As a business owner, you’re often required to juggle multiple roles, including overseeing operations, managing client relationships, handling payroll, and making sense of your financial data. That’s why using tools that simplify and automate your workflow is essential. If you’re a QuickBooks Online user, one powerful way to streamline your financial management is to connect your American Express Business account to QuickBooks. By linking your American Express card directly to QuickBooks Online, you can eliminate the need for manual transaction entry, tedious statement downloads, and misplaced receipts. This automation not only saves time but also improves the accuracy of your records, helping you stay compliant and prepared for tax season.

Connecting your American Express account offers more than just convenience; it provides real-time visibility into your business spending. This allows you to track cash flow, monitor budgets, and make more informed financial decisions. Whether you’re running a solo operation or managing a growing team, this integration ensures your financial data stays up to date and organized. However, it’s not always smooth sailing. Some users report running into the issue of QuickBooks not connecting to American Express, which can be frustrating when you’re trying to keep your records current.

If you’ve encountered this problem, then we’re here at your disposal. In this blog, we’ll walk you step by step through how to connect American Express to QuickBooks, along with tips to resolve common errors. With just a few clicks, you can integrate your accounts and shift your focus back to running your business, while QuickBooks takes care of the rest.

So, let’s get started with making your accounting more efficient, accurate, and stress-free.

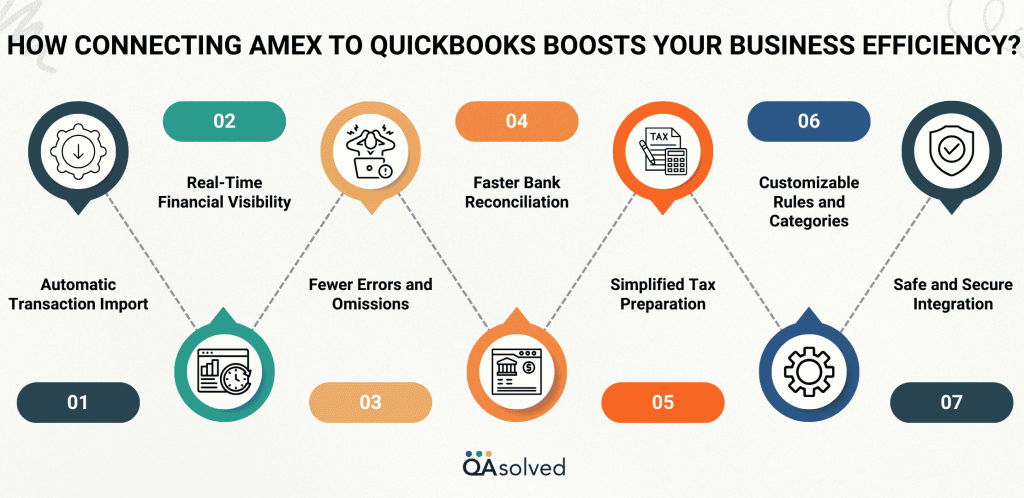

How Connecting Amex to QuickBooks Boosts Your Business Efficiency?

One of the best moves you can make if you want to simplify your business bookkeeping is to connect American Express to QuickBooks Online. With just a few clicks, this connection speeds up your financial processes, saves you time, and improves your records’ accuracy. The following are the key benefits of connecting American Express to QuickBooks Online:

1. Automatic Transaction Import

QuickBooks Online will automatically sync all American Express Business transactions as soon as you connect the accounts. We no longer require manual data entry, uploading of files, or downloading of monthly statements.

2. Real-Time Financial Visibility

The latest transactions are pushed in daily, so you get a real-time picture of your business expenditures. By doing this, you will be able to make more informed financial decisions faster.

3. Fewer Errors and Omissions

The manual process of bookkeeping often leads to mistakes, including typos, double entries, or missed transactions.When you sync your Amex account with QuickBooks, you significantly reduce human error.

4. Faster Bank Reconciliation

The matching of Amex transactions to invoices, bills, and receipts becomes much easier. To speed up the reconciliation process and keep your books in order, QuickBooks even suggests possible matches for you.

5. Simplified Tax Preparation

Your expenses will be accurately categorized and constantly updated, so you won’t have to rush around at tax time.You’ll thank yourself in the future, as well as your accountant.

6. Customizable Rules and Categories

QuickBooks allows you to create recurring charges rules. Whenever you add a regular expense (like a subscription or supplier fee), it’s automatically classified.

7. Safe and Secure Integration

The data you enter into QuickBooks Online is fully encrypted, and American Express has a trusted integration process, which ensures that your data remains secure.

You may be just starting out or already have a thorough understanding of how to manage your business finances, but connecting American Express to QuickBooks Online can be a great upgrade that can have big benefits for you. It’s a smart, secure way to streamline your bookkeeping and keep your business running smoothly, saving you time and reducing errors.

Steps to Link Your American Express Business Account To QuickBooks Online

QuickBooks Online can save you hours of manual data entry when you connect your American Express Business account. One of QuickBooks Online’s most time-saving features is Online Banking (also known as Bank Feeds). QuickBooks automatically pulls in and categorizes your transactions when you link an account. All you have to do is review and approve.

Using the steps below, we’ll walk you through how to link your American Express account the right way so that your financial data flows smoothly and stays up-to-date-helping you focus on what matters most.

Note: If you’re a card user who’s a Delegate (not the main account holder) and you’re authorized to connect the account in QuickBooks, make sure to select the “American Express (Delegate)” option when linking your account.

If you are already connected using a different American Express option, you’ll need to disconnect it first, then reconnect using the “American Express (Delegate)” provider to keep your bank feed working properly.

Step 1: Set Up Your American Express Account in QuickBooks

Adding an American Express Business account to your chart of accounts is a good idea if you haven’t done so yet:

- Select Chart of Accounts from Settings.

- To create an account, select New.

- Click the Credit Card or Deposit Account option in the Account Type dropdown.

- Give your account a name.

- Select Save and Close when you’re done.

Step 2: Link Your American Express Business Card or Checking Account

- Open the connection link (it will open in a new window).

- If this is your first time connecting a bank account, click Connect on the main page. If you’ve linked accounts before, choose Link account instead.

- Depending on your American Express account type, search for the following accounts:

- As the primary account holder, select American Express Business Credit Card > Checking (US).

- If you are an American Express delegate, search for and select American Express (Delegate).

- Hit Continue.

- Sign in with your American Express ID and password in the pop-up window. If American Express requires additional security steps, you’ll see them on screen.

- Connect QuickBooks to the accounts you want to connect.

- Select the account type for each account. This is the account you created in your chart of accounts in Step 1.

- Choose the date range for the download.

- Click on Connect.

Link American Express Business Card or Checking Account in QuickBooks Solopreneur for Expense Tracking

- Click on Transactions.

- When connecting an account for the first time, select Connect. Select Link account if you’ve already connected online banking accounts.

- Your American Express account user type determines which account you should search for:

- Select American Express Business Credit Card & Checking (US).

- If you’re a delegate user on a card account: Find and select American Express (Delegate).

- Click Continue.

- Sign in with your American Express ID and password in the pop-up window. If American Express requires additional security steps, you’ll see them on screen.

- Connect your QuickBooks accounts.

- Choose the date range for the download.

- Then select Connect.

Once your American Express accounts are connected, QuickBooks Online will automatically download your transactions so that you won’t have to do the same later.

Tip: QuickBooks Online allows each company to link only one American Express Business login. However, you can still connect multiple accounts, including personal and business accounts, under that same login. Just repeat the connection steps for each account one at a time to ensure everything syncs correctly.

How to Disconnect an American Express Account?

Here’s how you can disconnect a bank or credit card account from QuickBooks:

- Click the link to move to the next steps within the QuickBooks interface.

- Choose one of your American Express accounts from the blue square.

- Click the Edit icon and then Edit account information to open the Account section.

- Check the box for Disconnect this account on save.

- Save and close the window. The account is then disconnected from online banking.

How to Remove a Bank Account from QuickBooks Solopreneur?

- Click on Transactions.

- Make any necessary edits to your transaction list, including the categories.

- Go to the New transaction dropdown and choose Manage connections.

- Click the icon of the bank account you wish to update and select Unlink.

How to Switch From Tracking Multiple American Express Accounts to One Parent Account?

By switching to a single parent account, you can simplify the management of multiple American Express cards in QuickBooks. The transition will be smoother if you do this right after reconciling your existing Amex accounts.

Here’s what to do:

- Disconnect all of your American Express accounts that you have tracked separately.

- Reconnect using the parent account: Select “American Express Credit Card (US) – Parent Accounts”.

This parent account should be the only one connected to online banking moving forward.

- Follow this link to continue the setup in QuickBooks.

- Choose the Link account.

- Go to the American Express Credit Card (US) page and select “Parent Accounts.”

- Follow the onscreen instructions until QuickBooks asks you about downloading past transactions. There are two ways to handle past transactions. It is much easier to use the first method.

- When QuickBooks prompts you to download past transactions, choose the date after your most recent American Express reconciliation. Once the parent account has been connected, follow the on-screen instructions. Until your last reconciliation, QuickBooks will only import transactions from the date you selected. Your previously disconnected American Express accounts will still retain all past transaction history. Moving forward, your newly connected parent account will track any new transactions.

- Contact your accountant if you want a copy of the past transactions from each American Express account in the parent account. Create a journal entry with them. As a result, they’ll know how to balance the old transactions with the new parent account. Make the American Express accounts inactive after they create the journal entry. The new American Express parent account should be the only account that has American Express transactions. QuickBooks will not count transactions twice this way.

Also Read: How to Connect Bank and Credit Card Accounts to QuickBooks Online?

What Can You Do When Your American Express Accounts Are Grayed Out?

American Express Business card accounts that are grayed out when trying to connect may be the result because of one of the following:

- If your American Express account is already connected to another QuickBooks Online company, it may appear grayed out during the connection process. This happens because an American Express account can only be linked to one QuickBooks company at a time.

- Another possible reason is an incomplete connection on the QuickBooks side. This can occur if the setup process is interrupted, for example, if the browser closes unexpectedly or the connection does not finish properly, causing the link to break.

If you want to connect your AMEX account to a different QuickBooks company, you must first open the company it is currently connected to. Now, you need to disconnect the account there.

Also, if your AMEX accounts are grayed out, then it would be ideal for you to be aware of the steps to disconnect from the website itself. Here are the steps to disconnect the grayed out account from the American Express website:

- Visit the American Express website.

- Click on Account Services.

- Choose Security & Privacy.

- Click Manage Partner Permissions then Intuit to expand the section.

- Select Disconnect to stop the connection.

- Connect your QuickBooks account using the steps in this article.

American Express transactions can be managed by all admins, including any accounting firms you’ve added to your QuickBooks company. This shared access ensures smooth collaboration and easier financial oversight across your team. If you thoroughly follow the above-mentioned steps, you will be able to easily link American Express to QuickBooks and manage your transactions without interruptions.

What to Do If Some Transactions are Missing?

After connecting your American Express account to QuickBooks Online, your transactions should sync automatically on a daily basis. This real-time syncing helps you stay on top of your expenses and ensures your books remain accurate. However, there may be times when some transactions don’t appear as expected.

In most cases, missing transactions are simply delayed. American Express can take up to 10 business days to fully transfer all data to QuickBooks. So, if you’re not seeing a transaction right away, it’s a good idea to wait a few days before taking further action.

But what if it’s been more than 10 business days and the transactions are still missing? Then it would be ideal to connect with us and provide the following information of the missing transactions:

- Amount

- Data

- Transaction IDs from the American Express website.

In case you’re having trouble while executing the above mentioned steps, then it would be in your best interest to connect with our QuickBooks Online Experts at toll-free number +1-888-245-6075.

Winding Up

Connecting your American Express Business account to QuickBooks Online is a game-changer for managing your business finances. It simplifies your bookkeeping by automatically importing and categorizing transactions, giving you real-time visibility into your expenses and cash flow. Whether you’re a solopreneur or managing a team, this integration reduces manual work, minimizes errors, and keeps your records tax-ready throughout the year. While some users may face issues like accounts being grayed out or QuickBooks not connecting to American Express, most of these problems can be resolved quickly with the right steps.

With just a few clicks, you can save hours of manual data entry and stay in full control of your business finances. So, take the advantage of this integration to streamline your accounting process and focus more on growing your business, not managing spreadsheets.

Frequently Asked Questions

Yes, QuickBooks Online lets you link business credit cards. You can automate the import and categorization of your transactions once QuickBooks is connected, saving you time and reducing manual entry. Keeping track of expenses, matching receipts, and reconciling your accounts is easier this way.

Make sure you have access to online banking and admin rights in QuickBooks. Choose the appropriate provider based on your user role for American Express cards.

Step 1: Open the Payment Window

1. Click on Banking.

2. Make a credit card payment or write a check.

Step 2: Enter Payment Info

1. Select the account from which you’ll pay your credit card.

2. In the Pay to the Order of field, select the credit card company.

3. Add a note, the amount, and the date.

Step 3: Save

1. Save and close the window.

Here are the steps you need to follow in order to import credit card transactions automatically into QuickBooks Online:

1. Access Banking > Link Account (or Transactions > Banking).

2. Locate your credit card provider (e.g., American Express, Chase, etc.).

3. Use your online banking credentials to log in.

4. Connect the credit card account you wish to use.

5. Select the date range for importing transactions.

6. Click Connect once it matches your Chart of Accounts.

When QuickBooks is linked to your credit card account, it will automatically download and categorize your credit card transactions each day.

QuickBooks not connecting to American Express could be caused by one of the following reasons:

1. Login Issues: Verify the credentials you are using to log in to American Express.

2. Account Type Mismatch: Select the correct American Express provider (e.g., American Express Business Credit Card (US) or American Express (Delegate).

3. Already Connected Elsewhere: QuickBooks Online can only be connected to one American Express login at a time.

4. Connection Timeout: Deleting and reconnecting the account may solve the issue if the connection has been interrupted in the middle of the process.