Managing property doesn’t just mean leasing apartments or handling maintenance requests; it also means staying on top of constant financial activity. There are rent payments to be made, bills to be paid, and repairs that need to be done. For an entrepreneur, it is significant to keep a track on every spent dollar. This is why it becomes prominent to record transactions for Rental Properties. In QuickBooks, users can easily record transactions for rental properties, ensuring accurate financial tracking, simplified tax reporting, and better insights into each property’s profitability. Do you know how to record transactions for rental properties in QuickBooks? If yes, Great! If no, then don’t worry!

With QuickBooks, you can minimize the scope of confusion between property owners, tenants, and your team because it allows you to record property rental transactions properly. On top of that, QB also strengthens the users by creating an effortless flow for tax compliance and internal legal audits, keeping entrepreneurs at the forefront of their business.

If you also want to master the art of recording transactions for rental properties in QuickBooks, then you have indeed landed on the right page. In this blog, we will explain the steps to record transactions for a property management company along with its benefits. So, let’s dive in!

Steps to Record Transactions For A Property Management Company

Property managers serve both property owners and tenants, so their accounting needs to reflect two separate functions. You should set up and manage two separate company files in QuickBooks Desktop to keep everything organized:

- Rental Property Company File: You record rent collection, bill payments, and other business transactions on behalf of the property owner in this file.

- Property Management Company File: It represents your own business and tracks your earnings from managing properties.

The two separate files ensure that each set of transactions remains accurate, clear, and separate from the other legally. In the blog below, we’ll walk you through how to set this up and manage both files effectively.

Now, let’s discuss how to create a company file for a rental property company!

Create a Company File for Rental Property Company

In this file, you track all financial activity associated with your properties. It’s where you record rental income, expenses associated with your properties, and other transactions. There are six steps to create a company file for a rental property entity. Let’s take a look at these steps:

Step 1: Configure Tenant and Vendor Information

Start by setting up the customers and vendors:

| Managed Properties | Customers |

| Tenants | Property jobs: customer |

| Property owners | Vendors |

| Your property management company | Your property management company |

Note: Property owners can be set up as vendors since you pay them their property’s net income.

Step 2: Set Up Accounts and Items

You must set up your accounts and service items before recording any transactions. You can set up the following:

| Accounts |

| Type of Account | Account Name |

| Asset | Checking accounts |

| Liability | Security deposits |

| Income | Rent income |

| Expenses | Property management expense, property owner payment |

| Service Items |

| Item Name | Linked Account |

| Tenant security deposits | Liability: Security deposits |

| Rent | Income: Rent income |

| Property management fee | Expense: Property management expense |

Do you also Oversee Commercial Properties?

If yes, then consider creating an income account and a service item for common area maintenance (CAM). It allows you to track CAM income separately from your other tenant fees.

Step 3: Record Security Deposits

Security deposits are typically collected by property owners at the beginning of a lease term. The rental company may partially or fully refund this amount at the end of the tenancy, so it is considered a liability of theirs.

Use a security deposit liability account to track tenants’ deposits. Here’s how:

- Select Make Deposits from the Banking menu.

- In the Received From dropdown, choose the tenant.

- Click the From Account dropdown and select your security deposit account.

- Enter the amount and click Save & Close.

Step 4: Track the Rent Income

There are two ways to record rent from tenants, depending on when you receive their payment:

- Use invoices if you expect to receive payment later.

- Use sales receipts for immediate payments.

Select the appropriate tenant and the item you created in Steps 1 and 2.

How to Charge Late Fees?

Using QuickBooks’ finance charge feature, you can apply late fees if a tenant pays rent late. The tool automatically calculates and adds the charges to the tenant’s invoice.

Step 5: Record Expenses For Each Property

Keeping track of all related expenses, including property and management fees, is crucial.

Property Expenses

Utility, repair, and maintenance costs are included in these expenses. Depending on when you paid for the expense, record it as follows:

- You can use bills if you intend to pay later.

- If you need to pay vendors immediately, use checks.

Ensure that the Customer: Job dropdown contains the appropriate property or tenant.”

Property Management Fee

Property management fees vary depending on the agreement between you and the property owner. To determine the appropriate fee, you can use or run a Profit and Loss report to calculate a property’s gross or net income.

Select the relevant property or tenant from the Customer: Job dropdown and record the fee as a bill or a check.

How Can I Charge an Expense to a Tenant?

When a tenant damages a property or requests specific work, you can charge those costs to their account instead of the owner’s. In this case, the expense is a billable one.

- Pay the expense with a check or a bill.

- Select the tenant in the Customer: Job dropdown.

- In the Billable column, check the box.

- Add the tenant’s billable expenses to an invoice or sales receipt.

Step 6: Pay the Property Owners

Your next step is to determine how much each property owner owes after recording all income and expenses.

Tip: Calculate the amount to transfer to each owner’s account using a Profit and Loss report.

To issue the payment:

- Write a check for the payment to the property owner.

- Select the property owner from the list that you created in Step 1.

- In the Account column dropdown, choose the payment account you set up in Step 2.

- Generate a Profit and Loss report to view the net income for each property. If the owner decides to retain a portion of the net income, the report will display the remaining amount. Otherwise, the net income should reflect zero.

So, these are the six most effective steps that can help you record transactions for rental properties in QuickBooks. Now, let’s take a look at the steps that can assist you in creating a company file for a property management company.

Set Up a Company File for Your Property Management Business

You will track the financial activity of your own property management company in this company file. When managing properties, you should record the income you earn and the expenses you incur.

Step 1: Set Up Property Owners as Customers

Create a customer record in your system for each property owner. With this system, you are able to keep track of the income, expenses, and payments associated with the properties of each owner.

In case you haven’t done so yet, set up property owners as customers.

Step 2: Set Up Accounts and Items

Create accounts and service items to simplify the recording of transactions. The following are some recommended setups:

| Accounts |

| Account Type | Account Name |

| Asset | Furniture, equipment, and a checking account |

| Liability | Payroll liabilities |

| Income | Property management income |

| Expenses | Insurance expense, utilities expense |

| Service Items |

| Item Name | Linked Account |

| Property management | Income: Property management income |

| Utilities | Expense: Utilities expense |

Step 3: Record Property Management Income

You can record income from property owners in two different ways, depending on when the payment is received:

- Record the management income from property owners in two ways:

- Use invoices if you expect to receive the payment at a later date.

- Use sales receipts if the payment is received immediately.

- Be sure to select the tenant and service item that you set up in Step 1 and Step 2.

- Enter the exact amount received from the property owner, which should match the calculation made in Step 4 of “Company File 1: Rental Property Company.”

These steps should help you accurately record transactions for your property management company. When you set up your accounts, service items, and customer records correctly, you’ll be able to track income, expenses, and owner payments more conveniently.

Keeping consistent records will also allow you to generate more accurate reports, making it easier for you to manage properties, bill tenants, and provide transparency to property owners.

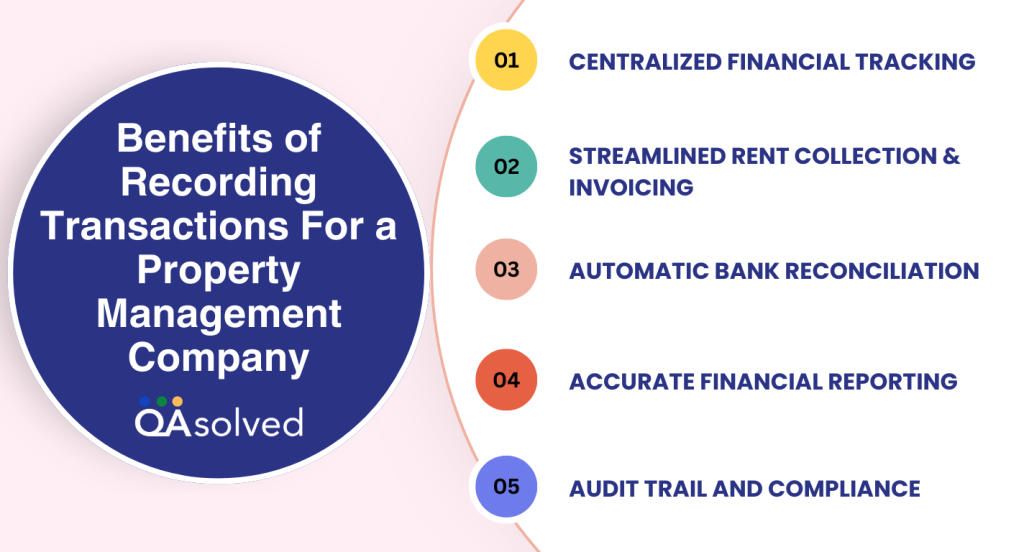

Benefits of Recording Transactions For a Property Management Company

Managing your property finances doesn’t have to be complicated. Whether you’re overseeing a few rental units or an expanding portfolio, QuickBooks can help you take control of your day-to-day operations with ease and confidence. By recording transactions and automating routine tasks, you can strengthen your operations and focus on what truly matters, growing your business.

1. Centralized Financial Tracking

QuickBooks allows you to track income and expenses by property, tenant, or class. You can then view how each unit or location is performing without having to manage multiple spreadsheets.

2. Streamlined Rent Collection and Invoicing

With QuickBooks, you can easily manage rent collection, set up late fees, and send payment reminders using built-in tools for recurring invoices and real-time payment tracking.

3. Automatic Bank Reconciliation

QuickBooks also syncs your bank accounts and credit cards, importing transactions automatically. As a result, there is less manual entry, fewer errors, and more accurate monthly reconciliation.

4. Accurate Financial Reporting

You can generate profit and loss statements, balance sheets, and cash flow reports for each property, then share them with property owners or use them internally to guide smarter business decisions.

5. Audit Trail and Compliance

QuickBooks automatically logs user activity and transaction history, allowing for a clear audit trail. Legal compliance and resolving tenant or owner disputes require this.

When you record transactions for a property management company, you gain a clear competitive edge. Your financial processes become more organized, reliable, and scalable. Whether you’re managing a handful of units or an expanding portfolio, keeping your records accurate and up-to-date ensures compliance and gives you better control over your business.

Conclusion

Recording transactions accurately isn’t just about compliance, it’s the foundation of a professional and profitable property management business. When you record transactions for rental properties in QuickBooks, you simplify your financial tracking, automate rent collection, manage expenses, and generate useful reports, all from one place. With QuickBooks, you can lay the foundation for organized and transparent financial management by properly setting up your company file, creating accounts and service items, and assigning each property owner and tenant to the correct category.

By setting up your accounts, vendors, customers, and items correctly from the start, you avoid confusion later and ensure smoother collaboration with owners and tenants. As your business grows, this structure gives you the confidence to scale without losing control of your finances. In short, QuickBooks empowers its users by allowing them to record transactions for a property management company with accuracy, transparency, and efficiency, ensuring better financial control and smoother day-to-day operations.

In case you’re having any trouble while recording transactions for rental properties in QuickBooks 2021, 2022, or other versions, then contact our QuickBooks support team immediately.

Frequently Asked Questions

In QuickBooks 2021, record rental property transactions as follows:

1. Set up a company file for property management and add each owner as a client. Create sub-customers (jobs) for individual properties.

2. Track rent, fees, expenses, and security deposits with accounts and service items.

3. Record rent payments using:

– Receipts for sales if paid immediately.

– If paid later, invoices.

4. Make deposits under Banking> Make Deposits to track security deposits.

5. Assign property expenses to the right property or tenant as bills or checks.

6. Using a Profit and Loss report, record management fees as a bill or check.

7. Use billable expenses to collect rent or utility costs from tenants.

8. Write checks to property owners based on net income, selecting the appropriate owner and account.

Track detailed information using classes or sub-customers. Ensure that transactions are assigned to the correct tenant or property to ensure accurate reporting.

Accounting for property management fees in QuickBooks is as follows:

1. Based on your agreement, calculate the fee – it might be a percentage of gross or net income.

2. Calculate the appropriate fee for each property by running a Profit and Loss report.

3. Enter the fee as a bill or check:

– Click on Enter Bills or Write Checks.

– Select the Payee field to indicate your management company (or yourself).

– Choose the management income account in the Account field.

– Click on the Customer: Job dropdown menu and choose the property or owner.

As a result, the fee is recorded properly as income for your management company and expense for the property owner.

The fees associated with property management are considered operating expenses by property owners. Among the services they provide are tenant management, maintenance, and financial reporting. The property owner’s Profit and Loss statement usually records these fees as administrative expenses or management fees under the Expense account.

Yes, property management fees are typically considered a fixed expense. The rent is typically a set percentage of the property’s rental income or a predetermined amount, making them predictable and consistent. Based on a percentage of income, however, the actual amount may vary.