Managing payroll is a critical aspect of any business, and a payroll ledger is a valuable tool in this process. This ledger serves as a comprehensive record-keeping system, tracking all financial transactions related to employee compensation.

In this article, we will explore how to create and effectively utilize a payroll ledger, offering insights into its importance, components, and practical steps to ensure accurate and organized payroll management for your business. Whether you’re a small business owner or part of a larger organization, understanding the ins and outs of a payroll ledger can contribute to effective financial operations.

What is a Payroll Ledger / Payroll Journal and why should you be using it?

A payroll ledger is a specialized accounting document or system designed to systematically record, track, and manage all financial transactions related to employee compensation within an organization. It serves as a centralized record-keeping tool that helps businesses maintain accurate and organized information about their payroll activities.

In this, you typically find details such as employee salaries, wages, bonuses, deductions, and taxes. The ledger can also include information about benefits, overtime, and any other financial transactions associated with employee compensation. Each employee typically has a dedicated section or entry in the ledger, providing a comprehensive overview of their financial history with the company.

The Primary Purposes of a Payroll Ledger

Record-keeping: It provides a detailed history of financial transactions related to employee compensation, offering a clear and organized record for both accounting and auditing purposes.

Calculation of Net Pay: By documenting all components of employee compensation, the ledger facilitates the calculation of net pay which means the amount an employee receives after deductions.

Tax Compliance: It helps ensure compliance with tax regulations by accurately tracking and recording tax withholdings for each employee.

Financial Reporting: Information from the payroll ledger is often used in financial reports and statements, providing insights into labor costs.

Audit Trail: In the event of an audit, a well-maintained payroll ledger serves as a reliable audit trail, demonstrating transparency and adherence to financial regulations.

Different Ways of Maintaining a Payroll Ledger

Using a Payroll Software Template

While payroll ledgers are effective for managing and monitoring employee pay, as a business owner, you have additional options to enhance efficiency. Payroll software like QuickBooks Payroll not only automates data entry but also integrates key functionalities found in a traditional payroll ledger. This software provides a more effective way to track employee pay, withholdings, gross pay, net pay, and more.

One significant advantage of using payroll software is the elimination of a major source of extra costs for small businesses which is human error. Automation also ensures timely and accurate payment to your staff by handling the technical aspects of payroll. Moreover, the software gathers all necessary data for IRS obligations in one location, ready for import into your preferred small business tax software.

While payroll ledgers are cost-free, easy to update, and useful for tracking important data in smaller businesses, they may pose limitations as your business expands. Dedicated payroll management software, like QuickBooks Payroll, can become more efficient in handling the complexities of a growing business.

QuickBooks Payroll offers various advantages, including:

- Auto Payroll

- Tax Penalty Protection

- Same-day Direct Deposit

- Time Tracking

- Expert Support

- Automated Payroll Taxes and Forms

Using a Manual Payroll Ledger Template

QuickBooks is primarily designed for automated payroll processes, and it doesn’t offer a manual payroll ledger template in the traditional sense. However, if you need to manually track payroll transactions outside of QuickBooks, you can create a spreadsheet using software like Microsoft Excel.

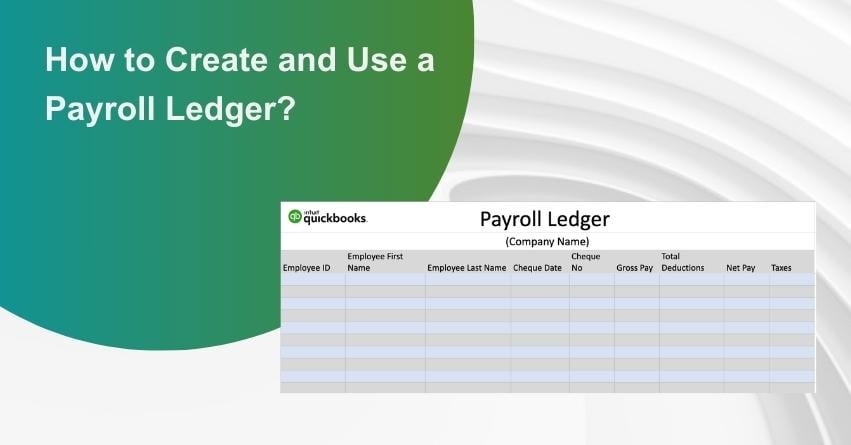

Elements in Payroll Ledger Template

You have the flexibility to structure your payroll ledger according to your preferences. The template is designed to make it easy for you to input and customize information as needed. This ensures that your payroll records are comprehensive and tailored to the specific needs of your business, but it’s crucial to include certain key details which are mentioned below:

- Dates

- Employee Names (and ID numbers if applicable)

- Pay Rate

- Gross Pay

- Pay Period

- Withholdings

- Net Pay

Here’s a format for a payroll ledger using an Excel spreadsheet with 6 columns:

- Explanation of columns: Below is the explanation of each column mentioned above. You can customize this template based on the specific needs and preferences of your organization.

- Employee Name/ID: Identify each employee by their name or a unique employee ID.

- Pay Period (Start – End Date): Clearly specify the time frame for each payroll entry, indicating the start and end dates of the pay period.

- Gross Pay: Display the employee’s total salary before any tax deductions or benefits contributions.

- Tax Deductions: Break down tax deductions, including federal, state, and local taxes. You can either have a single column for the total tax deduction or separate columns for individual taxes like Federal Income Tax, FICA Tax Withholding, etc.

- Other Deductions: Account for additional deductions, such as those related to employee benefits packages (e.g., life insurance). Like tax deductions, you can choose to have a total column or break it down into individual benefit components.

- Net Pay: Calculate the net pay by subtracting both tax and other deductions from the gross pay. This is the amount the employee receives and is what will appear on their final income statement.

How to Use the Payroll Ledger Template?

Now that we know how to create a payroll ledger template let’s dive into the intricacies and learn how to use it to effectively manage your accurate financial records. Follow the step-by-step process mentioned below:

- To use the Payroll Ledger Template start by inputting the provided information into each respective column on the spreadsheet.

- Then, fill in each employee’s row under the designated column with their respective names.

- After that, refer to the column headers explained in the section above on “How to build a payroll ledger” to ensure you enter the correct data for each employee.

- Take a moment to review your work and double-check the accuracy of the entered information.

- Once completed, the ledger becomes a valuable resource for various purposes, including Accounting and Bookkeeping, Tax Preparation, or Business Forecasting and Planning for your business.

What are the Benefits of Payroll Ledger ?

The benefits of it, particularly when integrated into payroll software, are mentioned in the points below:

Improved Accuracy: Digital payroll ledgers enhance accuracy by automating calculations and minimizing manual input errors. The ledger helps ensure that wages, deductions, and other payroll components are calculated correctly, reducing the risk of discrepancies.

Cost Reduction: Automation through digital payroll systems can lead to increased efficiency, reducing the likelihood of errors that could result in costly corrections. Accurate payroll ledgers assist employers in keeping track of expenses, helping them stick to annual wage budgets and avoid unexpected financial setbacks.

Time Savings: With digital payroll ledgers, the time spent on manual calculations and searching through spreadsheets for errors is significantly reduced. In case of audits or when addressing errors, having a digital ledger streamlines the process, saving valuable time for both employers and payroll administrators.

Data Security: Storing payroll data digitally, especially in secure cloud-based systems, provides protection against data loss and cyber threats. Compliance with regulatory requirements, such as the IRD’s mandate to keep payroll data for seven years, is facilitated by secure digital storage, preventing potential issues down the road.

Tips for Using a Payroll Ledger

You already know how to effectively use the Payroll ledger, now here are some tips mentioned below to simplify the process of maintaining an accurate ledger.

Log Complete Information: Ensure the accuracy and reliability of results by inputting thorough and timely data. Fill out the spreadsheet comprehensively to obtain a 360-degree view of the financial picture.

Use Payroll Calculations: Enhance the utility of the ledger by incorporating various sections in the report. This allows for multiple perspectives and insights from the same dataset. For instance, calculate payroll on a per-employee basis and employ a different calculation to determine total labor costs.

Enter Data Consistently: Consistency is key to the effectiveness of the ledger. Establish a specific timeframe for data entry into the payroll ledger to avoid missing or outdated information. This practice ensures accuracy and completeness, maximizing the ledger’s usefulness.

Transfer Records: Streamline bookkeeping processes by transferring payroll ledger information into the general ledger if your company maintains one. This not only saves time but also contributes to the overall organization of financial records. Minimize the need to hunt down information by ensuring data is recorded and transferred efficiently.

Conclusion

Creating and using a payroll ledger is a smart and efficient way to manage your business’s payroll information. Whether you opt for a traditional paper spreadsheet, a digital format, or utilize dedicated payroll software, the key is to maintain accuracy and consistency in recording crucial data.

A well-maintained payroll ledger serves as a reliable tool for understanding your labor costs, making informed financial decisions, and facilitating a smoother tax season. So, embrace the benefits of organized payroll management by incorporating a payroll ledger into your business practices.

If you come across any issue regarding how to create and use a payroll ledger? Reach out to QuickBooks Payroll assistance from our experts at our Toll-free Phone Number i.e. +1-888-245-6075 for personalized assistance.

Frequently Asked Questions (FAQs)

A general payroll ledger assists in monitoring the compensation of individual employees and accurately tracking the amount of taxes that need to be deducted from each paycheck.

QuickBooks facilitates the creation of a payroll ledger, automatically transferring all relevant information from your QuickBooks account. In QuickBooks terminology, this is referred to as a payroll summary report.

The main objective of a payroll journal or ledger is to document all transactions related to payroll, enabling employers to consistently evaluate the financial implications of payroll on their business.

Numerous employers opt for payroll software with integrated payroll ledgers and automated recordkeeping. For those who favor manual methods, such as Excel or dedicated ledger books, the typical approach involves the following steps:

1. Identify the information to be monitored, including employee names, pay rates, hours worked, etc.

2. Structure the ledger with columns corresponding to each dataset.

3. Establish sections for accounts payable and receivable to manage business-to-business transactions.

4. Introduce additional columns as necessary to accommodate new datasets.