Managing accounting, payroll, and tax reporting is no small feat, especially for small to mid-sized firms juggling multiple clients, compliance requirements, and tight deadlines. In such high-pressure environments, efficiency isn’t just a goal; it’s a necessity. That’s where Intuit EasyACCT steps in as a reliable, all-in-one solution tailored for accounting professionals who need to simplify and speed up their work. First introduced in the early 1990s, Intuit EasyACCT quickly became a go-to desktop solution for accounting professionals and small business owners. Built for firms managing multiple clients, this powerful software simplifies bookkeeping, payroll, and financial reporting.

Unlike many cloud-based systems, Intuit EasyACCT maintains a strong presence as a desktop-first solution, offering offline access and dependable performance for firms with high-volume data needs. From customizable reports and journal entries to built-in compliance forms and year-end filing support, EasyACCT has been a prominent player in the market for certified accountants who need to stay organized and accurate.

If you’re a tax professional, bookkeeper, or accounting firm looking for a smarter way to manage client data and compliance using Intuit EasyACCT Business System Software, then you landed on the right page. Today, we’ll walk you through everything you need to know, from exploring its advanced features to installing the different software versions, verifying the versions, and more. So, let’s get started!

10 Features That Make Intuit EasyACCT a Time-Saving Powerhouse

Intuit EasyACCT is your all-in-one solution for managing comprehensive write-up tasks efficiently. Whether you’re handling accounts payable, accounts receivable, payroll, or financial reporting, this software simplifies it all from a single platform. Let’s understand how Intuit’s EasyACCT Business System Software can help users save time and stay productive throughout their ops. Here are some advanced features of EasyACCT software:

1. All-in-One Compliance Forms

Intuit EasyACCT software comes equipped with over 30 built-in forms, including essential ones like SUTA, 94x, W-2, and 1099, all regularly updated to reflect the latest compliance requirements. It includes everything you need to handle routine accounting tasks and period-end processes with confidence. From managing A/P and A/R write-offs to adjusting fixed assets and preparing compilation reports, the platform covers all the bases.

2. E-File Payroll Forms with Ease

With Intuit EasyACCT software, you can electronically file essential payroll forms like 940, 941, and 944, saving valuable time during busy seasons. If you have a valid tax preparer PIN, the filing process becomes automatic, eliminating the need for manual data entry or paper submissions.

3. IP Whitelisting

Enhance security by restricting access to only approved networks. IP whitelisting ensures that only trusted devices can connect to EasyACCT, protecting your data from unauthorized access and cyber threats.

4. Simplify Year-End Tax Preparation

If you’re using Intuit Lacerte Tax or Intuit ProSeries Tax, EasyACCT makes year-end prep easier by allowing you to export balances and adjustments directly into your tax software. This smooth integration eliminates the need for manual data entry, helping you save hours and reduce the risk of errors, especially during tax season when every minute counts.

5. Role-Based Access Control

With role-based access control, you can assign tailored permissions to each team member based on their job function. This ensures that sensitive client and financial data is only accessible to authorized users, reducing the risk of internal errors or breaches while improving overall workflow efficiency and security.

6. Tailored Statements for Your Clients

Clients appreciate clean, professional financial statements that reflect your firm’s unique touch. With Intuit EasyACCT software, you can create customized financial reports that not only look great but also align with your branding. The software’s built-in reporting tools give you the flexibility to tailor layouts, formats, and details, so every statement you deliver feels polished and personalized.

7. Data Encryption and Activity Monitoring

Your clients’ financial data deserves the highest level of protection. EasyACCT uses advanced encryption protocols to safeguard information during storage and transmission. Alongside this, activity monitoring tracks user actions across the system, helping you maintain security, transparency, and regulatory compliance at all times.

8. Multi-Factor Authentication

Add an extra layer of protection to your EasyACCT account with multi-factor authentication. By requiring a second form of verification at login, you help safeguard sensitive financial data from unauthorized access, even if passwords are compromised.

9. Customizable Dashboards

Create a workspace that fits your workflow. With customizable dashboards, EasyACCT lets you prioritize the data and tasks that matter most, making your daily accounting work faster and more intuitive.

10. Time-Based Access

Time-based access allows you to define specific time windows for user logins, adding another layer of control to your system. By restricting access to approved working hours, you reduce exposure to after-hours tampering or unauthorized entry, helping maintain the integrity of your financial data.

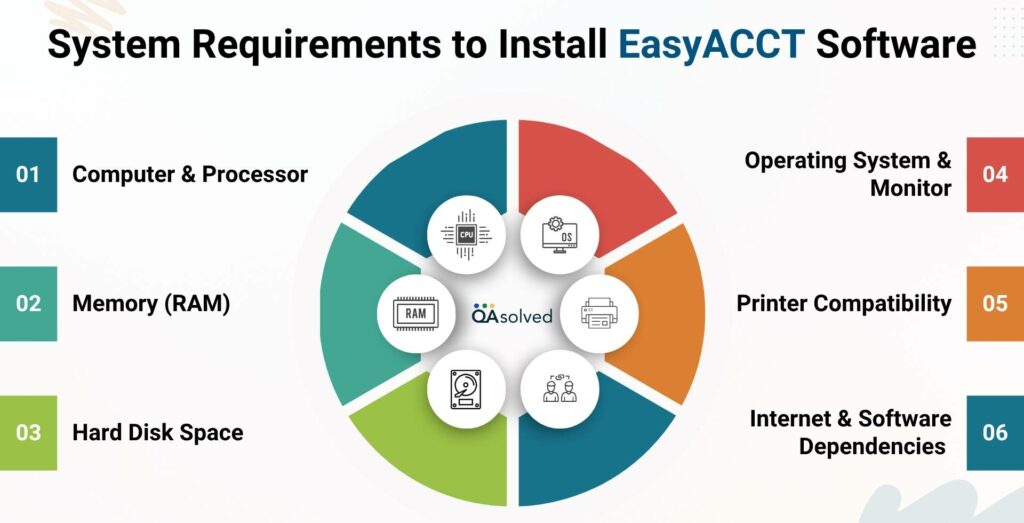

EasyACCT System Requirements: What You Need for Optimal Performance

To ensure Intuit EasyACCT software runs smoothly and delivers its full capabilities, it’s important to meet the recommended system requirements. Whether you’re managing daily bookkeeping or processing year-end payroll, the right hardware and software setup can make a significant difference in speed, stability, and overall user experience.

1. Computer & Processor

For optimal performance, a dual-core processor or faster is strongly recommended. While EasyACCT is not resource-intensive by today’s standards, it’s surely one of the most capable processors that ensures smooth multitasking, especially when one needs to handle large client files and switch between modules.

2. Memory (RAM)

At least 2 GB of RAM is required; however, more memory is ideal if you frequently work with multiple applications open simultaneously. Increasing RAM to 4 GB or more can noticeably improve speed, particularly during payroll processing or when running complex reports.

3. Hard Disk Space

You’ll need a minimum of 2 GB of available disk space to install and operate Intuit EasyACCT. However, consider reserving additional space for client data backups, updates, and report exports, especially if you manage multiple businesses or use the software on a year-round basis.

4. Operating System & Monitor

EasyACCT is compatible with Windows 11 and Windows 10, with Windows 10 support continuing through October 14, 2025. A display resolution of 1024 x 768 or lower is supported, though a higher resolution can enhance usability and make form layouts easier to navigate.

5. Printer Compatibility

When printing checks, reports, or tax forms, it’s best to use an HP LaserJet Series IV Plus or newer printer, ideally with 32 MB RAM or more. This ensures sharp, clear output and reduces printing errors.

6. Internet & Software Dependencies

A high-speed internet connection (DSL, cable, or broadband) is required for accessing updates, submitting e-file documents, or placing service requests. Additionally, make sure Microsoft .NET Framework 4.5.2 is installed, as this is essential for the software to function properly.

By meeting or exceeding these requirements, you’ll ensure that your experience with Intuit EasyACCT software is reliable, efficient, and frustration-free.

How to Install the EasyACCT IRS, Professional Series and Business Series?

Installing the EasyACCT IRS (Information Return System), Professional Series, or Business Series is the first step toward accessing a complete set of accounting and tax tools designed for firms of all sizes. But before you start, take these things into consideration to successfully install the EasyACCT IRS, Professional Series, and Business Series:

- You can download the EasyACCT Professional Series, EasyACCT Business Series (EBS), and the Information Return System directly from your ‘My Account’ dashboard.

- You cannot run EasyACCT Business Series (EBS) and EasyACCT Professional Series on the same system.

- The Information Return System is often purchased as a standalone product but is included with the EasyACCT Professional Series. If you’re using EasyACCT Business Services (EBS), you can add the IRS as a separate purchase.

So, these are the things to consider and steps to follow to successfully download, install, and use this software. Now, let’s take a look at the steps to download and install the Information Return System program in Intuit’s EasyACCT.

Steps to Download and Install the IRS as a Stand Alone

To Download

- You can download the Information Return System from My Account.

- Users without Lacerte or ProSeries will need the email with the download link for access. Users won’t see the URL. Instead, the link is labeled My Account and configured to point to the downloads page.

- For detailed instructions regarding downloads, refer to: Download EasyACCT and Information Return System from My Account.

To Install

- Make sure all other applications are closed before starting.

- Sign in to your My Account portal.

- Locate and select the Information Return System download.

- Press CTRL + J to access your Downloads folder.

- Double-click the installation file to begin setup.

- When the Product Installation window appears, choose Information Return System.

- Follow the on-screen prompts to finish the installation process.

- Once installed, restart your computer to apply all changes.

Steps to Download and Install the EasyACCT Business and Professional Series

Here are the Steps to Download the EasyACCT Business and Professional Series from My Account as a stand-alone:

- Begin by closing all open programs on your computer.

- Log in to your My Account dashboard.

- Find and select the download that matches the EasyACCT version you’ve purchased.

- Use CTRL + J to open your Downloads folder.

- Launch the installer by double-clicking the downloaded setup file.

- In the Product Installation window, choose EasyACCT and click OK.

- On the Module Selection screen, check the box for EasyACCT Program.

- Continue following the on-screen instructions to finish the installation.

- After setup is complete, restart your computer to finalize the process.

In short, installing EasyACCT, whether it’s the Information Return System (IRS), Professional Series, or Business Series, sets the foundation for efficient tax reporting and accounting operations.

How to Sign into EasyACCT for the First Time?

Whether you’re a new user or part of a larger team, signing in marks the start of a more efficient, organized way to manage your firm’s financial tasks. Here are the steps to sign in successfully into EasyACCT.

- Launch the installed 2024 version of EasyACCT.

- On the Getting Started with EasyACCT screen, provide your Customer Account Number and Billing ZIP Code to proceed with the initial setup.

- Now, to locate your customer account number:

- After purchasing EasyACCT or the Information Return System, check your email for the invoice. This email contains your payment details along with your account information.

- Alternatively, you can also log in to My Account and click the Account icon located in the upper-right corner to find your account number and billing ZIP code.

- If you receive a “No valid license found” error but have already purchased EasyACCT, it may indicate an issue with license recognition or setup.

- Visit My Account to double-check that your account number and billing ZIP code are correct.

- If the issue continues, contact our EasyACCT Support team at +1-888-245-6075. for further assistance.

- Now, to locate your customer account number:

- Now, enter your correct username and password to sign into your EasyACCT software.

- If you’re new to Intuit products, click on the Create an account link to set up your account and get started.

- If you fail to sign in, check this article: Resolve Sign in Problems when Signing into Your Tax Product.

How to Check the Version of Your Intuit EasyACCT Software?

To ensure you’re using the latest features and forms in Intuit EasyACCT software, it’s essential to keep your system updated. Updates often include critical compliance changes, tax form revisions, and software improvements. Fortunately, EasyACCT makes it simple to check your current version and apply updates if needed. Here are the steps to check your Intuit EasyACCT software version:

Steps to Check or Update EasyACCT:

- Open EasyACCT.

- Navigate to System > Update Via Internet.

- The software will check if you’re on the latest version.

- If yes, no action is needed.

- If an update is available, follow the on-screen prompts to install it.

- If you’re using an older version, you’ll be prompted to renew.

- To confirm your installed version of EasyACCT, go to Help > About EasyACCT > System Info.

Conclusion

In a nutshell, Intuit EasyACCT is a comprehensive and dependable desktop accounting solution built to support the fast-paced demands of small to mid-sized firms. From handling day-to-day bookkeeping tasks and payroll processing to ensuring compliance and simplifying year-end reporting, EasyACCT provides all the tools accounting professionals need in one powerful platform. With features like customizable dashboards, built-in forms, role-based access, and e-filing capabilities, it helps reduce manual work, increase accuracy, and save valuable time during busy seasons.

Whether you’re installing the Information Return System, Professional Series, or Business Series, EasyACCT makes it easy to set up and maintain. Its compatibility with Windows systems, support for secure login methods, and seamless integration with other Intuit tax products like Lacerte and ProSeries make it a valuable addition to your accounting toolkit.

At last, if you’re looking for a tried-and-true solution that scales with your growing client base, EasyACCT is worth the investment. With proper setup and understanding of its features, you’ll be well on your way to a more streamlined and productive accounting workflow.

Frequently Asked Questions

EasyACCT is a desktop-based application. However, it can be accessed remotely using third-party hosting solutions or remote desktop services if cloud access is needed.

Intuit EasyACCT is an all-in-one desktop accounting software designed for tax professionals, bookkeepers, and small to mid-sized accounting firms. It streamlines bookkeeping, payroll processing, financial reporting, and year-end tax filing, helping firms manage multiple clients with ease and accuracy.

EasyACCT Write-Up is a module within the Intuit EasyACCT software designed to help accountants and bookkeepers manage client general ledger activity. It allows users to record journal entries, maintain trial balances, generate custom financial reports, and perform year-end closings efficiently. This tool is especially useful for firms handling multiple clients, as it streamlines financial reporting and ensures accurate, audit-ready records.

Yes, EasyACCT includes e-filing capabilities that allow users to file 1099s, W-2s, and other IRS forms directly from the software, helping streamline year-end reporting and ensure compliance.