Effective financial management is essential for all businesses, regardless of size. With the help of QuickBooks Desktop’s powerful features, you can easily create, modify, and delete budgets. We’ll take you through each stage of the process in this article so you can manage budget in QuickBooks Desktop.

What is Budget in QuickBooks Desktop and Why It’s Important?

A budget is a financial plan that details your anticipated earnings, outgoing costs, and financial objectives for a given time frame. You may make budgets, keep track of them, and compare them to your actual financial data with QuickBooks Desktop.

Creating a budget is crucial to effectively managing your business. Setting a budget is essential for effectively organizing your money and ensuring that your company can meet its current financial obligations. Making a budget also enables firms to prepare for future expenses that may arise. Setting up a budget promotes responsibility. Owners and managers are accountable for the actions under their direct control. The goals for the year are established by one’s capacity to forecast future fluctuations while adhering to financial restraints. It also gives other investors a baseline against which to measure your actual performance to what you had anticipated.

The simplest approach to constructing a budget for your company is to use QuickBooks, which can help with the process. Using QuickBooks will also enable you to accurately track revenue and expenditures in comparison to the budget you’ve prepared, making it simple for business owners, managers, and CFOs to compare budget totals and actuals. Additionally, using this software can alert you when a purchase could push you over your spending limit.

Create, Edit, and Delete Budget in QuickBooks Desktop

With the wide range of forecasting and budgeting capabilities that QuickBooks offers, you can effectively plan and make well-informed business decisions.

The first action you plan to take is to make a budget. You can use your profit-loss information from the prior year, or you can start over from scratch.

A. Steps to Create a Budget in QuickBooks Desktop

Step 1. Go to the Budgeting Section

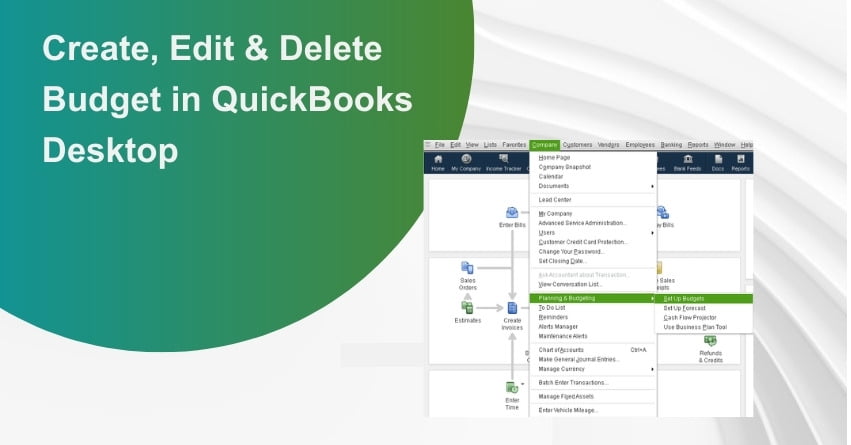

Upon starting QuickBooks Desktop, select “Company” from the menu, then “Planning & Budgeting,” and finally “Set Up Budgets.”

Step 2. Select the Financial Year and Category

Decide the fiscal year you want to construct a budget for. There are three different budget kinds available in QuickBooks Desktop:

- Profit and Loss Budget: This type concentrates on receipts and outgoings.

- Budget with a Balance Sheet: This style focuses on assets, liabilities, and equity.

- Budget that includes both the profit and loss and balance sheet budgets.

Step 3. Create a New Budget or Copy an Existing One

- Create a New Budget or Copy One That Already Exists

- You may either start from scratch by choosing “Create New Budget” or use a prior budget as a model by selecting “Create Budget from Previous Year’s Data.”

Step 4. Establish Budget Requirements

Define the budget and specify its frequency (monthly, quarterly, or yearly). You can either create a budget by account or by client/job. Choose the exact accounts you wish to include in the budget if you decide to use account-based budgeting.

Step 5. Specify the Budget Amounts

For each account, enter the anticipated amounts. The following techniques are available in QuickBooks Desktop for entering these amounts:

- Enter by Total: Enter the full fiscal year’s total amount.

- Enter Amounts by Month: Indicate amounts for every month separately.

- Copy of the Real Data Start using historical information from a prior fiscal year.

Step 6. Save your Money

Once all the essential information has been entered, click “Save” to save your budget.

B. Steps to Make Adjustments or Edit Budget in QuickBooks Desktop

Step 1. Revise your Budget

Budget adjustments may be necessary due to shifting business conditions. To do this, go to the “Company” menu, choose “Planning & Budgeting,” and then click “Set Up Budgets.” Find the budget you want to change, then select “Edit.”

Step 2. Update Budget Amounts

The budget amounts can be changed as necessary. You have the option to change the balances in each account, distribute money differently, or even open new ones.

Step 3. Save Changes

After making the adjustments, click “Save” to update your budget.

C. Steps to Delete Budget in QuickBooks Desktop

- Go to the company and point the cursor in the planning and budgeting area.

- Press the Setup Budgets button.

- Select the budget that you want to delete by using the drop-down menu.

- Begin to define the appropriate customer position or class.

- Select edit.

- Choose Budget Delete.

- Verify that deleting a budget was accomplished.

Tips for Creating a Budget in QuickBooks Desktop

1. Use Historical Data

This is not an option for newly established businesses but for those creating the budget for the next year, using actual data from the year before rather than a best guess is the best method for estimating budget totals.

2. Budget According to your Business Cycle

Verify that your budget totals accurately reflect any seasonal budget you may have. Make sure your budget accounts for more earnings during that time of year, for instance, if you make the majority of your income in the spring.

3. Get your Staff involved in the Budgeting Process

Make sure to involve your staff in the budget planning process if you’re creating a departmental budget. The person in charge of that department is the best person to ask about charges.

4. Understate Revenue and Overstate Costs

When revenue exceeds expectations, it is always a welcome surprise; when expenses exceed projections, not so much. When predicting revenue, always be a little conservative and add an extra 10% to 15% to your expenses. This might help you manage any unforeseen expenses and maintain your spending plan.

5. Make Adjustments

Static budgets can give your company useful information, but if they aren’t changed when necessary, they can quickly become out of date. Make sure to frequently review your budget and make any necessary adjustments.

How to Monitor and Analyze Budget in QuickBooks Desktop?

1. Access Budget Reports

Using the “Reports” menu, select “Budgets & Forecasts” and the appropriate budget report to track the performance of your budget. For both the Profit and Loss and Balance Sheet budgets, you can view budget vs actual reports.

2. Customize Reports

Make your budget reports specific to the data you require. To have a thorough grasp of your financial status, you can change the reporting period, columns, and other parameters.

3. Interpret the Data

To find differences between planned and actual financial data, examine the budget vs actual reports. This research might offer insightful information about potential areas where your expenditure or revenue strategies need to be modified.

Benefits of Budgeting in QuickBooks Desktop

Using the budgeting feature in QuickBooks Desktop offers several benefits to your business:

- Financial Control: Budgeting helps you maintain better control over your finances, making it easier to avoid overspending and identify potential issues early.

- Strategic Planning: With budgeting, you can align your financial goals with your business strategy, allowing you to allocate resources more effectively.

- Performance Tracking: By comparing actual financial data with budgeted amounts, you can track your business’s financial performance and make informed decisions.

- Decision-Making: Budgeting provides valuable insights that can influence decisions about investments, cost-cutting measures, and growth strategies.

Conclusion

Budgeting is a key strategy for achieving financial success, and QuickBooks Desktop makes it easier to create, manage, and analyze budgets. You can use the power of budgeting to steer your company toward its financial objectives by following the procedures described in this article. Maintaining flexibility and responsiveness to shifting market conditions will be made possible by routinely assessing and modifying your budgets based on actual performance. Remember, the key to successful budgeting lies in its continuous implementation and thoughtful analysis. If you have any doubts, reach out at toll-free number: +1-888-245-6075.

Frequently Asked Questions

Yes, you may make several budgets with QuickBooks Desktop for various projects or departments. Just define the accounts and figures for each department or project and follow the same processes as for constructing a budget.

Yes, you can duplicate and modify a budget from a prior year using QuickBooks Desktop. After selecting the current budget, select “Edit” and then “Copy Budget.” Make the necessary changes to the copied budget figures.

In QuickBooks Desktop, go to the “Company” menu, choose “Planning & Budgeting,” and then click “Set Up Budgets” to remove a budget. To delete a budget, select it, click “Delete,” and then confirm the action. Note that deleted budgets are irretrievably lost.

There is no direct capability for recurring budgeting in QuickBooks Desktop. On the basis of your regular expenses, you can manually establish budgets for each month or quarter.

By creating budget vs. real reports in QuickBooks Desktop, you can keep track of your actual spending in comparison to your allocated spending. To compare the amounts in your budget with the financial data that really exists, go to the “Reports” menu, pick “Budgets & Forecasts,” and select the relevant report.

The amount of line items you can include in a budget in QuickBooks Desktop is limited. For precise information, it’s best to consult the product documentation or support resources as the limit could differ depending on the version of QuickBooks Desktop you’re running.