In today’s technologically-driven world, managing bills and expenses has undergone a remarkable transformation in terms of convenience. One such convenience is bill pay, a service that empowers both individuals and businesses to efficiently refine their payment procedures. This article aims to offer a comprehensive understanding of QuickBooks bill pay service, including how it works, its benefits, and how to set it up.

Bills can pose significant challenges for small businesses, particularly when delayed payments. Cash flow problems with other financial obligations, including paying employees, rent, and utilities, make it hard to ensure timely payments to suppliers, lenders, and vendors.

A financial service called bill pay enables individuals and businesses to electronically pay their bills and send money to various service providers, creditors, and suppliers. It streamlines the process of paying financial commitments by eliminating the need for manual check writing and mailing. Every business has a unique bill-pay workflow. Most people would agree that tedious administrative tasks should take less time than money-making tasks that help the organization grow.

Challenges with Bill Payments and Cash Flow for Small Enterprises

The economy took a severe blow from the impact of COVID-19, leading various businesses to temporarily halt operations and, in unfortunate circumstances, permanently shut down.

Increasingly, organizations are facing challenges in maintaining their viability, with the service sector experiencing a notably rapid decline. Sectors including restaurants, hotels, performing arts, and movies are falling significantly behind, with almost half of their financial obligations delayed.

In the current circumstances, these organizations need an effective method to streamline and enhance their bill payment processes to safeguard funds and prevent bankruptcy. Unless there are individual arrangements and extensions established on a case-by-case basis, deferring payments without damaging your credit score becomes a complex endeavor. Moreover, juggling various responsibilities can make it challenging to keep track of your creditors, outstanding amounts, and due dates. This subsequently adds another layer of challenge to the task of reconciling your accounts payable.

The positive aspect is that you don’t have to tackle this challenge all alone to assist small business owners in reestablishing financial control, we’ve integrated a bill payment solution directly into our accounting software. This enables you to spare yourself the stress and time associated with managing all of your financial obligations.

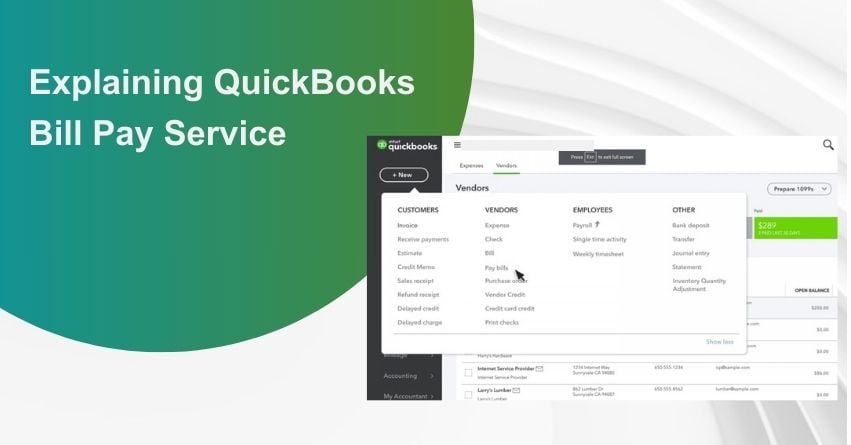

What is QuickBooks Bill Pay?

QuickBooks serves as an essential tool for small to medium enterprises, allowing them to document invoices, maintain accurate financial records, and manage their business accounting. Melio’s Bill Pay feature now enables QuickBooks to document invoices and facilitate their payment.

What is QuickBooks Online Bill Pay?

QuickBooks users who run small businesses now have a brand-new integrated payment option. For current users, access to the eBill feature is free, and it lets you plan electronic payments.

With the ability to arrange future payments through Bill Pay, you can stop worrying about missed deadlines and negative credit marks. As required, you can also send one-time payments to vendors, providing you with complete freedom and control.

Without exiting QuickBooks, you can manage all of your accounts payable and eliminate paper bills by using online bill payment. Additionally, you can use the mobile version of QuickBooks to access this service, and you’ll have flexibility in terms of payment methods. You’ll be able to precisely predict when and how the recipient will receive the funds in this method.

How Does QuickBooks Bill Pay Works?

You may conveniently and quickly submit checks and bank deposits with Bill Pay. Recipients do not need to set up anything. To pay bills online within your accounting software, all you need to do is enter the details of your bank account. You can plan bill payments, settle invoices in real-time, and balance your records.

First, decide how you’d like to proceed with the online payment.

- QuickBooks Cash: You can use your QuickBooks Cash account to directly pay your bills.

- Bank Account: You can manually complete the micro-deposit process or connect to your financial institution by providing a user ID and password. The completion of payments takes one to three business days and is free.

- Debit Card: Enter the card information to pay bills online using a debit transaction and checking account. The system will automatically process the payment without any fees on the following business day.

- Credit Card: Even in places where credit cards are not accepted, you can use a credit card to make bill payments and manage cash flow. Although credit payments include a 2.9% cost and are processed the next business day, the fee can be tax deductible. You can use this payment option to postpone bill payments to increase your cash flow, collect worthwhile card points, and gradually raise your business credit score.

Next, choose a payment method for the merchant.

- Bank Transfer: Bill Pay is the quickest available business-to-business (B2B) payment mechanism because it allows ACH transactions that take one to three business days to arrive.

- Check: We will mail you a paper check in about five to seven business days if you prefer to use that option. To prevent late fines, you can also expedite your check through FedEx for an extra $20.

With either option, there are no additional fees for the recipient, and receiving the payment requires no further action on their part.

Top Benefits of QuickBooks Bill Pay Service

- Convenience: Online paying bills is more convenient and quicker than writing checks and mailing them. The same platform can manage multiple invoices.

- Time Management: Create recurring payments so you never forget a deadline, lowering your chance of incurring late penalties or experiencing service interruptions.

- Cost Savings: Online bill payment saves you money over time by doing away with the need for postage, cheques, and envelopes.

- Security: Reputable online bill payment providers protect your financial information with encryption and other security precautions.

- Record Keeping: The majority of online bill payment services provide digital copies of your payment history, which makes it simpler to keep track of your spending.

- Environmental Impact: Going paperless reduces the demand for paper and helps to save the environment.

How to Activate Bill Pay in QuickBooks Online?

Follow the below-mentioned steps:

- Log into your QuickBooks Online company file,

- Next, navigate to “Get paid & pay” and select “Bills.”

- From there, either create a new bill or choose an existing unpaid bill.

- Depending on the type of bill, click on “Schedule Payment” or “Save and Schedule Payment.”

- If you’re creating a new bill, you can opt to schedule the payment immediately by clicking “Save and Schedule Payment.”

- For unpaid bills, you can schedule the payment directly from the Expenses, Vendors, or Bills sections.

- Choose the bank account that you want to use to deposit and withdraw money. You can add a new bank account or choose from the banks that are currently connected to your QuickBooks account. By default, the complete bill amount is shown, but if you’d rather arrange a partial payment, click Edit.

- Choose the appropriate account from your QuickBooks chart of accounts from the Payment Account selection menu in QuickBooks to ensure precise synchronization of your payment details in your QuickBooks Online account. You may also select + Add new to add a new account to QuickBooks just for tracking your bill payment information.

- Fill out the required details and choose the payee’s preferred payment method. Select a date up to 90 days in the future for the money to be withdrawn from your bank account.

- If everything looks correct after reading the payment instructions, select “Schedule Payment.”

Bill Pay provides you with the resources you need to organize your accounts payable and manage payments with ease on a single platform. Additionally, it provides new users with an extra reason to join the countless business owners who rely on QuickBooks accounting software.

Conclusion

In a nutshell, online bill payment provides a streamlined, effective, and feasible means to handle your financial obligations. It promotes time and money savings, improved organization, and enhanced security. Selecting a service, setting up an account, adding payees, connecting payment sources, and scheduling payments are all necessary steps in setting up online bill paying. Using this technology can make it easier for you to handle your finances and help you live a more organized and stress-free financial life. If you have any other queries, feel free to reach out to at +1-888-245-6075.

Frequently Asked Questions

Your bank account is synced with the program for QuickBooks Bill Pay Online to function. Once your bills have been put into QuickBooks, you may choose which ones to pay and start the process online.

QuickBooks Bill Pay Online is safe, and that is definite. QuickBooks’ maker, Intuit, protects your financial information and transactions using encryption and other security measures.

You can schedule recurring payments for bills that come up frequently. By setting up automatic bill payments through QuickBooks, you can make sure that they are paid on time.

It allows you to pay a variety of bills, including rent, utilities, and other business-related costs.

In QuickBooks, you may monitor the progress of bill payments. You can check the status of payments using the software’s features to see if they have been received, or deposited.