What is TurboTax? TurboTax is a tax preparation software that allows individuals to file their taxes electronically. It is designed to simplify the tax filing process by guiding users through each step and ensuring accuracy. The software is available in both online and desktop versions and can be used to file federal and state income tax returns.

Developed by – Michael A. Chipman of Chipsoft

Type – Tax Software

Operating System – Windows/Mac/Android

Developed in 1984

| Important – The software is owned by Intuit and it is the same company that owns QuickBooks and Mint software. |

TurboTax calculates the user’s tax liability and offers suggestions for maximizing their refund or minimizing their tax liability. TurboTax also includes a virtual assistant, live chat support, and access to a database of frequently asked questions and answers. Users can file their tax returns electronically and receive their refund via direct deposit.

In this article, we’ll explore the world of TurboTax, how it works, its key features, who can benefit from it, and its pros and cons. Additionally, we’ll cover the step-by-step process of using TurboTax for seamless tax filing. Let’s uncover how TurboTax works.

Understanding TurboTax

TurboTax is a tax preparation service suitable for individuals and companies of any size, regardless of the industry they operate in. It has a range of features that cater to the needs of people who want to maximize their tax deductions and credits.

- You can use TurboTax if you have a W-2 form, paid rent, own a home, have dependents, own stocks, or crypto, own rental property, have unemployed income, donated to charity, own a small business, or are self-employed.

- Additionally, TurboTax offers a variety of services for self-employed individuals and small businesses, including connecting them with tax experts and helping them handle 1065, K1, and 1120-S tax forms with ease.

- If you have a simple tax return with no investments or rental properties, you can file a single W-2 form for free. Finally, TurboTax helps homeowners get the largest possible tax refund by examining more than 350 deductions and credits through W-2 and 1099-NEC forms, making tax preparation fast and easy.

How to Upgrade TurboTax?

Features of TurboTax

TurboTax, developed by Intuit, is a widely used software for preparing and filing taxes. The software is known for its user-friendly interface and a range of features that simplify the often complex process of tax preparation. Here are some key features of TurboTax:

Guided Step-by-Step Process: TurboTax provides a guided, step-by-step process to help users navigate through their tax returns.

Easy Data Import: Users can import financial data directly from their employers, financial institutions, and other sources, reducing manual entry and minimizing errors. This includes W-2s, 1099s, and other relevant forms.

Deduction and Credit Maximization: TurboTax helps users identify potential deductions and tax credits they may be eligible for, ensuring they get the maximum refund possible.

Checking and Accuracy: TurboTax includes built-in error-checking features to identify common mistakes or missing information.

Live Expert Assistance: Users can access live support from tax experts, either through online chat or by phone.

Audit Support and Representation: TurboTax offers audit support, including guidance on how to handle an audit and what documentation may be required. Additionally, users can opt for an additional service that provides representation by a tax professional in the event of an audit.

Mobile Accessibility: TurboTax provides mobile apps for iOS and Android devices, allowing users to work on their taxes from anywhere. Users can start their tax return on one device and switch to another.

Free Edition: TurboTax offers a free edition for simple tax returns, providing basic features for those with uncomplicated financial situations. Users with more complex tax needs can choose from various paid editions with additional features.

Integration with Intuit Products: TurboTax integrates with other Intuit products, such as QuickBooks and Mint, making it easier for users with multiple financial tools to streamline their overall financial management.

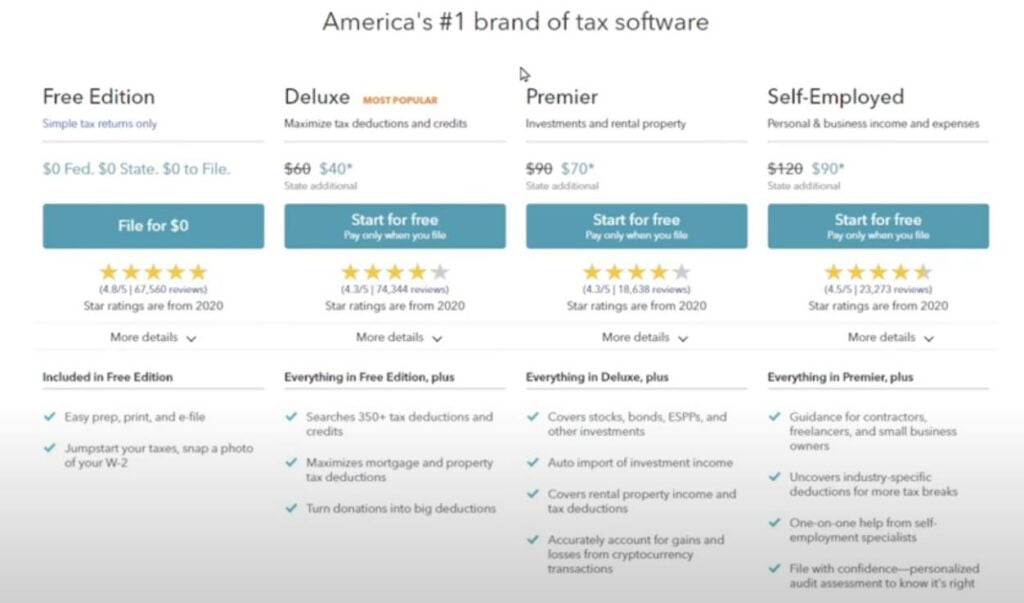

TurboTax Versions

Knowing different versions of TurboTax helps you to identify which version is more appropriate for your tax needs:

1. Free Edition

- It helps you prepare simple returns for an individual, keep check of errors, and also e-file the return for an individual.

- Basic or free versions suit the taxpayer who files a Form 1040, receives a W-2, has no credits left other than earned income tax, and has a simple tax condition.

2. Deluxe

- The Deluxe version helps you in preparing taxes that comprise itemized deductions or additional expenses that can be written.

- The software searches for tax breaks that are based on whether you own a house, pay for educational expenses or not, pay state and local taxes or not, make a charity or not, or you were the victim of a theft or not. The software offers documentation on definite tax topics in the text as well as video format.

3. Premier

- Premier tax software imports your investment details, calculates costs, and manages cryptocurrency gains and losses in a timely manner.

- Apart from this, some Premier tax software is capable of handling freelancer income, self-employment taxes, and inheritance.

- The particular tax software provides more resources and documentation on all your personal income tax topics.

4. Self-Employed

- If you have your own business, then it is mandatory to use a tax program that keeps a record of your sources of income, received payouts, money deductions, and investments returned.

- It suits the needs of business owners that cover self-employment taxes and maximizes business tax deductions as well as asset depreciation.

How Does TurboTax Work?

TurboTax is an online tool designed to help individuals file their taxes in the simplest and most user-friendly way. It eliminates the need for accounting services or CPAs for tax filing, saving you time, money, and, most importantly, stress.

1. To get started with TurboTax, all you need to do is sign up and answer a few questions. The platform will guide you through the process and make sure you’re providing all the necessary information.

2. You can use TurboTax to file both federal and state taxes. You can create tax forms from scratch or upload existing ones from your computer or phone. TurboTax will even check for possible deductions related to things like childcare, student loans, and charitable donations.

3. One of the interesting features of TurboTax is the ability to link it to your online bank account. It will scan your records for deductible expenses and include them in your tax forms.

4. Overall, TurboTax is a great solution for anyone who wants to simplify the tax filing process. It’s user-friendly, cost-effective, and can help you get the most out of your tax return.

How to Fix TurboTax Error 190?

Pros and Cons of TurboTax

Here is a table outlining the pros and cons of using TurboTax:

| Pros | Cons |

| Easy to use tax preparation service | Some features require additional payment |

| Maximizes tax deductions and credits | Not be suitable for complex tax returns |

| Offers services for self-employed individuals and small businesses | Prices can be higher than other tax preparation services |

| Connects you with tax experts | Not be as personalized as working with a tax professional |

| Can handle various tax forms with ease | Limited customer support options |

| Helps homeowners get the most out of their tax return | Not be accessible to those without reliable internet access |

| Offers a free option for simple tax returns with a single W-2 form | Not be suitable for those with investments or rental properties |

Complete List of TurboTax Error Codes

How to Use TurboTax?

TurboTax is the best online tax filing software tool, perfect for beginners. Follow the below steps to use TurboTax:

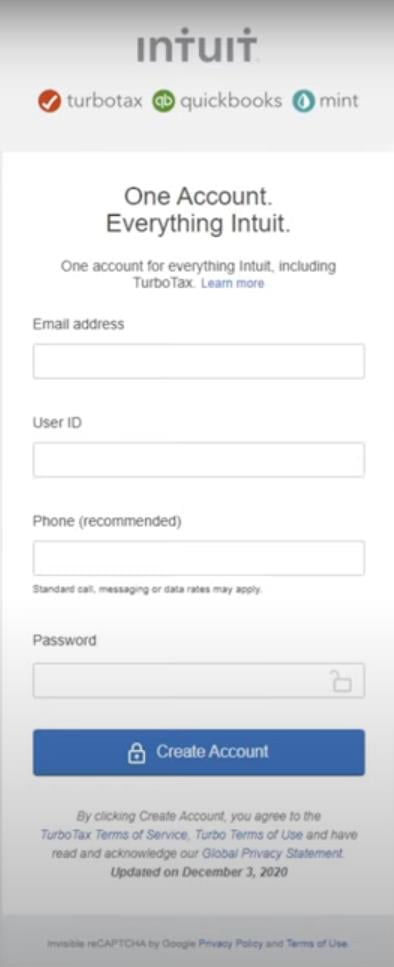

1. Registration:

- To start using TurboTax, you need to create an account.

- Simply click on “Create Account” and enter your email, User ID, password, and phone number.

- You’ll need to verify your account with the SMS code sent by TurboTax.

2. Choose Your Plan:

- Select a subscription plan that best suits your needs.

- Check the pricing section to help you decide.

- TurboTax will then guide you to the home page.

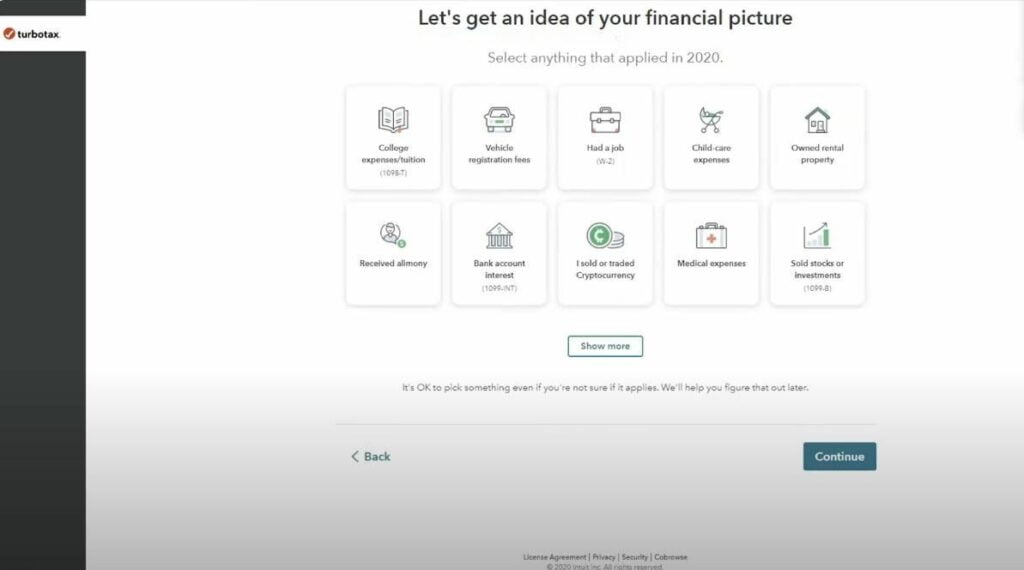

3. Answer the Questions:

- Answer a series of questions about your income, expenses, and personal details.

- These answers will help TurboTax optimize your return.

- You can skip questions but provide accurate information.

4. Fill in Federal Tax Info:

- Enter your federal tax details, including income information, deductions, and credits.

5. Enter State Tax Details:

- If applicable, enter your state tax details.

- TurboTax will walk you through any state-specific forms, ensuring that all necessary details are included.

6. Review Your Files:

- Review your application for accuracy.

- TurboTax will notify you of any missing details or potential errors.

7. Check Your Return:

- Before submitting, check your return and consider connecting with Credit Karma for additional benefits.

- TurboTax will confirm your potential deductions and provide expected return amounts.

How to Troubleshoot TurboTax Login Issues?

Conclusion for What is TurboTax

In conclusion, TurboTax is a reliable and user-friendly tax preparation software that can help individuals and small businesses file their taxes with ease. Its features are designed to maximize tax deductions and credits, connect users with tax experts, and ensure accuracy throughout the filing process. Additionally, TurboTax offers a variety of subscription plans that cater to different needs and budgets. While there may be some cons to using TurboTax, such as limited customer support options and higher prices, its pros outweigh the cons. Overall, TurboTax is a great solution for anyone who wants a stress-free and cost-effective way to file their taxes. If you still face any issues, contact TurboTax Customer Care at toll-free number +1-855-875-1223.

Frequently Asked Questions

Yes, TurboTax has both free and paid options. The TurboTax Free Edition is available at no cost for 37% of filers with simple tax returns. They also have a limited-time offer called “$0 Any Way“, allowing simple tax filers to prepare and file for free, even with expert assistance.

For more complex tax situations, you might need to use one of TurboTax’s paid products, and the cost depends on your specific tax needs.

TurboTax Online is a cloud-based service accessible through a web browser, providing flexibility, automatic updates, and secure cloud storage. TurboTax Desktop, on the other hand, is a downloadable software program installed on a specific device, allowing offline use and manual updates. The choice between them depends on preferences for accessibility, online or offline use, and individual tax-filing needs.

TurboTax provides several benefits to users, including an easy-to-use platform with interview-style questions, excellent customer service via phone, email, or chat, a free version for straightforward tax returns, live chat help, a mobile app for Android and iOS devices, the ability to upload tax documents for automatic filling, expert assistance for an additional cost, and a 100% guarantee on tax returns for the biggest refund in as few as eight days.

You can enter your W-2 information into TurboTax manually or automatically. Follow the steps given below:

1. To enter your W-2 manually, sign in to TurboTax and search for W-2.

2. Then, select Work on my W-2 and enter your Employer Identification Number (EIN) from Box b on your W-2.

3. If your W-2 can be automatically imported, answer a few questions to complete the import.

4. To import your W-2 directly from your employer, your payroll provider needs to be a TurboTax Import Partner and your W-2 must be available for import.

5. We also need the Box 1 amount from your W-2 or the year-to-date gross income from your year-end pay stub.