When it comes to tracking your businesses’ finances throughout the year, it can be a difficult task. Especially for real estate brokers who don’t know much about tracking numbers. And this is where QuickBooks for commercial real estate brokers come into picture.

Before getting into the complete guide of using QuickBooks, let’s have a look into why we need QuickBooks for Commercial Real estate Brokers near me.

When you start to track your transactions through QuickBooks rental property chart of accounts, you save yourself from the added expense of hiring a Bookkeeper. But you also get to make decisions by referring to the insights about your real estate business. Besides, tracking your flow of funds will always help you make informed decisions for the future.

Once a real estate business person gets well versed with the QuickBooks rental property chart of accounts, they will not be willing to go back to any other methods to track transactions because of its accuracy and added benefits.

How is QuickBooks for commercial real estate Broker, appropriate?

The list of features that makes this platform a suitable option for real estate brokers are:

- Create, edit and send multiple invoices.

- Set up unlimited classes and track their individual progress separately.

- Money-saving in terms of hiring professionals like Bookkeepers.

- Manage multiple businesses quickly and simply.

- Productive decision making with the help of tracking data.

- Fathom reporting with the help of detailed KPIs and analytics.

- You can create a user-friendly dashboard for your visitors.

- Get yourself an impressive report and presentation with the help of ‘Template reports.’

- Go for expense documents management instead of dealing with many transaction details.

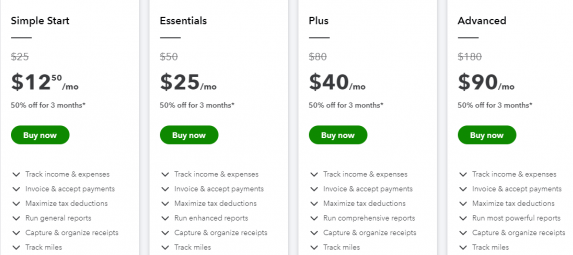

Here is a list of pricing plans of QuickBooks for commercial real estate.

- Self-employed: This plan is $12 a month and you get to use all the basic features of QuickBooks.

- Simple start: This comes for $25 a month and includes all the features of self-employed along with maximizing tax deductions.

- Plus: At $40 per month, it has an added feature of managing, paying bills, tracking time, and the facility to add up to 5 users, tracking projects and inventories.

- Advanced: At $90 per month, you get all the above features along with insights, invoices, expenses restoring data facilities, and automated workflows.

Also Read: How to use QuickBooks Payment card readers?

to resolve your query in no-time.

How to manage your income and expenses on QuickBooks?

Starting with the menu bar on the left-hand side, we click on the Banking option wherein you will get all the information you need with respect to income and expenses, transactions, and all that are added in QuickBooks. In order to stay up to date with all the transactions, you have to click on Update.

If you have two different businesses or sub businesses of the same parent company, then you can also manage the books of both entities via QuickBooks. ‘Classes’ is the perfect option under this for you to subdivide the various aspects of your business. Some of the classes that are usually helpful for rental property chart of accounts are:

Handy Services, Property 1, Property 2, Property 3, and so on.

When you use Classes, one of the biggest benefits is that your reports can also be created accordingly since the entire data is bifurcated. All the various aspects of your business can have their separate reports too automatically.

This feature is accessible from the basic Simple Start Plan itself. If you want to classify a transaction, all you need to do is simply click on it and then select the appropriate category you want to fit it into, by placing it under the drop-down menus and clicking ‘Add’ in the end.

If you can regularly classify your transactions then it will help you get the most accurate Profit and Loss statement.

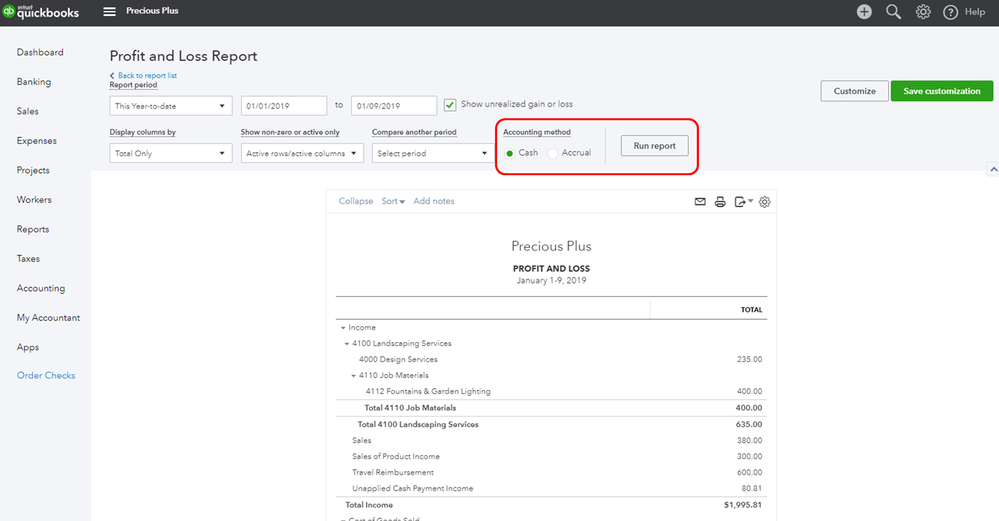

Make decisions with the help of Profit and Loss statements

In order to find all your Profit and Loss statements, you can click on the ‘Reports’ tab. You can also click on the ‘Customize’ option present in the upper right corner that will also help you filter your statements as per the classes.

If you want, you can also break it into days, weeks, months, and so on as per how you want the report to be. If you want to see a larger view of your real estate business, then the best way is to set it as per each month.

Once all the filters are in place, you can click on ‘Run Report.’

Also Read: Does QuickBooks keep crashing in your system?

In order for you to make the right decisions for your commercial real estate investor or business through QuickBooks, it is always a wise decision to get the monthly reports out for the last 6 months at least and then have a look at the QuickBooks insights to make an analyzed and an informed decision regarding your business. These also help you to let you know whether any special measures that you may have taken for your business, are working or not.

Final Words

QuickBooks for commercial real estate agents can seem to be a tough task at first. But it is only a thing of the beginning. If you still need further help in using QuickBooks for commercial real estate business, you can always reach out to ‘QuickBooks Error on the official website. The other way is to go for the Live Chat option available on their website. If needed, you can also write to them via email. Their email id will be provided on the QuickBooks website itself.

Frequently Asked Questions

The QuickBooks accounting software helps in creating organized documentation of expenses and also helps in reducing the need of holding on to receipts for years and years. It helps all real estate brokers to capture or scan the invoices and receipts and hence record each of the transactions.

Yes, you can fill up tax forms with the help of the QuickBooks accounting software when you record all your transactions in one place. The finance information is analyzed by the QuickBooks accounting software and it can hence help you in filling out the tax forms

Monitoring all your sales is highly critical in a business, especially the real estate business. This is not only important for the sake of maintaining correct entries in the books of records but also in order to have a detailed report to analyze later with respect to the number of sales and analyze the further prospects of your business. You can keep a monthly track of your income, which is the best way to monitor your sales. However, if you want, you can also set the time period to weekly or quarterly and so on.

The QuickBooks accounting software is built to run on certain metrics. It has the ability to set up reports on the basis of the insights. It can also have data trends fetched out of it. In the case of real estate, just like other industries, it has the ability to prepare a thorough industrial report. They are not only accurate but also helps in legitimate presentations.

There are various ways to organise QuickBooks transactions with the help of the plethora of options available. However, the most common way to differentiate is by segregating it into Assets, Liabilities, Income, and expenses.

For instance, petty cash, furniture, security deposits, credit cards, loans etc. fall under Assets and Liabilities category. On the other hand, mentor income, revenue share income, cost of goods sold, dues, payrolls, etc. fall under the category of Income and Expenses.