Every paycheck tells a story- detailing each employee’s earnings, taxes, and deductions. The standard pay stub template may not always capture everything your team needs. That is exactly when QuickBooks and its Pay Stub Template arrive at the scene. In QuickBooks Desktop, payroll management is more than issuing paychecks; it’s about providing transparency and clarity through detailed, personalized pay stubs. Intuit Pay Stub Template offers a standard format that can also be customized to meet distinct needs of businesses. With customized QuickBooks Pay Stub Templates, you can modify colors, fonts, logos, and layouts to create professional pay stubs, invoices, estimates, sales receipts, or purchase orders that resonate with your brand identity.

In this blog, we’ll walk you through customizing a QuickBooks pay stub template. From adding company branding to selecting the right deductions, you’ll be able to create a pay stub that answers all questions at a glance. Tailor each stub to display specific information like deduction summaries, detailed pay components, or even personalized notes, ensuring employees have a clear breakdown of their pay.

So, Let’s explore how to elevate your business documents with QuickBooks customization tools.

7 Benefits of Using QuickBooks Check Stub Template

QuickBooks is widely recognized and used software that allows small and medium business enterprises to manage their accounting and bookkeeping processes effectively. There are many exciting features that attract MSMEs and CPAs to use this software. Here, one of the most underrated aspects is QuickBooks Pay Stub Template. Let’s discuss the benefits of the same.

- Clarity and Transparency: Custom pay stubs help employees understand earnings, taxes, and deductions.

- Professional Branding: Include your logo and brand elements to make your business look professional and cohesive.

- Employee Satisfaction : Clear, detailed pay stubs contribute to employee satisfaction.

- Tailored Information: Provide specific details, such as deductions or benefits, to meet individual needs.

- Reduced Errors: Using consistent templates minimizes errors and streamlines payroll processing.

- Compliance: Custom fields ensure legal accuracy by including regulatory information.

- Efficiency: Standardizes formats across all documents to save time and money.

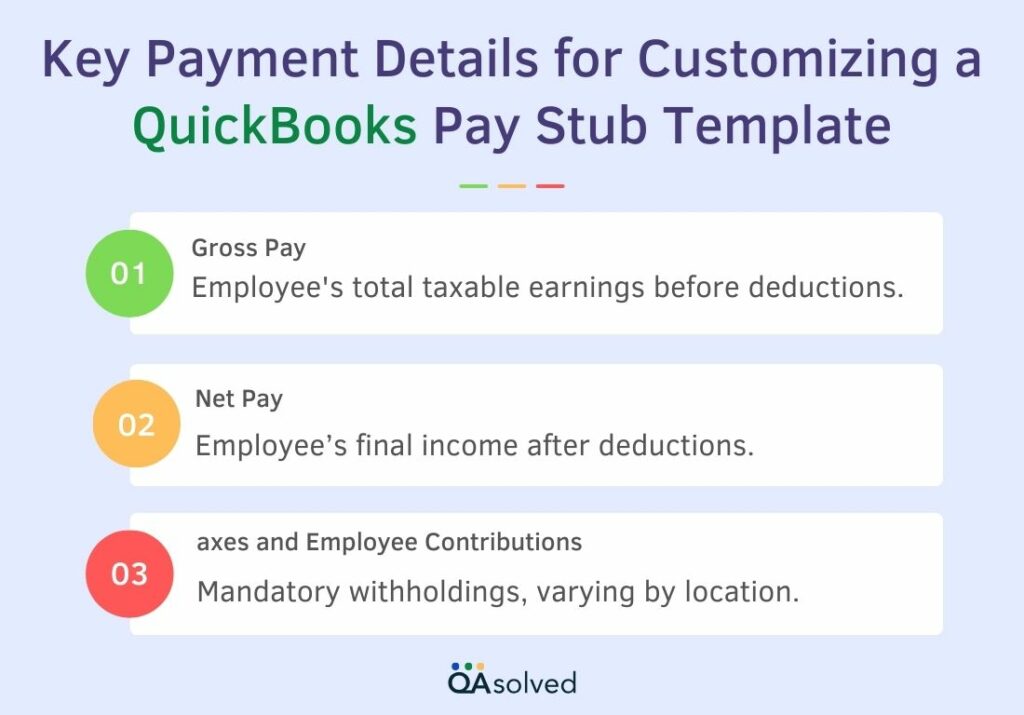

The ability to customize paychecks in QuickBooks Desktop Payroll improves employee satisfaction, brand image, and efficiency. Here are the key payment details to customize QuickBooks Pay Stub Template.

Steps to Customize Paychecks and Pay Stubs in QB Desktop Payroll

Using QuickBooks Desktop Payroll, you can customize paychecks and pay stubs according to your requirements. In addition to adjusting earnings and deductions, QuickBooks allows you to display specific details for each employee. With these steps, you’ll learn how to customize your paychecks and pay stubs so they accurately reflect your important information. Take control of your paychecks and personalize them effortlessly!

Customize Your Paychecks with 6 Easy Steps

Do you want to customize your intuit payroll pay stub template and paychecks? If yes, then you’re on the right page. QuickBooks Desktop allows you to customize the information displayed and printed on paycheck vouchers and pay stubs. The most ecstatic thing is that these paychecks can even be printed in the font of your choice.

Change Fonts, Add Company Name & Address, Logo and Signature

- Select Printer Setup from File.

- Choose payroll-printing-preferences from the dropdown menu.

- Go to the Fonts tab and select:

- Font to adjust the primary font for most of the form.

- Address Font to change the font for the company name and address.

- Select the font size and style you prefer.

- Choose one of the following options under the Settings tab:

- Print company name and address

- Use logo

- Print signature image

- To save, click OK twice.

Note: The numeric dollar amount font is preset to Arial 10-point in QuickBooks Desktop and cannot be changed.

Take Control of Your Pay Stubs and Paycheck Vouchers

Easily customize your intuit payroll pay stub template and paycheck vouchers! Using a few simple adjustments, you can customize these documents to display your specific details. It will help you create clear, precise, and customized pay stubs and vouchers that highlight deductions and provide key earnings information.

Basic Downloadable QuickBooks Pay Stub Template Details:

Managing your finances effectively requires understanding your pay stub. With each pay stub, you can see what your earnings are, what deductions were made, and what taxes were paid.

When you customize a pay stub template in QuickBooks, you’ll include the following information:

Adding Account Names

- Go to QuickBooks and log in.

- Select Edit > Preferences.

- Click on Company Preferences in the Preferences menu.

- Select Print Account Names and click OK.

- Pay stubs will include account names when this option is selected.

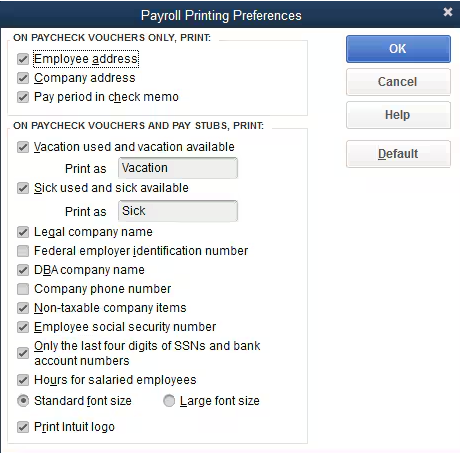

Creating a Custom Pay Stub Template

QuickBooks allows you to customize a basic pay stub template. Check vouchers can be printed with the account name if you wish:

- Select Preferences from Edit.

- Go to Company Preferences, then Payroll & Employees.

- Choose Print Pay Stubs & Vouchers.

- Uncheck any information you don’t want to appear on paycheck vouchers or pay stubs in the Payroll Printing Preferences window.

- To save, hit OK twice.

Essential Pay Stub Details

QuickBooks Desktop automatically generates pay stubs with details about your employees’ earnings and deductions that provide a comprehensive picture. The following information cannot be removed from paycheck vouchers and pay stubs under FLSA recordkeeping requirements:

- Employee Information: This includes the employee’s name, address, and other contact information. Identification of the payee is essential.

- Earnings: The gross wages of an employee are listed here, including regular pay, overtime, bonuses, and commissions. These are calculated by QuickBooks based on your payroll settings.

- Deductions: QuickBooks lists all deductions, such as federal and state taxes, Social Security, Medicare, and voluntary deductions like health insurance and retirement contributions.

- Taxes: Social Security and Medicare contributions, as well as federal and state tax withholdings, will be shown.

- Net Pay: An employee’s net pay is the amount they take home after deductions. All applicable taxes and deductions are subtracted from gross pay.

- Year-to-Date (YTD) Totals: A cumulative summary of earnings, taxes, and deductions for the year, which employees can use to track their earnings and tax obligations.

Also Read: Intuit ViewMyPaycheck Login and Sign-Up Process

Conclusion

The ability to customize pay stubs and paychecks in QuickBooks Desktop Payroll allows you to align your payroll documents with your brand and provide employees with clear, personalized information. By tailoring pay stubs to highlight essential information like gross pay, taxes, deductions, and company branding, you promote professionalism and transparency. By simplifying the payroll process, employees can also easily understand their earnings and deductions, reducing confusion.

QuickBooks Desktop’s Custom Pay Stub Template enables you to transform standard payroll documents into important communication tools for your business. All while simplifying the payroll process, it promotes employee trust, promotes efficiency, and strengthens your professional image.

If you need any professional assistance with QuickBooks Desktop Payroll then QAsolved is here to meet all your needs and requirements. Our certified and experienced professionals can help you customize your QuickBooks Pay Stubs and Paychecks.

Frequently Asked Questions

1. Firstly, login to your Quickbooks.

2. Next, go to the edit tab. Click on it.

3. After that, in the drop-down menu, you will get the preferences tab.

4. Here, click on payroll and employees.

5. Tap on the preferences of the company.

6. Then, select pay stub and voucher printing.

7. Hence, you will get a window of payroll printing preferences. As per your wish, select the checkboxes given.

8. Click on Ok twice.

Even if you have direct deposit, one can always ask their employer to provide their pay stubs. Hence, it doesn’t matter if you are holding a direct deposit. They will generate your pay stubs on your direct deposit. In addition, they can email you or hand it over to you. Ask them if they can do it for you.

1. First of all, go to Employees.

2. Here, select the employee and open the paycheque list tab.

3. Find the pay cheque you emailed.

4. In order to open it, click on Net Pay amount.

5. Click on print.

6. You’ll get a pdf of the pay stub.

While sending paystubs, one needs to enter the password. This password is either webmail or email one set up by you in QB Desktop. In case you’ve set up a Yahoo email for sending pay stubs, then I will recommend putting that password.

In order to do so :

1. Go to the file at the top.

2. Then, here, click on Print forms.

3. After that, select pay stubs.

4. Next, proceed by selecting your payroll bank account.

5. Hence, you have to enter the date range including the pay date of pay stub.

6. Select the pay stub you want to print.

7. Then, click on print.

8. You’ll get a pdf of it.