Payroll tax overpayments might sound like a small hiccup, but they can quickly turn into a headache if not handled properly. Whether it’s a duplicate tax payment, a simple typo, or an incorrect tax rate, even minor errors can throw off your financial reports and create unnecessary confusion in your books. For many small businesses, this can also affect cash flow and compliance if left unchecked. The good news is that QuickBooks provides you with the flexibility to identify and fix these overpayments before they snowball into bigger accounting issues. In short, understanding how to manage Payroll tax overpayments in QuickBooks Online Payroll and QuickBooks Dekstop Payroll can save you time, prevent reporting errors, and keep your books accurate.

If you’ve also spotted an overpayment or notice your payroll tax balance isn’t adding up, there’s no need to worry. QuickBooks Online and Desktop make it simple to review, adjust, and correct payroll tax overpayments. By double-checking your payroll liabilities and making the right adjustments, you can quickly get your records back on track. In this blog post, we’ll guide you step by step on how to fix QuickBooks Payroll tax overpayments and ensure your books stay accurate and compliant. So, let’s get started.

Before You Begin

If you notice a negative tax amount in QuickBooks or receive a credit notice from a tax agency, it means there’s an overpayment that needs fixing. Resolving it ensures your tax forms and reports stay accurate. Overpayments often happen due to a lower SUI rate, voided paychecks, or duplicate tax payments.

Remember that fixing negative tax amounts in QuickBooks Payroll only updates your records for reporting purposes. In the longer run, you’ll still need to contact the IRS or your state tax agency to either request a refund or confirm that the overpaid amount will be applied as a credit in future tax periods.

Also, choose your QuickBooks payroll plan in the beginning to get step-by-step instructions tailored to your version. Following the correct guide ensures you handle payroll tax overpayments accurately and efficiently.

5 Steps to Resolve the Tax Overpayments in QuickBooks Online Payroll

If the quarter hasn’t ended, you can leave the overpayment as it is. The credit will apply to upcoming payroll tax liabilities, and any leftover will show as an overpayment on your return. Follow these steps to either request a refund or carry the credit forward to the next quarter.

- Log in to your QuickBooks Online account and go to your Payroll Dashboard.

- Navigate to the Payroll section and select Payments.

- Find the tax with the overpayment and click Resolve.

- Now, you have two choices. You can analyze your options and pick the one that works best for you:

- Request a Refund – Best if the quarter has ended. Contact your tax agency to claim your refund. If your auto tax feature is on and QuickBooks files your taxes, this option will be selected when forms are filed.

- Apply to a Future Payment – Only choose this if you’ve confirmed the credit is valid and hasn’t been applied elsewhere.

- Finally, Click Confirm, then Done to complete the process.

So, these are the 5 simple steps that can help you resolve the tax overpayments in QuickBooks Online Payroll.

Steps to Resolve a Tax Overpayment in QuickBooks Desktop Payroll

Handling a tax overpayment in QuickBooks Desktop Payroll can feel tricky, but it’s easier than you might think. Whether you’re using QuickBooks Desktop Payroll Assisted or the Basic and Enhanced versions, the process may vary slightly, but the goal is the same: to ensure your payroll records remain accurate and compliant. Let’s dive in.

1. QuickBooks Desktop Payroll Assisted

When using QuickBooks Desktop Payroll Assisted, handling tax overpayments is straightforward, whether they occurred in the current quarter or a prior one. Here’s how you can fix tax overpayment matters in QB Desktop Payroll Assisted:

- Current-Quarter Overpayments: Any overpayment will automatically apply to upcoming payroll taxes within the same quarter. If there’s still a credit left when the quarter ends, it will be reflected on the relevant tax form.

- Prior-Quarter Overpayments: Overpayments from previous quarters will show up in your Payroll Liability Balance report. To get the money back, you’ll need to contact the tax agency for a refund. Once you receive it, make sure to enter and record the refund of liabilities in QuickBooks to keep your records accurate.

2. QuickBooks Desktop Payroll Basic and Enhanced

The process to recalculate payroll tax overpayments is the same for both Basic and Enhanced versions. If you receive a refund check from a tax agency for overpaid payroll taxes, you can easily record it as a deposit. Alternatively, if you want to apply the credit to your next payroll payment, you’ll first need to create a liability check and then apply the credit.

Before moving forward, it’s a good idea to check with your accountant to make sure the credit is applied to the correct account, keeping your payroll records and tax forms accurate. Here are the steps to fix payroll tax overpayments in QuickBooks Desktop Payroll Basic and Enhanced.

- Open your dedicated QuickBooks.

- Navigate to Employees and choose Payroll Taxes & Liabilities.

- Click on Pay Scheduled Liability.

- In the Pay Taxes & Other Liabilities section, select the tax or liability you want to handle and choose View/Pay.

- Pick either Check or E-pay as your payment method.

- Go to the Expenses tab.

- Select the account where you want the credit to be applied.

- Enter the credit amount as a negative number in the Amount field (up to the total of the check).

- Add a note or explanation in the Memo field for reference.

- Click Recalculate. If there’s still a remaining credit, you can apply it to your next payroll payment.

Whether you’re using QuickBooks Desktop Payroll Basic and Enhanced or Payroll Assisted, following the correct steps ensures payroll tax overpayments are handled smoothly, keeping your records accurate and your payroll compliant.

Also Read: How To Set Up & Pay Payroll Tax Payments in QuickBooks?

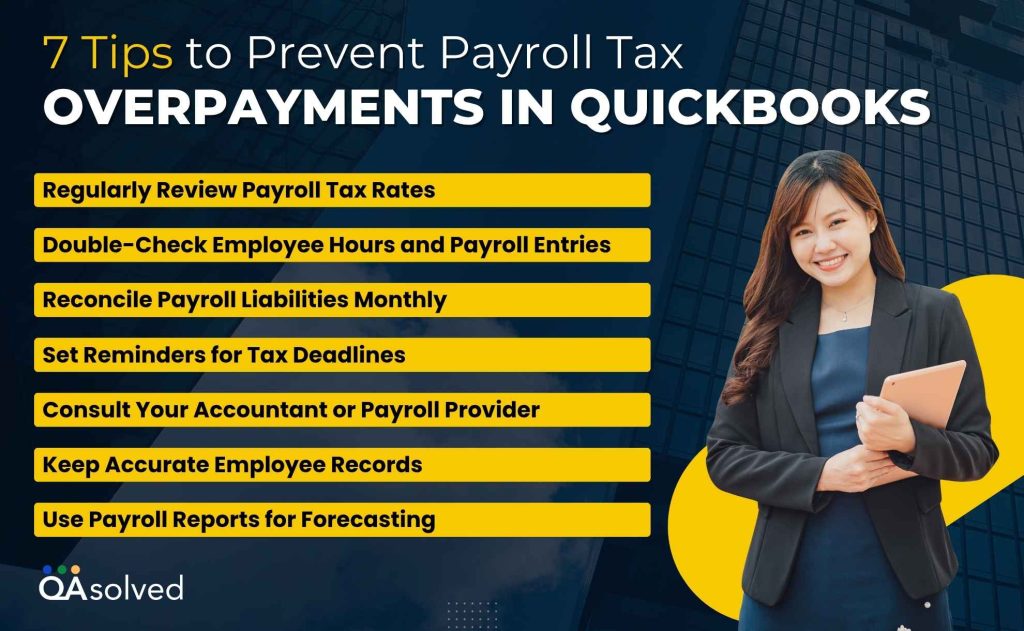

7 Tips to Prevent Payroll Tax Overpayments in QuickBooks

Preventing payroll tax overpayments is always better than fixing them later. With a few proactive steps and regular checks, you can ensure your payroll stays accurate, your reports are reliable, and you avoid unnecessary hassles with tax agencies.

1. Regularly Review Payroll Tax Rates

Tax rates can change at both state and federal levels. Make it a habit to check and update your payroll tax rates in QuickBooks before processing payroll to avoid accidental overpayments.

2. Double-Check Employee Hours and Payroll Entries

Small errors in hours worked or wage amounts can lead to incorrect tax calculations. Reviewing payroll entries carefully before running payroll ensures your tax liabilities are calculated correctly.

3. Reconcile Payroll Liabilities Monthly

Use QuickBooks reports to reconcile your payroll liabilities every month. This helps you spot discrepancies early and take corrective action before they turn into overpayments.

4. Set Reminders for Tax Deadlines

Missing deadlines can lead to rushed payments and mistakes. Setting reminders for payroll tax due dates keeps you on track and reduces the risk of errors.

5. Consult Your Accountant or Payroll Provider

Regularly check in with your accountant or payroll service to ensure your setup is correct and compliant. Their guidance can help prevent mistakes and keep your records accurate.

6. Keep Accurate Employee Records

Maintaining up-to-date employee information, including exemptions, benefits, and deductions, ensures that payroll taxes are calculated correctly and reduces the chance of overpayments.

7. Use Payroll Reports for Forecasting

QuickBooks Payroll reports can help you track trends in tax liabilities. Using these insights allows you to anticipate potential issues and adjust payroll accordingly before overpayments occur.

Staying proactive, double-checking entries, and regularly consulting reports, or your accountant ensures your payroll remains accurate and compliant. By following these simple yet effective tips, you can significantly reduce the risk of payroll tax overpayments in QuickBooks.

Conclusion

Payroll tax overpayments can be stressful, but with the right approach in QuickBooks Online and Desktop, they’re entirely manageable. By understanding how to identify, adjust, and apply credits or request refunds, you can keep your payroll records accurate and compliant. Pairing these steps with proactive practices, like regularly reviewing tax rates, reconciling liabilities, and consulting your accountant, can help prevent overpayments in the future. Taking control of your payroll not only saves time and avoids errors but also gives you peace of mind, knowing your business finances are in order.

Frequently Asked Questions

Here are the steps that you can use to account an overpayment in QuickBooks:

1. First, open your QuickBooks.

2. Go to the + New menu and choose Receive Payment.

3. Select the customer who made the overpayment.

4. Mark the credit and the invoice you want to apply it to.

5. If any credit balance is still left, apply it to another open invoice for the same customer.

6. Finally, click Save and New or Save and Close to record the transaction.

If you’ve overpaid UI, ETT, SDI, or PIT on a DE 88 before filing your DE 9 for the quarter, you can adjust it by subtracting the overpaid amount on your next DE 88 for the same calendar quarter. Make sure not to record credits or negative amounts directly on the DE 88 form.

When dealing with payroll overpayments, it’s important to act quickly and accurately. First, verify the overpayment details, then inform the employee right away. Work out a fair repayment plan or process a one-time correction if permitted by regulations. Keep thorough documentation, obtain written consent, and store all related records securely.

If a payroll overpayment occurred in a prior calendar year that’s already been reported, you’ll need to issue the employee a Form W-2c (Corrected Wage and Tax Statement). This ensures the employee has the proper documentation to amend their tax return and report the corrected income accurately.