Managing payroll taxes is indeed one of the most hectic and crucial tasks for a company. With ever-evolving regulations and tight deadlines, staying on top of the payroll taxes has become more important than ever. But what if there was a way to make the entire process smoother and more efficient? Well, that is exactly when QuickBooks comes into the picture.

QuickBooks Desktop’s Federal E-File and E-Pay features make it easy for businesses to manage payroll and taxes. The IRS Form 941, also known as the Employer’s Quarterly Federal Tax, is an important tax form for companies. Businesses must use this form since it reports the income and payroll taxes withheld from employees’ paychecks. Unlike individual taxpayers, businesses must file Form 941 quarterly instead of once a year.

Enhanced Payroll features in QuickBooks Desktop simplify the process of managing payroll. As a result, payroll calculations are done automatically with direct deposits and detailed payroll reports are generated, ensuring accuracy and compliance. The exceptional features also allow you to file Form 941 and make payments from the software electronically.

What is the 941 Form for Employers?

As we said, the IRS Form 941 stands for Employer’s Quarterly Federal Tax Return. Filing this form ensures that businesses are synched with the tax regulations of the US authorities and allows them to run their operations seamlessly. Today, many growing enterprises have shifted from traditional to advanced bookkeeping and accounting methods. One such solution for them is QuickBooks. Filing such important tax forms with QuickBooks enables businesses with features like accurate financial data, timely submissions, and prevention of hefty penalties.

In this blog, we will highlight the process of setting up the Federal e-file and e-pay for business instructions in QuickBooks Desktop to ensure compliance and efficient payroll tax management.

Steps to Setup Federal E-file and E-pay 941 in QuickBooks Desktop

Below are the steps for setting up the e-pay and e-file process in QuickBooks Desktop:

Getting Started Requires a Few Things:

- Your Federal Employer Identification Number (EIN).

- Your State Account Number.

- Your deposit schedule or payment frequency.

- Your contact number and email address.

For Electronic Payments or E-pay:

- You have a QuickBooks Desktop Payroll Enhanced account.

- Your bank account information

- Your EFTPS PIN and password.

Note: If you don’t have an EFTPS PIN and password, contact the IRS to register.

1. Enroll and Setup for Federal Taxes E-Payment

Step 1: Enroll in the IRS Electronic Federal Tax Payment System (EFTPS)

Enroll if you started your business after 2011

Note: You are required to enroll in EFTPS once. If you’re not sure about your enrollment, then connect with the IRS 1.800.555.4477.

Enrollment for businesses that started before 2011

- Visit EFTPS.gov and click on the Enrollment tab. You will need to follow the instructions on-screen to enroll.

- It takes 7 to 10 business days to receive your enrollment number and PIN by mail.

- Note: To receive your PIN, you must pay the IRS within two business days of enrolling. If your information matches IRS records, an agent can assist you. For security reasons, PINs cannot be given over the phone.

- When you receive your 4-digit EFTPS PIN:

- Visit EFTPS.gov.

- Hit the Login tab.

- Enter the required information (EIN, 4-digit EFTPS PIN, bank account, or the last eight digits of your enrollment number).

- Create a password to complete the process.

Step 2: Schedule and Setup your Tax Payments to E-pay

- Go to Employees, select Payroll Taxes and Liabilities, and Edit Payment Due Dates/Methods.

- Next, choose Pay Scheduled Liabilities.

- Note: Tax regulations differ from state to state. Some states allow electronic payment and filing, while others mandate that they must be done separately. Electronic payment and filing are not available in all states.

- Choose the liability to pay, then the View/Pay button.

- Select federal 941, 944, and 943.

- The amount due will appear on the liability payment screen. Taxes are listed under the payroll liabilities tab.

- For electronic payment, select ‘e-pay’ to pay your taxes online.

- The option to e-pay will appear if you have setup electronic payment.

- To pay your taxes electronically, select E payment.

- You must enter your four-digit PIN, EFTPS PIN, EFTPS Internet password, and login contact information for federal tax payments.

- State taxpayers only need to enter a phone number and email address.

- Hit Submit when you’re done.

- You may still pay by check if the e-pay is not setup.

- QuickBooks selects the check radio button when you process your payment.

- Enter Save and Close.

- Ensure your printer and checks are ready before you choose print checks.

- Next, hit close the window.

- Your electronic and check payments can be viewed under Payment History.

Your payroll taxes and liabilities have been paid successfully.

2. Enroll and Setup E-file

Step 1: Setup your Federal Filing Method

- Access the Employees section and select Payroll Tax Forms & W-2s.

- Next, click on Process Payroll Forms.

- Click Other Activities, then Manage Filing Methods.

- Click on Filing Methods, select a federal form (such as Federal 941/944/943 or Federal Form 940), and hit Edit.

- Select Filing As Responsible Individual (Owner/Partner/Corporate Officer) for a single FEIN under “Select how you want to file…”.

- Once you have selected the E-file, enter Finish.

If you haven’t signed up for the IRS e-file program, follow the steps below:

Step 2: Enroll in the IRS E-file Program

- Select Enrollments under Filing Methods.

- Choose IRS and then click Edit.

- Follow the on-screen prompts to verify your EIN and provide your company’s legal name and address. Enter Next.

- Provide the IRS with your name, job title, email address, and phone number.

- Note: Ensure this contact represents your company, not a third-party provider or accountant.

- Enter Send Information.

- Note: It could take up to 45 days to receive your 10-digit E-file PIN.

Conclusion

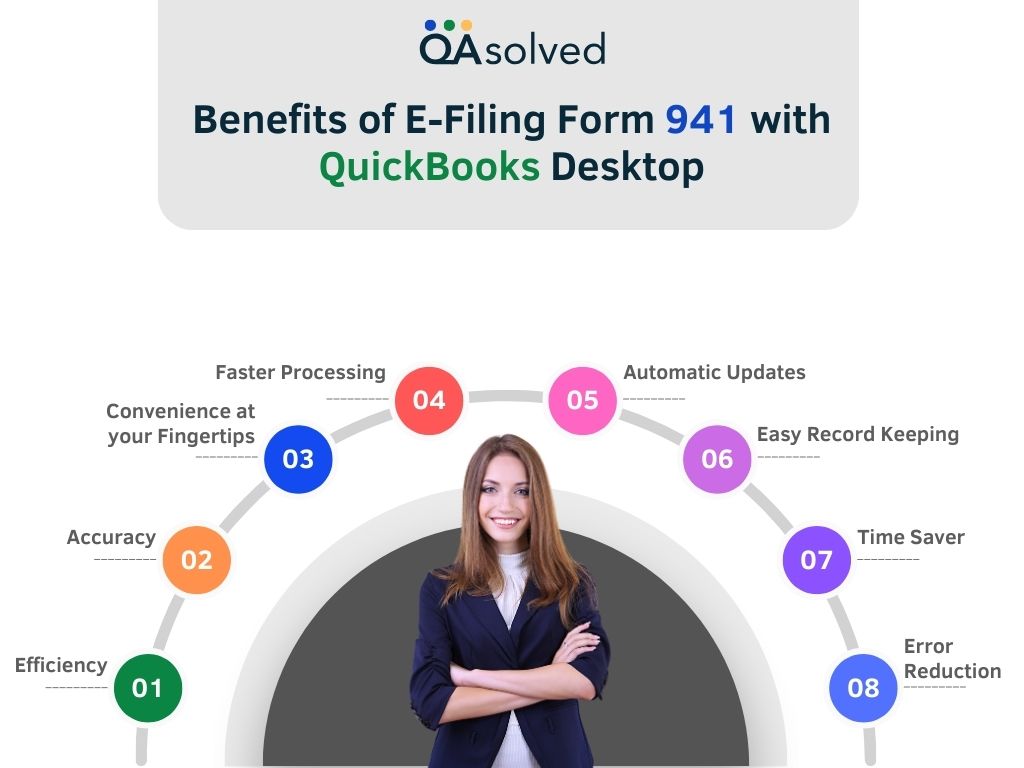

Setting upfederal e-file and e-pay for Form 941 in QuickBooks Desktop is a simple process that enhances payroll management efficiency. Following these steps will ensure that you file accurately and make timely payments to the IRS, reducing penalties and interest. With Federal E-File and E-Pay, you can focus more on your business operations while saving time and improving compliance with IRS regulations.

If you’re still facing issues with the same, then QuickBooks experts are here to provide you the best QuickBooks Desktop support service. You can directly reach out at toll-free number: +1-888-245-6075.

Frequently Asked Questions

1. Launch QuickBooks Desktop Payroll Setup.

2. Select the File Forms tab in the Payroll Center.

3. In the Other Activities section, pick Change Filing Method.

4. Click on Continue.

1. Select the Reports menu.

2. Select Find report by name and search for Payroll Summary.

3. From the drop-down menu, select a date range.

4. Pick an employee or group of employees.

5. Once you’re done, hit Run Report.

It is essential to pay your federal taxes and file the necessary payroll forms on time throughout the year. In QuickBooks Desktop Payroll Enhanced, you can pay and file your 941/944, and 940 taxes and forms electronically.

1. Click on Taxes, then Payroll Tax.

2. Select Quarterly Forms or View and Print Archived Forms to access archives of prior periods’ forms.

3. To access the 941 link.

4. Simply click Preview. Print or download the form in PDF format.

1. Create or modify your federal tax form (941, 944, 943)

2. Pick Payroll Settings under Settings.

3. Choose Edit next to Federal tax.

4. In response to “How often do you pay your taxes?” choose Edit.

5. Choose which form to file, when to pay your taxes, and the effective date of the form.

6. Save your work, then click Done.