Table of Contents

TogglePreparing and filing 1099-MISC forms is a cumbersome task. QuickBooks provides a great feature known as QuickBooks 1099 Wizard that simplifies the process of filing 1099-MISC forms.

QuickBooks 1099 Wizard saves you time and allows you to easily prepare, review and file all of your 1099-MISC forms to the Internal Revenue Service (IRS). QB 1099 Wizard also allows you to prepare, review and file form 1096, if you are filing by mail, to the IRS.

How to use QuickBooks 1099 Wizard to prepare and file 1099-MISC forms?

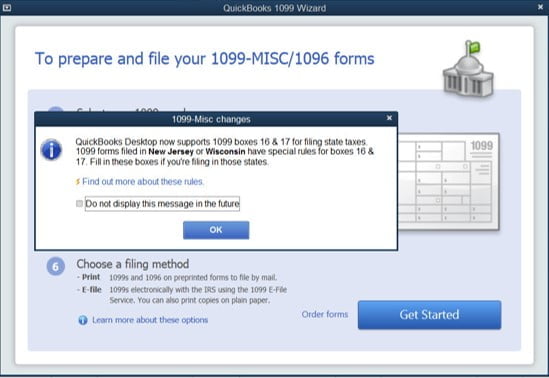

To open the wizard, go to Vendors, click Print/E-file 1099s, and after that click 1099 Wizard. Now, click the Get Started button to proceed and follow these steps :

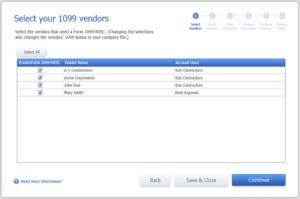

Select vendors requiring 1099-MISC forms

QuickBooks 1099 Wizard will show a list of vendors. From this list, you have to select those vendors that require 1099-MISC forms. Once you are done with the selections, click the continue button.

Verify information of vendors

A table will appear on the QuickBooks 1099 Wizard screen that will allow you to edit and verify each vendor’s information. This information will be used on the 1099-MISC forms. To edit values, you can double-click the cells in the table. Click the continue button to move to the next step.

Also Read: How to Prepare & E-File Tax Form 1099 for Vendors in QuickBooks

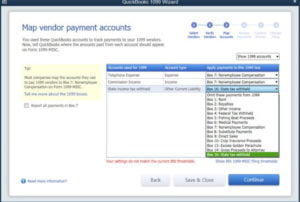

Map vendor payment accounts

In this step, you have to tell QuickBooks where the amounts paid from each account should appear on Form 1099-MISC. For mapping accounts or omitting payments from 1099-MISC forms, you have to choose from the Apply payments to this 1099 box dropdown list, or, if in case applicable, you have to select the Report all payments in Box 7 checkbox.

If in case, a red-colored message appears on your QuickBooks 1099 Wizard screen that your settings don’t match the current IRS thresholds, then you have to follow these two steps. Firstly, click the hyperlink Show IRS 1099-MISC filing thresholds, and then secondly, click the button named Reset to IRS Thresholds.

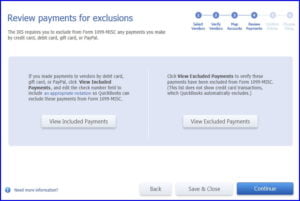

Review payments for exclusions

According to the IRS, you are required to exclude from form 1099-MISC the electronic payments such as credit card, debit card, gift card, or PayPal payments.

If you made payments to vendors by debit card, gift card, or PayPal, click View Included Payments button, and edit the check number field to include an appropriate notation so that QuickBooks can exclude these payments from form 1099-MISC. To verify payments that have been excluded from form 1099-MISC, you have to click the View Excluded Payments button.

Confirm your 1099 entries

In this step, a table will appear on the QuickBooks 1099 Wizard screen that will allow you to review the summary of vendors for whom you are creating 1099-MISC forms and the amounts being reported for the given calendar year. You can review transaction details by double-clicking any amount.

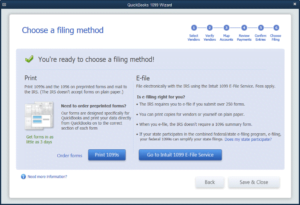

Choose a filing method

In this final step, you have to choose your preferred filing method. You have to choose from the two available choices appearing on the QuickBooks 1099 Wizard screen: print and e-file. By choosing the print option, you can print 1099-MISC and 1096 on preprinted forms and mail to the IRS. If you want to file electronically, you can use the paid 1099 E-file Service.

Thus, QuickBooks 1099 Wizard makes filing 1099-MISC forms an uncomplicated and trouble-free task. For some reason, you may find QuickBooks 1099 Wizard not working or may face any other technical problem with your QuickBooks. In such a case, you can contact our technical expert at our Certified ProAdvisor Support Number.

to resolve your query in no-time.

Also Read:

How to Write Off Bad Debt in QuickBooks?