Taking your business to a new state is a big step, and while it’s a sign of success, it also means navigating a new set of payroll tax regulations. Every state in the U.S. has its own payroll tax structure, filing requirements, and agency registration requirements. Setting up state-specific payroll correctly is essential for staying compliant and avoiding costly fines when opening new offices, hiring remote employees, or moving teams across state lines. QuickBooks simplifies this process by helping you register with state tax agencies, apply accurate tax settings, and stay on top of filings and payments, so you can expand confidently without payroll headaches.

When adding employees in a new state, it’s important to handle tax registrations, withholding details, and compliance requirements with care. QuickBooks Desktop and QuickBooks Online Payroll make this easier by helping you register for state employer tax accounts, configure accurate tax settings, and ensure timely payments and filings. You can assign state-specific tax items, manage unemployment insurance rates, and generate compliant paychecks, without relying on spreadsheets or manual processes.

If you’re also looking forward to expanding your team across state lines or hiring remote employees, then you are on the right track. In this blog, we’ll walk you through how to set up employees and payroll taxes for a new state in QuickBooks, from registering with state agencies to updating employee records and enabling tax payments. So let’s get started!

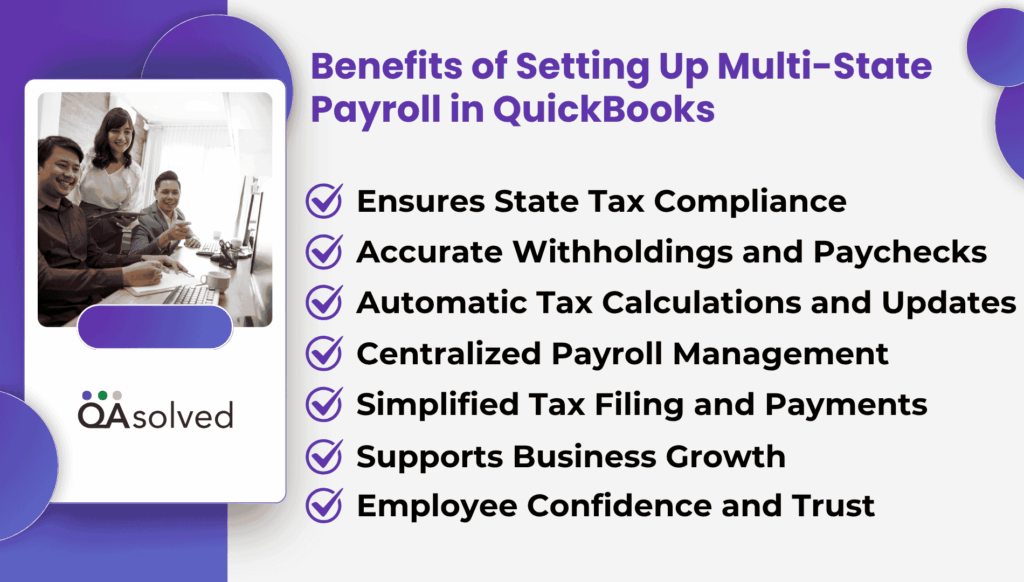

7 Benefits of Setting Up Multi-State Payroll in QuickBooks

When your business hires employees in a new state, it’s essential to update your payroll settings to comply with that state’s tax laws. Setting up multi-state payroll in QuickBooks not only makes the entire process smooth but also offers a wide spectrum of benefits to users. Let’s discuss them!

1. Ensures State Tax Compliance

Payroll tax laws vary from state to state, but QuickBooks supports your compliance by guiding you through the correct setup. It reduces the risk of penalties, late fees, or problems with tax filing.

2. Accurate Withholdings and Paychecks

When QuickBooks assigns the correct state tax items to each employee, it ensures that both state income tax and unemployment insurance withholds are accurately reflected in paychecks.

3. Automatic Tax Calculations and Updates

QuickBooks Payroll calculates and applies the tax rates automatically based on the state in which you operate, and you’ll receive a notification whenever those laws change in the state in which you operate.

4. Centralized Payroll Management

You can manage all payroll tasks-like payroll runs, tax payments, and filings-on one platform, regardless of where your employees are located, so that you can streamline your workflow, even if your employees are spread across multiple states.

5. Simplified Tax Filing and Payments

You can use QuickBooks to generate and e-file the required state payroll tax forms and make scheduled tax payments and save a lot of time and be sure to meet all state deadlines once QuickBooks has been set up.

6. Supports Business Growth

By properly setting up an employee payroll system for multiple states, your business will be able to scale confidently into new markets while ensuring employee tax compliance is controlled at all times.

7. Employee Confidence and Trust

Providing employees with timely and accurate paychecks and correctly deducting their taxes is key when onboarding new employees in new locations. It builds trust and shows professionalism.

In short, payroll and legal compliance gets ticked when you set up employees and payroll taxes in QuickBooks for a new state.

Steps to Set Up Employees and Payroll Taxes in a New State

The commercial real estate sector is booming across major countries worldwide, and as employee preferences shift toward flexibility, remote and hybrid roles are becoming increasingly common. This clearly highlights the importance of understanding the steps involved in setting up employees and payroll taxes when expanding into a new state.

So, let’s begin with it

Step 1: Identify The Correct State and Local Taxes and Gather Required Information

The correct state and local taxes can be complicated due to the fact that rules vary by state and by individual circumstances. In the areas where your employees live and work, contact the state agency responsible for withholding, unemployment insurance, and local taxes. You will receive guidance on what taxes apply and how to register for the necessary account numbers to pay taxes and file reports.

The following information is typically needed to set up the new state in your payroll system:

- Account number(s)

- How often you’re required to pay the tax (deposit frequency)

- Tax rates

What You Need to Know About Roaming Employees?

A roaming employee is someone who works across multiple states for the same employer, sometimes even within the same pay period. Managing payroll for these employees can be complex, as it may involve handling unemployment insurance and local tax withholdings in more than one state. The applicable taxes often depend on where the employee lives and whether they are considered a resident or non-resident in the states they work.

Despite this, QuickBooks payroll products do not support local withholding or multi-state unemployment on a single paycheck or within tax filings. We also recommend avoiding workarounds to file your state taxes, as they can lead to complications. Instead, if you’re using QuickBooks Desktop Payroll, you can enable class tracking to monitor your workforce across two locations. This setup requires manual adjustments to both tax forms and paychecks for accurate reporting.

A state unemployment tax is typically paid to only one state per employee. It should be set as the Work Location in QuickBooks Online Payroll or as the State Lived in QuickBooks Desktop Payroll. To determine which state unemployment tax applies, the U.S. Department of Labor (DOL) and all states follow four tests in order:

- Residence of your workforce or employees

- Specific place or location where work is localized.

- The location of the employee’s base of operations.

- Where the work is directed or controlled from.

Each of these tests is applied sequentially to all work performed under a single contract. By the time a test allocates all services to one state, no further tests are needed.

Step 2: Set Up or Edit Your Employees’ Information

After you determine the state and local taxes your new employee must pay, you can add them to your payroll. Make changes to an existing employee who moved to a new state. Here are the steps to set up or edit your employees’ information:

QuickBooks Online Payroll

Payroll management can be complex, especially when it comes to tax withholdings and filings. QuickBooks Online Payroll simplifies this process by providing an easy-to-use platform for staying compliant with federal and state tax laws. Here are the steps to set up payroll taxes in QuickBooks Online:

- Access the link to open the product page in a new window.

- Next, select Add an employee. Choose an existing employee’s name if they have moved to a new state.

- Click Start or Edit under Employment details.

- Select or add the work location where you are required to pay State Unemployment Insurance. (Note: For remote employees, this may differ from their physical work location.)

- Hit Save.

- Select Edit from the Tax withholding menu.

- If two states appear in the State withholding section:

- If you don’t need to withhold state tax for one state, select Do not withhold (exempt) from the Filing Status ▼dropdown.

- If your employee has provided a Certificate of Nonresidence form, select the reciprocity agreement.

- Select the applicable taxes under the Local Taxes or Other Taxes section and enter the tax rates.

- If you or your employee qualify for any tax exemptions, select them from the list under Tax Exemptions.

- To complete the setup, select Save.

QuickBooks Desktop Payroll

Payroll taxes should be managed accurately in order to maintain smooth business operations and ensure compliance with tax laws. Follow the steps to set up or make changes to your employees in QBD Payroll.

- Choose Employees, and then click on the Employee Center.

- To add a new employee, click New Employee. You can double-click an existing employee if they moved to a new state.

- Go to the Payroll Info tab, then select Taxes.

- Click on the state tab.

- Select the state where you’re required to pay State Unemployment Insurance from the State Worked dropdown. Your employee may work from a different state than where they are physically located if they work remotely.

- Choose the state where you must collect and pay State Income (or Withholding) taxes for your employees. If you must pay or file State Withholding Tax in more than one state, you may want to use QuickBooks Online Payroll.

- A prompt may appear asking you to set up the new taxes. Set up your new state taxes by following the instructions below.

- You may also see a prompt asking if your employee is subject to a list of additional taxes.

- Select Yes if your employee is subject to one or more taxes. On the Other tab, you’ll see the additional taxes. Remove any that don’t apply by selecting the item, then Delete.

- Select No if your employee isn’t subject to any taxes.

In case your employee is subject to local taxes, you can set up the local tax items to calculate. Taxes must be paid and filed manually.

- Select the Other tab and click anywhere inside the blank area below the Item Name box. Then select Add New from the dropdown.

- Choose the type of local tax, enter your account number, and enter the rates as instructed in the wizard.

Step 3: Add and Set Up Your New State Tax Details

When you want us to pay your taxes and file your forms electronically, you should complete the state tax setup. State taxes can be set up without account numbers. Until you add the account numbers, you’ll have to pay taxes and file forms manually.

QuickBooks Online Payroll

Note: You may still be required to file certain state forms, even if you aren’t collecting tax from your employees. Also, states and state taxes cannot be deleted or removed.

Here are the steps to set up your new state taxes in QBO payroll:

- Go to Settings, then Payroll Settings.

- In the [State] tax section, select Edit.

- Make sure you enter the information for the taxes you must pay.

- Select Get your account number if you need a state account number.

- You can leave the account number field blank and enter 0.00 for any rate field if you aren’t required to pay a tax.

Set up local taxes (QuickBooks Online Premium or Elite only)

- Go to Settings and click on Payroll Settings.

- Now, choose Local Tax Jurisdictions.

- Enter your account number and frequency of payments. Leave the account number field blank if you do not have to pay.

QuickBooks Desktop Payroll

Adding or editing your employee’s State Subject to Withholding and State Worked on the Taxes tab will prompt you to set up new state taxes.

- Select Setup from the state tax prompt.

- Leave the state tax name as is. Click Next.

- If you’re using QuickBooks Desktop Payroll Assisted or you’ve chosen to file and pay electronically, please provide the name of the state agency and your account number.

- The dropdown allows you to select a liability or expense account other than the one(s) shown. Choose the account you created. To create a new one, select Add New.

- Enter your quarterly SUI tax rate when setting up State Unemployment.

- Finally, click on Next and then select Finish.

If your employee is subject to local taxes, set up the local tax items.

- Click anywhere inside the Item Name box on the Other tab. Then select Add New from the dropdown menu.

- Choose the type of local tax, enter your account number, and enter the rates as instructed in the wizard.

Note: You’ll need to handle local tax payments and filings manually. Alternatively, you may want to explore QuickBooks Online Payroll Premium or Elite for automated support.

For those using QuickBooks Desktop Payroll Enhanced with e-file and e-pay. Here are the steps to set up your e-file and e-pay for your new state.

- Click on Employees and then select Payroll Taxes and Liabilities, and then Edit Payment Due Dates.

- Choose Schedule payments.

- Click Edit, then select the new state tax.

- Select E-pay under Payment (deposit).

- Choose your payment (deposit) frequency. After that, click Finish.

- Click on Continue.

- Choose the bank account you want to use to track your e-payments. It should match the bank account you provided when you enrolled with your state tax agency. Select Edit from the menu.

- Enter the routing and account numbers for your bank. Once you’re done, click Finish.

- Then select Finish Later.

Step 4: Complete and Sign Authorization Forms For The New State

QuickBooks Online Payroll

In QuickBooks Online Payroll, you’ll see a “To Do” item appear in your Payroll Overview, reminding you to review and e-sign the necessary authorization forms to complete the setup process.

QuickBooks Desktop Payroll

If you’re using QuickBooks Desktop Payroll Assisted, you’ll receive an email containing the necessary authorization forms along with instructions on how to sign and submit them. However, if you’re using QuickBooks Desktop Payroll Basic, Standard, or Enhanced, signing authorization forms is not required.

Completing these steps ensures your business stays compliant with state tax laws and your employees are paid accurately. Making sure you set up employees and payroll taxes in a new state correctly helps you avoid penalties and ensures smooth payroll processing as your team grows.

Summary

In short, setting up employees and payroll taxes in QuickBooks for a new state is essential for ensuring compliance with state-specific tax laws and maintaining smooth payroll operations. Whether your business is expanding into new regions or hiring remote workers, each state has its own set of payroll requirements, from state withholding to unemployment insurance.

QuickBooks’ Online and Desktop Payroll products provide flexible tools to help you manage these changes smoothly. The process of setting up new locations, entering accurate tax information, and signing authorization forms all play an important role in protecting your business from filing errors, penalties, or payroll delays.

If you complete the setup correctly, you’ll ensure that your employees are paid accurately and that your business remains in good standing with tax authorities. Whenever you need help, don’t hesitate to contact our QuickBooks Payroll ProAdvisor at toll-free number +1-888-245-6075.

Frequently Asked Questions

1. Select Employees from Payroll.

2. Pick the employee whose state tax info you want to change.

3. Click Edit under Tax withholding.

4. Update the state, filing status, and allowances in the State Withholding section.

5. Make any necessary adjustments to local or state taxes.

6. To save your changes, click Save.

No, QuickBooks does not automatically notify the state about new hires. It is the employer’s responsibility to submit a new hire report to the state agency within 20 days of hiring a new employee. For compliance, QuickBooks helps you manage payroll and employee data, but new hires have to be manually reported or you can use a third-party service that automates this process.

The QuickBooks Desktop Payroll software supports payroll for multiple states, so you can pay employees who work in different states. The handling of complex multi-state payroll situations, such as multiple state tax withholdings on a single paycheck or local taxes, may require manual adjustments. Multi-state payroll is also supported by QuickBooks Online Payroll, but with similar limitations. It is recommended to consult a payroll specialist for intricate cases.

1. Go to Edit > Preferences > Sales Tax.

2. Select the Company Preferences tab.

3. Select Add Sales Tax Item or Add Sales Tax Group.

4. Assign the correct tax agency to the state sales tax details.

5. Save and repeat for each additional state.