A balance sheet is one of the core financial statements that is used to assess a company’s financial standing at a specific point in time. It provides a snapshot of what the business owns (assets), what it owes (liabilities), and the owner’s equity. Understanding how the balance sheet works is crucial for budding entrepreneurs, CPAs, and investors to analyze performance, evaluate risk, and most importantly, make informed decisions. While the balance sheet is designed to reflect a comprehensive view of the business’s financial position, not all accounts from the general ledger appear in it.

Some accounts are intentionally excluded because they are meant for the income statement or other financial reports. This often leads to confusion, especially for those new to accounting or financial analysis. If you’re also one of those who want to elevate your knowledge and prepare error-free balance sheets, then you’re in the right place.

We’ll begin by exploring what a balance sheet is and its significance in business finance, followed by a breakdown of the key components that typically don’t appear in it. So, let’s start!

What is a Balance Sheet and Its Components?

A balance sheet, also known as the statement of financial position, is one of the three primary financial statements, alongside the income statement and cash flow statement. It is used to report a company’s financial status at a specific date, typically at the end of a month, quarter, or fiscal year.

Components of a Balance Sheet:

The balance sheet follows a simple accounting equation: Assets = Liabilities + Owner’s Equity

Here’s a breakdown of each component:

- Assets: Resources owned by the company that have economic value. This includes cash, inventory, accounts receivable, property, and equipment.

- Liabilities: Obligations the business owes to outside parties. Examples include loans, accounts payable, and accrued expenses.

- Owner’s Equity: The residual interest in the assets of the entity after deducting liabilities. It includes retained earnings and capital contributed by owners.

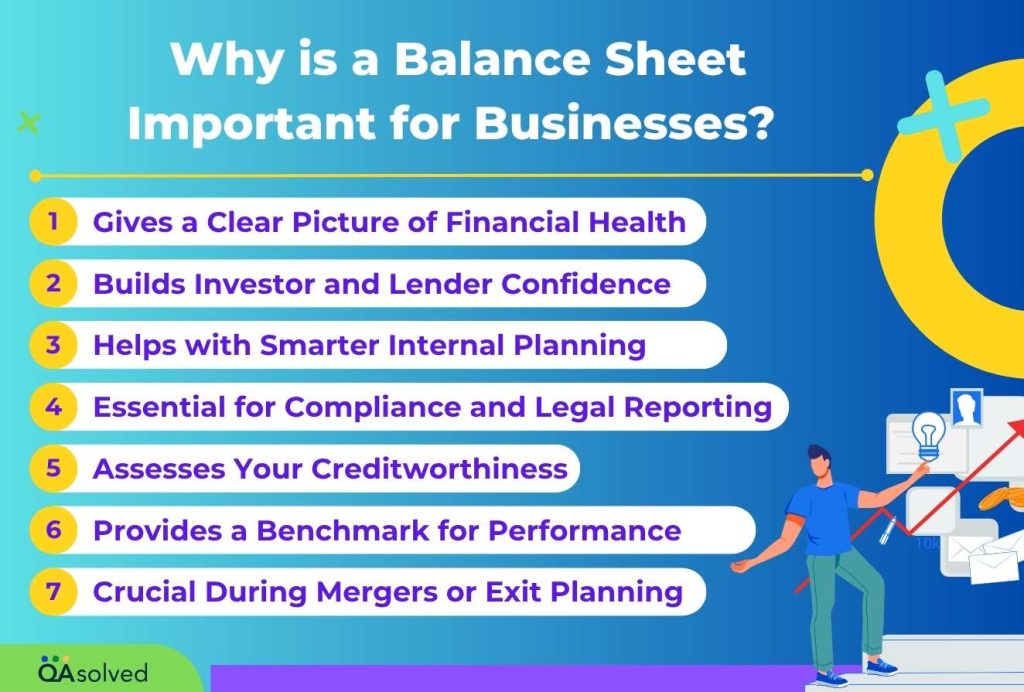

Why is a Balance Sheet Important for Businesses?

When it comes to understanding your business’s financial position, the balance sheet is one of the most powerful tools in your accounting arsenal. It does a lot more than just list numbers; it tells the story of where your business stands today and helps shape decisions for tomorrow. Here’s why it truly matters:

1. Gives a Clear Picture of Financial Health

At its core, the balance sheet reveals how financially sound your business is. It shows what you own (assets), what you owe (liabilities), and what’s left over (equity). This snapshot helps you gauge whether your business is growing sustainably, heavily reliant on debt, or holding too much idle cash. It’s a quick way to check the financial pulse of your company.

2. Builds Investor and Lender Confidence

Whether you’re pitching to investors or applying for a business loan, your balance sheet will be front and center. Investors and lenders look at it to assess risk by understanding the debt you have, how well you manage assets, and how strong your equity position is. A solid, well-structured balance sheet can inspire confidence and open doors to funding opportunities.

3. Helps with Smarter Internal Planning

Business owners and managers rely on the balance sheet to make smart, data-driven decisions. Do you want to expand operations, invest in new equipment, or hire more staff? Your balance sheet can tell you whether you’re financially ready. It’s also crucial for creating realistic budgets, forecasting cash flow, and tracking financial goals over time.

4. Essential for Compliance and Legal Reporting

Let’s not forget the legal side of things. Accurate balance sheets are a must for tax filings, audits, and regulatory compliance. Governments and tax authorities may request them, especially if you’re incorporated or running a larger operation. Keeping your balance sheet in order helps you stay compliant and avoid unnecessary penalties or legal headaches.

5. Assesses Your Creditworthiness

Before extending credit or offering flexible payment terms, suppliers and creditors often want to see your balance sheet. Why? Because it helps them decide if you’re capable of meeting your short-term financial obligations. A healthy balance sheet, especially one with a good current ratio, can help you negotiate better credit terms and build stronger vendor relationships.

6. Provides a Benchmark for Performance

Your balance sheet is also great for benchmarking. You can compare it year-over-year to measure progress or analyze how your business stacks up against industry standards. Key financial ratios derived from the balance sheet (like return on assets or debt-to-equity ratio) help you spot trends, highlight strengths, and identify areas for improvement.

7. Crucial During Mergers or Exit Planning

Thinking about selling your business, merging with another company, or bringing in new partners? The balance sheet will play a major role in those conversations. It offers a transparent view of your company’s value, assets, liabilities, and equity, and can influence the final deal. A clean and accurate balance sheet can give you the upper hand during negotiations.

The balance sheet is, therefore, a vital tool for a business to understand what it owns, what it owes, and how much has been invested by stakeholders. But as essential as it is, not every account makes its way to this report. Let’s discuss those exceptions next.

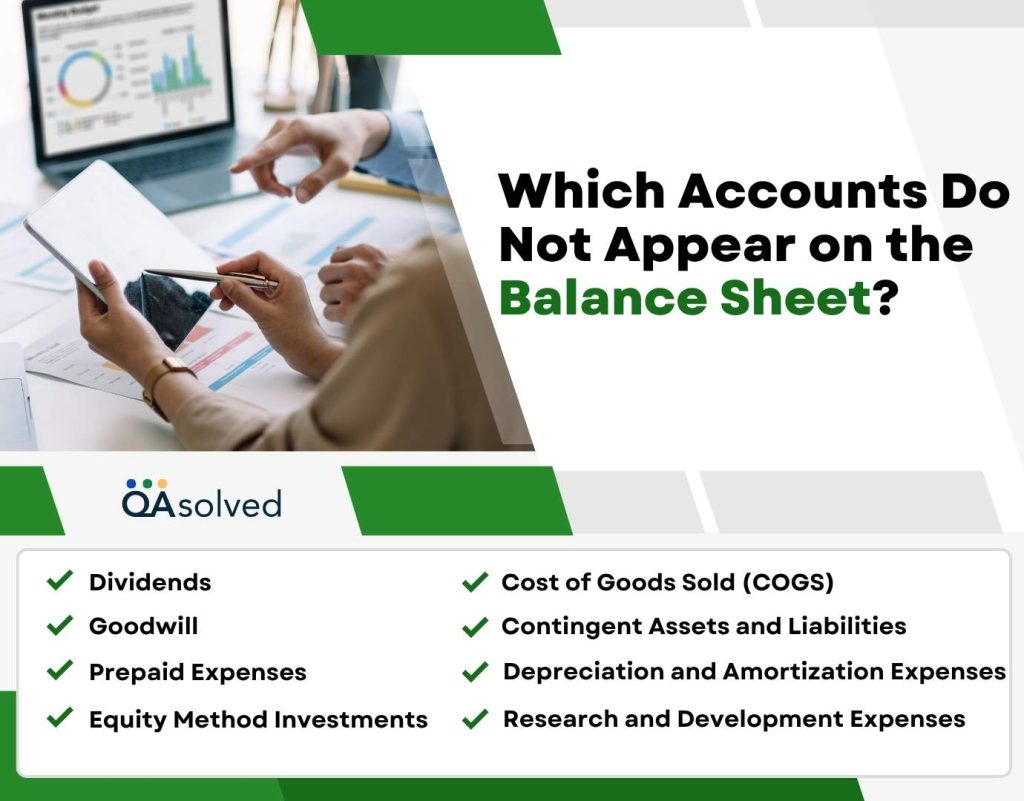

Which Accounts Do Not Appear on the Balance Sheet?

Certain accounts are specifically excluded from the balance sheet. These accounts often serve different purposes, like tracking business income, expenses, or operational performance over time. Here are the major categories of accounts that do not appear on the balance sheet:

1. Dividends

Dividends are the payments a company makes to its shareholders as a reward for their investment. While they represent a portion of the company’s profits, dividends don’t appear on the balance sheet because they aren’t classified as assets or liabilities. Instead, they show up in the statement of changes in equity. Even though they’re not recorded on the balance sheet, dividends do impact a company’s finances. Paying them reduces the available cash that could otherwise be used for business expansion or debt reduction. That’s why investors pay close attention to dividend policies.

2. Depreciation and Amortization Expenses

Depreciation and amortization represent the gradual reduction in value of a company’s tangible and intangible assets, respectively. These costs show up on the income statement and reduce taxable income, but they’re not directly listed on the balance sheet. Instead, they’re factored into the net book value of assets, quietly working in the background as part of long-term asset management.

3. Contingent Assets and Liabilities

Contingent assets and liabilities are “what-if” items. Because their realization is uncertain, they typically stay off the balance sheet unless the outcome is likely, and the amount can be reasonably estimated. Even though they’re not formally listed, contingents can still influence how stable or risky a business appears. For investors and stakeholders, being aware of these possibilities is key to understanding the company’s full financial picture.

4. Cost of Goods Sold (COGS)

Cost of Goods Sold, commonly known as COGS, represents the direct costs involved in creating the products or services a business sells. This includes expenses like raw materials, labor, and manufacturing costs. While COGS plays a crucial role in calculating gross profit and overall profitability, it doesn’t appear on the balance sheet. Instead, it’s reported on the income statement as an expense.

5. Goodwill

Goodwill comes into play when a company acquires another business for more than its fair market value. This excess amount, the premium paid, is recorded as goodwill on the balance sheet. However, it’s not always a permanent fixture. Goodwill is subject to regular impairment tests, meaning it can be reduced or even removed if the acquired business underperforms. While it may appear on the balance sheet initially, it doesn’t always stand out as a separate line item over time.

6. Research and Development (R&D) Expenses

R&D expenses reflect the money a company spends to innovate, whether it’s developing new products or improving existing services. These costs are usually treated as operating expenses and don’t appear directly on the balance sheet unless certain criteria are met for capitalization as intangible assets. Despite being off the balance sheet, R&D expenses tell a powerful story. They can signal a company’s commitment to long-term innovation and competitiveness.

7. Equity Method Investments

When a company invests in another business and has significant influence, typically owning 20% to 50% of its shares, but not full control, it uses the equity method of accounting. These types of investments aren’t always listed as traditional assets on the balance sheet. Instead, they’re reported under a separate “investments” category and further explained in the footnotes or accompanying financial disclosures.

8. Prepaid Expenses

Prepaid expenses are advance payments a business makes for goods or services it might receive in the future, such as insurance, rent, or subscriptions. When these payments are made, they’re recorded on the balance sheet as current assets because they represent a future economic benefit. As time passes and the service or benefit is consumed, the prepaid amount is gradually moved to the income statement as an expense.

So, these are eight major accounts that are not included in the balance sheet. Now, let’s take a look at the common mistakes that you must avoid in order to prepare a sound balance sheet.

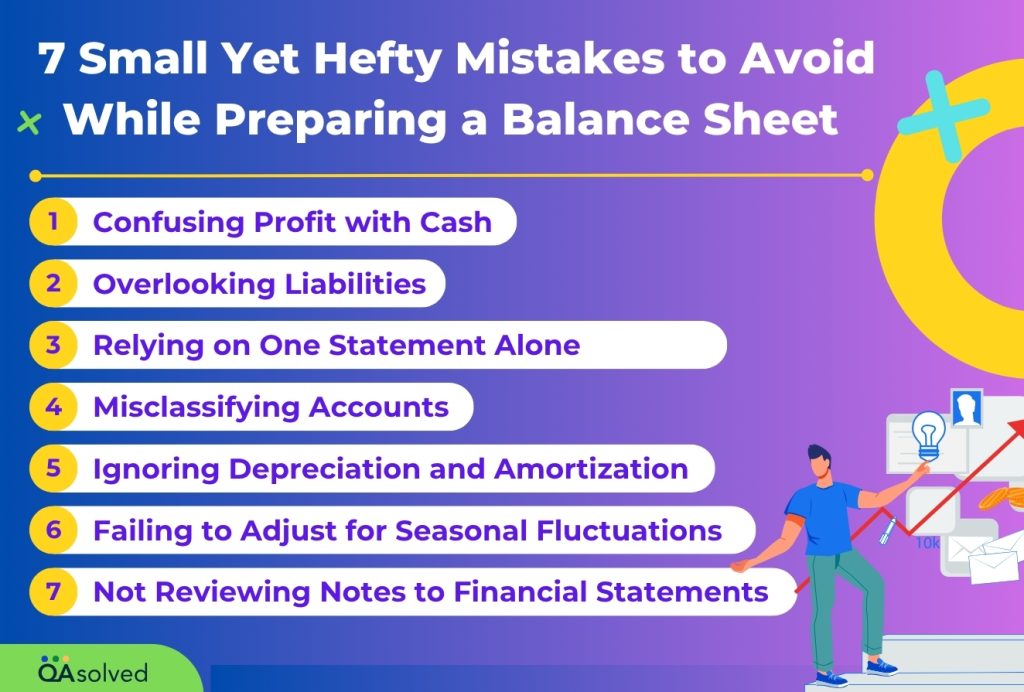

7 Small Yet Hefty Mistakes to Avoid While Preparing a Balance Sheet

Understanding financial statements is essential, but even seasoned professionals can slip up. Here are some of the most common mistakes businesses and individuals make when reviewing financial reports, and how to avoid them:

1. Confusing Profit with Cash

One of the biggest slip-ups is thinking that profit means available cash. Just because your income statement shows a healthy net profit doesn’t mean you have cash in hand. Timing differences in receivables, payables, and other factors mean your bank balance could tell a different story.

2. Overlooking Liabilities

Some liabilities, like legal obligations or pending settlements, don’t always show clearly on the balance sheet. These are called contingent liabilities, and ignoring them can lead to underestimating the financial risk a business might face.

3. Relying on One Statement Alone

It’s easy to focus on one report, but doing so gives only part of the picture. Real financial health is visible only when you look at the balance sheet, income statement, and cash flow statement together; they each reveal something unique.

4. Misclassifying Accounts

Placing an expense under assets or mixing up revenue and liabilities can distort your financials. These classification errors affect ratios, cash flow, and even decision-making. Always double-check where each account belongs.

5. Ignoring Depreciation and Amortization

Many overlook the impact of depreciation and amortization, assuming they’re just “accounting technicalities.” However, these non-cash expenses affect net income and the reported value of long-term assets over time.

6. Failing to Adjust for Seasonal Fluctuations

Some businesses are seasonal by nature, yet readers often ignore this context. Judging a business’s financial health without recognizing seasonal trends can lead to incorrect conclusions about profitability or cash flow.

7. Not Reviewing Notes to Financial Statements

The notes at the bottom of financial statements might seem fine print, but they often contain crucial explanations about accounting methods, contingencies, or unusual transactions. Skipping them is a missed opportunity to understand the full picture.

By keeping these seven points in mind, you can create an error-free balance sheet that truly reflects your company’s financial position. Avoiding common pitfalls ensures your data is accurate, your insights are reliable, and your decisions are grounded in a complete understanding of your business’s financial health.

Conclusion

A balance sheet is more than just numbers on a page; it’s a powerful financial tool that helps businesses, investors, and stakeholders understand where a company stands at any given moment. While it covers key accounts like assets, liabilities, and equity, it’s equally important to know which accounts don’t appear on it, such as dividends, R&D expenses, or contingent liabilities. Overlooking these exclusions can lead to misinterpretations and poor financial decisions.

That’s why understanding both what’s on the balance sheet and what’s left off is essential for accurate analysis. By recognizing common mistakes and being mindful of less-visible accounts, you’ll gain a more complete, informed view of your company’s financial health. Whether you’re a business owner, investor, or accounting student, mastering the balance sheet sets the foundation for smarter, more strategic financial planning.

Frequently Asked Questions

The balance sheet is divided into four key components: current assets, non-current assets, current liabilities, and non-current liabilities. In addition to these, it also includes the owner’s equity, which typically consists of items like common stock and retained earnings. Together, these sections provide a clear snapshot of a company’s financial position at a specific point in time.

The primary purpose of a balance sheet is to provide a snapshot of a company’s financial position, what it owns (assets), and what it owes (liabilities), at a specific point in time. It helps assess the company’s ability to meet short-term and long-term obligations, offering valuable insights into its overall financial health and stability.

The five essential financial statements every business should understand are:

1. Balance Sheet – shows the company’s assets, liabilities, and equity at a specific point in time.

2. Income Statement – outlines revenues, expenses, and profits over a reporting period.

3. Cash Flow Statement – tracks the movement of cash in and out of the business.

4. Statement of Changes in Equity – details changes in owner’s equity, including retained earnings and dividends.

5. Notes to the Financial Statements – provide additional details, explanations, and context behind the numbers.

Together, these reports give a full picture of a company’s financial health and operational performance.

A balance sheet, also known as a statement of financial position, offers a snapshot of your business’s financial health at a specific moment in time. It outlines what the company owns (assets), what it owes (liabilities), and the owner’s equity. By reviewing a balance sheet, you can assess financial stability, liquidity, and how effectively a business is managing its resources.

Off-balance sheet financing refers to financial arrangements that don’t show up directly on a company’s balance sheet but still impact its overall financial situation. Common examples include operating leases, partnerships, or joint ventures. These transactions are structured to keep certain liabilities or assets off the books, often to improve financial ratios or meet regulatory requirements.