Have you recently spotted a charge from Intuit on your credit card or bank statement and wondered what it’s for? If yes, then you’re not the only one. Many individuals and businesses use Intuit’s range of financial products, such as QuickBooks, TurboTax, and Mailchimp, without always realizing how or when charges may appear. Whether it’s a subscription renewal, payroll service fee, or an app add-on, understanding these charges is essential to managing your finances and avoiding unnecessary confusion or disputes.

Understanding these charges is essential to ensuring you’re billed correctly and not paying for services you don’t need.These charges sometimes appear under names like “INTUIT,” “INTUIT QBONLINE,” or “INTUIT TURBOTAX,” which do not clearly identify the specific product or account. Occasionally, these charges are caused by accidental purchases, duplicate accounts, or even unauthorized activity, so it’s important to investigate them right away.

In this blog, we will help you understand why Intuit charges appear on your credit card or bank statement and how to identify them with confidence. We’ll walk you through the common reasons behind such charges, show you how to view your active subscriptions and payment history, and explain how to identify the product or service linked to each transaction.

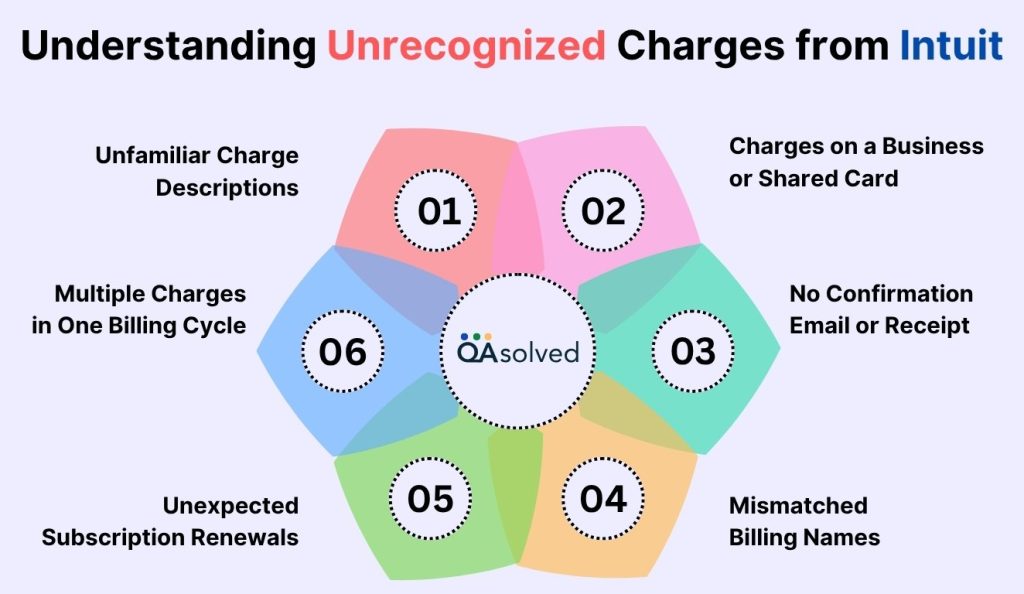

Understanding Unrecognized Charges from Intuit

When reviewing your financial records, you might come across a payment labeled in an unfamiliar way. Intuit charges on bank statement records may not clearly reflect the product or service you used. If you recognize the signs, you can determine whether the charge is valid or needs to be investigated.

1. Unfamiliar Charge Descriptions

There are vague or unexpected billing entries such as “INTUITQBO,” “INTUITPAYROLL,” or “INTUIT*TAX,” and they cannot be matched to a recent purchase.

2. Multiple Charges in One Billing Cycle

Intuit has made several transactions on your account, which may indicate multiple subscriptions or duplicate services.

3. Unexpected Subscription Renewals

After a free trial has ended or the product has been canceled, you’re billed for the product you thought had been paused.

4. Charges on a Business or Shared Card

An Intuit-related charge appears on a card used by several team members, making it difficult to identify the source.

5. No Confirmation Email or Receipt

The transaction appears to have been charged, but you do not recall receiving any email confirmation, receipt, or renewal notice.

6. Mismatched Billing Names

You see a charge that does not match an Intuit product you are familiar with, such as seeing a charge from “INTUIT*SERVICES” without knowing what service it belongs to.

It’s worth taking a closer look to ensure your billing is accurate and secure if you have experienced any of these signs. By proactively identifying charges, you can avoid confusion, detect fraud early, and ensure you’re only paying for services you actually use. With a better understanding of how Intuit bills across products, you can better manage your subscriptions and financial accounts.

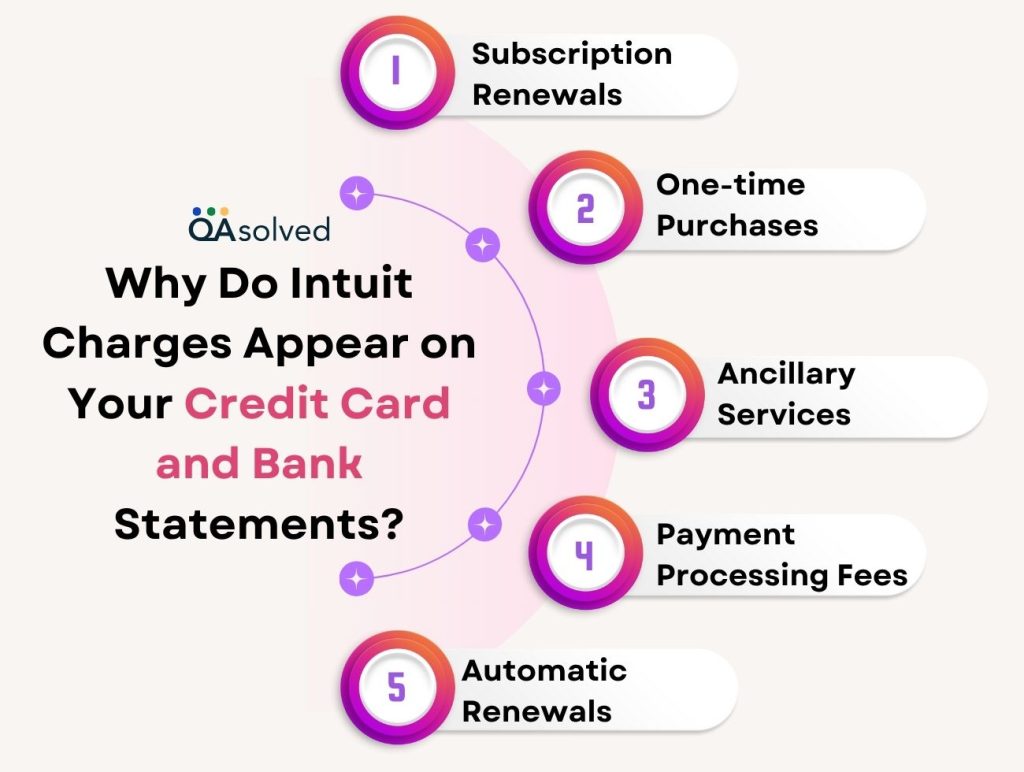

Why Do Intuit Charges Appear on Your Credit Card and Bank Statements?

Intuit charges appearing on your credit card or bank statement are typically related to their financial software and services, such as QuickBooks, TurboTax, or Mint. Common reasons for these charges include:

- Subscription Renewals: Many of Intuit’s products, especially cloud-based software like QuickBooks Online, are subscription-based, meaning you’ll be charged periodically (often monthly or annually) for continued access.

- One-time Purchases: This could be for specific products or features within Intuit’s software, or even for certain financial planning products.

- Ancillary Services: Some charges may be for additional services like payroll processing.

- Payment Processing Fees: If you use QuickBooks Payments to process credit card or bank transfer (ACH) transactions, you’ll see charges related to these transactions.

- Automatic Renewals: Some subscriptions may automatically renew, leading to charges you might not have explicitly initiated.

If you notice a charge from Intuit on your bank or credit card statement, it’s likely tied to one of the reasons mentioned above. By reviewing your recent activity within Intuit products, you can often identify the source of the charge quickly.

How to View All Your Active Subscriptions and Payment History?

To keep track of your spending and manage your services effectively, it’s important to know where to view your active subscriptions and payment history. This section will guide you through the simple steps to access this information from your account dashboard.

To investigate any charge, be sure to have a few key details ready: your credit card or bank account number, as well as the exact amount and date of the charge. Locating and identifying the transaction will be easier with these details.

If you don’t have this information handy, simply sign in to your Intuit account to access your billing history. Next, choose the specific Intuit product related to the charge so you can proceed with the lookup process more efficiently.

Note: If you’re using online banking with QuickBooks, your bank may apply a service fee for the connection. This fee is charged by your bank, not by Intuit.

For QuickBooks Online, QuickBooks Self Employed, or QuickBooks Payroll (Standard or Advanced) Charge

You’ll receive an email notification whenever your subscription is billed. You can also view your billing invoice directly within your QuickBooks account.

- Log in to your account.

- Go to Settings, then Subscriptions and billing. All your active subscriptions will be displayed.

- Click View Payment History.

View Charges in QuickBooks Desktop and QuickBooks Enterprise Charge

To better understand the charges on your account, use the Customer Account Maintenance Portal (CAMPs):

- Log in to camps.intuit.com

- Select View your transaction history.

- Choose the time range you’d like to review (up to two years of transactions).

- Click on the Order details link to view the details of the specific order.

- Use the printer icon to print the transaction.

- Click Back to My Account to return to the CAMPs dashboard.

Identify Charges from These QuickBooks Products

You can use the above-mentioned steps to identify credit card or bank charges related to the following products:

- QuickBooks Desktop and Enterprise

- QuickBooks Online

- QuickBooks Self-Employed

- QuickBooks Online Payroll

- QuickBooks Time

- QuickBooks Checks & Supplies

So, monitoring your billing activity ensures that you’re only paying for what you use and helps you manage your finances better. It’s smart to keep track of your Intuit credit card fees and other charges to keep your business expenses transparent. In case you want better clarity on Intuit credit card processing fees and charges on bank statement, then it would be ideal to contact our seasoned professionals for expert assistance at +1-888-245-6075.

Summary

Understanding the origin of charges on your credit card or bank statement from Intuit is crucial to managing your business finances accurately. Being informed about what each charge represents can prevent confusion and unnecessary disputes. Whether it’s a monthly subscription fee, service charge, or payroll transaction, being aware of what each charge represents helps eliminate confusion. You can easily verify these charges through your Intuit account, the CAMPs portal, or the transaction lookup tool.

In short, tracking your billing notifications, reviewing your payment history, and identifying charges like Intuit credit card processing fees keeps you informed of what’s happening with your money.

Frequently Asked Questions

To dispute a charge from Intuit:

1. Check the Charge: Log in to camps.intuit.com and review your transaction history.

2. Confirm It’s an Intuit Charge: Verify that it isn’t from a connected service.

3. Contact Intuit Assistance: Chat or call the Intuit Support site.

4. Dispute via Bank: Contact your bank if the dispute is unresolved.

To see your charges on Intuit:

1. Visit camps.intuit.com to access the Customer Account Management Portal (CAMPs).

2. Log in with your Intuit credentials.

3. Click “View your transaction history.”

4. Select the time period to filter transactions by.

5. Click on a transaction to see full order details or print a copy.

This shows charges for QuickBooks, TurboTax, and other Intuit products.

Credit card processing fees are charged by Intuit (or any payment processor) to cover costs associated with credit and debit card transactions. Typically, these fees cover:

1. Transaction processing by banks and card networks (like Visa or Mastercard)

2. Secure handling of customer payment data

3. Payment gateway and fraud protection services

When you accept payments via credit or debit cards through QuickBooks Payments, these are known as Intuit credit card processing fees.

The credit card processing fee statement outlines the fees charged for handling credit card transactions. The report includes details like transaction dates, amounts, card types, and fees associated with the transactions. The statement is used by businesses to track the costs associated with accepting credit card payments and to reconcile them with their financial records.