Payroll Error Code 557 in QuickBooks is like a red flag in your accounting software that creates a direct impact on your day-to-day operations. Usually, this error occurs after upgrading your software and trying to download payroll updates. Payroll processing can be frustrating, especially when it is time-sensitive. A smooth payroll system ensures employees are paid on time, taxes are calculated correctly, and businesses remain financially sound. However, when QuickBooks Error 557 strikes, these critical functions are at risk of disruption.

But why does it happen? Well, there are multiple reasons behind this disruption and in this blog, we are not only going to cover the signs and causes of Error 557 in QuickBooks Desktop but will also provide five advanced solutions to get rid of this effectively. Whether you’re an accountant or a small business owner, these fixes will ensure your payroll runs smoothly without further hiccups.

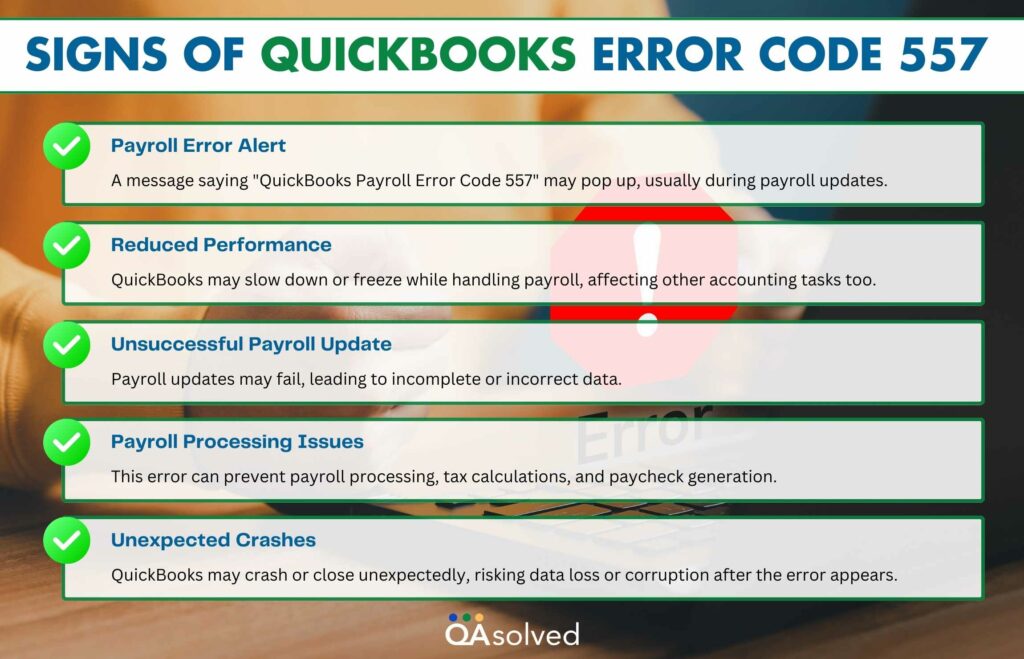

5 Signs of QuickBooks Error Code 557

There are times when QuickBooks Payroll Error Code 557 appears without warning. The following are some common signs to watch out for:

To avoid further disruptions in your payroll management, address these signs promptly if you notice them. Once you’re aware of these indications, you now need to understand the potential causes that might trigger QuickBooks Payroll Error 557.

Causes of QuickBooks Desktop Payroll Error 557

There are several reasons why QuickBooks Payroll Error Code 557 occurs, each of which disrupts the connection between QuickBooks and its payroll services. The main causes are as follows:

- Update Error in QuickBooks: A QuickBooks update can trigger Error Code 557 if the payroll component is not updated correctly.

- Corrupted Windows Registry: Damaged or corrupt Windows registry files can cause QuickBooks to malfunction during payroll processing.

- Inactive Payroll Subscription: QuickBooks will block payroll update processes if your payroll subscription is expired or inactive.

- Damaged QuickBooks Files: Missing or corrupted QuickBooks files can result in a download error.

- Virus or Malware Attack: A malware infection can damage QuickBooks files or cause system disruptions, resulting in Error Code 557.

- System Crash During Update: A system crash or power outage may leave the update incomplete, resulting in an error.

- Inactive Payroll Subscription: QuickBooks won’t allow payroll updates if your payroll subscription has expired or is inactive.

- Data Damage: Damaged or corrupt data files in QuickBooks may interfere with payroll updates, leading to Error Code 557.

- Product Not Updated: An outdated version of QuickBooks may cause compatibility problems when downloading payroll updates.

- Incorrect Service Key: QuickBooks will fail to verify your payroll subscription if you enter the wrong service key.

Identifying the root cause of the problem is crucial to implementing the correct fix and ensuring payroll functions continue to run smoothly.

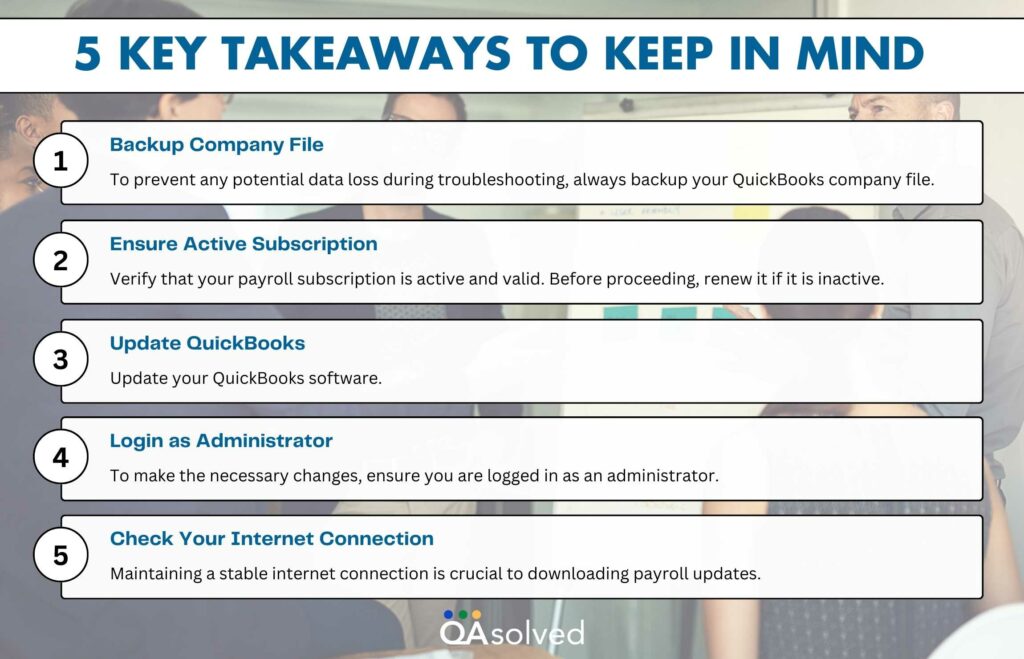

5 Key Takeaways You Shouldn’t Miss

It’s crucial to take a few preliminary steps to ensure a smooth troubleshooting process before diving into QuickBooks Payroll Error Code 557 solutions. It is important to follow these steps thoroughly to avoid complications during the fixing process:

With these preliminary steps completed, you’re ready to troubleshoot the error!

5 Solutions to Fix “QuickBooks Payroll Error 557”

These solutions will help you fix QuickBooks Error Message 557. Each step addresses a specific cause of the error, ensuring a thorough fix. You can restore QuickBooks payroll functionality by following the steps in order. Come on, let’s get to work!

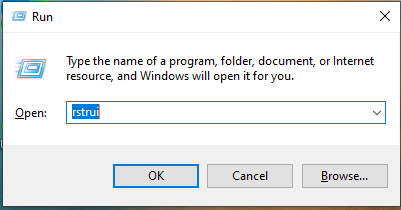

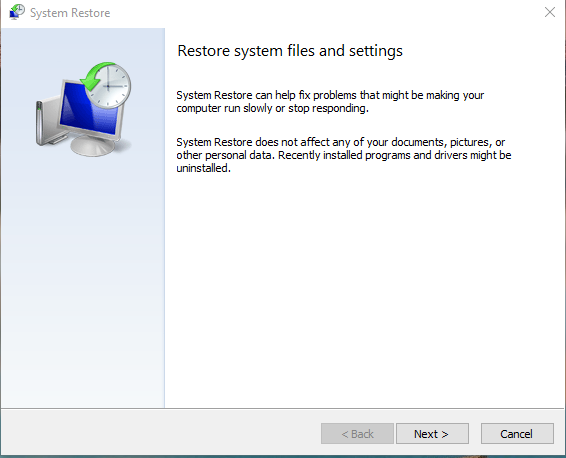

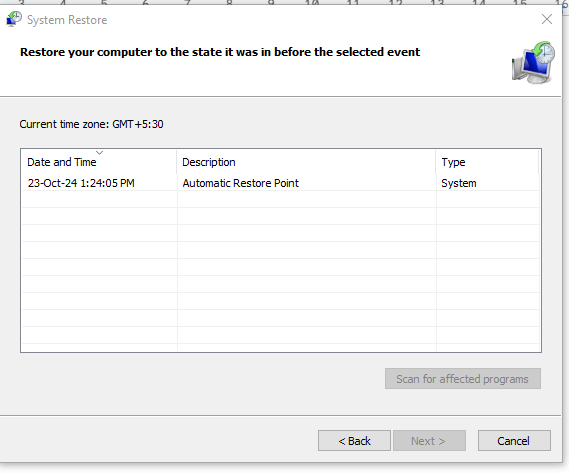

Solution 1: Restore Your System

- Press Windows + R, type rstrui, and hit Enter.

- Click Next in the new window.

- Pick a restore point from the list, preferably one from before the error. Continue by clicking Next.

- Hit Finish once you have reviewed your selection.

- Your computer will restart and restore the system.

- Finally, access QuickBooks.

Solution 2: Make Adjustments to the Windows Registry

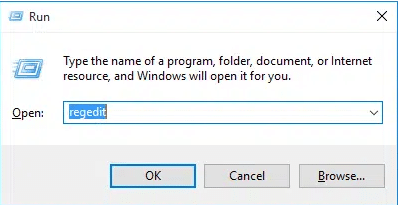

- Press Windows + R, type regedit, and hit Enter.

- Select File, then Export. Back up your data to a safe location.

- Go to: HKEY_LOCAL_MACHINE\SOFTWARE\Intuit\QuickBooks [Your Version] (replace [Your Version] with your specific version).

- Verify the Service Key entry. If necessary, update it.

- Right-click and select Delete to remove invalid or outdated entries.

- Close the Registry Editor.

- To apply the changes, restart your computer.

- Check if QuickBooks Error Code 557 has been resolved.

Note: Registry editing should be done carefully due to the possibility of affecting the stability of the system. Make sure you backup your data before making any changes.

Solution 3: Update QuickBooks to the Latest Release

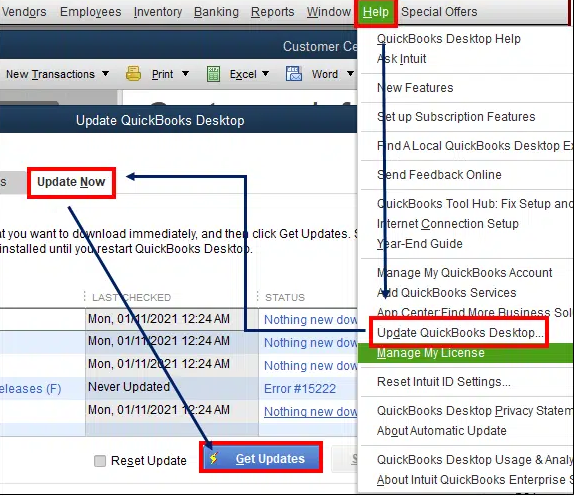

- Open QuickBooks.

- Click on the Help menu.

- Choose Update QuickBooks Desktop.

- Click Get Updates to search for the latest updates.

- Close QuickBooks to install the updates when prompted.

- Reopen QuickBooks after installation.

- Go to Help, then About QuickBooks to check the version.

Solution 4: Enter QuickBooks Service Key

- Launch QuickBooks.

- Click on the Employees menu at the top.

- Choose Payroll Setup from the dropdown.

- In the Payroll Setup window, look for the Service Key section.

- Type in the correct Service Key provided by Intuit. Make sure to enter it accurately.

- Click OK to save the changes and exit the Payroll Setup window.

- Close and reopen QuickBooks to ensure the Service Key is activated.

Solution 5: Reactivate the Expired Subscription

Ensure that your QuickBooks subscription is reactivated if it has expired. Steps in the process include:

- Open QuickBooks:

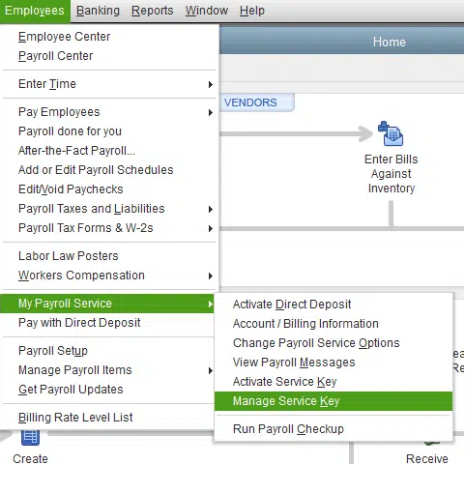

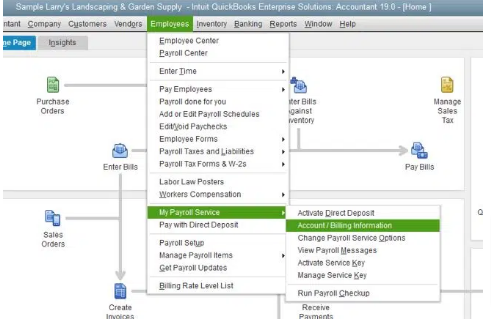

- On the top menu, click Employees.

- Select My Payroll Service from the dropdown, then choose Account/Billing Information.

- Log in using your Intuit credentials to access your account details.

- In the account details, locate your payroll subscription status and click Reactivate or Renew.

- Follow the prompts to update your billing information and complete the payment process.

- Once reactivated, close and reopen QuickBooks to ensure your subscription is updated.

- Go to Employees > Get Payroll Updates to download the latest payroll updates.

Hopefully, these solutions will help you fix QuickBooks Payroll Error Code 557. These steps should help you resolve the error and restore smooth functionality to your system.

Conclusion

In conclusion, resolving Error 557 in QuickBooks Desktop is essential for ensuring the smooth operation of your payroll system. There are a number of possible causes of the error, including outdated software, an inactive subscription, data corruption, and incorrect service keys. Follow these troubleshooting steps to fix the current problem as well as prevent future problems.

Ensure that your QuickBooks software and payroll subscription are up to date. Check the service key and perform any necessary registry updates or system restores to fix damaged files. You can save time and headaches down the road by regularly backing up your data. Also, consider automating your payroll process with QuickBooks’ scheduled updates and regular system checks.

Lastly, if you still encounter issues, reach out to our QuickBooks experts via our toll-free number: +1-855-875-1223.

Frequently Asked Questions (FAQs)

QuickBooks Payroll Error Code 557 is an error that occurs when there are issues with updating or installing payroll tax tables in QuickBooks Desktop Payroll. These tax tables are essential for accurate payroll calculations.

Common causes include using outdated QuickBooks Desktop software, having a corrupted company file, incorrect employee information, or errors in payroll setup. Network issues or problems with the internet connection can also trigger this error.

To resolve this error, you can:

1. Update QuickBooks Desktop to the latest version.

2. Run payroll updates to ensure you have the latest tax tables.

3. Check and correct employee information for accuracy.

4. Review and adjust payroll settings.

5. Manually update the payroll tax table if needed.

While some factors leading to this error may be beyond your control, keeping your QuickBooks software up to date, regularly verifying your company file, and maintaining accurate employee data can help prevent this error.

QuickBooks Payroll Error Code 557 can disrupt your payroll processing and potentially lead to inaccuracies in employee paychecks and tax calculations. While it’s not a critical error, it should be addressed promptly to ensure accurate payroll management.

You should update payroll tax tables in QuickBooks as soon as you receive a notification for new updates, and regularly throughout the year to ensure your payroll calculations are accurate and compliant with tax regulations.

Remember that specific solutions may vary depending on your version of QuickBooks and the nature of your payroll setup, so it’s essential to follow the appropriate steps or consult with QuickBooks support for personalized assistance.