Understanding the financial health of your business goes far beyond just tracking sales and revenue. To truly measure profitability, you must know how much you are spending to generate that income, which is where the Cost of Goods Sold comes in. COGS, or cost of goods sold, reflects the direct costs associated with the production or purchase of the goods or services you sell, such as raw materials, inventory, and direct labor. Accurately managing COGS in QuickBooks isn’t just an accounting task; it’s a critical component of making informed business decisions. This brings us to ask you this, “Do you know how to calculate the cost of goods sold in QuickBooks?” If not, then don’t worry, we are here to assist you in the best possible manner.

Poor COGS management can lead to poor strategic decisions and distort your financial insights. To ensure and promote economic transparency and accuracy, you must set the right prices, manage inventory, calculate your gross profit, and comply with tax reporting requirements. Knowing where your money goes and how it is used can significantly help you understand your profits and spending.

In this informational blog, we are going to help you understand every aspect of the cost of goods sold in QuickBooks so that you can effectively maintain your records, maximize the profit margins, and make sure that the financial pillar of your business remains intact. So, let’s begin with it!

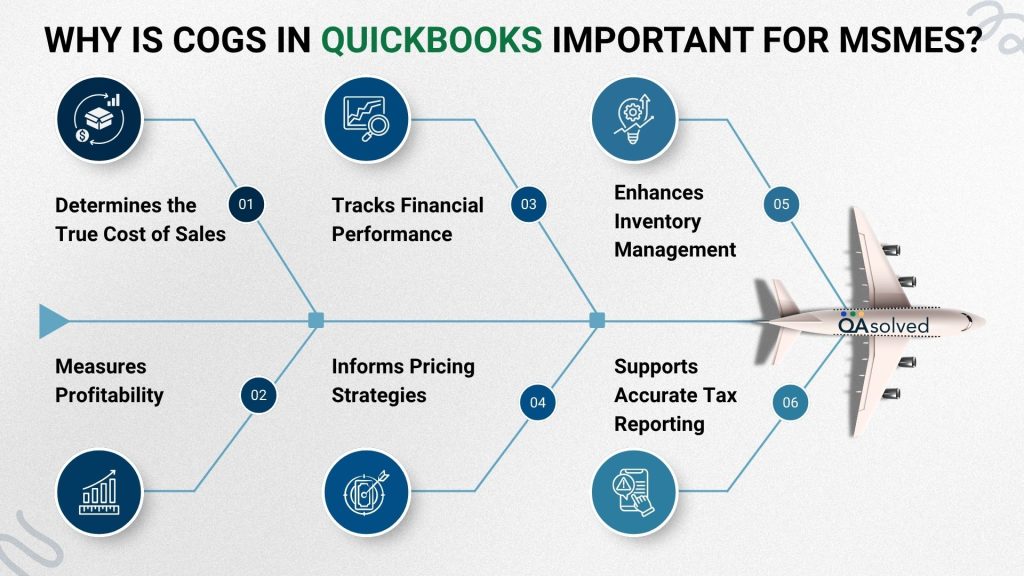

Why is COGS in QuickBooks Important for MSMEs?

The cost of goods sold (COGS) indicates the direct costs associated with the production of the product your business sells. This usually includes materials, labor, and manufacturing expenses directly related to the production of product-based businesses.

Gross profit is calculated by subtracting COGS from total revenue on your income statement:

Gross Profit = Revenue – Cost of Goods Sold (COGS)

Tracking COGS accurately is crucial not only to calculating profitability, but also to setting effective pricing strategies and ensuring sound financial management. In short, COGS is a vital business metric for companies that manufacture or sell goods.

An operational efficiency analysis is crucial to evaluating the health of a business. This is why it calculating COGS is important for budding entities:

1. Determines the True Cost of Sales

The cost of goods sold is the actual cost of producing or acquiring the products your business sells, including materials and labor. You will be able to understand the real cost of every unit sold by doing this.

2. Measures Profitability

COGS are subtracted from sales revenue to determine gross profit. Assessing the profitability of each product or service allows you to focus on high-margin items and reduce losses on low-performing items.

3. Tracks Financial Performance

Cost trends, inefficiencies, and pricing issues can be identified by monitoring COGS over time. A valuable metric for ongoing financial analysis and business planning.

4. Informs Pricing Strategies

Setting competitive and profitable prices depends on knowing your cost structure. Understanding COGS ensures that pricing covers all production expenses while delivering sustainable margins.

5. Enhances Inventory Management

Better inventory decisions can be made with accurate COGS data. It helps reduce waste and improve turnover by guiding stock levels, reorder timing, and product lifecycle management.

6. Supports Accurate Tax Reporting

COGS is a deductible business expense, so properly calculating and reporting it can lower your taxable income. Tax savings may result from this, and compliance will be ensured.

With a clear understanding of how to calculate the cost of goods sold in QuickBooks, you can improve these processes, enabling better decision-making and improved financial visibility.

Also Read: Manage and Track your Inventory in QuickBooks Online

What Is Included in the Cost of Goods Sold?

COGS refers to all direct costs associated with manufacturing a product or delivering a service. Typically, they include:

- Production or service-related raw materials

- Labor directly involved in manufacturing or providing services

- Overhead costs associated with running equipment, such as utilities

However, COGS does not include:

- Costs associated with marketing, distribution, or administration

- Overhead not directly related to production in general

- The cost of goods or services that remain unsold

Accounting for COGS correctly and complying with tax requirements requires understanding what qualifies. Knowing how to find the cost of goods sold in QuickBooks ensures that your reports reflect this accurately, improving financial analysis and tax reporting.

How to Calculate Cost of Goods Sold?

Every business, especially those that manufacture or sell products, must be profitable. To evaluate your financial health, you must understand and accurately calculate your COGS. Here’s how you can calculate it:

COGS = Beginning Inventory + Purchases During the Period – Ending Inventory

Here are some aspects that you should be aware of before calculating the COGS!

1. Identify Relevant Costs

Identify all direct costs (e.g., materials, production labor) and indirect costs (e.g., warehouse staff, equipment, and utilities).

2. Determine Beginning Inventory

Your beginning inventory should be the closing inventory from your previous period. The finished goods, raw materials, and work-in-progress are included in this category.

3. Add Inventory Purchases

Include all inventory purchased during the period. Track expenses accurately by keeping records and receipts organized.

4. Calculate Ending Inventory

Make a physical inventory count of your remaining inventory. If you have supporting documentation, exclude damaged or obsolete items.

5. Apply the COGS Formula

Calculate your cost of goods sold using the gathered data. Additionally, you can use tools such as the Cost of Goods Sold Calculator.

Understanding how to use the cost of goods sold in QuickBooks is important if you use this software. The system can track production and sales costs automatically when COGS is properly linked to items and transactions. Apart from all this, QuickBooks also helps you manage inventory, price strategies, and analyze overall profitability by accurately reflecting your direct expenses in your financial reports.

What Types of Businesses Can Track Inventory and Calculate COGS?

Tracking the cost of goods sold depends on whether tangible goods are involved in delivering the service. Service providers can manage inventory or use physical products in their operations, while others can’t, and therefore don’t report COGS.

Businesses that include inventory and track COGS include:

- Construction companies

- Plumbing and electrical services

- Repair and maintenance providers

- Mining and manufacturing operations

- Transportation and hospitality businesses

As an example, a plumber may also sell and use parts in addition to providing services. The cost of materials as well as labor must be considered when calculating COGS. A cost of goods sold report in QuickBooks provides a clear picture of the expenses directly related to revenue-generating activities.

The following are examples of pure service businesses that do not track COGS:

- Law firms

- Accounting practices

- Medical services

- Consultants and real estate professionals

- Performing artists

As a result, these businesses generally record a cost of services or cost of revenue instead. Since they don’t sell physical products, COGS isn’t reported on their income statement, and the cost of goods sold report in QuickBooks isn’t relevant.

Example of Cost of Goods Sold

It is necessary to know your inventory at the start and end of the reporting period before you can calculate COGS.

As an example: Twitty’s Books began 2018 with an inventory of $330,000. Inventory reached $440,000 by year’s end. An additional $950,000 in inventory was purchased by the store during the year.

The COGS calculation would be as follows:

$330,000 (beginning inventory) + $950,000 (purchases) – $440,000 (ending inventory) = $840,000

On Twitty’s Books’ 2018 income statement, this $840,000 would be reported as the cost of goods sold.

How to Set Up the Cost of Goods Sold in QuickBooks Online and Desktop?

QuickBooks cost of goods sold accounts are crucial for businesses selling products or services involving inventory. You can monitor profitability, manage inventory accurately, and generate accurate financial reports by tracking COGS properly.

The following steps will help you set up a COGS account in QuickBooks Online and Desktop:

In QuickBooks Online:

- Choose Chart of Accounts under Settings.

- To create a new account, click New.

- Choose Cost of Goods Sold for Account Type.

- Select the appropriate Detail Type (e.g., Supplies & Materials – COGS).

- Identify the account (e.g., “Product Costs” or “Direct Labor”).

- Enter Save and Close.

In QuickBooks Desktop:

- Click on Lists, then Chart of Accounts.

- Go to the bottom of the page and select New Account.

- Select Expense as the account type and click Continue.

- Enter a name, such as “Cost of Goods Sold” or “COGS.”

- Provide a description for internal clarity.

- Then click Save & Close.

Assign the COGS account to your inventory items or products/services after setting up the account. By doing so, you can ensure that the gross profit reports are accurate by properly reflecting associated costs for each sale. In short, setting up the cost of goods sold in QuickBooks will help you track your finances more effectively and make better business decisions.

How to Adjust the Cost of Goods Sold in QuickBooks?

The cost associated with each sold item needs to be recorded accurately in QuickBooks to adjust Cost of Goods Sold (COGS). To make necessary adjustments, follow these steps:

- Select Sales from the Reports tab, then select Item Summary.

- Click on Modify, followed by Revert to reset the report view.

- Identify and group the relevant items in the Item Name column.

- Find any items displaying $0.00 under Extended Cost (Ext Cost).

- Click Inventory, then Item List.

- Select Edit for each affected item, and review its history to identify how many units were sold without a recorded cost.

- Identify how many units were sold without an associated cost.

- Enter a journal entry for the total amount of the missing cost in QuickBooks Desktop: debit Inventory Asset and credit COGS.

By following this process, you can ensure that your financial reports reflect the true cost of inventory sold and that your profit margins and balance sheet remain accurate.

Conclusion

Understanding and accurately managing the cost of goods sold (COGS) in QuickBooks is fundamental for any product- or inventory-based business, especially for MSMEs that operate on tight margins and need clear financial visibility. By tracking COGS properly, you gain deeper insights into the real cost of doing business, insights that influence pricing strategies, inventory decisions, tax reporting, and overall profitability.

This blog has walked you through everything from the importance of COGS to calculating it correctly, setting it up in QuickBooks, and even making necessary adjustments. For service-based businesses, understanding when COGS applies, and when it doesn’t, is equally important to avoid misreporting and maintain clarity in financial records.

Ultimately, QuickBooks makes it easier to automate and streamline your accounting processes, but it’s your understanding of concepts like COGS that will lead to better business decisions. Whether you’re just starting out or looking to refine your accounting practices, having a solid grasp of COGS can significantly enhance your operational efficiency and financial accuracy. Make sure your COGS data is always up-to-date, regularly reviewed, and correctly categorized, because when you know where your money is going, you know how to grow.

In case you’re having trouble in executing the steps to calculate the cost of goods sold in QuickBooks Online or Desktop, then it would be ideal to connect with our QuickBooks Experts at +1-888-245-6075.

Frequently Asked Questions

Yes, COGS is a business expense. It includes direct costs like raw materials, labor, and manufacturing overhead used to produce goods or services. It helps calculate gross profit and directly impacts net income and taxable income, higher COGS usually means lower profit but also lower taxes. In QuickBooks, it applies to sold items, while inventory refers to unsold stock. Recording them accurately ensures reliable financial reporting.

If You Track Inventory in QuickBooks:

1. Set up inventory items:

– Assign your products to inventory.

– Link them to the COGS account.

2. Selling (invoice or sales receipt):

– You can automatically record COGS in QuickBooks and reduce your inventory with it.

If You Don’t Track Inventory, COGS must be recorded manually:

1. Access + New > Expenses or Checks.

2. Select Cost of Goods Sold from Category.

3. Enter the amount and vendor.

Cost of goods sold (COGS) and cost of sales are the same. Direct costs are the costs that a business incurs to produce or purchase the products or services it sells, such as materials and labor. In financial reporting, they are interchangeable.

Depending on the work they do:

1. COGS – When the subcontractor helps you deliver a product or service you sell (for example, a builder on a client project).

2. Expense – For general business needs (e.g. cleaning or administrative help).

In QuickBooks:

1. Work on projects using a COGS account.

2. Expense accounts are used for general services.

Yes. You can record COGS manually if you don’t use inventory tracking:

1. Select + New >Expense or Check.

2. Choose a COGS account in the Category section.

3. Provide the cost and vendor information.

Cost of Goods Sold (COGS) is a type of expense account that tracks direct costs of making or buying products. To calculate gross profit in QuickBooks, it is shown separately from regular expenses. Among the most common COGS items are inventory, materials, and subcontracted labor.