Hiring a new employee is more than just expanding your team, it’s a clear indication that your business is growing and evolving. Whether you’re onboarding your very first team member or adding to an established workforce, every new hire brings with them new responsibilities, especially when it comes to payroll setup and compliance. Ensuring your employees are correctly added to your payroll system from day one is critical to avoid payment errors, tax issues, and potential legal complications. With QuickBooks Payroll, managing employee data becomes easier and more streamlined, but it’s important to input every detail accurately.

From entering personal information and tax withholding details to assigning pay schedules, direct deposit preferences, and benefits, each step ensures your new hire is paid correctly and on time. In this blog, we’ll walk you through everything you need to know about how to add a new employee to QuickBooks Payroll.

By the end, you’ll be equipped with the knowledge to confidently and compliantly set up your new hires, ensuring smooth onboarding, accurate recordkeeping, and payroll that runs like clockwork.

Steps to Set up New Employee to QuickBooks Payroll

Setting up a new employee in QuickBooks Payroll is a vital step in ensuring accurate payroll processing and compliance with tax regulations. The process involves entering essential employee information, such as personal details, tax withholding data, pay rate, and benefits. Doing this correctly from the start helps avoid payroll errors, ensures timely payments, and keeps your business in good standing with labor laws.

Get started with QuickBooks Online Payroll and QuickBooks Desktop Payroll by adding your new employee. If you’re adding a new employee to QuickBooks Payroll, make sure you have their information prepared, including a W-4 and banking information.

Step 1: Set Up a New Employee Profile

Follow the steps given below to set up a new employee profile in both QuickBooks Online Payroll and QuickBooks Desktop Payroll:

A. For QuickBooks Online Payroll

Either enter all of your employee’s information yourself or start the setup and invite them to finish it. Provide all necessary employee details during setup.

Add Your Employee to Payroll

- Follow the link to complete the steps within the product.

- Click on Add an employee.

- Fill in the employee’s name and email address. Enable “Yes, allow employee to enter their own tax and banking information in Workforce” if you want them to provide their own personal, tax, and bank details.

- To continue, click Add employee.

- To complete the remaining employee details, click Start or Edit in any section.

Note: If employee self-setup is enabled, you may not be able to edit certain fields in the Personal Info, Tax Withholding, or Payment Method sections. To make changes directly, disable Employee self-setup from the Personal Info tab. - Be sure to click Save after you have completed a section.

B. For QuickBooks Desktop Payroll

By setting up employee defaults in QuickBooks Desktop, you can streamline the onboarding process for most or all employees. When you add a new employee, these defaults are automatically populated, saving you time and ensuring consistency. Include settings such as:

- Pay schedule or frequency

- Sick or vacation policies

- State worked and applicable state taxes

- Standard earnings or deductions

To access the employee defaults, make sure you’re signed in as the QuickBooks Admin:

- Click on Edit and then Preferences.

- Select Payroll and Employees, then click Company Preferences.

- Enter the employee default details under Employee Defaults.

- You must click OK twice to save your changes.

By using this setup, we can standardize employee data entry and reduce the chances of human error. Now, add your employee to payroll by following these steps:

- Select Employee Center from Employees.

- Then select New Employee and enter the employee’s information.

- Hit OK.

Depending on your payroll service, the fields and tabs may differ. Below is a list of required fields in each tab:

- Required Info – Name, Social Security number, date of birth, home address, main phone number, and main email address.

- Personal Info – not required

- Additional Info – there is no mandatory information

- Payroll Info – Add pay schedules and pay frequencies, pay types, pay rates, W-4 information and federal and state taxes in order to pay an employee. Add deductions, sick or vacation policies, and direct deposit if necessary.

- Employment Info – Date of hire

- Workers’ Compensation (for QuickBooks Desktop Payroll Assisted and Enhanced Payroll only) – Enter a code for workers’ compensation if you want to track it in QuickBooks.

Step 2: Finish Setting Up the New State If Your Employee Lives or Works in a Different State

If your employee lives or works in a state other than your business location, you might be required to register and pay taxes there.

Collect Employee Details:

- W-4: An Employee’s Withholding Certificate containing personal data such as their name, address, social security number, dependents, and adjustments. The information can be entered by your employees when you invite them, but a copy should be kept by you.

- I-9: A form used to verify an employee’s eligibility for employment in the United States. Social Security numbers must be valid for your employees. You should never accept an ITIN as an employee identification number or as proof of employment. An ITIN is only available to residents and nonresident aliens who cannot work in the U.S. and need identification for other tax purposes. ITINs begin with the number “9” and are formatted like Social Security numbers (NNN-NN-NNN).

- Email Address: Invite your employees to add their personal information and access their pay stubs and W-2s online.

- Work Location: The address of your employee’s workplace.

- Pay Info: The employee’s salary or pay rate, other pay types, and their pay schedule (how often they are paid).

- Direct Deposit Info: Employee’s routing number and account number. A maximum of two bank accounts can be added by an employee.

- Pay History: Only applicable if you are setting up QuickBooks payroll for the first time. In that case, you’ll need your employees’ year-to-date pay stubs so you have accurate year-end totals for taxes, etc. You will be guided through this process, but make sure you have this information handy.

There you have it! Upon entering the necessary information and saving the details, your new team member will officially become a part of your payroll system. Executing these steps correctly helps avoid payroll errors, ensures timely payments, and keeps your business in good standing with labor laws.

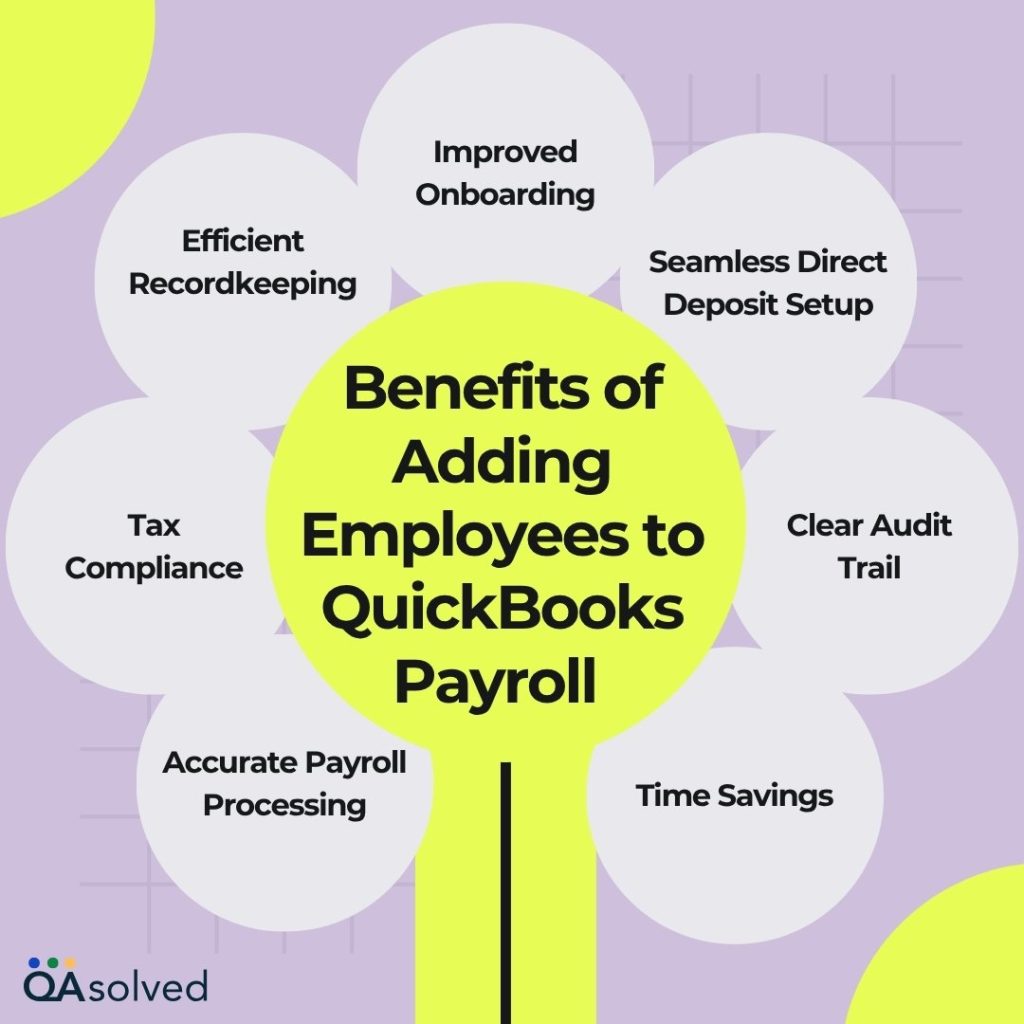

Benefits of Adding Employees to QuickBooks Payroll

Before you process your new hire’s first paycheck, you must understand why adding them to QuickBooks Payroll correctly goes beyond a simple procedure. The benefits of doing this step right extend far beyond payroll accuracy to overall business compliance and efficiency. Here are the key benefits of setting up and adding a new employee in QuickBooks Payroll:

1. Accurate Payroll Processing

Ensures that your new employees are paid the correct amount, on time, with the right tax withholdings and deductions automatically applied as part of the payroll process.

2. Tax Compliance

It automatically calculates, withholds, files, and keeps track of federal and state payroll taxes, which reduces the risk of costly errors and penalties from occurring.

3. Efficient Recordkeeping

Keeping track of employee personal information, tax information, pay rate, benefits, and deductions is now done through a centralized employee record.

4. Improved Onboarding

Provides an easy way for you to set up employee pay schedules, direct deposit, and employee benefits at the time of onboarding by allowing you to do so online.

5. Seamless Direct Deposit Setup

Employers are provided with the option of receiving their employees’ pay directly into their bank accounts, eliminating delays caused by manual processing of checks.

6. Clear Audit Trail

Keeping detailed records of payroll transactions is important for internal review, audit, and employee inquiries, as well as for internal audits.

7. Time Savings

It allows you to simplify the process of data entry and paperwork, giving you more time to focus on growing your team and your business.

Adding every new hire to QuickBooks Payroll properly isn’t just about payroll-it’s about building trust, compliance, and operational excellence. Your business runs smoothly when employees are paid accurately and on time, boosting morale and reducing administrative burdens.

Conclusion

In a nutshell, adding a new employee to QuickBooks Payroll is more than just a setup task, it’s an investment in accuracy, efficiency, and compliance. By entering the right details from the start and leveraging QuickBooks’ built-in tools, you not only streamline your payroll process but also lay the groundwork for a smooth employer-employee relationship. Whether you’re managing one hire or scaling your team, a well-organized payroll system ensures timely pay, avoids costly errors, and supports your business’s long-term success. If you’re ever unsure about any step, seeking expert help can make all the difference.

In case you’re having any sort of trouble while performing these steps, it would be ideal to connect with our Certified QuickBooks Payroll experts for immediate assistance at +1-888-245-6075.

Frequently Asked Questions

1. Employee is Inactive: Check if they are marked as inactive. Go to the Employee Center, right-click their name, and select Make Active.

2. Profile Isn’t Complete: Fill in all required information (such as your social security number and W-4).

3. No Payroll Schedule Assigned: Under the Payroll Info tab, assign a payroll schedule to the employee.

4. Filters Are Hiding Them: You may be using filters based on pay type or group. Delete or adjust them so that all employees can be seen.

5. QuickBooks Isn’t Updated: Fix display issues with QuickBooks and payroll by updating them.

Here are the steps to successfully add a new employee to QuickBooks Time:

1. Log in to QuickBooks Time.

2. Click on “My Team” in the main menu.

3. Select “Add Team Member.”

4. Enter the employee’s email address and name.

5. Specify their role and permissions.

6. Save the invite and send it to them.

1. Launch QuickBooks Payroll (Online or Desktop version).

2. Go to the Payroll menu, then select “Employees.”

3. Hit “Add an employee.”

4. Provide the employee’s name, address, and Social Security number.

5. Include their pay rate, pay schedule, and payment frequency.

6. Input tax withholding information (from their W-4 form).

7. Provide a payment method (e.g., direct deposit or check).

8. Create an employee profile and save it.

1. Choose Employees from Payroll.

2. Select the employee whose status you wish to change.

3. Select Edit next to the “Employment details” section.

4. Select a new status under Status, such as:

– Active

– Terminated

– On Leave

5. Decide when the termination or leave will take place, if applicable.

6. To save your changes, click Save.