If you’ve ever tried keeping track of mileage using spreadsheets or handwritten notes, you know how frustrating it can be. Between client meetings, business errands, and daily commutes, managing travel expenses can quickly become a chaotic task. The good news is that QuickBooks Online makes it easy to record trips, categorize business miles, and claim the tax deductions you’re entitled to. With this, you can effortlessly track mileage in QuickBooks Online, ensuring every business mile is accurately logged without the hassle of manual entries.Whether you’re a freelancer meeting clients across town or a small business owner managing multiple company vehicles, this tool makes it easy to record trips, categorize business miles, and claim the tax deductions you deserve.

Whether you prefer manual entry or want the app to do the heavy lifting, QuickBooks gives you the flexible options to stay on top of your business’s travel expenses. In this blog, we’ll explain how to set up vehicles and mileage tracking in QuickBooks Online, so you can get started without any confusion. Today, you’ll also learn how to automatically track mileage using the QuickBooks mobile app, making it effortless to log every trip while you’re on the go. So, let’s dive in.

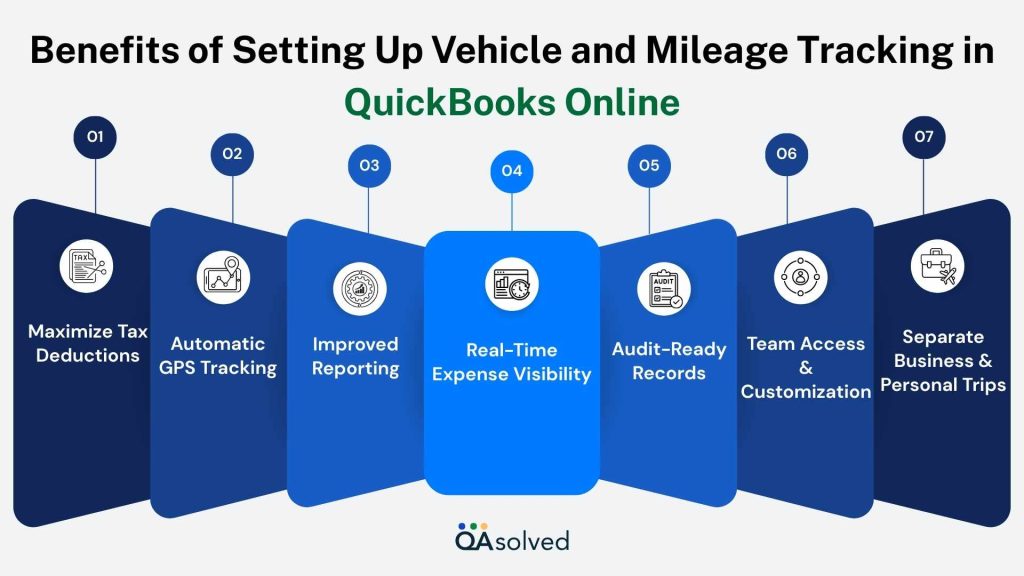

Benefits of Setting Up Vehicle and Mileage Tracking in QuickBooks Online

Setting up vehicle and mileage tracking in QuickBooks Online offers more than just convenience; it helps you take control of your business travel expenses in a smarter way. Instead of juggling paper logs or spreadsheets, you can keep all your trip details in one place, ensuring accurate records for tax deductions and reimbursements. Here are some advantages of the same:

1. Maximize Tax Deductions

QuickBooks Online automatically calculates mileage deductions using the latest IRS rates, ensuring that every eligible business mile is counted. This helps you maximize savings at tax time without the hassle of manual calculations.

2. Automatic GPS Tracking

With the QuickBooks mobile app, your trips can be logged automatically through GPS tracking. This minimizes human error, removes the need for manual entries, and ensures your mileage records are always accurate.

3. Separate Business and Personal Trips

QuickBooks makes it simple to categorize trips as either personal or business. This way, only the relevant business mileage is included in expense reports, keeping your records clean and compliant.

4. Real-Time Expense Visibility

By tracking mileage throughout the year, you maintain a running record of travel-related expenses. This provides better insight into spending patterns and helps improve both budgeting and operational decision-making.

5. Audit-Ready Records

Organized digital logs stored in QuickBooks Online save valuable time during audits or tax filings. Since the records meet IRS requirements, you can feel confident that your mileage reports will hold up under review.

6. Team Access and Customization

If you manage employees or contractors, QuickBooks allows for permissions and multi-user access. This makes it easier to track mileage across a team while customizing settings to suit your business needs.

7. Improved Reporting

Your QuickBooks dashboard provides detailed mileage summaries that can be viewed, exported, or printed. These reports make it easier to analyze travel costs and share data with your accountant or tax professional.

Whether you’re a solo entrepreneur or managing a small team, QuickBooks Online’s mileage tracking helps you stay organized, compliant, and financially informed. Now, let’s move ahead and address the focal points of this blog.

How to Set Up Vehicles and Mileage Tracking to Use the Mobile App Optimally?

Did you know that you can easily use the QuickBooks Online mobile app to track business vehicles and their mileage? If you’re already using it, that’s great! If not, don’t worry; we’re here to make this process simple and straightforward for you.

Before you start tracking trips with the QuickBooks mobile app, it’s essential to set up your vehicles and mileage tracking correctly. Doing so ensures that all your trips are accurately recorded, properly categorized, and ready for review or reporting. With the right setup, using the mobile app becomes smooth and efficient, whether you’re tracking business or personal mileage.

So, let’s take a look at how you can add and manage your vehicles, allow location access, turn on mileage tracking and business miles, and use other live activity features.

1. Add a Vehicle to QuickBooks

The steps to add a vehicle in QuickBooks vary depending on whether you’re using the web version, iOS, or Android app.

A. On a Web Browser

- Open QuickBooks Online and go to the Mileage section.

- Click the dropdown arrow next to Add Trip.

- Select Manage Vehicles, then click Add Vehicle.

Note: To update an existing vehicle, select it from the list, make your changes, and click Save. - Enter your vehicle’s details, such as make, model, and year.

- In the Tax Info section, choose how you want to track mileage for the year.

- Click Save to complete the setup.

B. On an iOS Device

- Open the QuickBooks app and tap on the Menu bar, then select Mileage.

- Tap Auto-tracking.

- In the Manage section, tap Vehicles.

- Click Add Vehicle.

Note: To update an existing vehicle, select it from the list, make the necessary changes, and tap Save. - Enter your vehicle’s make and model.

Tip: To set this as your primary vehicle, toggle the primary vehicle switch. You can also add additional details by tapping Optional Information. - Tap Save to complete the setup.

C. On an Android Device

- Open QuickBooks and click the Menu bar.

- Then select Mileage.

- Tap + New, then choose Vehicle.

- Tap Manage Vehicles, then select Add New Vehicle.

Note: To update an existing vehicle, tap the vehicle you want to edit, make your changes, and tap Save. - Enter your vehicle’s details, such as make, model, and year.

- Finally, click on Save to complete the setup.

2. Enable Location Access on Your Mobile Device

To enable auto-tracking, make sure QuickBooks has permission to access your device’s location. Follow the steps below based on whether you’re using an iOS or Android device:

A. On an iOS Device

Follow Apple’s instructions to set Location Services for QuickBooks to Always on your device. For the most precise trip tracking, make sure to also enable Motion & Fitness permissions.

B. On an Android Device

Follow Google’s instructions to enable location access on your device, and set it to Allow all the time. Also grant permission for Physical Activity for precise trip tracking.

3. Turn On Mileage Tracking

Activating automatic mileage tracking in the QuickBooks Online mobile app is a breeze, and the same steps work whether you’re on iOS or Android. Once it’s turned on, the app can automatically log your trips, making it super easy to keep your business mileage accurate.

Note: Before you start tracking mileage, make sure your vehicle information is added. Currently, only Primary Admin and Company Admin users can track mileage in QuickBooks Online, and each user can only see their own trips. To allow a driver to track mileage, you may need to update their user permissions.

Here are the steps to turn on mileage tracking in QuickBooks Online mobile app:

- First, Open your QuickBooks mobile app.

- Then, click on the menu bar and click on Mileage.

- Now, select Auto-tracking.

- Finally, Toggle the Switch to turn on the Auto-Tracking feature.

4. Make the Best Use of Live Activity Features for Trips

On an iPhone, you can use the Trips Live Activity feature to monitor your current allowable expenses in real time.

- Open the QuickBooks mobile app and either go to the Today tab and tap Track Trip from the Quick Actions menu, or open the Menu (☰) and select Mileage.

- Click on Track a Trip to start the process.

- Press Start to begin recording your trip.

- On the Add Destination screen, enter the destination address manually or choose from a list of previously used addresses.

- Once the trip begins, a Live Activity message will appear, and the Dynamic Island will display the trip details on your iPhone’s lock or home screen.

Note: This feature is only available on iPhone 14 models and above.

5. Manage Your Vehicles

Managing your vehicles in QuickBooks Online ensures that all mileage and trip data is accurately tracked and properly categorized. You can manage your vehicles in 2 ways. Let’s discuss them:

A. Assign a Primary Vehicle

If you have multiple vehicles, designate the one you use most often as your primary vehicle. QuickBooks will then automatically assign any auto-tracked trips to this vehicle.

Tip: You can easily assign a different vehicle when categorizing your trips.

Note: Only active vehicles can be set as your primary vehicle, and if you have just one vehicle, it automatically becomes the primary and cannot be deactivated.

There are different steps for different users.

a. On a Web Browser

- Navigate to Expenses and select Mileage.

- Click the dropdown arrow next to Add Trip, then choose Manage Vehicles.

- Select the vehicle you want to designate as your primary vehicle.

- Toggle the Set as Primary Vehicle switch to turn it on.

- Click Save to confirm your selection.

b. On an iOS Device

- Open the QuickBooks mobile app, tap the Menu bar, and select Mileage.

- Tap Auto-tracking.

- In the Manage section, tap Vehicles.

- Choose the vehicle you want to set as your primary.

- Toggle the Set as Primary Vehicle switch to turn it on.

Note: This will not change previously reviewed trips associated with your old primary vehicle. - Tap Confirm, then Save to finalize your selection.

c. On an Android Device

- Open the QuickBooks mobile app, click on the Menu bar, and then select Mileage.

- Tap + New, then choose Vehicle.

- Select the vehicle you want to designate as your primary.

- Turn on the Set as a Primary Vehicle switch.

Note: This will not affect any trips previously reviewed under your old primary vehicle. - Tap Confirm, then Save to complete the process.

B. Make a Vehicle Inactive

If you have vehicles you no longer use, you can mark them as inactive so they don’t clutter your list of active vehicles. This keeps your mileage tracking neat and organized.

Things to be aware of from the very beginning:

- You cannot mark a vehicle as inactive if it is currently set as the primary; you must assign another vehicle as the primary first.

- Any trips previously recorded with the vehicle will remain linked to it even after it’s made inactive.

- You can still export trips associated with inactive vehicles whenever needed.

a. On a Web Browser

- Go to Expenses and select Mileage.

- Click the dropdown arrow next to Add Trip, then choose Manage Vehicles.

- Select the vehicle you want to mark as inactive.

- Choose Vehicle No Longer in Use to move it to the Inactive section in your Manage Vehicles panel.

To reactivate a vehicle, follow the same steps, but select Activate. The vehicle will then return to your list of active vehicles.

b. On an Android Device

- Open the QuickBooks mobile app, tap the Menu (☰), and select Mileage.

- Tap Auto-tracking.

- In the Manage section, tap Vehicles.

- Select the vehicle you want to mark as inactive.

- Tap I no longer use this vehicle.

- Review the confirmation prompt, then tap Confirm. This moves the vehicle to the No Longer in Use section of your Vehicles page.

Note: You can easily add as many vehicles as you need.

6. Add and Edit Your Favorite Locations

You can create and manage a list of your favorite locations, making trip tracking a breeze. When it’s time to review your mileage, these saved spots will automatically pop up, saving you time and ensuring your trips are accurately categorized. Here are the steps:

- Login to your QuickBooks Online account.

- Navigate to the Expenses.

- Click on Mileage

- Now, in the Add trip dropdown, click on Manage Favorite Locations.

- Once this is done, select Add Favorite Location or you can also choose an existing location to make edits.

- Now, manually enter the address in its respective field.

Note: QuickBooks may come up with auto-suggestion of the locations as you type. - Enter a Name to your new location.

- Finally, click on Save.

7. Track Business Miles

Now that everything is set up, let’s take a look at how you can start tracking your trips using the QuickBooks Online mobile app. Continue reading our next section to successfully track the business miles.

Note: Only accountants can see the Download your client’s trip log option. Primary Admins cannot access it; only firm users have permission to view this page.

How to Automatically Track Mileage in QuickBooks Online?

Tracking mileage in QuickBooks Online is a simple way to keep all your travel-related expenses organized in one place. Instead of relying on manual logs or guesswork, the platform allows you to record trips, separate business and personal mileage, and ensure your records are accurate for tax purposes. So, let’s discuss how to turn on mileage tracking in QuickBooks Online.

Step 1: Review and Update Driver Permissions

Before you begin tracking mileage, make sure your driver has the right user permissions. In QuickBooks Online, only admin users are allowed to track mileage, so you may need to adjust permissions to give access if it hasn’t been set up already. Here’s how to Change the User Permissions.

Step 2: Switch On Mileage Tracking and Add a Vehicle

Next, enable the mileage tracking feature in QuickBooks Online. Once it’s turned on, you can add your vehicle details, such as the make, model, and year. If you forgot to set up the automatic mileage tracking feature, simply follow the steps outlined in the third point of the previous section. Also, before you begin tracking trips, you need to add your vehicles to QuickBooks Online. This ensures that each trip can be accurately matched to the correct vehicle later on.

Step 3: Track Business Miles

Whenever you begin a drive, just open the QuickBooks Online mobile app on your phone. Keep the app running throughout the trip, and it will automatically detect and record the miles from start to finish. Or, you can add a trip manually with the help of these steps:

- First, open QuickBooks Online.

- Then, click on Add Trip.

- Enter Trip Details like Date, Start and End Locations, Distance, and the Purpose.

- Then, select the Vehicle.

- Finally, save the Entry.

Step 4: Categorize Your Mileage

Once you reach your destination, review the trip to categorize it in real-time. Here are the steps:

A. For Android and iOS Devices

- Launch the QuickBooks mobile app on your device.

- Tap the menu (☰) icon and choose Mileage from the list.

- Go to the Unreviewed tab to view your recorded trips.

- Locate the trip you want to update. Swipe left to mark it as Business, or swipe right to mark it as Personal.

- Enter the purpose of the trip for your records.

- Select the vehicle used for that trip.

- Tap Save to confirm your changes.

B. For Web Browsers

- Open QuickBooks Online.

- Locate the trip you want to update and tick the checkbox next to it.

- Choose Mark as Business or Mark as Personal to set the trip type.

- Go over the trip details to make sure everything is correct.

- If you need to adjust the location or distance, open the trip, make the necessary edits, and then click Save to update it.

Step 5: Review, Edit, or Export Trips

Once your trips are recorded in QuickBooks Online, you have the flexibility to review, edit, or export them whenever needed. Follow the steps:

- Log in to your QuickBooks Online account using a web browser.

- Open the Mileage section and choose from the Unreviewed, Business, Personal, or All tab.

- Locate and click on the trip you’d like to update.

- Make the necessary edits to the trip details.

- Click Save to apply the changes.

Here are the steps to export your mileage data:

- Open QuickBooks Online.

- Click the dropdown arrow next to Add Trip.

- Choose Download Trips to export your mileage records.

QuickBooks Online downloads all your trips to your computer in the format of a CSV file. You can locate it in your Downloads folder.

So, these are the steps that can help you track mileage with QuickBooks Online. The QBO mileage tracker makes it easy to record mileage accurately with minimal effort. In case you have any queries, don’t hesitate to contact us for immediate QuickBooks Online assistance.

Summary

In short, tracking business mileage doesn’t have to be a tedious or error-prone task. With QuickBooks Online, managing your vehicles, recording trips, and categorizing mileage is easier and more accurate than ever. By setting up your vehicles correctly, enabling automatic tracking, and making use of features like Live Activity and favorite locations, you can streamline the entire process and save valuable time. Whether you prefer manual entries or let the mobile app handle the tracking automatically, QuickBooks ensures that every mile is properly recorded and ready for reporting or tax deductions.

For businesses and freelancers alike, maintaining accurate mileage logs not only simplifies expense management but also maximizes potential tax benefits. Features like primary vehicle settings, the ability to make vehicles inactive, and exporting trips help you stay organized and maintain clean, audit-ready records. Plus, with the QuickBooks mobile app, you can properly track mileage in QuickBooks Online on the go, ensuring that every trip is recorded accurately and nothing is missed.

Ultimately, by leveraging QuickBooks Online’s powerful mileage tracking tools, you can focus less on paperwork and more on growing your business. Accurate, hassle-free mileage management is just a few taps away, giving you peace of mind and better control over your travel expenses.

Frequently Asked Questions

To set up mileage reimbursement, first create a dedicated expense account. Go to your Chart of Accounts, select New, and from the Account Type dropdown, choose Expenses. Then, under Detail Type, select Auto or Travel. Give the account a clear, unique name that’s easy to identify, such as “Mileage Reimbursement,” and click Save. Once set up, you can record mileage expenses and reimburse employees accurately.

1. Log into QuickBooks Online as a Primary Admin or Company Admin (only admins can track mileage).

2. Click on the Mileage tab on the left.

3. Select Add your vehicle to add vehicle details (make, model, etc.).

4. Download and open the QuickBooks Online app on your mobile device.

5. QuickBooks will be able to track your trips automatically if you allow location access when prompted.

6. Go to the Menu > Mileage > Auto-tracking and turn it on.

QuickBooks will automatically record your trips once you set it up.

1. Access the Gear icon.

2. Choose Payroll Settings (for payroll checks) or Check Printing Setup (for regular checks).

3. Select Alignment check or Print setup.

4. Choose the type of check you want (Voucher or Standard).

5. Print a sample check on plain paper.

6. Align the sample with a real check.

7. Use the grid to align vertically and horizontally if it doesn’t line up. If it doesn’t line up, click No, it doesn’t line up.

8. Print the test again until the alignment is correct.

9. Click Done.

1. Log in to QuickBooks Online.

2. Click on the Mileage tab on the left.

3. Choose the Settings gear icon at the top right of the Mileage page.

4. Select Add rate or Edit next to the current rate under Mileage Rates.

5. Specify the new mileage rate and its effective date.

6. Enter Save.

1. Location Permissions are Off: Enable location access on QuickBooks on your mobile device (set to “Always” on iOS or “Allow all the time” on Android).

2. Low Power Mode is On: Battery saver modes may prevent background tracking.

3. App Not Updated: Make sure your QuickBooks Online mobile app is up-to-date.

4. Background App Refresh is Disabled: This can prevent the app from tracking trips.

5. You’re Not an Admin: QuickBooks Online only allows mileage tracking for Primary and Company Admins.

Restart the app and double-check these settings to see if tracking resumes.