Accounting is not just about crunching numbers and drafting budgets – it’s about keeping track of every financial responsibility your business faces. Among these responsibilities, Accounts Payable (AP) stands out as one of the most crucial aspects for small and medium-sized businesses. From vendor invoices and supplier payments to rent and utilities, every business has bills to pay. It can be challenging to track and manage these financial obligations, especially as your business grows. That’s where QuickBooks comes in, offering a user-friendly and efficient way to keep a track on all your payables. QuickBooks enables you to record, track, and manage all your payable accounts in one place. Moreover, tracking due dates, scheduling payments, or generating reports is easy with QuickBooks.

Besides saving time, QuickBooks also enables you to have a clear visibility into your financial health, allowing you to make informed business decisions. In this blog, we are going to cover several essential aspects of Accounts Payable. So let’s get started!

Understanding Accounts Payable

The accounts payable account represents the amount owed to vendors and subcontractors for goods and services received. In addition to short-term liabilities, this balance also includes bills and other liabilities due within the next few months.

Accounts payable is part of the liabilities section in the balance sheet equation:

Assets – Liabilities = Equity

The balance sheet categorizes accounts into current and noncurrent.

Difference Between Accounts Payable and Accounts Receivable

Accounts Payable (AP) and Accounts Receivable (AR) are both important parts of a business’s financial system, but they represent opposite sides.

- Accounts Payable (AP): A business owes money to suppliers or vendors for products or services it has purchased on credit. AP appears on the balance sheet as a current liability for the company.

Example: A business receives goods from a supplier and promises to pay them within 30 days.

- Accounts Receivable (AR): This represents the money owed to a business by customers who purchase goods or services on credit. On the balance sheet, AR appears as a current asset for the company.

Example: A business sells products on credit to a customer who must pay within 30 days.

What are the Key Benefits of Using Accounts Payable in QuickBooks?

Accounting Payable (AP) in QuickBooks provides businesses with several key benefits, helping to streamline financial management and increase efficiency. The following are some of the main advantages:

- Simplified Payment Tracking: QuickBooks keeps track of all outstanding bills, ensuring you never miss a payment deadline. As a result, you are less likely to incur late fees and can maintain positive relationships with vendors.

- Improved Cash Flow Management: QuickBooks makes it easier to manage your cash flow by keeping track of bills and payments.

- Time-Saving Automation: QuickBooks offers features such as recurring billing, automated payment reminders, and batch payments that save time and effort.

- Accurate Financial Reporting: With QuickBooks, you can keep track of overdue bills and get an overview of overall business expenses with accurate reports such as the Accounts Payable Aging Report.

- Better Vendor Relationships: Keeping payments organized and on time can result in discounts, favorable terms, and priority service with vendors.

- Error Reduction: QuickBooks reduces human error by automating AP processes, resulting in accurate financial data.

- Streamlined Reconciliation: QuickBooks makes reconciling AP transactions, tracking payments, and managing outstanding bills easier.

- Increased Control and Visibility: With user permissions and access levels, you can control who can manage and approve payments, enhancing security and accountability.

Also Read: How to Fix Negative Accounts Payable in QuickBooks?

What are the Components of QuickBooks Accounts Payable?

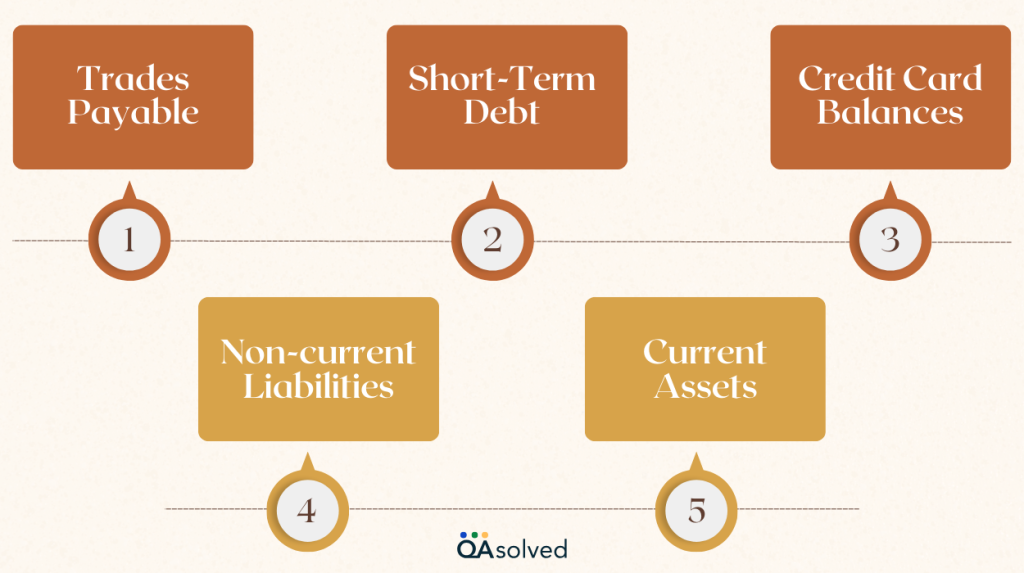

Let’s discuss the components of QBO Accounts Payable and their effects on your overall accounts payable system. Accounts payable is a part of current liabilities, representing obligations settled within the next 12 months. Other components of current liabilities include:

- Trades Payable: Some companies utilize trades payable to record bills received from suppliers, while others directly post supplier invoices to accounts payable without using the trades payable account.

- Short-Term Debt: This includes the principal and interest due on loans that fall under current liabilities. For example, if a firm owes $4,500 in principal and interest within the next 12 months, it is categorized as a current liability.

- Credit Card Balances: Amounts owed on credit cards are also recorded as current liabilities.

- Non-current Liabilities: These include debts due in a year or longer. For instance, a significant portion of a five-year loan balance is classified as a long-term (noncurrent) liability.

- Current Assets: Current Assets include cash and balances that will be realized within the next 12 months. Accounts receivable and inventory are examples of current assets. Noncurrent assets, such as machinery, are not expected to be converted into cash within the next year and are classified as long-term assets.

Note: The accounts payable balance significantly impacts your business’s cash flow.

QuickBooks accounts payable workflow enables businesses to manage bills and payments efficiently, ensuring timely and accurate financial transactions.

5 Ways to Prepare an Accounts Payable Report in QuickBooks

Here are the 5 simple yet effective steps to create a flawless Accounts Payable report:

Step 1: Prepare a Chart of Accounts

Accounts payable starts with the creation of a chart of accounts, which organizes your financial transactions. There are five main types of accounts in a chart of accounts:

- Income accounts

- Asset accounts

- Liability accounts

- Expense accounts

- Equity accounts

There is a specific name, number, and financial statement for each category. To keep things organized, you can also create subcategories.

Step 2: Assign Vendor Details

Use vendor details to track orders and payment deadlines, and use codes to remind yourself to make payments. The following are some common vendor codes:

- Net 10: Payment is due in 10 days.

- Net 30: Payment is due in 30 days.

- Net 60: Payment is due in 60 days.

- You can use codes to organize accounts payable and keep track of payment due dates. Payment terms and due dates can be tracked easily with accounting software.

Step 3: Review Your Invoices

Ensure that the invoice is accurate and that you have received the correct product or service before paying. This three-way match ensures everything is in order:

- Purchase Order: Verify the quantity, cost, and payment terms.

- Goods Received Note: Check the delivery.

- Invoice: Confirm the amount and terms.

Input the invoice details (number, amount, due date) into your accounting software once you have verified them.

Step 4: Pay Pending Invoices

After verifying the invoices, you can pay the vendors. It may be necessary to notify them when the payment has been processed, depending on their preferred method of payment. To ensure all payments are up to date and completed, review your accounts payable weekly.

Step 5: Record and Repeat

Once you have completed these steps, update your books to reflect the latest information. Once a vendor payment has been made, remove it from your accounts payable list, and repeat the process every week.

So, by automating reconciliation, accounting software can ensure timely payments and prevent late fees. By setting up Accounts Payable in QuickBooks, you can track and manage vendor bills and payments efficiently.

Tips to Simplify the Accounts Payable Process

Optimizing accounts payable ensures smoother financial operations and greater efficiency. Apart from automating invoices, consolidating payment tracking, and defining approval steps.

- Create Monthly Reports: Monitor trends, improve AP processes, and prevent late payments with monthly reports.

- Set Up Reminders: Set up reminders for invoice deadlines or weekly AP status checks.

- Switch to Electronic Payments: Use electronic payments to reduce manual effort and speed up the process.

- Make Early Payments: Take advantage of early payment discounts and early payment opportunities.

- Use Accounting Software: Automate invoice and payment management with accounting software like QuickBooks. With QuickBooks, you can schedule and pay bills online, receive notifications about upcoming due dates, and pay vendors by bank transfer, check, or ACH transfer.

So, take control of your Accounts Payable with QuickBooks and optimize your financial operations effortlessly. Regularly reviewing invoices and leveraging automation can make accounts payable easier and more efficient.

Conclusion

Managing your Accounts payable plays a key role in maintaining healthy cash flow and fostering strong relationships with vendors. With QuickBooks, invoice tracking, payment scheduling, and financial reporting are automated. You can save time, avoid late fees, and keep your business finances in order by reducing manual tasks and minimizing errors. Regardless of your business size, QuickBooks provides the control and clarity you need to stay on top of payments.

Reach out to QuickBooks experts for guidance on how to maximize QuickBooks for your AP process.

Frequently Asked Questions

1. Repair Services

2. Inventory

3. Supplies

4. Raw Materials

Accounts Payable represents the short-term obligations owed by your business, requiring payment within one year. These sums, distinct from expenses, do not affect the income statement as they are considered debts. Instead, they are listed as current liabilities on the balance sheets, not under the category of accounts payable.

Typically, Accounts Payable maintains a credit balance since it represents the amount owed to suppliers. Nevertheless, it may shift to a debit balance after the payment has been made to the vendor.

Embracing automation for accounts payable is highly recommended and advantageous. Utilizing automation tools like QuickBooks Online streamlines accounting procedures and minimizes errors that often occur in non-automated AP processes. Additionally, it offers several benefits, including:

1. Simplification of Filing Systems: Automation streamlines the storage and organization of financial data, making it easier to access and manage documents related to accounts payable.

2. Scalability for Future Growth: Automated systems are designed to handle increased volumes of transactions, making them more manageable as your business expands.

3. Reducing Reliance on Employees: Automation reduces the need for manual data entry and repetitive tasks, allowing employees to focus on more strategic and value-added activities.