Let’s say you are all set to start your day, ready to tackle your company’s finances using QuickBooks. But as you click to open the program, your plans come to a halt. A warning message pops up–QuickBooks “Error 103.” Facing this error feels like hitting a red light just as you’re speeding towards your destination. This pesky error can be a real roadblock, especially when you’re trying to sync your bank transactions. But what exactly does this error mean, what causes it, and most importantly, how can you fix QuickBooks Error 103?

In this article, we will answer all these questions and provide a list of steps to help you resolve QuickBooks Error 103 smoothly and efficiently.

Meaning of QuickBooks Error Code 103

Error 103 occurs in the QuickBooks Online and Self-Employed versions. It simply means that QuickBooks is unable to log in to your bank’s website using the login credentials you provided. Essentially, QuickBooks Error 103 indicates that the login attempt has been rejected by your bank’s server due to incorrect login credentials, outdated information, or changes in the bank’s server.

In addition to disrupting your workflow, this error can impede your financial tracking and decision-making. But what are the primary causes of QuickBooks error code 103? Let’s take a look at them!

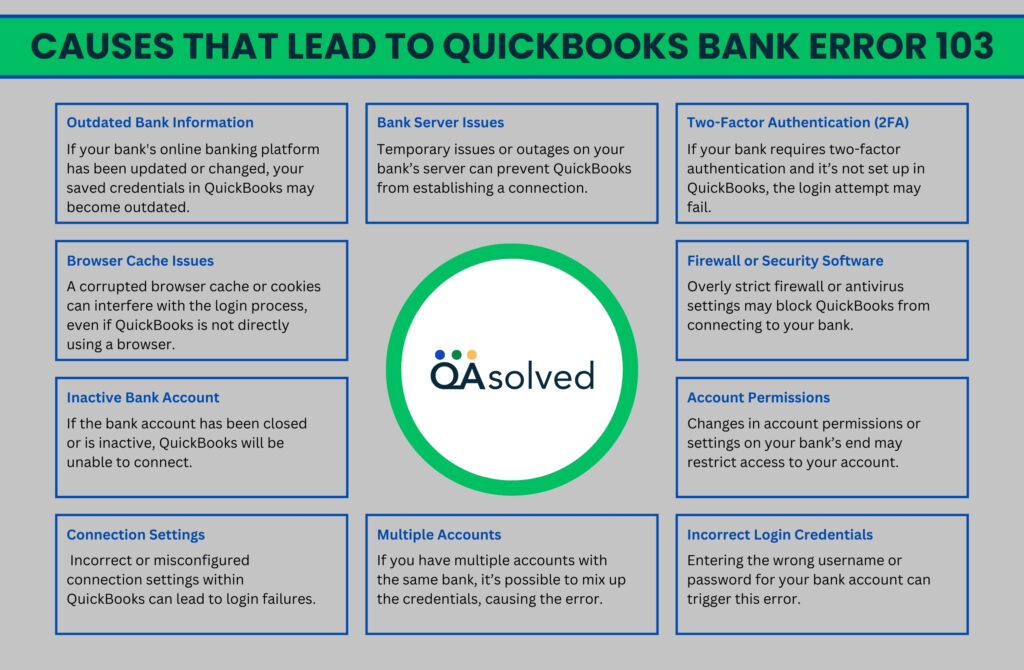

10 Potential of QuickBooks Bank Error 103

There is no doubt that QuickBooks is one of the ideal accounting and bookkeeping solutions for CPAs and small and mid-sized businesses. Even being arguably the best in the business, it has a range of errors that create a halt in day-to-day operations. In case of QuickBooks bank error 103, there are ten potential causes that lead to this disruption.

So, these are the primary causes of QuickBooks bank error code 103. Many users think that this error appears suddenly but the reality is different. Before disrupting your operations completely, QB error code 103 gives several alarming pops and prompts that users should respond to in order to prevent it from escalating.

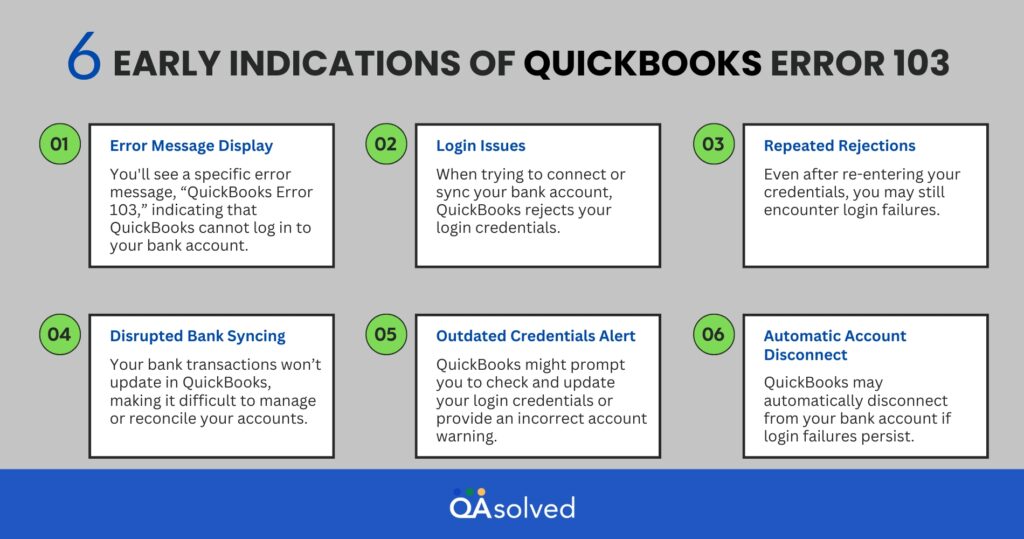

6 Signs of “QuickBooks Error Code 103”

Let’s take a look at the signs that indicate QuickBooks Error 103. Identifying these symptoms early will help you get rid of the problem quickly and stay on top of your finances.

It is important to recognize these symptoms in order to be able to resolve this error as soon as possible. Coming back to the focal point of the blog, let us help you with a step-by-step guide to fix QuickBooks error code 103.

3 Easy Steps to Fix “QuickBooks Error Code 103”

If you’re wondering how to fix QuickBooks Error 103, take a look at the solutions mentioned below! To ensure smooth financial operations, it is imperative to address this error immediately and take required actions. Whether you’re updating your bank feed or verifying your login credentials, we’ll walk you through every step.

Step 1: Verify Your Sign-In Information

- To access your bank’s website, open a new tab in your web browser.

- Make a note of the web address (e.g., https://www.bank.com) for future use.

- Next, enter your user ID and password to access the site.

- Note: If you have multiple bank accounts, such as personal and business accounts, log into the specific account you need to resolve in QuickBooks.

- To fix a sign-in error, follow your bank’s instructions for retrieving your user ID or resetting your password.

- Your user ID and password are correct if you can sign in successfully.

Step 2: Enable Third-Party Access If Your Bank Requires It

Several banks require you to grant permission to connect your account to other services, including QuickBooks Online. You might want to check your bank’s website to see if this is necessary. Follow your bank’s instructions to enable it, or contact your bank for assistance.

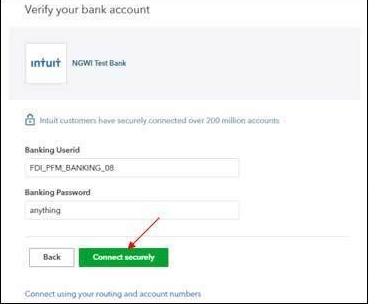

Step 3: Add Your Bank Sign-In Information to QuickBooks

A. For a New Connection

Setting up a new account is very simple. You just need to connect your bank account as you normally would.

B. For an Existing Connection

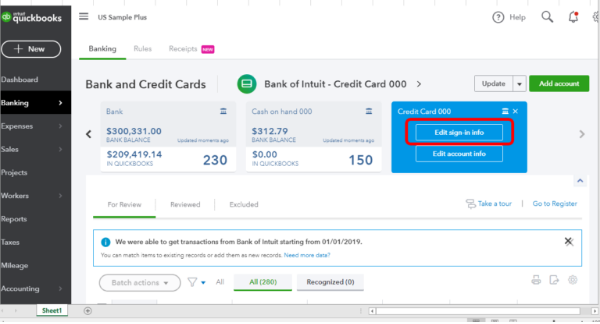

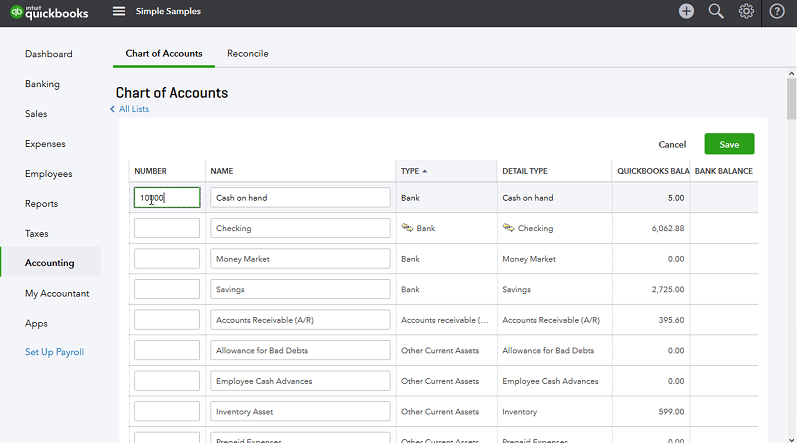

- Select Bank Transactions from the Transactions menu.

- Select the account that needs to be updated.

- Hit the Edit icon.

- Click Edit sign-in information.

- To avoid using outdated credentials, remove the automatic user ID and password fields from your browser.

- Ensure that you enter your bank account username and password.

- Then click the Update button.

C. Connecting QuickBooks Solopreneur to an Existing Connection

- Access Transactions.

- Go to the New Transaction ▼ dropdown and select Manage Connections.

- To update your bank account information, click the vertical ellipsis icon.

- Remove the user ID and password if your browser fills them in automatically.

- Fill in your bank account login information.

- Tip: If your bank provides the Show option, check that you entered the password correctly.

- Hit Update.

Are You Having Trouble Connecting Your Bank Account because of an Incorrect Security Question?

If you enter incorrect login credentials, your bank may provide an incorrect Multi-Factor Authentication (MFA) security question rather than displaying an error message.

You can resolve this issue by:

- Verify your login credentials by using a private browsing session on the bank’s website.

- Choose the appropriate bank from the available options.

So, these are three easy steps to get rid of QuickBooks bank error code 103. Please make sure to follow the above-mentioned steps carefully to resolve this issue as quickly as possible.

Conclusion

QuickBooks Bank Error 103 can be frustrating for both QuickBooks Online and QuickBooks Self-Employed users. Syncing bank transactions, reconciling accounts, and maintaining accurate financial records are often disrupted by this error. Understanding the underlying causes and following the troubleshooting steps outlined in this article will allow you to resolve the issue and minimize downtime.

Verifying your login credentials, managing your bank connections, and ensuring your browser settings are correct are essential steps to restoring QuickBooks functionality. You can also prevent future occurrences of QuickBooks error 103 by regularly checking for updates and understanding your bank’s requirements for third-party access. In case you fail to resolve this or face the same issue again, kindly reach out to our QuickBooks Proadvisors for the best possible assistance.

Frequently Asked Questions

The login credentials you entered for your bank account or financial institution are incorrect.

As a security measure, some banks require users to grant permission for third-party applications to access account information.

Maintain your QuickBooks software regularly, verify your login credentials, and ensure that your bank allows third-party connections.

No, the QuickBooks Bank Error 103 can occur in both QuickBooks Online and QuickBooks Self-Employed since both depend on a bank connection.

Make sure you select the correct account in QuickBooks if you have multiple bank accounts.

QuickBooks can still be used for other functions, but you won’t be able to sync bank transactions or access bank feeds until the error is resolved.