Venturing into consulting or launching a small business is a big move, and with it comes the responsibility of managing your taxes. Unlike traditional 9-to-5 jobs, where taxes are deducted automatically, self-employed individuals must track their income, manage expenses, calculate quarterly estimated taxes, and file all relevant information with the IRS. It can feel overwhelming, but the right tools can make all the difference.

Self-employed professionals such as freelancers, gig workers, consultants, and sole proprietors don’t receive W-2s like traditional employees. Instead, they are responsible for managing forms like Schedule C and Form 1040, all while keeping accurate financial records throughout the year. That’s where QuickBooks Self-Employed or QuickBooks Online becomes a game-changer, simplifying everything from income tracking to tax preparation.

These platforms are designed to simplify your workflow with features like automatic expense categorization, invoice tracking, mileage logging, and real-time profit/loss insights. They even calculate your quarterly taxes and send reminders to help you avoid IRS penalties. Plus, you can easily track and deduct eligible expenses, like internet, phone bills, office supplies, advertising, and business travel, especially if you work from home.

In our latest blog, we will walk you through the entire process of handling self-employment taxes using QuickBooks. Whether you’re just getting started or looking for a smoother way to manage your finances, this blog will help you stay ahead. So, let’s begin with it.

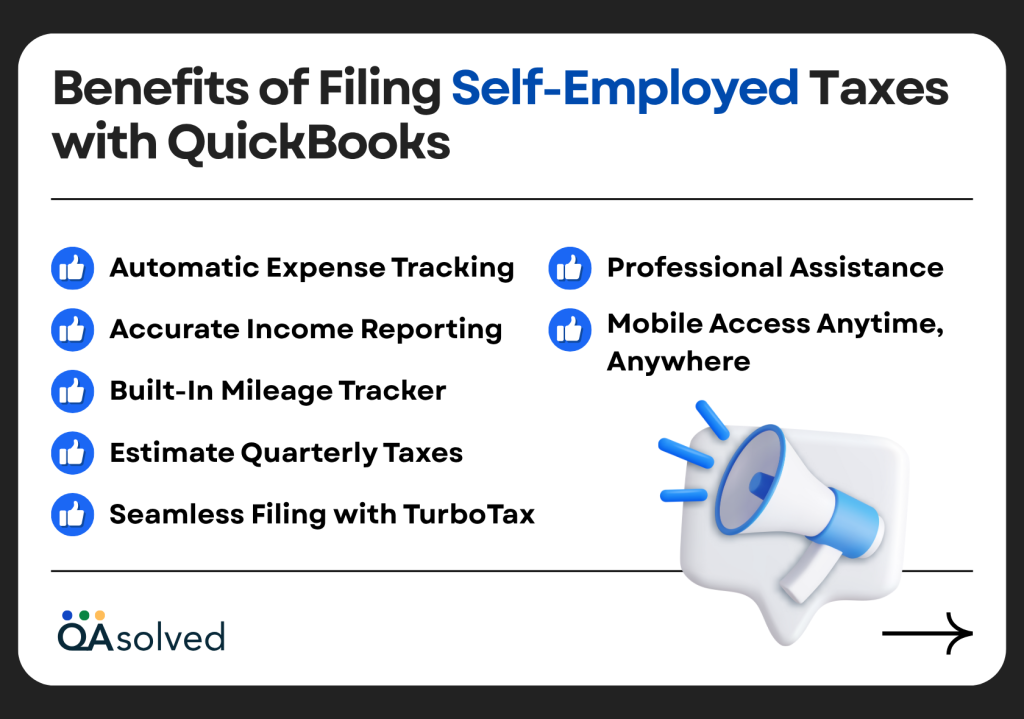

Benefits of Filing Self-Employed Taxes with QuickBooks

Filing taxes as a self-employed professional can be complex and time-consuming, but with QuickBooks, the process becomes far more manageable. Designed specifically for freelancers, gig workers, and small business owners, QuickBooks offers a range of features that simplify tax filing. Here are some benefits of filing self-employed taxes with QuickBooks:

1. Automatic Expense Tracking

QuickBooks automatically imports and categorizes your business expenses by connecting directly to your bank account and credit card account. Keeping track of your spending this way ensures that you don’t miss any deductions.

2. Accurate Income Reporting

A single place can be used to track all sources of income. When it’s time to file, you won’t have to dig through spreadsheets, payment apps, or invoices.

3. Built-In Mileage Tracker

QuickBooks Self-Employed includes a mobile mileage tracker that automatically logs trips, making it easy to claim vehicle deductions.

4. Estimate Quarterly Taxes

QuickBooks provides you with an estimated quarterly tax payment based on your income and expenses, helping you avoid penalties and surprises at the end of the year.

5. Seamless Filing with TurboTax

TurboTax Self-Employed automatically imports your financial data when tax season arrives, streamlining your filing process.

6. Mobile Access Anytime, Anywhere

Your phone allows you to track income, track expenses, and view tax estimates. It is the perfect solution for solopreneurs who are always on the go.

7. Professional Assistance

The QuickBooks platform includes built-in help tools, and if you need additional assistance, you can connect with an accountant or tax professional.

In short, with QuickBooks you get a powerful set of tools designed to keep your finances organized, your deductions maximized, and your tax filing on track. Whether you’re a freelancer, consultant, or gig worker, QuickBooks helps you stay ahead of deadlines and gives you the confidence to file accurately and efficiently.

Now, let’s help you with the steps to file self-employed taxes with QuickBooks effortlessly.

4 Steps to File Self-Employed Income Tax in QuickBooks

Being self-employed comes with extra responsibilities-but QuickBooks helps you manage them easily. It helps you keep track of everything you need to file correctly, whether you’re freelancing, consulting, or running a small business. Here are the steps to file and prepare your self-employed income tax with QuickBooks:

Step 1: Track Your Tax Deductions

Keeping track of your business expenses throughout the year is one of the best ways to reduce your self-employment tax bill. When it’s time to file, these expenses can reduce your taxable income, saving you a lot of money. It helps you keep track of all kinds of deductible expenses, from everyday office supplies to software subscriptions to larger expenses like advertising and travel. Using the IRS mileage rate, you can also deduct miles driven for business.

Step 2: Link Your Bank Account

QuickBooks can be integrated with your online banking or credit card account to save you time and reduce manual data entry. All you need to do is link your bank and credit card accounts with QuickBooks to automatically download and sync your transactions. This makes it easy to review, categorize, and update your financial records in real time, saving you hours of manual entry and keeping everything accurate for tax filing.

Step 3: Categorize your expenses

Stay on top of your finances by categorizing your transactions regularly. Sorting transactions as they come in makes it easier to identify deductions and stay organized come tax time.

Also, QuickBooks Solopreneur comes with a default setting where categorizing of your transactions are done automatically. However, you can recategorize your transactions as per your requirements.

Step 4: Claim your tax deductions

Once you have tracked and categorized your business expenses, you can claim them on your tax return. Your tax liability can be reduced by these deductions, which reduce your taxable income.

So, these are the steps that can help you file your self-employed income tax in QuickBooks.

How to File Year-End Taxes in QuickBooks?

If you intend to file your taxes at the end of the year, then you need to make sure that remains updated throughout the year for accurate figures at the very end. Here are 5 steps to file your year-end taxes in QuickBooks effortlessly:

Step 1: Sign up for Year-End Tax Filing within QuickBooks

To get started with filing your year-end taxes, first enroll in the Year-End Tax Filing feature within QuickBooks. This step unlocks tools and support designed to guide you through the filing process, ensuring your records are accurate and tax-ready.

Step 2: Review Your Year-End Checklist

Make sure everything is in order with your year-end checklist in QuickBooks before filing your taxes. By following this step, you can ensure that your financial records are accurate and complete.

Step 3: Collect and Save Your Financial Statements

Providing financial statements is an essential part of preparing your self-employed tax return. Your Profit and Loss (P&L) statement and Balance Sheet are automatically generated in QuickBooks and linked to your tax filing process.

Step 4: E-File Your Taxes

Start filing taxes for your sole proprietorship. You can do this by following these steps.

- Use the link to complete the steps.

- Choose Start taxes or Continue taxes if you’ve already started.

- To file with Schedule C, select Sole Proprietorship.

Note: Enter your personal and business info to proceed. - When you first open it, select Add my income. If you’ve already started, select Add more income.

- Enter your self-employment income and expenses, then click Start.

Note: QuickBooks auto-fills your business info. If needed, you can add or update it. - Choose Yes, add this income, or No, I’ll manually enter this income.

- Click Continue. Any additional income or expense can also be added or updated.

- Verify the transferred expenses from QuickBooks. Using your Profit and Loss statement, you can manually add it.

Review your Schedule C tax return for income and expenses. The information can be exported from QuickBooks and transferred to TurboTax for filing.

Note: If you’re a sole proprietor, you can move your income and deduction details to TurboTax. However, items like assets, liabilities, and equity accounts won’t be transferred.

Conclusion

Filing self-employed taxes doesn’t have to be stressful or confusing, especially when you have the right tools in place. Whether you’re managing income and expenses throughout the year or preparing for your year-end tax return, QuickBooks simplifies the entire process. From tracking deductions and categorizing transactions to estimating quarterly payments and e-filing through TurboTax, QuickBooks is built to support freelancers, gig workers, and small business owners every step of the way.

By staying organized and proactive with your finances, you can reduce tax-time stress, maximize your deductions, and ensure accurate, on-time filings. So whether you’re just starting your self-employment journey or looking to improve your current tax routine, QuickBooks gives you the confidence to take control of your taxes with ease.

In case you’re facing any trouble with filing year-end income tax in QuickBooks, then contact QuickBooks Support at the toll-free number +1-888-245-6075.

Frequently Asked Questions

Yes, QuickBooks helps with self-employment taxes. Using QuickBooks Self-Employed or QuickBooks Solopreneur, you can:

– Keep track of your income and expenses

– Organize your spending by tax category

– Estimate your quarterly taxes

– Prepare a summary of Schedule C

– Send your info to TurboTax for easy filing

While QuickBooks doesn’t file your taxes for you, it gives you everything you need to stay organized.

Yes, QuickBooks can file W-2s for you automatically if you’re using the right payroll plan. QuickBooks Online Payroll Core, Premium, or Elite will:

– Generate W-2 forms for your employees

– File them with the IRS and Social Security Administration

– Either send electronic copies or mail hard copies to your employees

Once your payroll setup is correct and up-to-date, QuickBooks handles it for you.

Be sure to:

– Accurate employee information is provided

– Payroll is processed on time at the end of the year

– Up-to-date tax payments

Statements from your bank can be used to supplement your tax records, but they do not replace receipts. In addition to the amount, date, and vendor, they do not provide details about what you purchased. Keep both receipts and bank statements for tax purposes. Making tax time easier is easier when you use apps like QuickBooks to store, match, and organize receipts.

QuickBooks makes it easy for you to pull reports when it comes to filing your taxes. The following are the main ones to grab:

1. Profit and Loss Report – This shows how much you made and spent during the year. The information is crucial to filing your tax return.

2. Balance Sheet – In case you are not a sole proprietor, this is a good way to show your assets and liabilities.

3. Income Tax Summary – Provides a breakdown of income and expenses by tax category (great for Schedule C).

4. Expense Report – Useful when looking for deductions because it shows where your money went.

5. General Ledger – Your accountant or the IRS may need detailed information about every transaction.

You can also export your Schedule C worksheet to TurboTax if you’re using QuickBooks Self-Employed or Solopreneur.