (Optional): You can include details like “Tracks owner’s investment and withdrawals.”

7. Save the Account.