Balancing work and personal life is essential for keeping employees satisfied and productive. Paid time off, sick leave, and vacation days are more than just perks; they play a big role in creating a healthy workplace environment. For businesses, managing time off the right way ensures fair pay, compliance with labor laws, and smooth workforce planning. The challenge is that without the right tools, keeping track of leave requests can quickly become confusing and error prone. That’s where QuickBooks makes things easier. With its simple and flexible features, you can set up time off in QuickBooks and keep everything organized in one place.

QuickBooks not only helps you avoid payroll mistakes but also gives employees peace of mind, knowing their vacation and sick days are tracked accurately. You can even customize accrual schedules for different types of employees, whether you offer hourly PTO accruals or fixed annual leave. This makes payroll processing more efficient for managers and allows employees to plan their time with confidence.

In short, QuickBooks time off management helps strengthen the financial foundation of your business, allowing you to keep both your numbers accurate and your workforce satisfied. If you’re also looking forward to tracking the employees’ time off in QuickBooks, then you’ve found exactly what you were looking for. In this blog, we are going to demonstrate the steps to successfully set up QuickBooks time off and more. So, let’s get started!

Steps to Set Up and Track Time Off in QuickBooks Online and Desktop Payroll

Setting up and managing employee leave doesn’t have to be complicated. With the right process in place, you can handle vacation days, sick leave, and other paid time off smoothly. In this section, we’ll walk you through the steps for time off tracking in QuickBooks Payroll, whether you’re using the Online version or the Desktop version, so you can keep your payroll accurate, and your team organized.

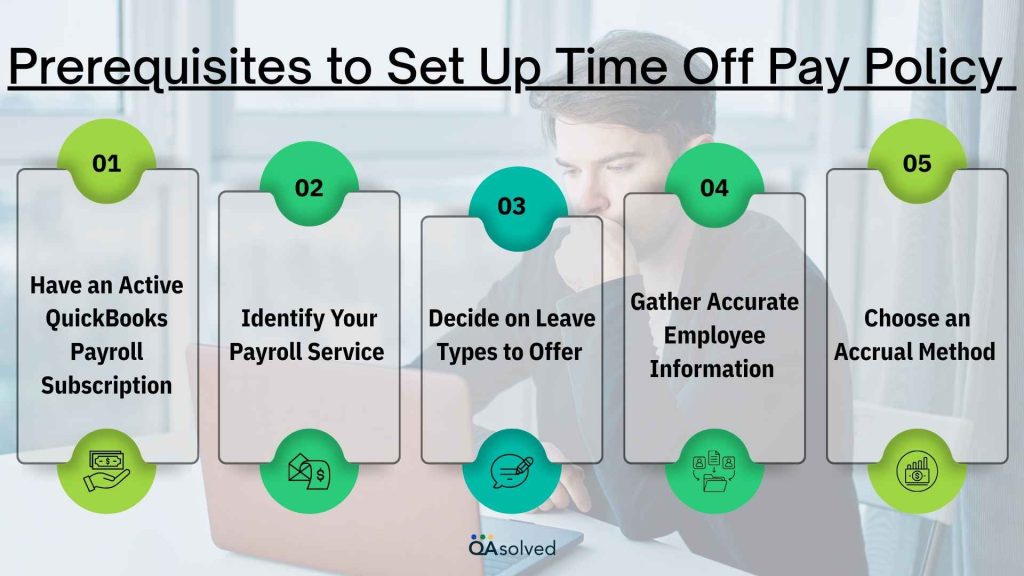

Before diving into the steps, let’s first go over the prerequisites that will help you set up a time off pay policy.

Prerequisites to Set Up Time Off Pay Policy

Before setting up time off policies in QuickBooks Payroll, make sure you’ve prepared the following essentials. Having these details ready will make the process smoother and ensure accurate time off tracking.

1. Have an Active QuickBooks Payroll Subscription

To set up and track time off for your employees, you need an active QuickBooks Payroll subscription. Without it, the time-off management features won’t be available.

2. Identify Your Payroll Service

If you aren’t sure which payroll service you’re currently using, check Find your QuickBooks Payroll service. This will help you follow the correct setup process, whether you’re on QuickBooks Online Payroll or QuickBooks Desktop Payroll.

3. Decide on Leave Types to Offer

Clearly define the categories of time off you want to provide, such as vacation, sick leave, personal days, or paid holidays. This will help you set the right policies for your employees.

4. Gather Accurate Employee Information

Ensure that all employee records in QuickBooks are up to date, including hire dates, pay schedules, and employment type (hourly or salaried). This information affects how time off accruals is calculated.

5. Choose an Accrual Method

Decide how you want employees to earn their time off. Options may include accruals based on hours worked, pay periods, or a fixed annual allotment.

Note: If you’re using QuickBooks Online Payroll Premium or Elite, you can create your time-off policies in QuickBooks Time to align with your payroll account. Both you and your employees can track time off directly in QuickBooks Time, and all data will automatically sync back to payroll.

Now, let’s walk through the actual process in detail.

Steps to Set Up Time Off Pay Policy in QuickBooks Online Payroll and QuickBooks Desktop Payroll

Learn how to establish time-off pay policies for your employees, including vacation, sick leave, and other paid or unpaid time-off types.

A. QuickBooks Online Payroll

- Login to your QuickBooks Online.

- Navigate to the Employees section.

- Select the Employees you want to assign a policy to.

- In the Time off section, click Start or Edit.

- Click on Add new [time off pay] policy from the dropdown menu:

- Vacation Pay

- Paid Time Off

- Sick Pay

- Unpaid Time Off

- Complete the on-screen fields to define the policy, then click Save.

- Once finished, select Save again.

All employees will be able to access the policy you create. It is possible to assign this policy to other employees or to create separate policies for them as needed.

B. QuickBooks Desktop Payroll

Step 1: Create a Time-Off Payroll Item

- Select Payroll Item List from Lists.

- Click the Payroll Item dropdown and select New.

- Select Custom Setup, then click Next.

- Select Wage, then click Next.

- Choose either Annual Salary or Hourly Wages, then click Next.

- Select Sick Pay or Vacation Pay, then click Next.

- Enter a name for the payroll item, then click Next.

- Choose the appropriate Expense Account for tracking the item, then click Finish.

Step 2: Assign a Time-Off Policy to an Employee

- Navigate to Employees, then open the Employee Center.

- Select the Employee’s Name.

- Click Payroll Info, then select Sick/Vacation.

- Enter the total number of hours currently available for the employee in the Hours available as of mm/dd/yyyy field.

Note: This represents the total hours available as of the date you add the sick or vacation policy. - Choose an accrual schedule from the Accrual period ▼ dropdown.

- Enter the number of hours that will be accrued in the Hours Accrued field (based on your accrual schedule).

- (Optional) Enter a maximum balance in the Maximum number of hours field.

- If hours do not carry over from one year to the next, choose Reset hours each year?

- Enter the start date of the accrual year.

Note: Use January 1 for a calendar year or the employee’s hire date if accrual is based on their anniversary. - Enter the date when sick time should begin accruing.

- Repeat steps 4-10 for the Vacation section if setting up vacation accruals.

- Click OK to save your changes.

Once you’ve set up your initial time off pay policy in QuickBooks Online Payroll, you may need to make updates later. Whether it’s adjusting accrual rules, changing carryover limits, or correcting an employee’s balance, QuickBooks gives you the flexibility to modify these settings anytime. Let’s look at how you can change your time off pay policy settings and update balances when needed.

How to Modify Your Time Off Pay Policy Settings and Balance?

Over time, your business needs or employee requirements may change, and so will your time off policies. QuickBooks makes it easy to update these settings without disrupting payroll. Here are the steps to do the same in both Online and Desktop versions.

A. QuickBooks Online Payroll

- Login to QuickBooks Online.

- Go to Employees.

- Select the Employee you wish to update.

- Go to Time Off and choose Start or Edit.

- Click the Edit icon next to the policy to adjust its details or update the current balance.

- Make the necessary changes to the policy and select Save.

- Once everything is updated, select Save again to confirm.

B. QuickBooks Desktop Payroll

a. Change your Policy Settings

- Firstly, open QuickBooks Desktop.

- Go to Edit, then select Preferences.

- Select Payroll & Employees and then click Company Preferences.

- Choose Sick and Vacation.

- In the Sick or Vacation Pay section, you can update:

- Accrual period

- Hours accrued

- Maximum number of hours to accrue

- Check Reset hours each new year? if hours are not allowed to carry over.

- You can select Sick and Vacation hours paid in the Sick and Vacation Accrual section if you do not want time to accrue when you pay sick or vacation hours.

b. Update your Employee’s Time-Off Balance

- Go to Employees, then open the Employee Center.

- Select the Employee’s Name.

- Click Payroll Info, then select Sick/Vacation.

- In the Sick or Vacation Pay section, enter the total hours currently available in the Hours available as of mm/dd/yyyy field.

Note: This represents the total hours available as of the date you add sickness or vacation to the employee’s profile. - To save your changes, click OK.

Follow these steps to ensure accurate tracking of employee leave, streamline payroll processing, and maintain compliance with your company’s policies. A QuickBooks time off policy setup provides clarity for managers and employees, reduces errors, and supports smooth payroll operations.

Also Read: How to Edit or Change Employee Info in QuickBooks Payroll?

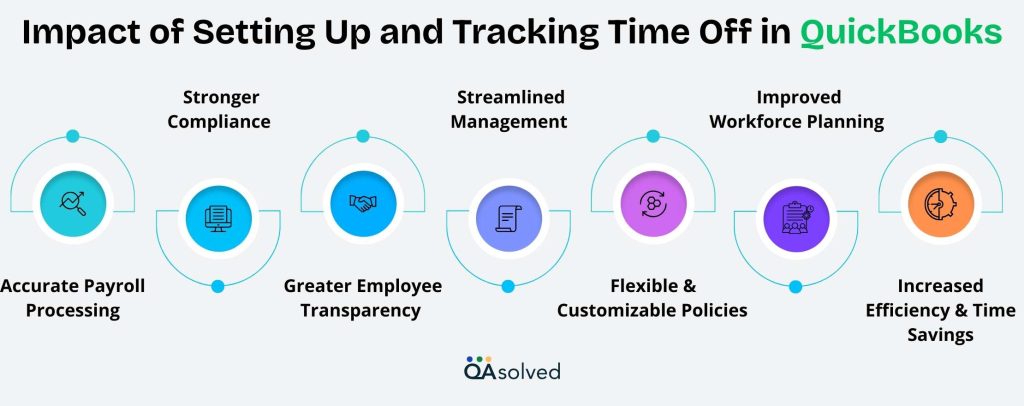

Impact of Setting Up and Tracking Time Off in QuickBooks Payroll

Implementing a structured system for time off tracking in QuickBooks brings lasting benefits to both employers and employees. By automating accruals and leave calculations, QuickBooks not only saves time but also ensures accuracy and compliance across the board. Here are some of the key positive impacts:

1. Accurate Payroll Processing

With time off integrated directly into payroll, paid time off is calculated and reflected correctly in employee paychecks. This ensures payroll runs smoothly, prevents costly errors, and eliminates risks of overpayments or underpayments—all while saving valuable processing time.

2. Stronger Compliance

A systematic approach to PTO helps businesses stay aligned with labor laws and internal policies. Accrual rules, carryover limits, and usage policies can be applied consistently, reducing compliance risks and maintaining fairness for all employees.

3. Greater Employee Transparency

Employees gain full visibility into their PTO balances, including used time and upcoming accruals. This clarity fosters trust, minimizes disputes, and helps employees plan their time off with confidence.

4. Streamlined Management

For managers and HR teams, QuickBooks simplifies oversight by making PTO balances, requests, and approvals easy to manage. Administrative work is reduced, and decision-making becomes faster and more accurate.

5. Flexible and Customizable Policies

QuickBooks supports different accrual schedules for salaried or hourly staff, as well as multiple leave types. This flexibility ensures policies reflect the unique needs of your workforce and business structure.

6. Improved Workforce Planning

Accurate tracking of time off empowers managers to schedule effectively, ensuring the right staffing levels while allowing employees to enjoy their well-earned breaks.

7. Increased Efficiency and Time Savings

By automating PTO tracking, HR and payroll professionals can shift their focus from manual calculations to higher-value tasks, leading to greater productivity and smoother operations.

By setting up accurate time off tracking in QuickBooks Payroll, you build a transparent system that benefits both your business and employees. These steps will help you configure policies, keep payroll smooth, and give employees clear visibility of their leave balances.

Conclusion

Effective time off management is key to running a smooth and compliant business. QuickBooks time off management makes it easy to track, manage, and adjust employee leave, ensuring accurate payroll and clear visibility for your team. By following the steps outlined in this guide, you can confidently handle QuickBooks time off policy setup, customize accruals, and maintain accurate balances. Implementing a structured system not only saves time but also strengthens trust and transparency across your workforce, helping your business operate more efficiently.

Frequently Asked Questions

Create Payroll Items

1. Go to Lists > Payroll Item List > Payroll Item > New.

2. Choose Custom Setup > Wage > Hourly/Salary > Vacation Pay or Sick Pay.

3. Name the item and select an Expense Account, then click Finish.

Assign to Employees

1. Access Employees > Employee Center and select an employee.

2. Under Earnings, click Payroll Info and add the payroll item.

3. Enter hours available, set accrual schedule and maximum hours, then click OK.

Track Time Off

1. QuickBooks Desktop tracks accruals and usage automatically.

2. Update balances or schedules as needed in the employee’s Payroll Info section.

PTO is calculated based on the accrual settings you configure for each employee in QuickBooks. Several factors affect the calculation:

1. Accrual Method – PTO can accrue per pay period, per hour worked, or as a fixed annual amount.

2. Employee Type – Different rules can be applied for hourly vs. salaried employees.

3. Accrual Rate – The number of hours an employee earns per pay period or per hour worked.

4. Maximum Balance – QuickBooks can enforce a cap, so PTO stops accruing after the maximum hours are reached.

5. Carryover Settings – You can decide whether unused PTO carries over to the next year or resets annually.

QuickBooks tracks and updates PTO balances automatically as payroll is processed, ensuring accurate accrual and usage reporting.

PTO (Paid Time Off) and sick leave are both forms of paid absence but serve different purposes. PTO gives employees a flexible pool of paid time they can use for vacation, personal days, or sick days. The purpose of sick leave is to address health issues, medical needs, or caregiving responsibilities. PTO covers all types of leave, while sick leave is strictly health-related and may be subject to legal compliance requirements.

Yes. It is possible to update an employee’s time off balance at any time in both QuickBooks Online Payroll and QuickBooks Desktop Payroll. This includes:

– An employee’s balance of hours should be adjusted if he or she has taken time off outside of payroll.

– Changing the accrual period (per paycheck, hour worked, or annually) to match the company’s policy.

– Updating the policy settings, such as maximum accrual limits or rollover rules.

– Correcting balances during year-end reviews or after policy changes.

You will be able to keep your records accurate and ensure your employees see the correct available time off each pay period.