Maintaining a healthy business requires managing cash flow, and QuickBooks Desktop’s cash flow projector helps you do just that. It allows small business owners and accountants to estimate future cash flows over a defined period, typically six weeks. Making informed decisions about spending, investments, and potential shortfalls can be achieved by projecting cash flow based on incoming payments, regular expenses, and other financial activities.

The cash flow projector in QuickBooks Desktop pulls data from your existing company file, including open invoices, bills, and scheduled transactions. Having an accurate picture of your expected financial position helps you anticipate when cash might be tight, so you can adjust payment terms or secure short-term financing accordingly.

If you’re also looking forward to setting up the cash flow projector in QuickBooks Desktop, then you have landed on the right source. In this blog, we are going to explain how cash flow projector works to ensure your business runs smoothly with the right setup.

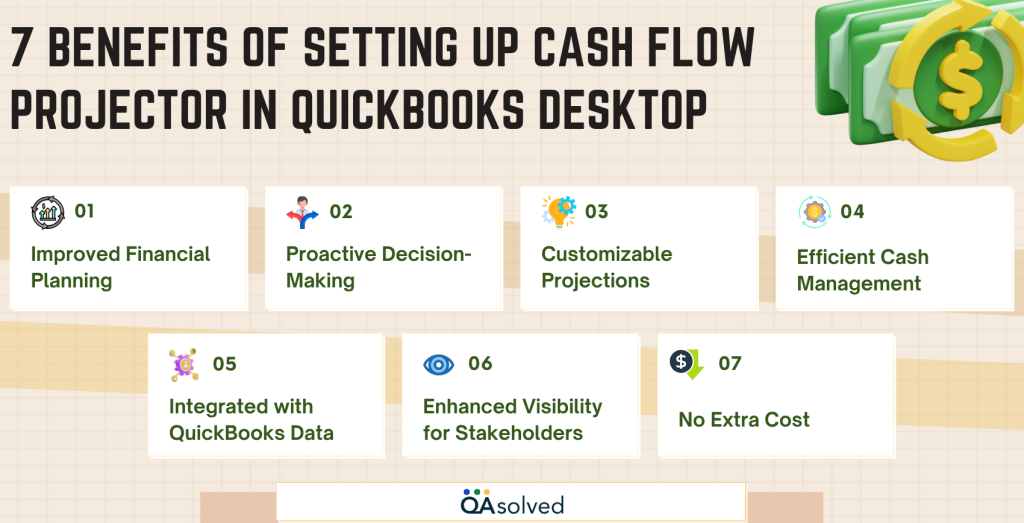

7 Benefits of Setting Up Cash Flow Projector in QuickBooks Desktop

It is crucial to keep track of your cash flow in order to make smart financial decisions and avoid surprises in the future. Using QuickBooks’ cash flow projector, you can monitor your short-term financial health by forecasting incoming and outgoing funds. Here are some benefits:

1. Improved Financial Planning

Plan for upcoming expenses, manage working capital, and avoid overdrafts by knowing your short-term cash position.

2. Proactive Decision-Making

Identify potential cash shortages early so you can take action, such as delaying purchases, collecting receivables faster, or securing financing before issues arise.

3. Customizable Projections

Customize your cash flow forecast to reflect real-time invoice, bill, and recurring payment data, making it more accurate and relevant.

4. Efficient Cash Management

Optimise the timing of bill payments, payroll, and other obligations by monitoring when money will come in and go out.

5. Integrated with QuickBooks Data

Instead of manually forecasting, the tool pulls data directly from QuickBooks transactions, saving you time and reducing errors.

6. Enhanced Visibility for Stakeholders

Ensure your business’s financial health and stability by providing lenders, investors, or management with up-to-date forecasts.

7. No Extra Cost

You can create simple, short-term cash flow forecasts with QuickBooks Desktop without any additional software or subscriptions.

So, these are the seven benefits of setting up a Cash Flow Projector in QuickBooks Desktop. Now, let’s take a look at the steps to set it up effortlessly.

Also Read: How to Manage Companies Cash Flow in QuickBooks?

9 Steps to Set Up Cash Flow Projector in QuickBooks Desktop

QuickBooks Desktop’s cash flow projector shows you your current and future cash flow. You can use the projection to see how your business finances look for the next six weeks, so make sure your QuickBooks data is accurate.

Note: QuickBooks Desktop 2022 no longer supports Cash Flow Projector. Cash Flow Projector is still supported in previous versions.

Here are the steps to set up Cash Flow Projector in QuickBooks Desktop:

- Click on Planning & Budgeting in the Company menu.

- Select Cash Flow Projector.

- Hit Next to begin.

- Set up the cash accounts you wish to include and adjust the starting balance as necessary.

- Enter Next.

- Choose the projection method you prefer, and update all weekly figures in the Cash Receipts Summary.

- Add a new expense description with the corresponding amount or select an existing account. You can adjust weekly expenses in the Business Expenses Summary, then click Next.

- Review and update any accounts payable expenses due in the next few weeks, then select Finish Projection.

- Use the Print or Save as PDF options to view or share the complete cash flow projection outside of QuickBooks.

Now that you have set up your cash flow projections, you know how money will flow in and out of your business on a weekly basis. As a result, you can plan for shortfalls, avoid overdrafts, and make informed financial decisions, such as when to schedule payments or when to delay expenses.

The cash flow projector is especially useful for small businesses with tight margins or predictable payment cycles. You can prevent cash gaps by accelerating collections, adjusting payment terms, or securing short-term funding by identifying potential cash gaps in advance.

Summary

Setting up the cash flow projector in QuickBooks Desktop is a simple yet powerful way to maintain control over your business’s financial future. With the ability to predict your cash inflows and outflows over a six-week period, you gain a clear snapshot of your short-term financial health. This proactive insight enables you to prepare for potential cash shortfalls, optimize bill payments, and make confident financial decisions that keep your operations running smoothly.

The tool integrates seamlessly with your existing QuickBooks data, eliminating the need for manual entry and reducing the chance of human error. Whether you’re a small business owner or an accountant managing multiple clients, the cash flow projector helps streamline your financial planning process without any additional software costs.

By using this built-in QuickBooks feature, you’re not just reacting to cash flow challenges, you’re anticipating and planning for them. In case you face any trouble in executing steps, then it would be ideal to connect with QuickBooks Desktop Support.

Frequently Asked Questions

Yes, QuickBooks Desktop includes a cash flow report called the Statement of Cash Flows. It shows how cash flows through your business from operating, investing, and financing activities. You can find it under Reports > Company & Financial. Over time, you can monitor your actual cash position with this report.

1. Log in to QuickBooks Desktop.

2. Click on Reports.

3. Choose Company & Financial.

4. Click Statement of Cash Flows to view your cash inflows and outflows.

5. Go to Company > Planning> Budgeting to forecast cash flow.

6. Create a cash flow projection based on your invoices and bills by selecting Cash Flow Projector.

1. Review Regularly: Monitor your cash flow statements on a weekly or monthly basis.

2. Compare Periods: Examine current statements against previous periods to identify trends and unusual developments.

3. Analyze Sections: Understand how cash is being generated and spent by examining operating, investing, and financing activities.

4. Check Cash Position: Make sure you have enough cash to cover upcoming expenses.

5. Use for Planning: Adjust spending, manage receivables, or plan financing based on insights from the statement.

Statements of Cash Flows in QuickBooks show how cash flows into and out of your business. Cash activity is broken down into three sections: operating, investing, and financing activities, thus helping you understand your company’s cash position beyond just profits.