Do you need to delete a bank account that is no longer in use or has become obsolete? QuickBooks provides a simple process to do so. In QuickBooks, managing your financial accounts is crucial for maintaining accurate and organized records. Adding, modifying, or removing bank accounts is a routine task that ensures your financial data stays up-to-date and reflective of your business transactions.

In this article, we’ll walk you through the steps on how to delete a bank account in QuickBooks Online and Self-Employed. Keep in mind that removing a bank account should be done with caution, and it’s advisable to consult with experts.

Reasons to Delete your Bank Account in QuickBooks

Deleting a bank account in QuickBooks involves the removal of an existing bank account within the software. This action is typically taken when a bank account is no longer in use, has been closed, or if there’s a need to clean up. The reasons for deleting a bank account in QuickBooks are mentioned below in detail:

- If you have a bank account that is no longer working properly, or inactive for some reason, it makes sense to remove it from QuickBooks.

- If a user accidentally attaches their personal bank account in QuickBooks.

- Deleting an account can help in saving annual fees.

- If you’ve made errors in setting up a bank account you might choose to delete the account and re-enter the correct information.

- Businesses may change, such as restructuring or shifts in financial management. During these times, it may be necessary to clean up and reorganize your financial data, which can include deleting unnecessary bank accounts.

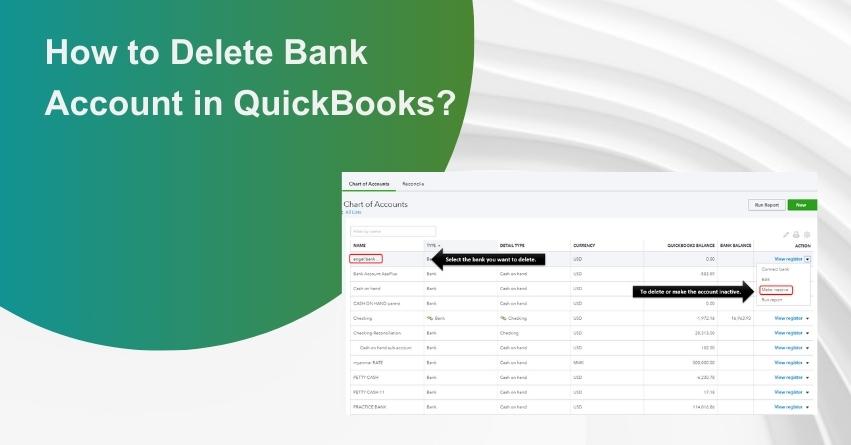

How to Delete a Bank Account in QuickBooks Online?

To remove a bank account from your Transactions screen discreetly:

- Navigate to Transactions in QuickBooks Online and click on Bank Transactions.

- Choose the Bank Account you wish to delete.

- Look for a Pencil icon at the top right of the Account.

- Opt for Edit Account Info.

- Scroll down, and check the Disconnect this Account on Save box.

- Click Save and Close.

The account won’t be visible on this screen, but note that it might still be active in the Accounting tab.

How to Delete a Bank Account in QuickBooks Self Employed?

Delete your bank accounts and transactions:

1. Web Browser

To remove your bank accounts and transactions, follow these steps:

1.1: Delete data from connected bank and credit card accounts

- Click on the profile icon.

- Then, choose “Bank Accounts.”

- Locate the account you wish to delete.

- Click on the trash icon in that section.

- Enter “DELETE” and confirm by selecting the Delete option.

Note: Keep in mind that deleting a bank or credit card account will also delete all associated transactions. Exercise caution when performing these actions.

1.2: To delete transactions imported from a specific CSV file

Follow the steps mentioned below:

- Click on the profile icon.

- Then choose “Imports.”

- Select the bank account where you imported the CSV file.

- In the “Files imported” section, click on the trash icon next to the relevant file.

This action will remove all transactions that were imported from the specified CSV file. Make sure to verify your selection before confirming the deletion.

How to Import Transactions into QuickBooks?

2. On an iOS (iPhone or iPad)

To delete a bank account, follow these steps:

- Click on the profile icon and then go to Settings.

- Choose “Bank Accounts.”

- Select the specific bank account you wish to delete.

- Click on “Delete Bank.”

- Confirm your decision to disconnect the connection and delete the associated data.

Always double-check your selections before confirming to avoid accidental deletions.

3. On an Android phone or tablet

To delete a bank account on an Android phone or tablet, use the following steps:

- Open the menu by tapping on the ☰ icon.

- Go to “Settings.”

- Choose “Bank Accounts.”

- Tap the three dots ⋮ icon next to the bank account you want to delete.

- Select “Delete Bank” and then confirm by tapping “Delete.”

Conclusion

Removing a bank account from QuickBooks is a simple process, whether you’re using a web browser or a mobile device. Always exercise caution to double-check your selections before confirming deletions, as removing a bank account is typically irreversible. Remember that deleting a bank account also removes associated transactions.

Hope this article provided clear steps to ensure a smooth deletion, if you still have queries or do not wish to go ahead with the steps mentioned above, reach out to our experts at our Toll-free Phone Number i.e. +1-855-875-1223.

Frequently Asked Questions

To remove your bank accounts and transactions, follow these steps:

1. Click on the Profile icon.

2. Choose “Bank Accounts.”

3. Locate the account you wish to delete.

4. Click on the Trash icon in that section.

5. Type “DELETE” and confirm by selecting the Delete option.

Following are the QuickBooks accounts that cannot be deactivated:

1. Opening Balance Equity

2. Retained Earnings

3. Undeposited Funds

4. Inventory/Stock Asset and Cost of Goods Sold/Cost of Sales

5. Sales of Product Income

6. Reconcile/Reconciliation Discrepancies

7. Unapplied Cash Payment Income

8. (Sales tax agency name) Payable

9. QuickBooks Checking

For QuickBooks Online, follow these steps:

1. Navigate to Settings and choose Payroll Settings.

2. Under Bank Accounts, click Edit.

3. Select Update.

4. Opt to Add a new bank account.

5. Search for your bank name. If necessary, enter your online banking user ID and password. Alternatively, choose to Enter bank info manually.

6. Click Accept and Submit.

Closing an account can be an important financial move, potentially saving on annual fees or mitigating the risk of fraud. However, it’s crucial to exercise caution as closing the wrong accounts may have adverse effects on your credit score. To safeguard your credit standing, it’s advisable to check your credit reports online to assess your account status before proceeding with any account closures. This proactive step ensures that you make informed decisions that positively impact your credit score.