Recording S-Corp distributions accurately in QuickBooks, whether you are using the Desktop or Online version, is essential for maintaining clear financial records and staying compliant with tax regulations. In an S-Corporation, profits, losses, deductions, and credits pass through to shareholders’ personal tax returns, making distributions a key component of the company’s financial operations.

Unlike salaries or wages, shareholder distributions are considered a return on investment, which means they must be tracked separately from payroll and day-to-day operating expenses. Properly entering these transactions in QuickBooks ensures that retained earnings and equity accounts remain accurate, making it easier to prepare year-end financial statements and manage shareholder equity.

Both QuickBooks Desktop and QuickBooks Online offer tools for recording distributions through equity accounts, though the exact steps vary. In this blog, we will walk you through the step-by-step process for each platform to help you record S-Corp distributions correctly and avoid costly errors.

What is S-Corp in QuickBooks?

An S-Corporation (S-Corp) in QuickBooks is a type of business entity that elects to pass through corporate income, losses, deductions, and credits to shareholders. In QuickBooks, it’s important to keep track of S-Corp activity, especially distributions, for accurate financial reporting and tax compliance. A S-Corp distribution is a payment made to shareholders from the company’s profits, and it differs from salaries or wages because it is not subject to payroll taxes.

QuickBooks allows you to create equity accounts to record these payments correctly in your accounting system. By using the proper account type, such as a Shareholder Distribution account or Owner’s Draw account, you ensure that these payouts are not mistaken for expenses or income. Managing QuickBooks S Corp shareholder distribution accurately helps maintain clean books, supports tax filing accuracy, and keeps equity balances accurate.

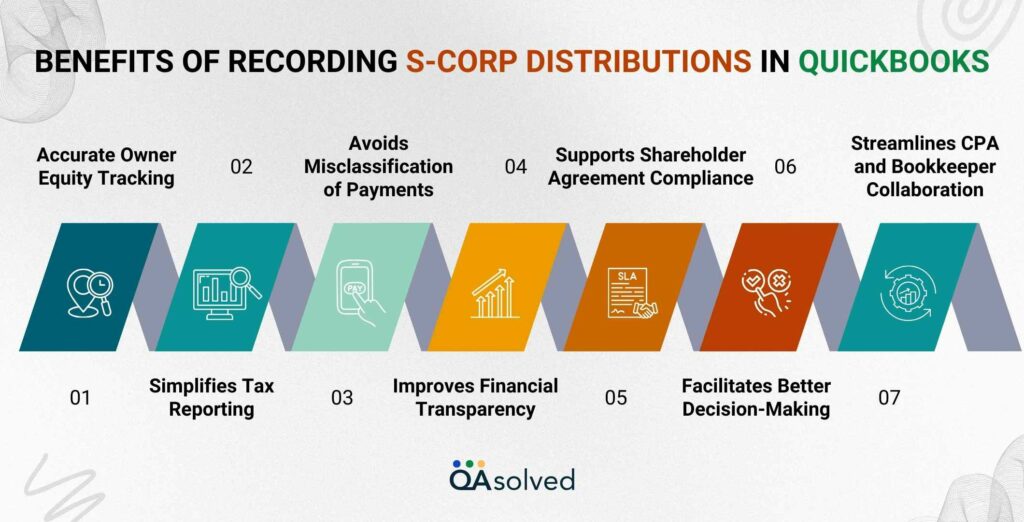

Benefits of Recording S-Corp Distributions in QuickBooks

The accuracy of S-Corp distributions is critical for maintaining clean books, ensuring tax compliance, and providing transparency to shareholders. Whether you use QuickBooks Desktop or Online, documenting these distributions properly will benefit your business in the long run.

1. Accurate Owner Equity Tracking

Make sure that shareholder distributions are properly reflected in your equity section. Maintains clear records of how much each shareholder has received.

2. Simplifies Tax Reporting

Schedule K-1 and other IRS forms are easier to complete with well-documented distributions. Ensures your books are audit-ready and in compliance with IRS regulations.

3. Avoids Misclassification of Payments

Ensures that owner distributions or draws are not confused with wages or business expenses. Maintains correct categorization, preventing distributions from affecting net income or taxable profits.

4. Improves Financial Transparency

Provides a clear picture of how profits are allocated and distributed. Facilitates the understanding of the financial health of the company by shareholders and accountants.

5. Supports Shareholder Agreement Compliance

Assures distributions are aligned with ownership percentages or specific terms in shareholder agreements.Maintaining an accurate ledger of all payments reduces disputes or discrepancies.

6. Facilitates Better Decision-Making

Accounting records help business owners assess profitability and decide when to distribute further funds. Considers retained earnings and cash flow when planning for the future.

7. Streamlines CPA and Bookkeeper Collaboration

When distributions are properly recorded in QuickBooks, accountants and bookkeepers can reconcile them more efficiently. During tax season, it reduces back-and-forth and cleanup work.

In addition to keeping your accounting organized, recording S-Corp distributions in QuickBooks helps you comply with IRS regulations and shareholder agreements. You can reduce taxes and foster financial clarity throughout your organization by tracking distributions properly.

Checklist Before Recording S-Corp Distributions in QuickBooks

To ensure accurate and compliant recordkeeping, you should have the following prerequisites in place before recording S-Corp distributions in QuickBooks Desktop or Online:

- S-Corp Election Filed with the IRS: The IRS Form 2553 must be filed and your business must be officially recognized as an S-Corporation.

- Set Up Equity Accounts: Create an equity account in QuickBooks specifically for Shareholder Distributions (also known as Owner’s Draw or Owner’s Equity – Distribution”).

- Identify Shareholders and Ownership Percentages: Identify the shareholders of the S-Corp and their ownership percentages, since this affects distributions.

- Confirm Profit Availability: Make sure your business has enough retained earnings or profit to distribute legally.

- Separate Payroll from Distributions: Dividends must be paid to shareholder-employees through payroll before they can receive distributions.

- Consult with an Accountant: S-Corp distributions are subject to taxation. Ensure distributions are made in compliance with IRS rules by consulting a CPA or tax advisor.

- Back-Up Company File (For Desktop Users): If you are entering equity-related information into your QuickBooks Desktop company file, make a backup first.

After you have completed these steps, you can enter your S-Corp distributions accurately into QuickBooks.

Now, let’s take a look at the steps and understand how one can record S-Corp Distribution in QuickBooks Desktop.

Steps to Record S-Corp Distribution in QuickBooks Desktop With the Help of Journal Entries?

To keep accurate books and ensure tax compliance, it is important to properly record shareholder distributions if your business is set up as an S-Corporation. You can easily track these distributions in QuickBooks Desktop by following a few structured steps. There are 5 steps to follow in order to record the S-Corp Distribution by using the journal entries in QuickBooks Desktop. Here are the steps:

Step 1: Open the Chart of Accounts

- Navigate to the Chart of Accounts in QuickBooks.

Step 2: Set Up a New Equity Account

- Click “New” to create a new account.

- Select “Equity” as the account type and give it a clear name like “Shareholder Distribution Account.”

In order to prepare accurate financial and tax reports, you need to choose the right account type. Your financial statements will reflect S-Corp distributions correctly if they are classified properly.

Step 3: Create Journal Entries

- Select Make General Journal Entries from the Company menu.

- Fill out the following fields on the journal entry screen:

- Debit the newly created Shareholder Distribution Account with the distribution amount.

- Distribute funds from the cash or bank account that has been credited.

- Add a memo to describe the purpose of the transaction for future reference.

- Review the journal entry to ensure accuracy, then enter Save & Close.

Step 4: Monitor Overall S-Corp Distributions

Ensure distributions stay within the company’s accumulated profits and earnings:

- Open the Reports menu and run a Balance Sheet to review retained earnings.

- Divide the retained earnings by the total distributions to shareholders.

- A distribution that exceeds earnings could have unfavorable tax implications for shareholders. In case of doubt, you should consult a tax advisor.

Step 5: Use the Same Category for All S-Corp Transactions

Whether you’re recording distributions as an expense or liability depends on how you’re recording them.

- Go to the Expense section and review your transactions.

- Ensure that the payee or category matches “Shareholder Distribution”.

- All entries should use clear terms, such as “Shareholder Distribution,” rather than generic ones, such as “Owner Distribution.”

Steps to Record the S-Corp Distribution Using Checks in QuickBooks Desktop

Another way to record the S-Corp Distribution in QuickBooks Desktop is by using checks. Here are the steps to do the same:

- Launch QuickBooks Desktop to get started.

- Select “Write checks” from the Banking menu.

- Make sure you choose the right bank account to send distributions from.

- Input the name of the shareholder receiving the distribution.

- Choose the correct account from your Chart of Accounts.

- Add a memo to describe the transaction after entering the distribution amount.

- To record the check, click Save.

This concludes the steps for accurately recording S-Corp distributions in QuickBooks Desktop. Maintaining clear records and ensuring compliance is possible with accurate setup and consistent categorization.

Let’s move on to handling S-Corp distributions in QuickBooks Online.

Record S-Corp Distribution in QuickBooks Online

Maintaining clear financial records and complying with tax regulations require accurate recording of S-Corp distributions in QuickBooks Online. In this section, we’ll explain how to record shareholder distributions correctly, so your financial reports reflect them correctly. Regardless of whether you’re distributing profits to owners or shareholders, these steps will streamline the process.

Step 1: Set Up an Equity Account

- Choose Lists > Chart of Accounts.

- Choose New from the dropdown menu.

- Then, click Save & Close after selecting Equity as the account type.

Step 2: Record the S-Corp Distribution

- Enter a journal entry debiting retained earnings and crediting shareholder equity.

- You may also write a check to the shareholder:

- Click on the Expenses tab on the check.

- Select the correct shareholder equity account for accurate tracking.

Step 3: Categorize Correctly

- Always use an equity account for distributions to avoid affecting your Profit and Loss.

- It is important to designate a separate account for income.

- Track business-related expenses using clear expense accounts.

To conclude this section, it is essential to maintain clean financial records and stay in compliance with tax laws by appropriately setting up and recording S-Corp distributions in QuickBooks. You can keep your books organized and ready for review by categorizing distributions and using equity accounts.

Wrapping Up

In a nutshell, it is important to record S-Corp distributions accurately in both QuickBooks Desktop and Online to ensure compliance with IRS regulations and provide transparency to shareholders. No matter how you handle distributions, it’s important to categorize them under equity accounts rather than as income or expenses. By doing so, you protect the integrity of your Profit & Loss statement and ensure that shareholder equity is properly reflected in the balance sheet.

The process involves setting up equity accounts, entering journal entries, and managing check payments accurately in QuickBooks Desktop. Even though QuickBooks Online has a slightly different interface, the principles remain the same-track every distribution under the appropriate account type, ensure consistency, and ensure that total distributions do not exceed retained earnings. A regular review of your balance sheet and consultation with a tax professional can help you avoid costly mistakes.

Frequently Asked Questions

QuickBooks categorizes Shareholder Distribution as an equity account, not as an expense. It represents profits distributed to shareholders in an S-Corp and is usually called “Shareholder Distribution” or “S-Corp Distribution.” This account tracks these payouts without impacting Profit and Loss. The Equity type ensures accurate financial reporting and compliance with tax guidelines for S-Corp distributions.

1. Create an Equity Account

– Access Settings > Chart of Accounts > New.

– Choose Equity as the Account Type and name it “Owner Distribution.”

– You can now save your account.

2. Record the Distribution

– Select + New > Expense or Check.

– Pick the bank account and select the Owner Distribution account under Category.

– Finally enter the amount and hit save.

No, an S Corporation distribution is not considered an expense in QuickBooks or in Accounting. The transaction is instead classified as an equity transaction. A distribution is a return of profits to shareholders and does not appear on the Profit and Loss statement. They are recorded as a reduction of retained earnings or shareholder equity, not as business expenses. Tax compliance and accurate financial reporting depend on this distinction.

Yes, it is possible to transfer money from an S Corporation to a personal account, but it must be done correctly to avoid tax penalties. S Corp shareholders typically classify such transfers as follows:

1. Salary – Shareholder-employees must be paid a reasonable salary through payroll, with appropriate tax withholdings.

2. Shareholder Distributions – Profits distributed after payroll taxes are recorded against a shareholder equity account (and not as an expense).

3. Loan Repayment – If the S Corp owes its shareholders money.

4. Reimbursement – Paid on behalf of the company for personal expenses.