Managing finances is the backbone of any successful business, and one essential practice that ensures financial accuracy is bank reconciliation. Whether you’re a small business owner, an accountant, or simply someone trying to keep books in order, understanding how to reconcile your bank statements can save you from costly errors and provide a clear picture of your cash flow. This process helps you catch discrepancies, prevent fraud, and ensure your records align with your bank’s transactions.

In this blog, we’ll break down three types of bank reconciliation, why it’s prominent for businesses, and how you can simplify the process to maintain impeccable financial health.

So, let’s dive in!

What is Bank Reconciliation?

Bank reconciliation is the process of comparing a business’s financial records, such as its accounting ledger, with the bank statement to ensure that both matches. This process helps identify any discrepancies between the two, such as outstanding checks, deposits in transit, or bank fees that may not yet be recorded in the business’s books. Regular bank reconciliation is essential for maintaining accurate financial records, as it ensures that the company’s cash balance is correctly reflected, and any errors are promptly identified and corrected.

The goal of bank reconciliation is to ensure that the business’s accounting records accurately reflect the available balance in its bank account. It also helps in detecting fraud, preventing errors, and understanding cash flow. By reconciling regularly, businesses can ensure they are managing their finances properly, reducing the risk of errors and fraud, and improving overall financial control.

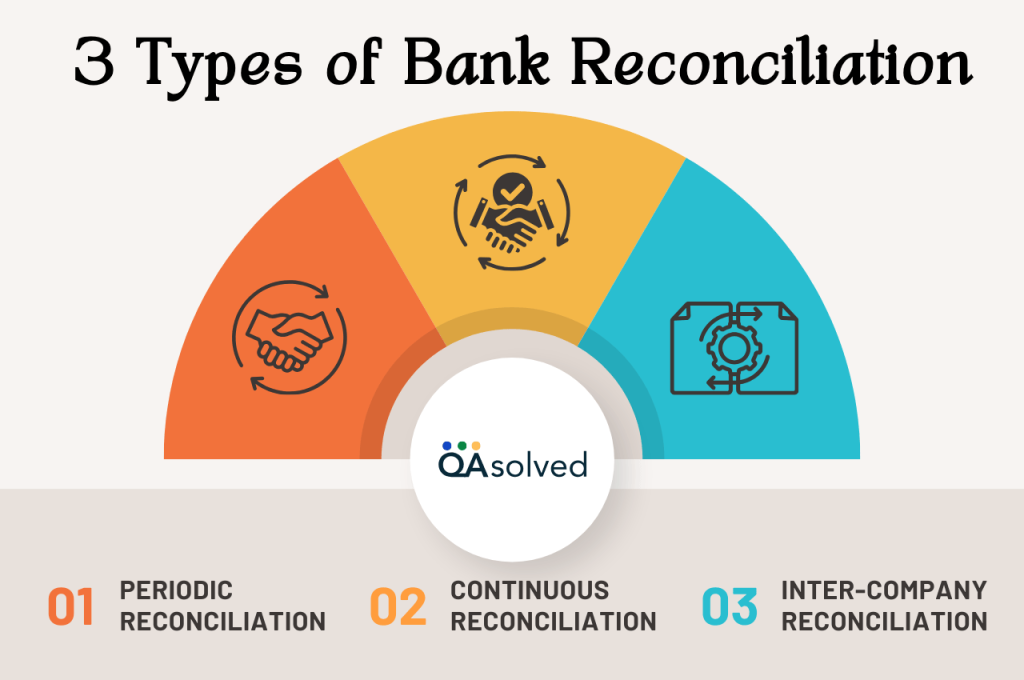

What are the 3 Types of Bank Reconciliation?

If you’re a finance or accounting professional, then you must know the three types of bank reconciliation that can help you manage the books and business effectively. Here’s a brief explanation of each:

- Periodic Reconciliation

This is one of the most common and effective types of reconciliation that helps professionals keep their books sound from every minor and major error. Periodic reconciliation is done at regular intervals such as weekly, monthly, or quarterly. Businesses compare their bank statements to their accounting records at the end of each period. Any discrepancies are identified and corrected at that time. It’s a more traditional and suitable approach for businesses with fewer transactions or those that don’t require real time tracking.

- Continuous Reconciliation

Unlike periodic reconciliation, continuous reconciliation is an ongoing process. Businesses reconcile their bank transactions against their accounting records in real-time or on a daily basis. This method ensures that any discrepancies are identified and resolved immediately, helping businesses stay on top of their financial records. It’s particularly useful for high-volume businesses that need to maintain accuracy at all times.

- Inter-Company Reconciliation

This type of reconciliation is typically used by businesses with multiple branches or subsidiaries. It ensures that transactions between different entities within the same organization are properly recorded and balanced. It helps ensure that intercompany transactions, such as transfers, loans, or shared expenses, are accurately reflected in each company’s financial records

So, these are three types of bank reconciliation that every finance and accounting professional should be aware of. Now, let’s explain the benefits and importance of bank reconciliation.

Also Read: How to Reconcile a Bank Account in QuickBooks Online?

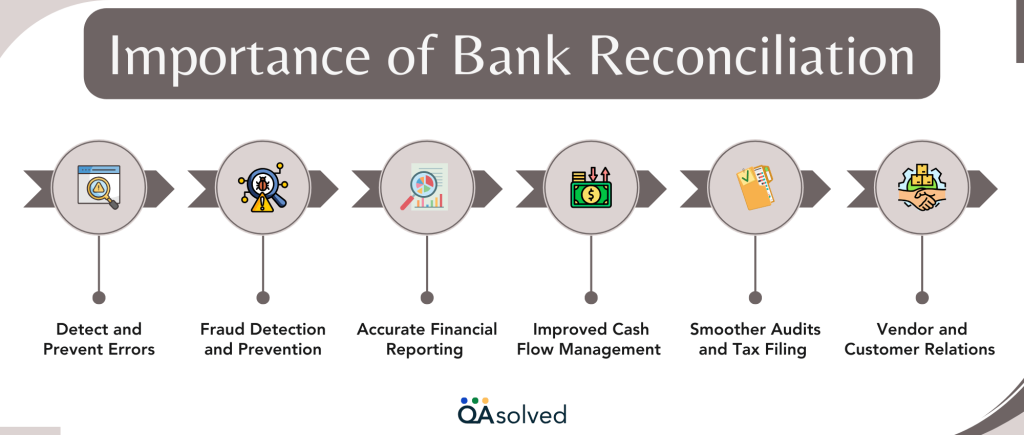

What is the Importance of Bank Reconciliation?

Bank reconciliation is more than just a routine accounting task — it’s a vital part of maintaining financial accuracy and stability. Regularly reconciling your bank statements ensures that your records are up to date, helps you catch discrepancies early, and keeps your business financially healthy. Let’s explore why this process is so important:

- Detect and Prevent Errors

Mistakes happen—from data entry errors to bank processing issues. Reconciliation helps you catch duplicate entries, incorrect amounts, or forgotten transactions so you can correct them before they cause bigger issues.

- Fraud Detection and Prevention

Regularly comparing your books with bank statements can uncover unauthorized transactions or suspicious activity. Early detection helps prevent financial loss and strengthens your internal controls.

- Accurate Financial Reporting

Accurate books lead to accurate reports. Reconciliation ensures your financial statements reflect your true cash position, helping you make informed business decisions based on reliable data.

- Improved Cash Flow Management

Knowing exactly how much cash is available prevents overdrafts, missed payments, or unnecessary penalties. It also helps you plan for upcoming expenses and allocate funds more strategically.

- Smoother Audits and Tax Filing

Clean, reconciled records make audits and tax filing much easier. You’ll have organized documentation, minimizing the risk of compliance issues or penalties due to misreported financials.

- Strengthened Vendor and Customer Relations

Reconciling payments ensures you don’t accidentally miss invoices or payments, building trust with vendors and customers alike. It keeps your transactions transparent and your business relationships solid.

By incorporating regular bank reconciliations into your financial routine, you safeguard your business from preventable risks and lay the foundation for long-term financial success. In the next section, we are going to highlight the crucial aspects of bank reconciliation that a user should know.

Also Read: How to Undo Reconciliation in QuickBooks Online?

What are the Benefits of Bank Reconciliation for Businesses?

Here are the benefits of a regular bank reconciliation process for every business enterprise.

- Aids in Business Growth

Accurate financial records, achieved through regular bank reconciliation, provide a solid foundation for business growth. These records offer insights into your cash flow, expenses, and profitability, which are crucial for aspirational individuals to make decisions about expansion or seeking investment opportunities.

- Enhances Internal Controls

Bank Reconciliation strengthens internal controls by establishing a routine check-and-balance system. This process helps reduce the likelihood of fraud, errors, and unauthorized transactions within the organization, creating a more secure financial environment.

- Supports Financial Planning and Analysis

When your bank statements are reconciled, you have reliable financial data to work with. This data serves as the foundation for effective financial planning and analysis, leading to better forecasting and informed strategic decisions. Whether planning for growth, budgeting, or evaluating performance, reconciled statements provide the clarity you need.

So, these are the primary benefits of reconciling with your bank on a regular basis. Let us now move ahead and understand the difference between manual bank reconciliation and automated bank reconciliation.

Manual Bank Reconciliation Vs Automated Bank Reconciliation

Bank reconciliation can be performed either manually or through automated accounting software. Both approaches come with their own features, advantages, and limitations. The table below outlines a comparison between manual and automated bank reconciliation.

| Aspect | Manual Bank Reconciliation | Automated Bank Reconciliation |

|---|---|---|

| Process | Involves Physically checking and matching bank statements against internal financial records. | Uses software to automatically match transactions, reducing the need for manual input. |

| Time Consumption | Manual reconciliation can be slow and tedious, especially with a high volume of transactions. | Processes transactions quickly, handling large volumes with ease. |

| Accuracy | More susceptible to human errors during data entry and transaction matching. | Minimizes errors by automating the matching process, boosting accuracy. |

| Requirements | Manual reconciliation requires significant human effort and resources to complete. | Automated processes help in reducing manual labor, allowing teams to focus on more strategic tasks. |

| Error Detection | Erros may linger undetected for long periods. | Flags discrepancies and mismatches almost instantly |

| Reporting | With manual reconciliation, the reporting capabilities are often limited which leads to additional manual processes. | Automated reconciliation offers detailed reports and insights at the click of a button. |

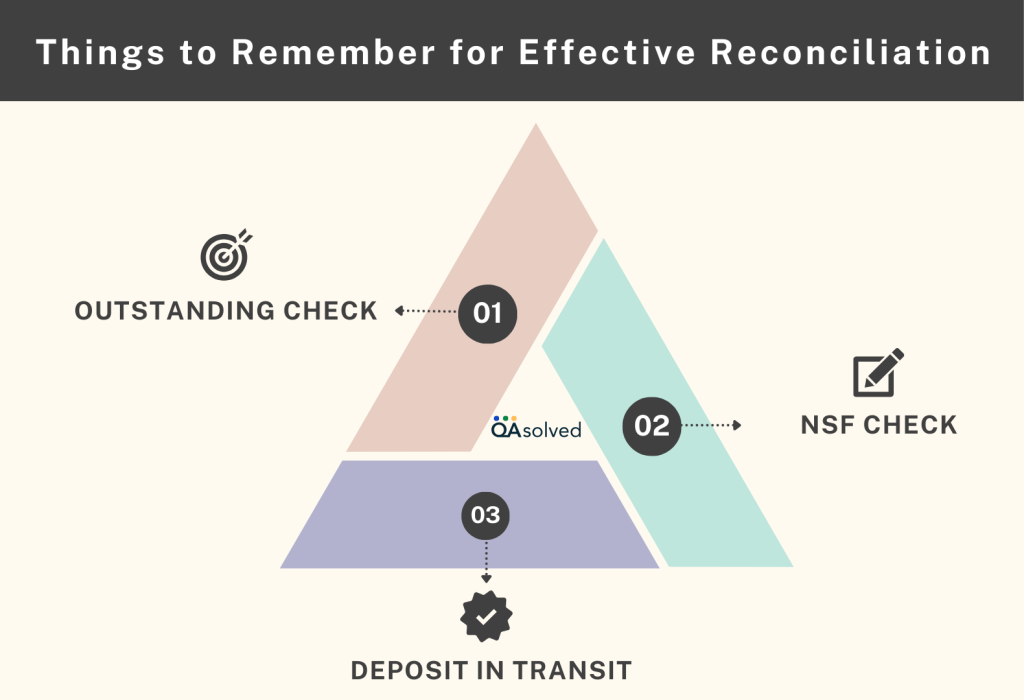

3 Things to Remember for Effective Bank Reconciliation

There are three aspects that every aspirational finance professional should be aware of. Here are the things to remember:

- Outstanding Check:

An outstanding check occurs when a company receives a check but hasn’t yet deposited it, or when a deposited check hasn’t cleared the bank. It can also refer to a check issued by the company that the recipient hasn’t yet deposited.

- NSF Check:

When a company deposits a customer’s check, but there aren’t enough funds to cover the payment, the transaction fails. This is also known as a non-sufficient funds (NSF) check, or a bounced check. In such cases, the money doesn’t reach the recipient’s account, and both the payer and recipient may face bank fees.

- Deposit in Transit:

A deposit in transit happens when a company receives a payment, but the funds haven’t yet appeared in the bank account. For example, if a deposit is made late in the day, it might not be processed until the following day. Delays can also happen if checks are mailed or left undeposited at the office.

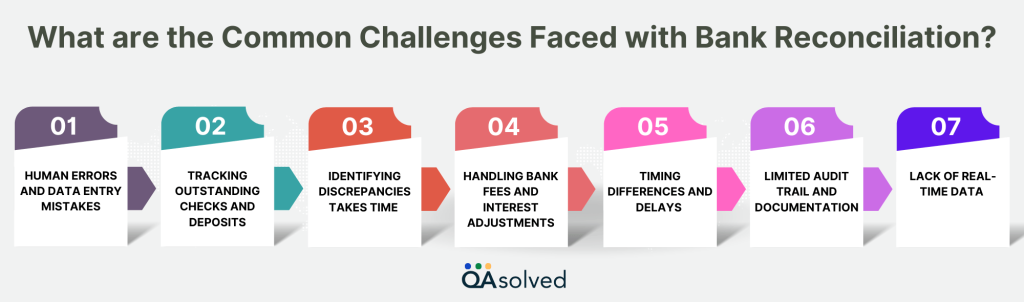

What are the Common Challenges Faced with Bank Reconciliation?

Reconciling bank statements can be a time-consuming and error-prone task, especially without the support of accounting software. Let’s break down some of the most common challenges businesses face during this process:

- Human Errors and Data Entry Mistakes

Manually tracking transactions increases the risk of simple human errors, like typos, transposed numbers, or incorrect amounts. Even small mistakes can throw off your entire reconciliation, making it hard to balance your books.

- Tracking Outstanding Checks and Deposits

Without software to flag outstanding items, businesses may lose track of uncashed checks or delayed deposits. This makes it difficult to understand the true cash balance and can lead to inaccurate financial records.

- Identifying Discrepancies Takes Time

Finding the root cause and source of mismatches between records and bank statements can be like searching for a needle in a haystack. Manually comparing transactions line by line can drain valuable time and delay month-end closings.

- Handling Bank Fees and Interest Adjustments

Banks may deduct fees or add interest that businesses only catch when receiving statements. Manually updating records for these adjustments—and remembering to account for them—adds another layer of complexity.

- Timing Differences and Delays

Payments made near the end of the month might not appear in bank statements until the next cycle. Without automated tracking, it’s easy to overlook timing differences, causing temporary imbalances in your records.

- Limited Audit Trail and Documentation

Manual reconciliation often lacks a clear, organized audit trail. If records are scattered across paper statements and handwritten, it becomes difficult to justify entries or provide documentation during an audit.

- Lack of Real-Time Data

When relying on conventional processes, you’re always working with historical data and have very limited knowledge of what’s going on in real time. Without real-time updates, it’s almost impossible these days to make informed financial decisions and eliminate the scope of discrepancies. On top of that, the lack of on-time updates can further go unnoticed until the next reconciliation cycle.

These are some of the common challenges that people face while reconciling their banks. In today’s competitive business landscape, it has become imperative for MSMEs and CPAs to look for the ideal accounting solutions that can help them streamline their processes with ease.

Many industry experts believe that platforms like QuickBooks and others are ideal for experienced professionals like CPAs, solopreneurs, and even enterprises to reconcile their banks and accounts effortlessly. QuickBooks not only helps accounting professionals to manage bank accounts in QB Online but also reconciles bank and credit card accounts in QB Desktop.

In a Nutshell

Bank reconciliation is a crucial process that ensures your financial records align with your bank statements, helping you maintain accuracy, prevent fraud, and make better decisions. Understanding the different types, recognizing the benefits, and being aware of potential challenges can empower you to fortify your accounting processes and ultimate results.

Fortunately, tools like QuickBooks make reconciliation easier by automating transaction matching, reducing errors, and saving valuable time. Whether you’re managing a small business or handling complex accounts, QuickBooks simplifies the reconciliation process, so you can focus on growing your business instead of getting stuck in paperwork.

If you’re facing any issues with bank reconciliation in QuickBooks, we’re here to provide the best solution. Call us directly at +1-888-245-6075.

Let’s get your accounts back on track!

Frequently Asked Questions

Bank reconciliation in QuickBooks involves matching the transactions in your bank statement with those recorded in the software. By carefully reviewing the dates and amounts, you can ensure that all transactions are accurately accounted for. Once everything aligns, you’ll know your records are complete and up to date. Click the link if you want to reconcile bank account in QuickBooks.

The bank reconciliation process typically involves six steps: comparing your bank statement with your cash records, reviewing the statement, identifying cash book entries, adjusting both bank and book balances, and finally, documenting the reconciliation to ensure everything aligns.

If you’re consistently struggling with bank reconciliation in QuickBooks, start by double-checking dates, transaction amounts, and any missing entries. Verify that no duplicate transactions exist and review bank fees or adjustments that might cause discrepancies.