Keeping your books aligned with real-world bank activity is essential for accurate financial reporting in QuickBooks Online. One key step in this process is learning how to deposit payments into the Undeposited Funds account. This temporary account holds customer payments you’ve received but haven’t yet deposited into your bank. It helps group multiple payments together before recording them as a single deposit, matching the actual deposit total that appears on your bank statement.

Using the Undeposited Funds account not only simplifies daily bookkeeping but also prevents reconciliation errors, especially when you receive several payments throughout the day. In this blog, you’ll learn when and how to use the Undeposited Funds feature correctly, so your records remain clean, accurate, and easy to manage.

So, let’s get started!

What is Meant by Undeposited Funds in QuickBooks?

In QuickBooks, Undeposited Funds is a special account that temporarily holds customer payments until you’re ready to deposit them into your actual bank account. It acts like a virtual lockbox where all received payments, whether by check, cash, or card, are stored before being grouped into a single deposit. This is particularly useful when you receive multiple payments throughout the day but make just one deposit at the bank.

Instead of posting each payment directly to the bank register (which can cause mismatches during reconciliation), QuickBooks lets you collect them in the Undeposited Funds account. Once you’re ready, you can combine and deposit them together, ensuring the transaction matches exactly with your real-life bank deposit. This method keeps your financial records accurate, clean, and easy to reconcile.

Now, let’s discuss how to add, clear, use, and change undeposited funds in QuickBooks Online!

How to Add and Use Undeposited Funds in QuickBooks Online?

As we said, an undeposited fund account in QuickBooks serves as a temporary holding place for your payments until you deposit them at your bank. As banks often combine multiple payments into one deposit, QuickBooks lets you do the same. Once you have your bank deposit slip, you can combine payments in QB into one deposit in the Undeposited Funds account. By doing so, you can ensure that your financial records match with your bank statements.

Here are the steps to add undeposited funds in QuickBooks Online:

Step 1: Record Payments in the Undeposited Funds Account

QuickBooks provides an Undeposited Funds account for holding all incoming payments you plan to consolidate into one deposit. Once you’re ready to combine them, you’ll choose the appropriate bank account.

Depending on how the payment was received and recorded in QuickBooks, follow the instructions below.

a. When You Download Transactions From Your Banks and Credit cards

QuickBooks automatically downloads your transactions when you link your bank and credit card accounts. You don’t need to use the Undeposited Funds account or manually combine payments since QuickBooks already captures the information directly from your bank. Each downloaded transaction simply needs to be reviewed and categorized.

b. When Your is Payments Processed with QuickBooks Payments

QuickBooks Payments automatically places invoice payments in the Undeposited Funds account, so you do not need to manually do it. If you receive payments outside of QuickBooks Payments, you need to record them as follows:

- Click + New.

- Select Receive payment.

- From the drop-down menu, choose the correct customer.

- Check the box next to the invoice you’re receiving payment for.

- Select Undeposited Funds from the Deposit to dropdown menu.

- Complete the form by filling in the remaining details.

- As needed, click Save and Send, Save and New, or Save and Close.

c. When Sales Receipts for Payments Received Outside of QuickBooks

- Click + New and select Sales Receipt.

- Select the customer from the Customer dropdown menu.

- Choose Undeposited Funds from the Deposit to field.

- Fill out the rest of the receipt details.

- Depending on your needs, click Save and Send, Save and New, or Save and Close.

Tip: Double-check the Deposit to field to ensure your payments are being directed to the correct account. If your bank processes a payment separately, there’s no need to combine it. You can instead allocate the payment directly to an account in QuickBooks, bypassing Undeposited Funds.

Also Read: How to Delete a Deposit in QuickBooks Online and Desktop?

Step 2: Make a Bank Deposit

QuickBooks allows you to record your bank deposit and combine payments once you have your deposit slip. Bank Deposit will automatically display all payments stored in the Undeposited Funds account.

Step 3: Check Your Undeposited Funds Account

Make sure any pending payments are cleared by reviewing the Undeposited Funds account.

- Click Settings, then Chart of Accounts.

- Find the Undeposited Funds account in the list.

- Select View Register.

Following this process will ensure your payments are accurately recorded and ready for final deposit.

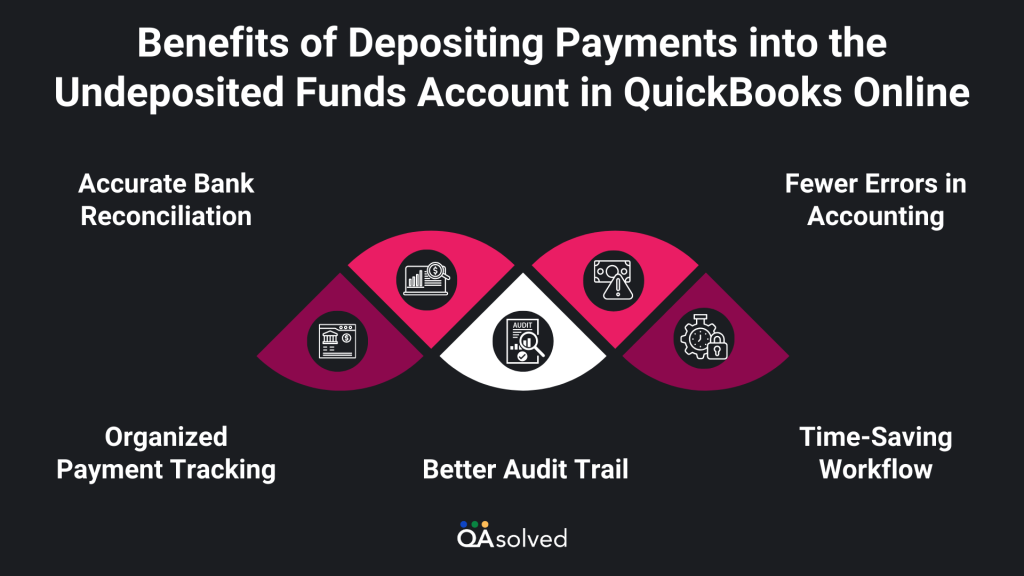

Benefits of Depositing Payments into the Undeposited Funds Account in QuickBooks Online

Undeposited funds in QuickBooks Online allows you to hold customer payments temporarily until you are ready to record the actual deposit. The function is especially useful if you receive multiple payments and deposit them together, making it easier to match deposits with bank statements and automate reconciliation.

1. Accurate Bank Reconciliation

Your QuickBooks records can be matched exactly to your bank deposits with the Undeposited Funds account. It is especially useful when multiple customer payments are deposited at once. Hence, it is important for a user to understand how bank reconciliation works.

2. Organized Payment Tracking

You can review, manage, and verify all incoming funds before they are added to your bank account by storing them in one place until they are ready to be deposited.

3. Fewer Errors in Accounting

When payments are grouped like your bank does, they are less likely to be mismatched, double-entered, or lost.

4. Time-Saving Workflow

QuickBooks allows you to select and combine payments from each bank deposit in one step, saving you time and simplifying your bookkeeping.

5. Better Audit Trail

Every payment received and deposited is recorded, making it easier for you to review and audit your books.

To conclude, undeposited funds allow you to keep your payment records accurate and organized in QuickBooks Online. It reduces accounting errors and simplifies reconciliation to ensure your deposit data matches with your bank statement.

Conclusion

Mastering the use of Undeposited Funds in QuickBooks Online is a game-changer for small business owners and bookkeepers aiming for streamlined and error-free financial records. By treating the Undeposited Funds account as a virtual drawer for incoming payments, you gain full control over how and when these transactions hit your bank register. This not only aligns your QuickBooks records with actual bank activity but also ensures smoother, faster, and more accurate reconciliations.

Whether you’re receiving payments through QuickBooks Payments, sales receipts, or manually entering them, using the Undeposited Funds account helps group and manage them before creating a bank deposit. This method reduces the risk of mismatched transactions, duplicate entries, and time-consuming corrections later on. It also contributes to a cleaner audit trail and better visibility into your cash flow.

In essence, undeposited funds in QuickBooks Online provide a simple yet powerful way to keep your books aligned with reality. Embracing this feature leads to fewer reconciliation headaches, increased bookkeeping efficiency, and ultimately, better financial oversight. So if you want accurate, organized, and bank-ready records, start using the Undeposited Funds feature the right way, today.

Frequently Asked Questions

To find the Undeposited Funds account in QuickBooks Online:

1. In the top right corner, click the Gear icon.

2. Under “Your Company,” select Chart of Accounts.

3. Find Undeposited Funds in the list of accounts.

4. To view the transactions stored in the register, click View register.

The holding account is where payments are held before they are deposited into the actual bank account.

The payments are held in a temporary holding account in QuickBooks called Undeposited Funds. Using this method, you can track payments before depositing them into the actual bank account, ensuring that multiple payments can be combined into one deposit. By matching QuickBooks entries with actual bank deposits, it simplifies reconciliation.

1. Click on the + New button and select Bank Deposit.

2. Select the payment from the Undeposited Funds account in the Bank Deposit window.

3. Uncheck the payment you no longer want to include in the deposit.

4. To complete the action, select Save and Close.

If you hold payments before making a bank deposit, they will go to the Undeposited Funds account by default. Payments can also be deposited directly into a bank account or recorded as income, depending on how they are entered.