Let’s be honest, payroll isn’t the most exciting part of running a small business, but it’s certainly one of the most important. Whether you’re hiring your first employee or managing a growing team, making sure everyone gets paid accurately and on time is non-negotiable. But payroll is more than just issuing checks. It involves calculating taxes, managing employee benefits, meeting strict deadlines, and staying compliant with ever-changing labor laws. For small business owners juggling multiple responsibilities, these tasks can quickly become overwhelming. That’s why adopting the right payroll management practices is crucial.

Payroll mistakes can lead to serious consequences, ranging from costly penalties and legal trouble to frustrated employees and reputational damage. On the flip side, a well-managed payroll system not only ensures accurate, timely payments but also helps maintain compliance and builds trust within your team. Whether you’re handling payroll in-house, using software, or working with a service provider, understanding and implementing effective payroll practices can save you time, money, and stress in the long run. Even if you’re just starting out, putting the right processes in place now can lay the groundwork for smoother operations and sustainable growth.

In this blog, we’ll explore practical and proven payroll management practices tailored specifically for small businesses, so you can streamline your processes, avoid common pitfalls, and focus more on growing your business. So, let’s get started!

What is Payroll Management?

Payroll management is the process of administering employee compensation within a business. It involves calculating wages, withholding taxes, managing benefits and deductions, and ensuring that employees are paid accurately and on time. But it doesn’t stop at just writing paychecks, it also includes recordkeeping, tax compliance, filing reports, and following labor laws.

In short, payroll management ensures that:

- Employees receive correct salaries or wages

- Legal obligations (like taxes and social security) are fulfilled

- Payroll-related data is documented and reported accurately

For small businesses, payroll can be handled manually, through payroll software, or by outsourcing to a payroll service provider. Regardless of the method, effective payroll management practices are essential to avoid errors, ensure compliance, and keep employees satisfied.

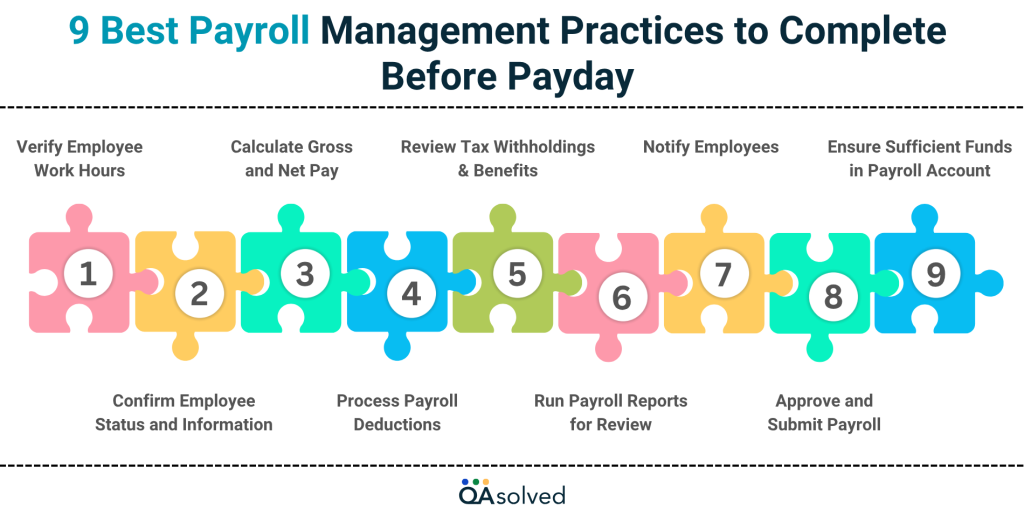

9 Best Payroll Management Practices to Complete Before Payday

To ensure everything runs smoothly on payday, you should take care of several key payroll tasks:

1. Verify Employee Work Hours

Make sure all timesheets or attendance logs are submitted and reviewed. This includes verifying overtime, paid time off (PTO), sick leave, and holiday hours, especially if you’re managing hourly workers.

2. Confirm Employee Status and Information

Double-check employee classifications (full-time, part-time, contractor) and ensure all relevant information, such as tax details, bank account numbers, and deductions, is up to date.

3. Calculate Gross and Net Pay

Determine the gross pay based on hours worked or salary, then apply deductions like taxes, benefits, retirement contributions, and garnishments to arrive at the net pay.

4. Process Payroll Deductions

Apply all mandatory and voluntary deductions accurately. This includes:

- Federal and state tax withholdings

- Social Security and Medicare (FICA)

- Health insurance or retirement contributions

- Any wage garnishments or loan repayments

5. Review Tax Withholdings and Benefits

Ensure all employee withholdings and employer contributions are calculated properly for tax filings and benefits programs.

6. Run Payroll Reports for Review

Generate and review payroll reports for errors or inconsistencies. Cross-check total pay amounts, tax deductions, and direct deposit information.

7. Ensure Sufficient Funds in Payroll Account

Confirm that your payroll bank account has enough funds to cover employee payments, tax liabilities, and any associated fees to avoid overdrafts or missed payments.

8. Approve and Submit Payroll

Once everything is verified, submit the payroll through your chosen method, manual, payroll software, or third-party provider, well before the cut-off time to avoid delays.

9. Notify Employees

A quick reminder to employees about payday or any payroll-related updates (such as changes in deductions or bonuses) can help manage expectations and build transparency.

Now that we have outlined nine basic yet imperative tasks to complete, let’s take a look at the best software that can help you implement the best payroll management practices easily.

Consequences of Not Managing Payroll Activities Properly

Improper payroll management may lead to more than just late paychecks and it can have serious consequences on the financial, legal, and reputational pillar of your business. Here are some of the key risks that are directly associated with poorly handled payroll processes:

- Facing Legal Penalties and Fines

- Losing Employee Trust and Morale

- Inaccurate Financial Records

- Exposure to Fraud Risks

- Damaging Your Business Reputation

- Negative Impact on Tax Credits

- Risk of Employee Lawsuits

- Disruption of Employee Benefits Administration

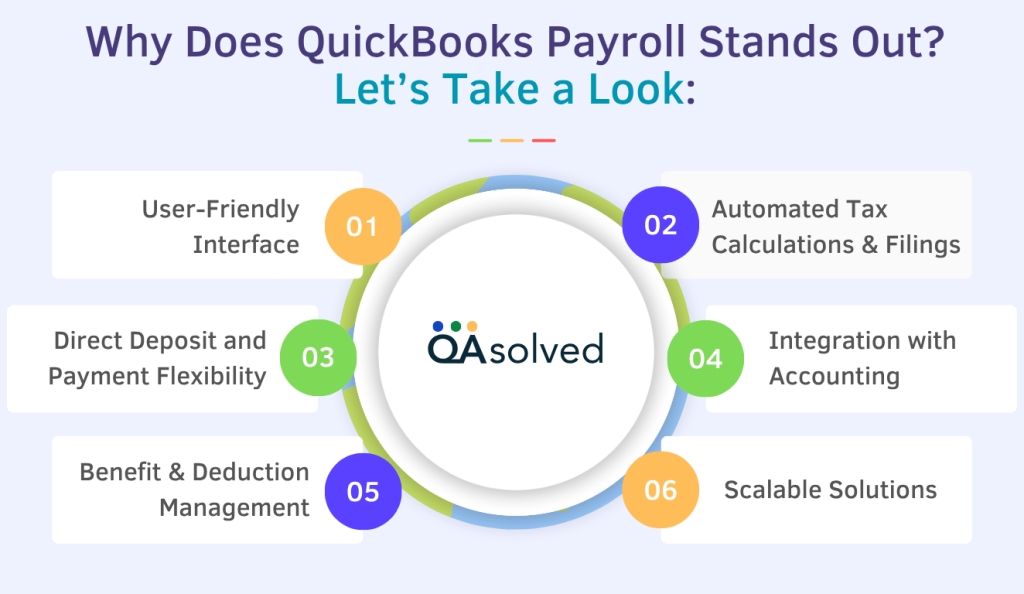

Our Recommendation: QuickBooks Payroll Software for the Best Payroll Management

If you’re looking for payroll software that can streamline your payroll process, we highly recommend QuickBooks Payroll because of its exciting features and benefits. A comprehensive and user-friendly solution tailored to meet the unique needs of growing businesses. QuickBooks integrates seamlessly with your accounting system, saving you time and reducing errors.

1. User-Friendly Interface

QuickBooks Payroll offers an intuitive dashboard designed for business owners and managers who aren’t payroll experts. Setting up employee profiles, tracking hours, and processing payroll can all be done with just a few clicks.

2. Automated Tax Calculations and Filings

One of the biggest challenges in payroll is tax compliance. QuickBooks Payroll automatically calculates federal, state, and local taxes, files tax forms on your behalf, and sends reminders for deadlines, reducing your risk of costly errors or penalties.

3. Direct Deposit and Payment Flexibility

QuickBooks Payroll also supports fast, secure direct deposits so your employees get paid on time. It also handles paper checks, if needed.

4. Integration with Accounting

Since QuickBooks Payroll is also a leading accounting software, your payroll data syncs seamlessly with your books, simplifying bookkeeping and financial reporting.

5. Benefit and Deduction Management

QuickBooks Payroll allows you to easily manage employee benefits, retirement plans, and other deductions, helping you stay compliant and organized.

6. Scalable Solutions

Whether you have a handful of employees or a rapidly growing team, QuickBooks Payroll offers scalable plans that grow with your business.

Using QuickBooks Payroll simplifies payroll management and helps you focus on growing your business. For small businesses seeking accuracy, efficiency, and peace of mind, it’s a great choice.

In short, QuickBooks Payroll is one of the most popular platforms for businesses of all sizes and verticals to ensure their payroll management is effective.

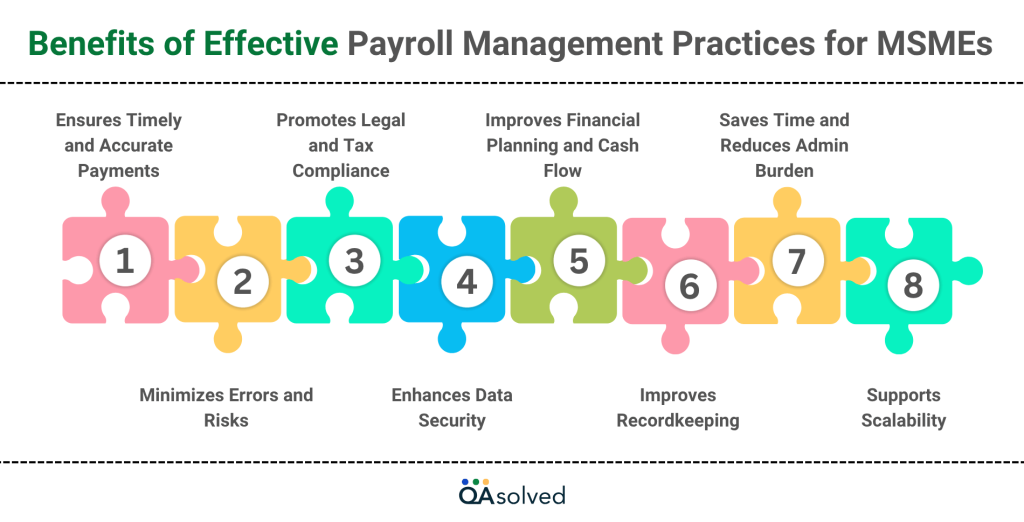

Benefits of Effective Payroll Management Practices for MSMEs

Here are some of the benefits of following the best practices in payroll management for businesses of all sizes and verticals.

1. Ensures Timely and Accurate Payments

When employees are paid on time and correctly, it fosters trust and improves morale. Accurate payroll reflects professionalism and helps retain talent, an essential factor for growing businesses.

2. Promotes Legal and Tax Compliance

Payroll mistakes can lead to non-compliance with tax laws, labor regulations, and statutory filings, resulting in penalties or legal complications. Good payroll practices ensure you stay compliant with federal, state, and local regulations.

3. Improves Financial Planning and Cash Flow

With organized payroll systems, you gain better insight into labor costs, tax liabilities, and benefit expenses. This helps you forecast more accurately and manage cash flow efficiently.

4. Saves Time and Reduces Admin Burden

Automated or streamlined payroll processes free up valuable time for business owners and HR teams. This allows you to focus on core activities like sales, marketing, and customer service.

5. Minimizes Errors and Risks

Manual payroll processes are prone to human errors. Implementing best practices and using reliable payroll tools reduces miscalculations, missed deadlines, and incorrect deductions.

6. Enhances Data Security

Proper payroll systems protect sensitive employee and financial data from unauthorized access. With secure digital platforms, MSMEs can reduce the risk of data breaches and maintain confidentiality.

7. Improves Recordkeeping

Good payroll management keeps accurate records of salaries, tax filings, benefits, and working hours. This proves useful during audits, funding rounds, or while applying for business loans or grants.

8. Supports Scalability

As your business grows, your payroll needs become more complex. Having robust payroll management practices in place from the start ensures that scaling your team and operations is smoother and less disruptive.

So, these are some of the advantages of consciously following the best practices in payroll management. Now, let’s cover another important aspect of payroll management before revealing the best software for the same.

Summary

Payroll may not be the most glamorous part of running a small business, but it’s undeniably one of the most critical. From ensuring your employees are paid accurately and on time to staying compliant with tax regulations and labor laws, effective payroll management practices can make a significant impact on your business’s stability and growth. By understanding the essential tasks before payday, implementing the right systems, and following best practices, you can avoid common payroll pitfalls that lead to legal trouble, financial loss, and employee dissatisfaction. Whether you’re managing payroll manually, using software, or working with a service provider, the key lies in being consistent, accurate, and compliant.

If you’re looking for a reliable, all-in-one payroll solution, QuickBooks Payroll offers everything MSMEs need to streamline the process, from automated tax filings to seamless integrations and user-friendly tools. So, start prioritizing payroll management today, and set your business up for long-term success, trust, and peace of mind.

Frequently Asked Questions

Authorization and recordkeeping are the two main payroll controls. Authorization ensures that only approved employees receive payment and that payroll changes are verified before they are processed. It involves keeping accurate and detailed records of employee hours, wages, deductions, and tax filings. By combining these controls, they prevent errors, fraud, and ensure compliance with legal and financial requirements.

Maintaining accuracy and compliance is a best practice for payroll accountants by regularly updating their knowledge of tax laws and payroll regulations. Keeping detailed records, automating calculations, and conducting frequent audits are essential to catching errors early. Efficient payroll management also relies on clear communication with employees and timely payroll processing.

1. Verify Employee Information: Verify that employee information (name, ID, job title) is accurate and current.

2. Review Time Records: Make sure hours worked, overtime, and leave are accurately recorded.

3. Check Payroll Calculations: Ensure taxes, deductions, and benefits are calculated correctly.

4. Validate Tax Filings: Check for timely filing and payment of payroll taxes.

5. Examine Payroll Reports: Look for discrepancies or unusual entries.

6. Confirm Compliance: Comply with labor laws and company policies.

7. Reconcile Payroll Accounts: Check payroll expenses against accounting records.

Payroll reconciliation involves comparing your payroll records with your financial statements to ensure accuracy. Verifying employee payments, taxes, deductions, and benefits against your accounting records is part of this process. Compliance with regulations is ensured through the identification of discrepancies, the prevention of errors, and the prevention of fraud. By reconciling payroll regularly, you can ensure that your books are accurate and your employees are paid on time and in full.

1. Select Reconcile under the Tools menu in QuickBooks.

2. Choose the account you want to reconcile from the list.

3. Enter the statement’s ending balance and date.

4. Compare QuickBooks transactions with your bank statement. Matching entries should be checked off.

5. Identify and correct any items that are not matched or missing.

6. To complete the reconciliation, click Finish Now when the difference is $0 or less.

7. Save the reconciliation report for your records after reviewing it.