Do you ever run into a situation where QuickBooks’ pay period dates don’t match your actual payroll schedule? If yes, then you’re not the only one to face this situation and we’re not going to let you suffer. The incorrect pay period dates in QuickBooks is one of the most common hiccups that can lead to payroll errors, employee confusion, and tax reporting problems. Users often face this problem and fail to rectify it promptly due to lack of knowledge of troubleshooting steps. Pay period dates can be incorrect due to a simple data entry mistake, a change in your payroll cycle, or an import glitch.

Payroll processing is the foundation of any successful business, and one of the details that often goes overlooked is the correct pay period dates. Errors in the pay period date can lead to a cascade of problems, including employee confusion and payroll discrepancies to problems with tax reporting and compliance.Paychecks in QuickBooks contain detailed information, including start and end dates for each pay period. These dates may not match your actual payroll cycle, which can affect pay stubs, direct deposits, tax filings, and employee records.

QuickBooks offers tools for reviewing and correcting pay period dates on existing paychecks, so you can maintain precise records and avoid costly mistakes. In this blog, we will explore the early signs and common causes to understand the root cause behind this problem. In addition to this, we will also help you to troubleshoot and fix incorrect pay period dates on paychecks in QuickBooks. So, let’s begin with it!

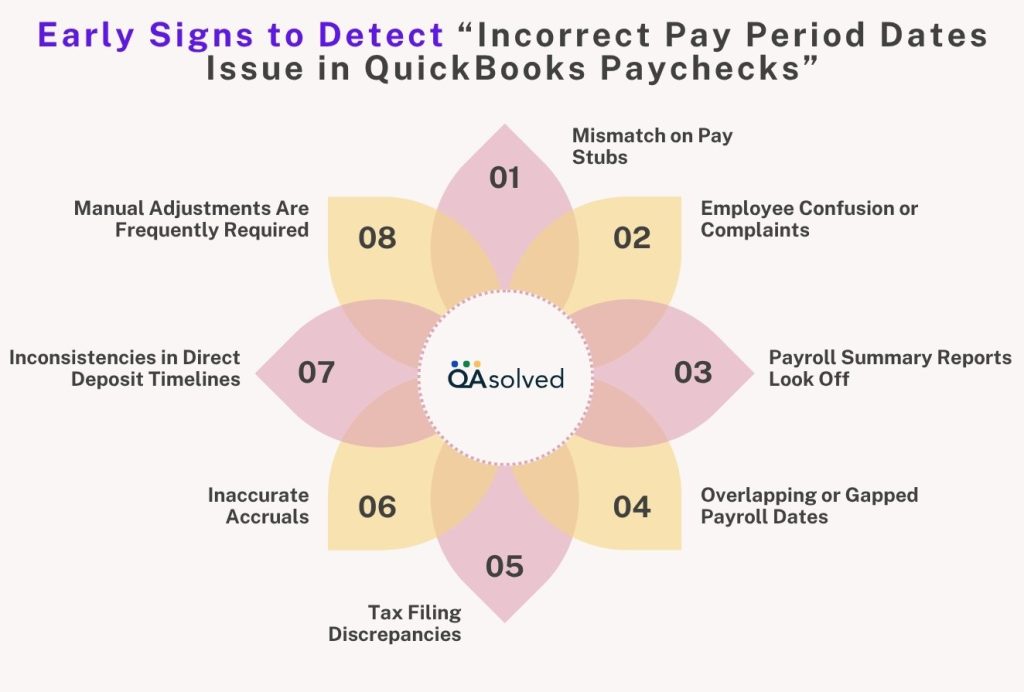

Early Signs to Detect “Incorrect Pay Period Dates Issue in QuickBooks Paychecks”

Preventing payroll errors from snowballing into bigger problems can be achieved by spotting them early. It may be a sign that QuickBooks is reporting incorrect pay period dates if you notice discrepancies in employee pay stubs or tax reports. Here are some of the early signs that can help you detect the possible threat and neutralize the threat of this roadblock:

1. Mismatch on Pay Stubs

They notice that the pay period listed on their pay stubs doesn’t match the days they actually worked.

2. Employee Confusion or Complaints

When overtime, PTO, or holiday pay is affected, employees may question why their paycheck does not reflect the correct time frame.

3. Payroll Summary Reports Look Off

Payroll Summary and Payroll Detail by Employee may not align with your actual payroll schedule, causing reconciliation issues.

4. Overlapping or Gapped Payroll Dates

Pay period dates overlap across multiple paychecks or payroll runs don’t align with your regular schedule due to overlapping or gaps between payroll runs.

5. Tax Filing Discrepancies

Tax filings (like Form 941) contain incorrect wage data because pay period dates do not match reporting requirements.

6. Inaccurate Accruals

Benefits accruals, PTO, and sick leave do not calculate correctly since they are based on pay period dates.

7. Inconsistencies in Direct Deposit Timelines

Employees or your bank may raise flags when direct deposits appear earlier or late than expected.

8. Manual Adjustments Are Frequently Required

Recurring issues associated with incorrect date ranges often require manual adjustment of hours, taxes, and benefits.

These signs can save you from bigger payroll headaches if you catch them early. Once they have been identified, you can correct their pay period dates so that payroll processing runs smoothly.

Also Read: How to Troubleshoot Paychecks Calculating Incorrectly in QuickBooks?

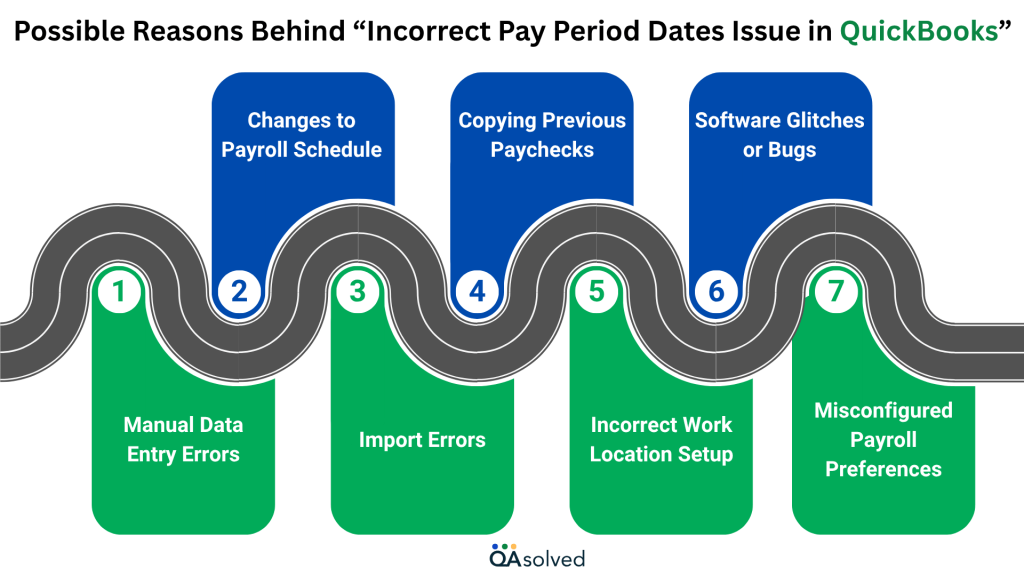

Possible Reasons Behind “Incorrect Pay Period Dates Issue in QuickBooks”

Understanding the cause of a problem is crucial before you can fix it. Even small mistakes in payroll can cause QuickBooks pay period dates to be incorrect, impacting tax filings, paychecks, and compliance. Here are some of the most common reasons behind this problem.

1. Manual Data Entry Errors

Manually entering pay period dates increases the risk of typos or selecting incorrect calendar ranges. Paychecks and reports can be distorted by these small mistakes.

2. Changes to Payroll Schedule

Pay periods can be misaligned when a company switches from weekly to bi-weekly or monthly pay cycles without updating payroll settings in QuickBooks. QuickBooks often uses the old schedule by default as a result.

3. Import Errors

There is a possibility that payroll or time data imported from third-party apps may contain incorrect or missing dates.Mismatches in QuickBooks can lead to inaccurate entries overwriting accurate entries, causing confusion among users.

4. Copying Previous Paychecks

Duplicating a prior paycheck without updating the date range can carry forward outdated pay period data. Long-term reporting problems often result from this shortcut.

5. Incorrect Work Location Setup

Depending on whether an employee’s work location or time zone is incorrectly set, the pay period can be affected. The situation is especially difficult for employees who work remotely or across multiple states.

6. Software Glitches or Bugs

In some cases, QuickBooks updates and internal glitches can alter your saved payroll settings for a given month. In rare instances, the wrong pay period may be automatically assigned to newly created paychecks as a result of these rare occurrences.

7. Misconfigured Payroll Preferences

QuickBooks may default to outdated payroll settings when payroll preferences are not adjusted after operational changes have been made. Among these things are the pay frequency, employee schedules, and the tax configurations.

When you understand these causes, you are empowered to take preventive action and minimize future errors. Keeping your payroll settings and processes in check will help you maintain accurate pay period dates and run payroll with confidence. Finally, let’s fix the issue and restore payroll to normal.

Steps to Fix Incorrect Pay Period Dates Issue in QuickBooks Online Payroll and QuickBooks Desktop Payroll

A mistake in a pay period date can have a ripple effect on payroll, taxes, and employee records. Fortunately, QuickBooks provides options for fixing these errors quickly. Follow these step-by-step instructions to keep your payroll records accurate and compliant, whether it’s one paycheck or your entire schedule. Find out how to fix incorrect pay period dates in QuickBooks Online Payroll and QuickBooks Desktop Payroll:

1. QuickBooks Online Payroll

Once the paycheck has been created, the pay period cannot be edited. You have the following options:

- If the paycheck has already been processed via direct deposit or issued as a paper check, please contact us for immediate assistance and fix incorrect pay period dates in QuickBooks Online Payroll.

Note: This will not update the dates on a paper check unless you reprint it.

- If the direct deposit paycheck has been created but hasn’t been processed yet, you can delete the paycheck and recreate it with the correct pay period.

2. QuickBooks Desktop Payroll

A. For QuickBooks Desktop Payroll Assisted

Changes to pay period dates can only be made on paychecks that have not yet been submitted to Intuit. Paychecks with incorrect pay period dates should be entered in the memo field instead if they have already been sent.

a. Edit the memo on paychecks already sent to Intuit:

- Choose Edit/Void Paychecks under Employees.

- Fill out the “show paychecks from and through” fields with the paycheck date range.

- Locate the paycheck with an incorrect pay period and double-click it.

- In the Memo field, type the correct pay period dates, for example, “Correct pay period 11/01-11/15.”

- Then click Save & Close.

- To record your changes, select Yes.

- Whenever you need to correct other paychecks, follow these steps.

b. Edit pay period dates on paychecks that have NOT been sent to Intuit:

- Choose Edit/Void Paychecks under Employees.

- Enter a date range for “show paychecks from and through.”

- Locate the paycheck with an incorrect pay period and double-click it.

- Select Paycheck Detail.

- Update the pay period dates in the Review Paycheck window.

- Hit OK.

- Click Save & Close.

- Click Yes to save the changes.

- Any other paychecks that need correction can be corrected by following these steps.

- Send Intuit your payroll information along with direct deposits of paychecks.

B. QuickBooks Desktop Payroll Basic, QuickBooks Desktop Payroll Standard and QuickBooks Desktop Payroll Enhanced

You can correct the pay period dates on paychecks that were entered incorrectly.

- Choose Edit/Void Paychecks from Employees.

- Enter the paycheck date in the show paychecks from and through the field.

- Open the paycheck with the incorrect pay period by double-clicking it.

- Click on Paycheck Detail.

- Enter the correct dates in the Review Paycheck window.

- Enter OK.

- Save and close the window.

- To record your changes, select Yes.

- If there are additional incorrect paychecks, repeat the steps.

Follow these steps carefully to correct any incorrect pay period dates on your paychecks and maintain accurate payroll records. In case you’re having trouble in fixing this issue, then you can contact QuickBooks Payroll Support.

Summary

Correcting incorrect pay period dates in QuickBooks ensures the integrity of your payroll system and ensures compliance with federal, state, and local tax laws. Pay period dates that are inaccurate can lead to payroll errors, employee confusion, delayed payments, and incorrect tax withholdings. Discrepancies may even lead to penalties or audits from tax authorities, which can be costly and time-consuming. Correcting incorrect pay period dates improves payroll accuracy, ensures employees are paid correctly and on time, and simplifies tax reporting processes.

In short, a proper payroll management process minimizes compliance issues and audit risks, ensuring your peace of mind.

Frequently Asked Questions

Due to how your employer schedules payroll processing, your pay stub might show a pay date before the end of your pay period. Employers often set pay dates earlier so that they can process direct deposits or issue checks in a timely manner.The pay period could end before the full amount is paid. Mismatches can also be caused by payroll system settings or data entry errors. Check with your payroll department if you’re unsure.

Edit Payroll Schedule:

1. Access Employees > Payroll Center > Pay Employees tab.

2. Select Edit Schedule from the right-click menu.

3. Click OK after updating the Pay Period End Date and Pay Date.

Fix Paycheck Date (Not Yet Sent):

1. Select Employees > Edit/Void Paychecks.

2. Click Paycheck Detail on the paycheck.

3. Change the date > Save & Close.

Note: Fill in the Memo field with the correct date if the file has already been sent to Intuit.

For Paychecks (Not Yet Sent to Intuit):

1. Select Employees > Edit/Void Paychecks.

2. Enter the range of paycheck dates.

3. Click twice on the paycheck you wish to edit.

4. Click on Paycheck Detail.

5. Save and Close to update the pay date.

6. To confirm, select Yes.

For Bills or Expenses:

1. Select Vendors > Vendor Center to open the bill or expense.

2. Enter a new payment date.

3. Then click Save & Close.

Note: It is not possible to change the pay date of a paycheck that has already been sent to Intuit. Replace it with a new paycheck with the correct date instead.

1. Select Employees from the Payroll menu.

2. Go to the Pay Schedules tab.

3. Find the pay schedule you want to delete.

4. Then click the dropdown arrow and select Delete.

5. Confirm the deletion.

Note: Only pay schedules that don’t have any employees assigned can be deleted. If assigned, first reassign or remove employees from that schedule.