In the current scenario where every industry is trying to overtake the other ones, Nonprofit Organizations are silently contributing to the welfare of underprivileged living beings out there. Managing a nonprofit organization is completely different when all your accounting and bookkeeping needs are sorted via spreadsheets. But as your vision expands, you need a proper solution to keep your finances intact. This is exactly when QuickBooks for nonprofit organizations comes into the picture.

QuickBooks Online is widely regarded as one of the best accounting solutions for both for-profit and nonprofit organizations. It not only helps in tracking donations, overseeing grant funds, and controlling but also offers a range of solutions that make QuickBooks for nonprofit organizations an ideal platform to manage the financial pillar of the business.

In this blog, we are going to first highlight the key features of QuickBooks Online and will then help you with the steps to configure a QuickBooks nonprofit account. Let’s begin then!

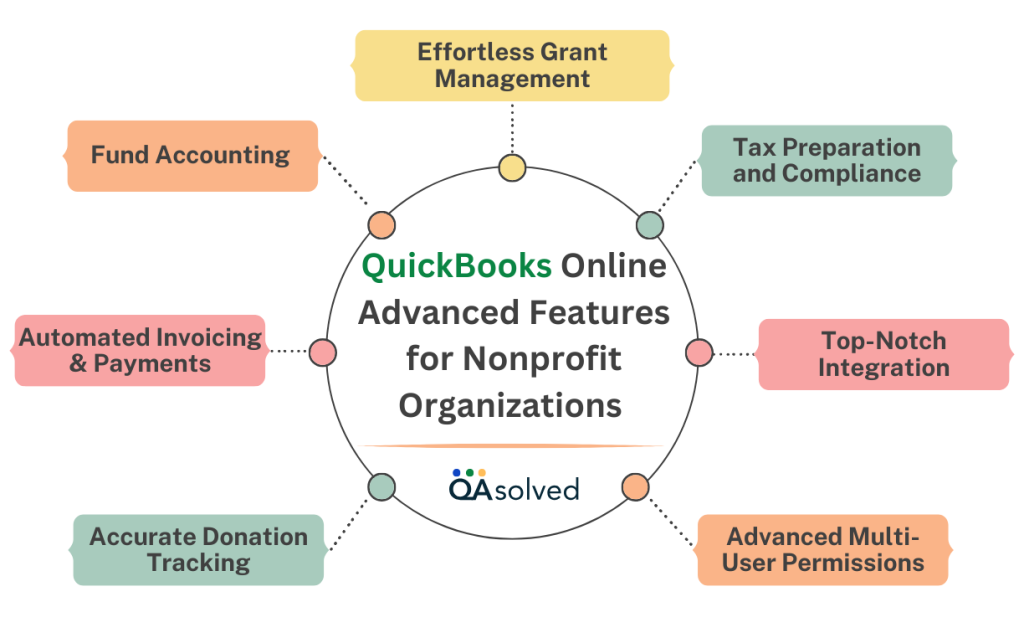

QuickBooks Online Advanced Features for Nonprofit Organizations

As we said, managing a nonprofit organization comes with a unique set of challenges ranging from tracking donations and grants to creating and sending tailored reports. Here are some of the best features of QuickBooks Online for nonprofit organizations.

1. Accurate Donation Tracking

The very first feature of QuickBooks Online is that it empowers nonprofit entities to track donations by categorizing them. Also, you, as a user, can easily monitor donor activities as well. Hence, your nonprofit organizations are on track if you’re seeking accounting software like QuickBooks Online.

2. Automated Invoicing & Payments

The next feature that fascinates most nonprofit individuals is automated invoicing and payments. With QuickBooks Online, you certainly have the option of providing services, hosting events, and collecting membership fees. And with QBO, you can easily streamline payment collection.

3. Fund Accounting

QuickBooks Online provides nonprofits with the ability to track and manage various funds individually, ensuring that financial resources designated for specific programs, projects, or initiatives are accurately monitored and utilized. This helps organizations maintain transparency and stay compliant with funding requirements.

4. Effortless Grant Management

The next feature on our list is grant management. With QuickBooks Online, managing grant funding and monitoring expenditures has become a really easy task for all the users out there.

5. Tax Preparation and Compliance

QuickBooks Online streamlines tax preparation for nonprofits, making it easier to stay compliant with IRS regulations. It provides tools to track tax-deductible expenses, organize financial records, and assist in preparing essential forms like the 990, ensuring accurate and hassle-free filings.

6. Top-Notch Integration

One of the biggest advantages of QuickBooks is its impeccable integration capabilities for not only nonprofits but other prominent industries as well. As a result, a large number of nonprofit entities use fundraising tools like Donorbox, Fundly, or GoFundMe. This integration allows nonprofits to sync donation data and track fundraising campaigns.

7. Advanced Multi-User Permissions

Last but not least, there is flawless multi-user access and permissions. Nonprofit organizations typically involve various stakeholders, such as finance teams, board members, and external auditors. QuickBooks Online makes it easy to manage user access by allowing nonprofits to assign customized permission levels, ensuring each user only sees the information relevant to their role.

So, these are the seven top-notch features of QuickBooks Online that attract nonprofit organizations to switch from conventional methods to advanced ones. Now, let’s talk about how to configure QuickBooks nonprofit accounts easily.

Easy Steps to Configure QuickBooks Nonprofit Account

If you’re running a nonprofit organization for a cause, then QuickBooks Online is a go-to solution for all your accounting and bookkeeping needs. All you need to do is make some changes, and boom! You will then be able to ensure your account uses reports, forms, and terms used in nonprofit organizations.

To configure your QuickBooks nonprofit account, you need to be assured of 2 aspects.

First, Change Your Company Type to Nonprofit.

The first thing to do is to change your company type to nonprofit because nonprofit organizations are typically tax-exempt and file a different tax form. This form is called “Form 990.” Given below are the six steps to update your company type and tax form in QuickBooks Online easily:

- Navigate to Settings (gear icon) and select Account and Settings.

- Choose the Advanced tab.

- In the Company type section, click Edit.

- Open the Tax form dropdown and select Nonprofit Organization (Form 990).

- Click Save, then select Done.

- Sign out and log back in to apply the changes throughout QuickBooks.

After updating your tax form, the label “Invoice” will change to “Pledge.” You’ll also gain access to nonprofit-specific reports, like the Statement of Activity and Statement of Financial Position.

Note: Certain labels, such as the Profit and Loss tile on your dashboard, may not update immediately.

Then, Change Customers to Donors.

The next important aspect of configuring a QuickBooks nonprofit account is to change customers to donors. Because in a nonprofit, “customers” are typically your donors. Here’s how you can update QuickBooks and see “donors” instead of “customers” on different reports and important forms.

- Click the Settings (gear icon) and choose Account and Settings.

- Select the Advanced tab.

- In the Other Preferences section, click Edit.

- Open the Customer label dropdown and select Donors.

- Click Save, then select Done.

So, these are the two important aspects for you to configure a QuickBooks nonprofit account. If you’re also planning to purchase QuickBooks Online for your nonprofit organizations, then our experts are here to guide you through the buying process, installation, and even integration process.

Conclusion

QuickBooks Online offers a range of advanced features that are specifically designed to meet the unique needs of nonprofit organizations. From streamlined tax preparation and compliance to powerful reporting tools and customizable user permissions, QBO helps nonprofits efficiently manage their finances while ensuring transparency and accountability. By leveraging these features, nonprofits can save time, reduce manual work, and focus on what truly matters—advancing their mission and making a greater impact in their communities.

So, configure QuickBooks nonprofit accounts easily with our QuickBooks expert assistance!

Frequently Asked Questions

Yes, you can use QuickBooks to manage all your financial activities that are directly linked to nonprofit organizations.

Well, the price of a plan mainly depends on your usage and requirements. If you want to check, click this link.

Contact our team via +1-888-245-6075 to get the best price for QuickBooks Online for Nonprofit Organizations.

QuickBooks Online is considered one of the most prominent and powerful accounting and bookkeeping software for nonprofit organizations. QuickBooks Online Plus and QuickBooks Online Advanced are the two most preferable plans for users.