When it comes to managing your business finances and staying compliant with IRS regulations, understanding the paperwork involved is just as important as tracking your income. One of the most common areas of confusion for both employers and employees is understanding the difference between W-2 vs W-4 forms. Whether you’re starting a new job or preparing for tax season, you’ll come across several key forms that play a crucial role in determining how much tax you pay, and how much you might get back. Among the most common yet often misunderstood tax forms are the W-2 and W-4 forms.

While they might seem similar at first glance, they serve entirely different purposes in the payroll and tax process. In this blog, we are first going to explain the meaning and will then highlight the key benefits of both the forms. Most importantly, we will draw a clear comparison between W-2 and W-4 forms to help you understand the difference between both the forms.

In short, By the end, you’ll have a clearer picture of how the W-4 and W-2 form impact your paycheck and your year-end tax filing. So, let’s get started!

What is the Meaning of W-2 and W-4 Forms?

Before diving into the differences between W-2 and W-4 forms, it’s important to have a basic understanding of what each form represents and why they play a crucial role in the U.S. tax system.

Meaning of W-2 Form

A W-2 form, officially known as the Wage and Tax Statement, is a legal tax document that employers are required to send to both the IRS and their employees at the end of each tax year. It details the employee’s total wages, tips, and other compensation received during the year, along with the taxes withheld—such as federal income tax, Social Security, and Medicare. Legally, every employer must provide a W-2 form to each employee by January 31st to ensure timely and accurate tax filing.

The information on this form is essential for employees when preparing their annual tax return, as it shows how much tax has already been paid on their behalf. The IRS uses the W-2 to verify income and ensure proper tax reporting. Unlike independent contractors who receive a 1099 form, only employees receive W-2s, making this form a critical component in distinguishing legal employment classifications.

Read More: How to Print W-2 in QuickBooks Desktop and Online?

Meaning of W-4 Form

A W-4 form, officially titled the Employee’s Withholding Certificate, is a legal document that employees complete and submit to their employer when starting a new job or experiencing major life changes, like marriage or having a child. This form tells the employer how much federal income tax to withhold from the employee’s paycheck based on their filing status, dependents, and other adjustments. Unlike the W-2, which reports annual earnings, the W-4 form affects how much tax is taken out of each paycheck throughout the year.

Submitting an accurate W-4 ensures the correct tax amount is withheld, helping employees avoid underpayment penalties or large tax bills when filing. Since tax situations vary, employees are legally encouraged to review and update their W-4 forms regularly to reflect any changes in income or personal circumstances.

Now that you have a clear understanding of the basic distinction between the W-2 and W-4 forms, let’s dive into the specific differences between them.

What is the Difference Between W-2 and W-4 Forms?

While both the W-2 and W-4 forms are essential components of the U.S. tax system, they serve very different purposes. Here’s a table that correctly explains the true meaning of W-2 vs W-4 forms.

| Feature | W-2 Form | W-4 Form |

| Purpose | Reports annual earnings and taxes withheld. | Instructs employers on how much tax to withhold. |

| Who Fills It Out | Employer | Employee |

| When It’s Completed | At the end of each tax year (Usually by January 31st) | At the start of employment or after personal changes |

| Submitted to | IRS and employee | Employer only |

| Affects Tax Filing? | Yes – It is used to file income taxes. | Indirectly – It affects how much tax is withheld. |

| Legal Requirements | Employers must issue it annually. | Employees must complete it to start a job. |

| Can It Be Updated? | No – it’s a year-end document. | Yes – anytime when personal or financial status changes. |

| Used By | Tax preparers and IRS for verifying income. | Employers for calculating paycheck tax withholding. |

Hence, Understanding the unique roles of the W-2 and W-4 forms can help you stay better prepared during tax season and avoid unnecessary surprises. While both forms are connected to your income and taxes, they function differently within the payroll and reporting process.

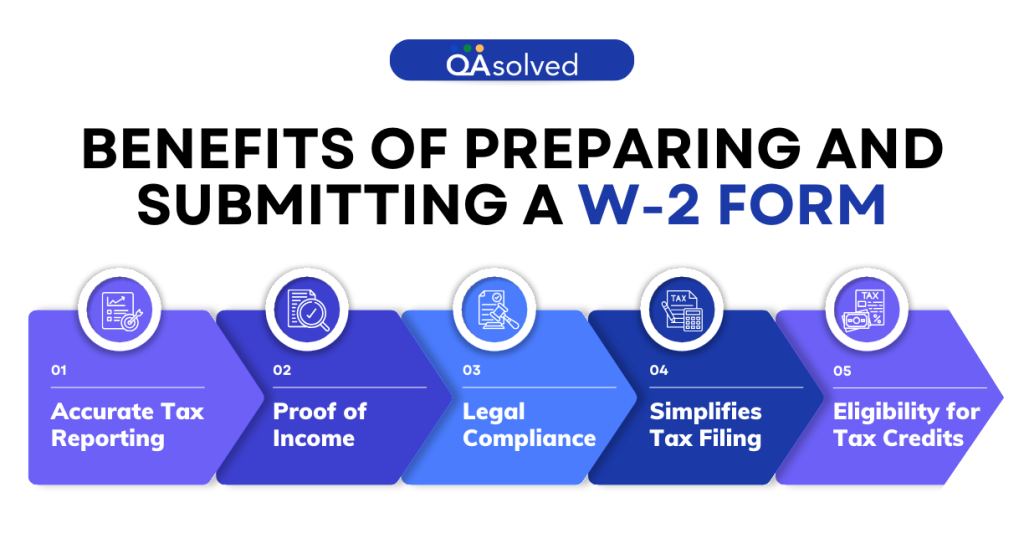

Benefits of Preparing and Submitting a W-2 Form

Preparing and submitting a W-2 form is an essential part of the year-end payroll process for employers and a vital document for employees during tax season. This form ensures that income and tax-related information is properly communicated to both the employee and the IRS. Here are the 5 benefits of preparing and submitting a W-2 form on time:

1. Accurate Tax Reporting

The W-2 form provides a detailed summary of an employee’s annual earnings and tax withholdings, making it easier to report income accurately to the IRS during tax season.

2. Proof of Income

It serves as official documentation of income, often required when applying for loans, mortgages, rental agreements, or financial aid.

3. Legal Compliance

Employers meet their legal obligation by issuing W-2 forms, helping both parties avoid penalties or audits from the IRS.

4. Simplifies Tax Filing

Tax software and professionals use the W-2 to auto-fill tax returns, streamlining the filing process for employees.

5. Eligibility for Tax Credits

The form helps determine eligibility for tax credits like the Earned Income Tax Credit (EITC) or Child Tax Credit, which can lead to substantial refunds.

So, these are the five benefits of preparing and submitting W-2 forms in order to avoid legal penalties from the IRS.

Also Read: How to Setup Federal E-File and E-Pay 941 in QuickBooks Desktop?

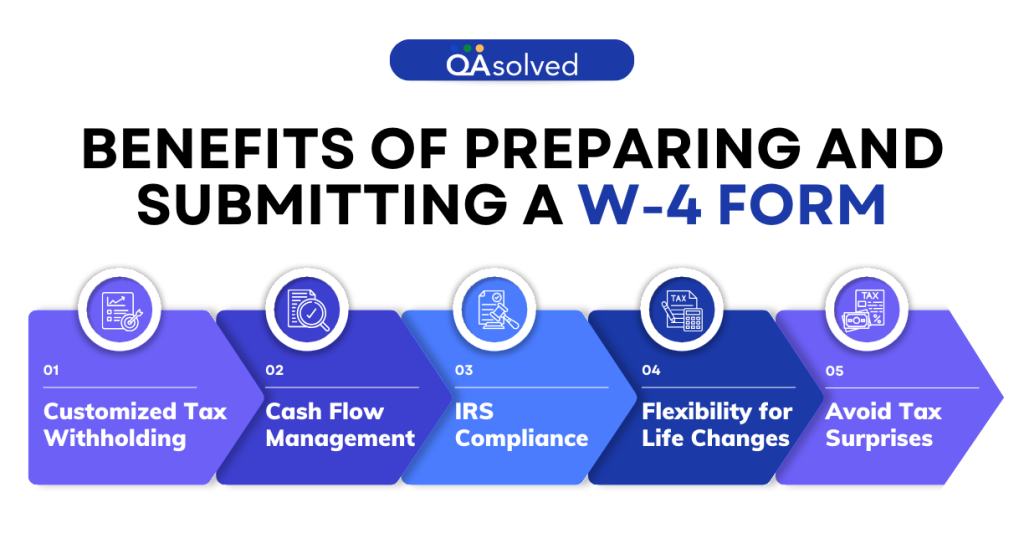

Benefits of Preparing and Submitting a W-4 Form

Filling out and submitting a W-4 form is a key step in managing your tax responsibilities as an employee. It serves as a tool for communicating your tax situation to your employer, ensuring proper withholding from your paycheck. Here are the top benefits of preparing and submitting a W-4 form:

1. Customized Tax Withholding

The W-4 form allows employees to fine-tune their federal tax withholding based on marital status, dependents, and deductions, helping avoid over- or underpayment.

2. Cash Flow Management

By adjusting withholding, employees can increase take-home pay or set aside more tax throughout the year, depending on their financial strategy.

3. IRS Compliance

Submitting a current and accurate W-4 ensures that employers are withholding the right amount of tax, keeping both employee and employer in legal compliance.

4. Flexibility for Life Changes

The W-4 can be updated any time there’s a significant life change—like marriage, divorce, or a new baby—ensuring that tax withholding reflects your current situation.

5. Avoid Tax Surprises

Proper use of the W-4 helps reduce the risk of owning a large sum at tax time or facing penalties for under-withholding.

So, these are the benefits of creating and submitting the W-4 form on time.

Why Do These Tax Forms Matter?

W-2 and W-4 forms indeed play a crucial role in ensuring the accuracy of your tax fillings and proper tax withholding throughout the year. The W-2 form provides a detailed record of your annual earnings and the taxes withheld by your employer, which is essential for filing your taxes and staying compliant with IRS regulations. On the other hand, the W-4 form allows employees to adjust their tax withholdings, ensuring that the right amount of tax is deducted from each paycheck based on their personal circumstances.

Understanding and submitting these forms correctly helps avoid underpayment or overpayment of taxes, prevents penalties, and can even help optimize potential tax refunds. These forms not only impact your current financial situation but also ensure that your tax obligations are met efficiently and accurately.

Conclusion

In a nutshell, W-2 and W-4 forms may sound similar, but their roles in the tax system are completely different. The W-4 form helps ensure the right amount of tax is withheld from each paycheck, while the W-2 form provides a summary of annual earnings and tax withholdings needed for accurate tax filing. Both are critical for staying compliant with IRS rules and avoiding surprises during tax season.

Whether you’re an employee trying to manage your finances or an employer handling payroll, staying informed about these forms can help streamline processes, reduce errors, and support smarter financial decisions. Keeping these documents up-to-date and filed on time is a simple yet powerful way to take control of your tax responsibilities.

In case you need any assistance in filing W-2 and W-4 forms in QuickBooks, then our QB seasoned professionals are here at your disposal.

Frequently Asked Questions

The W-2 and W-4 are IRS tax forms used by employers and employees in the U.S. The W-4 form is filled out by employees to inform their employer how much federal income tax to withhold from their paycheck. The W-2 form is issued annually by the employer and reports an employee’s total earnings and the taxes withheld, which is used to file federal and state tax returns.

The employee fills out a W-4 form when starting a new job or when their financial or personal situation changes. This form helps the employer determine how much federal income tax to withhold from the employee’s paycheck.

If you don’t fill out a W-4 form, your employer is still required to withhold federal income tax from your pay. However, without your completed W-4, they will default to the highest withholding rate — treating you as single with no adjustments. This typically results in more tax being withheld from your paycheck than necessary.

There are many common yet significant tax forms that both employers and employees need to take care of. W-4 and W-2 form are two of them and apart from them, there are a few important tax forms as well, including:

– W-3 Form

– Form 1098

– 1099 and 1096 Forms

– 1099s Form

Yes, it’s mandatory for new employees to submit an up-to-date W-4 form. This form is used to inform the employer of their tax filing status, sources of income, and any dependents they plan to claim, all of which are necessary to calculate the correct amount of federal tax withholding.

While you generally can’t file a personal lawsuit over a missing or incorrect W-2, it is your legal right to receive it by January 31. If your employer fails to provide it, the appropriate step is to report the issue to the IRS or relevant labor authorities, who can investigate and take action if necessary.